fizkes/iStock via Getty Images

Investment Thesis

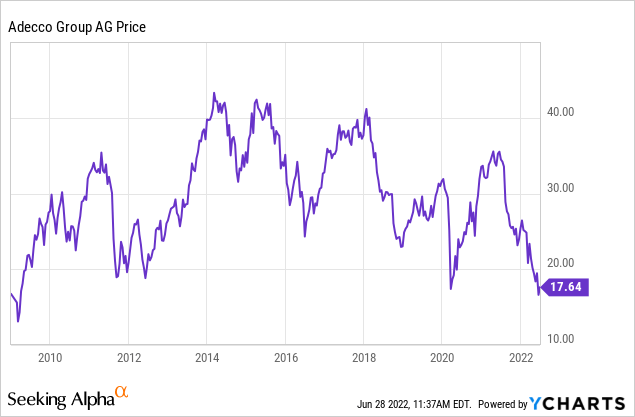

Fears of an upcoming recession have already made investors sell out of the human resource and employment services industry. In fact, during times of layoffs and unemployment, this industry fares poorly as its main customers are companies looking for employees. Among the major industry players, the Swiss company Adecco Group AG (OTCPK:AHEXY) seems to have already priced in a very pessimistic outlook, as the stock is now at its 2009 and 2020 lows. Even though, as we will see, there are some reasons why Adecco has been almost chopped in half during the past year, the current situation could be a good entry point. It offers an opportunity to start building a position that aims at taking advantage of a tight working force market and a possible need of workforce flexibility in case of a recession and a following recovery.

The Company

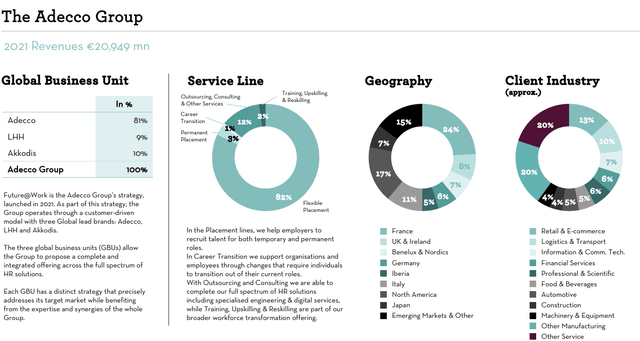

Adecco Group is one of the major companies in the industry. As we can see from the slide below, it is organized into three Business Units: Adecco, LHH, and Akkodis, with the former accounting for 81% of the whole group.

Adecco 2022 Investor Relations Presentation

The three units address different markets.

The Adecco unit offers flexible placement by recruiting and managing of flexible workers that work for another company but are hired by Adecco; permanent placement by sourcing and screening candidates that will be hired by other companies; outsourcing by staffing and managing entire workforces; training, upskilling and reskilling by providing coaching and training to enhance employability and address skills shortages in certain industries.

LHH is more of an advisory firm and solutions delivery partner that advises both business and single people on how to succeed in the world of work.

Akkodis offers expertise in technology and digital engineering consulting with a clear focus on digital transformation.

As we can see from the graph shown above, the most important service line is flexible placement, otherwise known as temporary staffing. For those who are not familiar with this service, it means that Adecco, as most of its peers, offers employers a flexible workforce. This allows employers to have workers for temporary needs without having to hire them directly. The workers are Adecco’s employees and, as such, are paid by Adecco, which, for this service, charges the employer a fee. The cost of the worker is higher for the employer, but the advantage is that the employer is free to have the needed workforce only for certain peak periods. Another advantage for employers is that, before hiring, they have the chance to see in action their possible employee and can, as a consequence, have a more precise valuation on what the employee could give to the company.

The Adecco Group is very strong in Europe, where 61% of its revenue comes from. From North America, the company obtains only 17% of its revenue. We will see in a moment that one of the company’s main goals is to complete the so-called U.S. turnaround to improve performance in this area.

Another important aspect to point out is that The Adecco Group is clearly exposed to those industries that see a higher level of cyclicality with peaks of workforce needs followed by periods of lower production needs. As we see, industries like logistics, automotive, construction, machinery and manufacturing make up around 43% of the company’s clients.

A quick general consideration. One of the best ways to understand how the economy is doing is to keep track of this industry and read the reports and the transcripts of the major players. They are always full of insights on the labor force market and the developing trends.

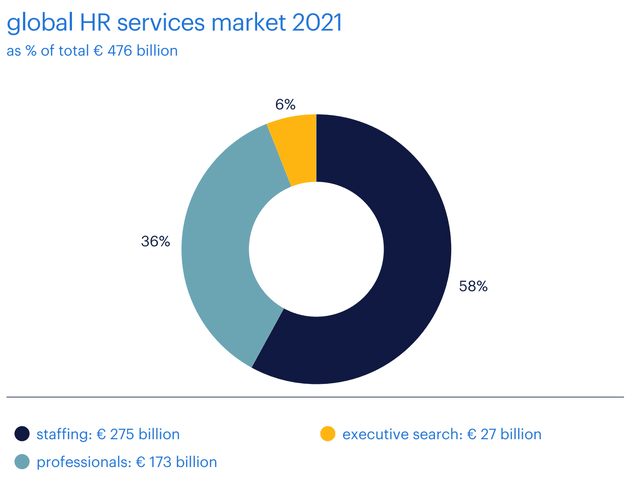

According to one of Adecco’s main competitors, Randstad (OTCPK:RANJY), the global HR services market is worth around €476 billion, 57% of which comes from staffing.

The market is highly fragmented, with the three main players: Randstad, Adecco and Manpower holding together just 13% of the pie, with the remaining 87% split among many other competitors of different sizes and different geographies. This can be understood by the fact that there are not really big barriers that prevent new businesses from entering into this market. I think this fragmented situation will surely lead to many M&As which will lead to a consolidation of some major players with a market share of at least 10% each.

Business and Financials

Last year, The Adecco Group’s revenue reached €20,95 billion, a 9% increase compared to 2022, but still below its 2019 result of €23,4 billion.

A very important thing to know about this industry is that most companies don’t use EBITDA because they prefer EBITA. In fact, it is not a capital-intensive industry, and depreciation of assets doesn’t have a big impact on the income statement. Another aspect of this industry is that EBITA margins are usually low. At the end of 2021, for example, Adecco Group’s margin was 4.6%. This makes us understand that the key driver towards better results is volume. In fact, The Adecco Group claims to place every day more than 500,000 people into different roles. This situation exposes The Adecco Group to economic cycles: when volumes are high so are margins, when the economy cools off, volumes decrease and margins suffer.

If we look at the company from 2006 to today, we see that its total revenues didn’t change a lot, as they were €20,42 billion back in 2006 and now they stand, as we have seen, pretty close to that number. True, Adecco saw a peak in 2017 that brought its total revenues up to €23,66 billion, but then, already before the pandemic, the results were already reversing back to the mean of around €20 billion.

During the financial crisis recession, The Adecco Group was hit severely as its revenues came down from €21,09 billion in 2007 to €14,80 billion in 2009. However, by 2011 the company was back at its usual result of €20,5 billion.

The company’s EBITA and free cash flow did too go dramatically down during the last recession (EBITA in 2009 was €299 million compared to €1,08 billion in 2007; free cash flow went down from €971 million in 2007 to €350 million in 2009). However, in the past decade, although with some ups and downs, the company has been able to grow its EBITA at a CAGR of 1.9% and its free cash flow at a CAGR of 2.15%. These numbers paint a clear picture: the company has reached a mature stage and it is now working at increasing its bottom line through good management, rather than increasing its top line.

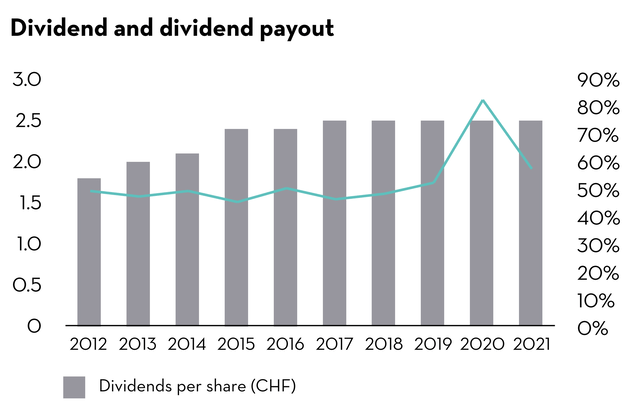

Thanks to these improvements, the company has been able to return excess cash to shareholders through a growing dividend.

The Adecco Group 2021 Annual Report

As we can see, the payout ratio, apart from its 2020 peak, is around 50%, which leaves the company with enough cash for any need, while rewarding shareholders. To dividends, we also have to factor in share buybacks: from 2012 to 2020 the company spent €1.35 billion and is now executing a €600 million buyback plan, of which only €81 have been spent so far.

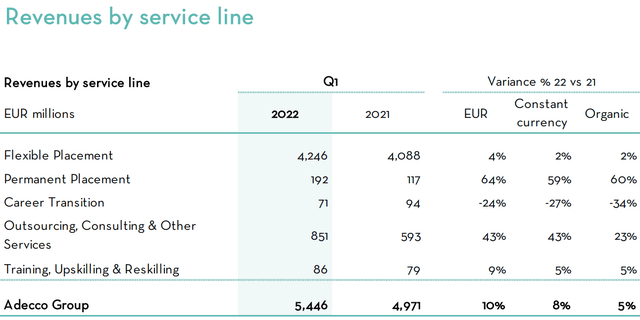

In Q1 2022, The Adecco Group posted good results that highlight once more how its core business lies on flexible placement. As the vast majority of business during the last two years, The Adecco Group, too, is achieving good results with a constant growth.

Adecco Q1 2022 Earnings Press Release

As we can see, permanent placement is growing at a fast pace and this is a sign of a strong economy where workers are sought for and then hired. About this fact, during the Q1 2022 Earnings call, Coram Williams, the company’s CFO, underlined that “Talent scarcity and wage inflation provide a supportive trading environment for us.” The call was also the right moment for the company to receive questions about its U.S. plans, since, so far, it hasn’t managed to obtain significant benefits for the group. Alain Dehaze, the CEO, addressed this issue by stating that

We’re very focused on the turnaround in the U.S. […] it’s about making sure that we are shifting the legacy sector focus that we’ve got a moving towards higher growth sectors and areas in the market. And it’s also about bedding down the new operating model, particularly with the Career Center. That’s a model that we have successfully implemented elsewhere. And we’re in the process of implementing in the U.S., that turnaround is absolutely heading in the right direction.

We will have to watch the company quarter after quarter to see if the focus of the company will prove successful and able to turn things around.

Risks

In case of a recession, The Adecco Group may suffer, as we have seen when we looked at its financials during the last financial crisis. However, if I look at the stock price, I think that the expectations of an upcoming recession may have already driven the price near to its historic lows.

Even though almost the whole market is down and so are the HR services, The Adecco Group has lagged behind its peers and has been brought down to a price not seen if not during an important crisis. Fears of a recession are clearly hitting the weakest among the industry leaders, the one with no revenue growth and with the greatest exposure to flexible staffing.

Valuation

In my discounted cash flow model, I plugged in a perpetual growth rate of 1% for ten years, with a discount rate of 10%. The result I have in a normal scenario is that the fair price would be $40,53, which is about a 20% upside from the current price. If we combine this valuation to the technical situation of the stock price, I think it is possible to initiate a position in Adecco. In case of further drops, that would discount even more the impact of a recession on the stock, and there would be a sure opportunity to take advantage of the surge in price that the stock would see as soon as the recession ends. In case the stock bounces upwards from its support, then, investors could profit also over the short term. However, since I am a long-term investor, I think Adecco is a buy that will reward with dividends and capital appreciation over the next 5 years.

Be the first to comment