James Rolevink

Investment Thesis

AeroVironment (NASDAQ:AVAV) offers products and services of unmanned surveillance with strike capabilities that are highly sought after by modern militaries.

The effectiveness of such capabilities is demonstrated by the Ukrainians in their conflict with Russia. In the preparation for a ‘potential’ conflict with China in the South China Sea, the US marines have already recognized the value of loitering drones due to their lighter, faster operational deployment capabilities and are in the process of replacing their bulkier armored units with these new assets.

AVAV’s loitering drones with vertical take-off capability are also selected by the US army to replace the runway-dependent equivalent products. This is a positive attestation of the quality of AVAV’s products and services.

AVAV’s high-profile contribution of SwitchBlade drones to the Ukrainian military raised awareness of its combat capabilities. This likely results in an increased interest in these products from other US allies.

Company Overview

AeroVironment is headquartered in Arlington, Virginia. The company supplies unmanned aircraft systems, tactical missile systems, and other related services to government agencies of the US and its international allies. This equipment provides unmanned security, surveillance, or sensing capabilities.

According to the company’s latest annual report, it owns several trademarks of “AeroVironment, AV, Switchblade, Raven, Wasp, Quantix, VAPOR, Arcturus UAV, Crysalis, and Jump”.

These are its customers and the revenue contributions:

- US Army: 21%

- “Other U.S. government agencies and government subcontractors” that do not belong to point 1: 37%

- Other foreign customers which are mostly government agencies that are allies of the US: 32%

- AVAV has a commercial joint venture with HAPSMobile (a subsidiary of Japanese telco Softbank) to “design and develop a solar-powered, high-altitude, unmanned aircraft”: 10%

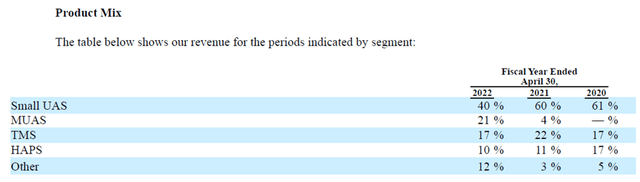

The company is best known for making small UAS (Unmanned Aircraft System). It forms the lion’s share of the company’s revenue at 40%:

Product Mix (Company Annual Report 2021)

Recently, the company is best known for supplying Ukraine with small UAVs of SwitchBlade Loitering Drones which, together with the other US-supplied arsenals has effectively denied Russia a swift victory in the invasion of Ukraine.

The Advantages of Loitering Drones in Modern Warfare

The terrains of modern conflict have changed. Historically, armed forces with the largest weapons and firepower can confidently expect to have a clear advantage in most conflicts.

Today, the US most likely views China as one of its greatest adversaries in the world. China has militarized at least three of the Spratly group of islands of the South China Sea. Given the dispute in ownership of these islands and its proximity to Taiwan, which the US has recently expressed its solidarity with; we can expect this military outpost will most likely be one of the highly contested battlegrounds should a full-scale conflict occurs.

Large weapons like howitzers and tanks can only be effectively utilized in spacious terrain that allows for movements of these weapons easily. The terrain must also be much larger than the firing range. The largest Spratly island is just 1.4km in length which means the deployment of conventional bulky artilleries commonly used by the ground troops is going to be a huge logistical problem, as reported by Popular Mechanics:

Howitzers like the M777 would have to go ashore first and set up, and then would have a minimum firing range of up to 2.7 kilometers—on an island that might not be two kilometers long!

As noted by the same article, loitering drones can provide a solution to the US military:

Unlike the tanks they replace, a loitering drone would be more responsive to requests for support, quickly flitting from one side of an island to another to deliver a precision punch.

Indeed, the US Marines have been reinventing themselves to become lighter, faster, and equipped with the surveillance capabilities to engage in a “joint future fight” with allies.

Loitering drones like those manufactured by AVAV have all the characteristics that the US military, in particular the marines, needed in a potential conflict with China. This is why the marines have been considering acquiring the Switchblade 600 which is capable of packing a warhead that is derived from those used on the Javelin anti-tank missile, to the benefit of AVAV.

Advantages of Loitering Drones With Vertical Landing Capabilities

Loitering drones with “vertical landing capabilities’ is a forward-looking design to further improve the mobility of the already relatively mobile unmanned ariel system (“UAS”) technology, compared to conventional manned surveillance and attack aircraft.

Recently it was reported that AVAV’s “Jump 20 Medium unmanned aircraft system” was chosen by the US army to replace the runway-dependent Shadow UAS.

We discussed earlier that modern warfare called for a more mobile and agile weapons system that can navigate and launch quickly and effectively within small battlefields. The “Jump 20 unmanned aircraft system”, with the added capability for vertical landings, offered significantly improved mobility in the deployment of loitering drones.

This video describes the benefits of the new UAS. We understand that personnel deploying the Shadow UAV has to travel many “miles” away from the main unit just to set up a “flight line” to launch and land the Shadow. This creates lots of logistical issues with the transport of supplies between UAV deployment teams and the main unit. With the new “Jump 20” UAS, the team can launch the UAS just “100 yards” away from the main unit.

These developments greatly enhance the operational capability of the US military. It was mentioned in the report that the Jump 20 UAS is the “first fixed-wing unmanned aircraft system capable of vertical takeoff and landing to be deployed extensively in support of U.S. military forces “. Hence, we expect AVAV to have a first-mover advantage over other competitors.

Surge In Demands For Switchblade Drones

The use of switchblade drones in the Ukrainian conflict has been largely successful. According to Newsweek:

100 Switchblades, containing systems that include a launcher, controller, and 10 of the one-time-use drones, could potentially defeat 1,000 units of Russian artillery.

This has sparked a surge in interest from other NATO countries in acquiring such products, significantly increasing its total addressable market:

Despite the latter fact that the weapon isn’t reusable, its success in Ukraine has served to entice U.S. allies and partners to adopt it. Earlier this month, the French Army had begun the process of procuring the loitering munitions. The Switchblade is part of an ongoing effort by the French military to field remotely operated weapons systems.

The war in Ukraine is still ongoing and there is no sign of ending yet. With the Biden administration’s continued commitment to providing support to Ukraine, the US defense department is already fast-tracking the delivery of these drones to the Ukrainian military. With this commitment, AVAV is expected to benefit from these drone sales.

Financial Comparison

According to the company’s annual report, these are the direct competitors:

- Elbit Systems Ltd.(ESLT),

- FLIR Systems, a subsidiary of Teledyne Technologies (TDY),

- L3 Technologies, Inc.(LHX)

- Lockheed Martin Corporation. (LMT)

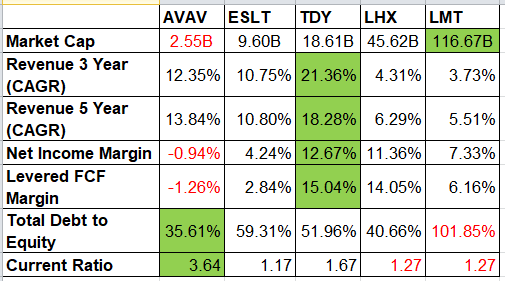

Key Financial Figures (Seeking Alpha)

We can observe that:

- LMT is the largest company in the comparison list by a wide margin. No other peers come close.

- In terms of top-line growth, TDY is growing the fastest. AVAV is growing at a decent rate of double-digit percentage.

- AVAV is the only company in the comparison list that is not profitable in the bottom line items of net income and FCF.

- AVAV incurs the least amount of debt with respect to net income.

- AVAV has the most assets with respect to liabilities.

AVAV is still a relatively ‘small’ company that is incurring high expenses and sacrificing profits to grow rapidly. While it does not have the fastest growth in the comparison list, its growth rate is still significantly higher than LMT, the largest player on the list. With the lowest debt and highest asset profile in the comparison list, I consider AVAV’s financial status to be relatively ‘decent’.

Valuation

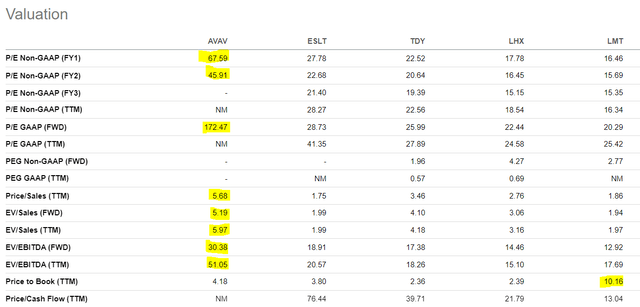

AVAV is not profitable based on FCF and net income so we cannot project its intrinsic value using discounted free cash flow and net income. We will instead use some valuation figures provided by Seeking Alpha.

Valuation Ratios (Seeking Alpha)

At one glance, it is obvious that AVAV is highly overvalued by most valuation ratios.

Risk

Unmanned technologies that offer precision strike capability provide massive value in reducing casualties of conflicts. Most militaries, especially those from rich first-world countries are expected to actively pursue such technologies.

Generally, AVAV is expected to benefit from the tailwind of such emerging demands. However, since the cost of producing such small unmanned UAVs is relatively low compared to conventional military assets like the F-35 fighter jet, the barriers to entry are comparatively much lower. As such, other alternatives exist.

Investors should observe whether the company’s products can rise above these competitions and dominate the market in the long run.

Conclusion

The persistence of the Ukraine conflict and China’s military build-up in the South China Sea is expected to accelerate the demand for AVAV’s highly popular small UAS products and services.

The high-profile provision of switchblade drones in the Ukrainian war is providing great publicity for its SwitchBlade products in the short term.

However, the stock price is currently very overvalued. Since the company is also not profitable, investors should hold and wait for the price to retrace and become undervalued before considering entering a position.

Be the first to comment