Oleg Elkov/iStock via Getty Images

AerCap Holdings N.V. (NYSE:AER) has been one of my most favorite investments given the long-term strength of its market and the beaten-down stock prices as demand for air travel fell in 2020. Even before that, aircraft lessors and more, particularly AerCap, were among my favorite investments, though the market has not fully appreciated the business prospects in prior years.

However, I do believe that the second quarter results speak volumes about the strength of AerCap and the market it is active in, and I will discuss this in this investor report.

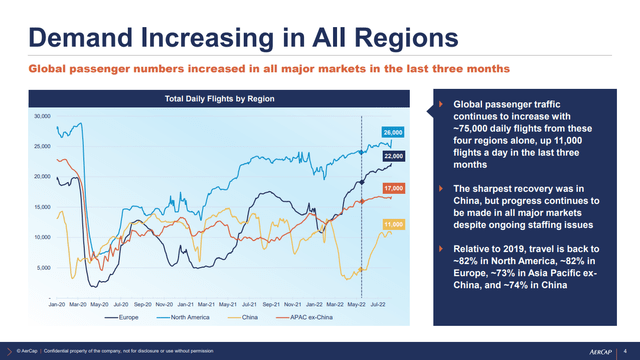

Air Travel Rebound Continues

Demand recovery air travel (AerCap)

During the first quarter, we saw recovery across all regions, except for China. In China, rapid lockdowns and re-openings were stalling the recovery in air travel. In the second quarter, things looked a lot differently. Europe and primarily China saw a strong recovery, while Asia-Pacific and North America saw appreciable continued recovery. So, the number of flights serving as a reflection of demand for air travel increased, which supports demand for the flight equipment owned by AerCap.

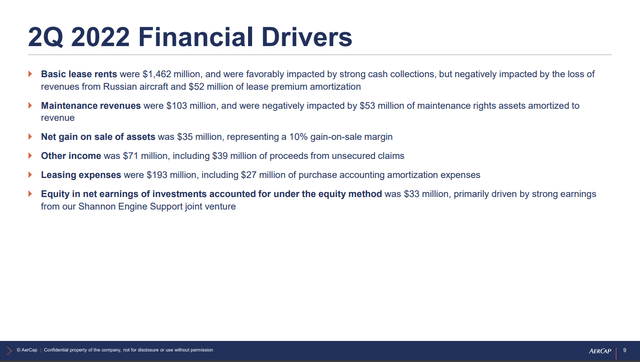

AerCap Results Strong, But Impacted By Russia Sanctions

Q2 2022 Financial results (AerCap)

Sequentially, total revenues were $1.671 billion compared to $1.8 billion in the first quarter. So, sequentially, there was a decline in revenues of around $119 million. Russian operators on any normal day would account for around $100 million per quarter. While I believe that Russian operators have paid at least some of their rents in the first quarter of the year, a significant portion of the revenue decline can be attributed to the loss of revenues in Russia. In total, lease revenues declined by $175 million of which $92 million in basic lease rents and $83 million in maintenance rents reflecting lower revenues from Russia and lower revenues recognized related to lease terminations. Net gain of sales stood at $35 million compared to $3 million in the previous quarter while other income increased from $47 million to $71 million, driven by the sale of the last portion of unsecured claims in relation to the LATAM bankruptcy.

While lease revenues were lower sequentially, they beat estimates by $20 million and earnings per share of $1.91 beat expectations by $0.49, which I believe are rock-solid results. The seeming positives in earnings were the $39 million sale of the unsecured claims and earnings from the Shannon Engine Support joint venture, which saw its earnings being diminished by Russia-related impairments in the first quarter. These two items already cover $0.30 of the earnings beat, and I believe that widely lower gain on sales explaining another $0.14 of the EPS beat and slightly higher leasing expenses were expected.

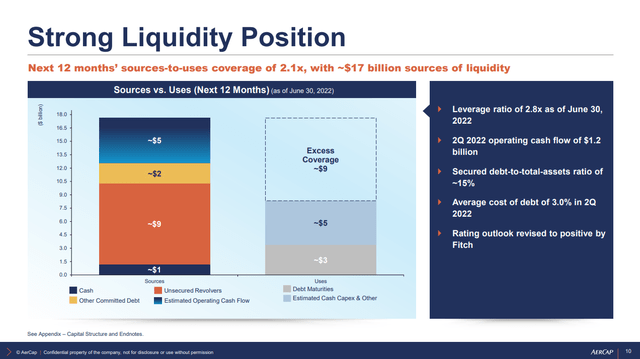

AerCap Liquidity Position Remains Strong

AerCap liquidity position (AerCap)

During the height of the pandemic, AerCap like many lessors agreed with lessors on deferring payments, and we are now seeing that translate into strong rental collections. As a result, the deferred balance for lease payments reduced by $38 million to $538 million. Operating cash flow decreased from $1.34 billion in Q1 to $1.168 billion in Q2, reflecting the absence of cash collections from Russia. The six-month ended figures still show the robust recovery in cash flow as cash flow more than doubled to $2.5 billion.

The liquidity position of AerCap remains strong. The company has $3 billion in debt maturities in the coming 12 months and $5 billion in CapEx, both of which it can cover with its $5 billion cash flow, cash position and other committed debt, meaning that its unsecured revolver provides all excess coverage.

Is AerCap Stock A Buy?

AerCap stock prices currently are trading at $48.88 per share, while its book value is $62.43 per share. Using a typical price-to-book ratio for AerCap, the book value per share should imply share price levels of $52.44 per share, implying a 7% upside. Keeping in mind that GECAS assets were acquired at a $3.3 billion discount, I have put my price target at $64 for AerCap, which is slightly lower than the $68.44 average price target by Wall Street Analysts but still representing a 31% price target.

Conclusion: AER Shares Are A Strong Buy

I believe that AerCap is a strong buy. Its current book value provides up to 31% upside, and supply chain issues strengthen support for higher lease rates and aircraft lease extensions. With its orderbook and existing delivered aircraft, AerCap stands to benefit from supply chain issues that lead to supply falling short of demand. That will benefit AerCap on aircraft that are placed, but also on future business and I believe that none of that really is reflected in the results as it is an incremental process and most certainly this is not reflected in the share prices.

Be the first to comment