da-kuk

iShares MSCI ACWI ETF (NASDAQ:ACWI) is an exchange-traded fund that invests in a wide array of global equities in both developed and emerging markets, including the United States. The fund seeks to replicate the performance of its chosen benchmark index, the MSCI ACWI Index. The net expense ratio is reported by iShares as being 0.32%, which is fair, with $15.37 billion in assets under management as of November 2, 2022, indicating strong popularity. As of the same date, ACWI had 2,332 holdings.

I last reviewed ACWI in May 2022, when I was bullish on ACWI’s prospects. Unfortunately, at least one of the risks that I considered has materialized. I thought that ACWI offered significant upside unless there be either a significant recession or under-whelming earnings. Since then, inflation readings are still high (although they are possibly peaking now), and long-term yields (risk-free rates) have also risen. Further, plenty of large corporates are reporting disappointing earnings relative to forecasts. All considered, the environment has continued to be difficult for equities across the world, as well bonds and other asset classes.

Nevertheless, I did attempt to value ACWI previously, with a projected IRR in the range of 12% per annum over the next few years. I would not throw out the longer-term return profile, and therefore lower ACWI prices today more likely reflect a higher underlying equity risk premium than lower earnings power over the long run. Of course, your view may differ if you believe that elevated inflation will persist for several years beyond 2022.

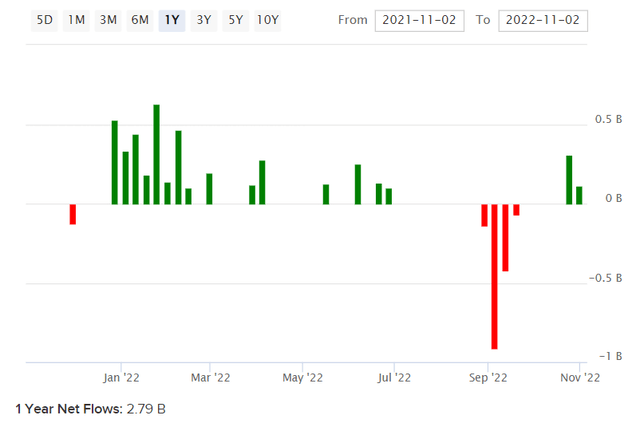

ACWI suffered some significant net outflows in August and September 2022, as depicted below. However, over the past year, investors have ultimately supported ACWI with net fund flows of +$2.79 billion.

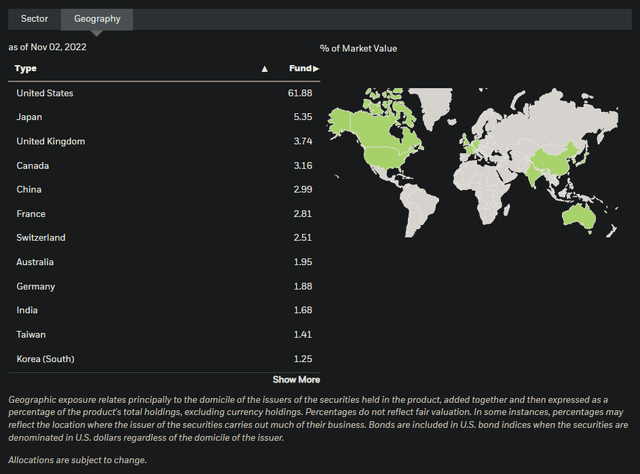

ACWI invests across the world. While the U.S. equity market is larger than the rest, and indeed represents 62% of the ACWI fund as of November 2, 2022, other significant exposures include Japan (5%), the United Kingdom (4%), Canada (3%), and China (3%), among others. The aggregate non-U.S. balance is enough to make ACWI a truly international fund.

Given all the different geographical exposures, I have taken the fund weights (per country) and multiplied those against local 10-year bond yields for each country (sourced from the World Government Bonds website). The weighted 10-year yield, rebalanced for cash/other, is 3.66% for ACWI. That is our theoretical risk-free rate. Meanwhile, a long-term equity risk premium that is fair for a mature market might be in the region of 4.2-5.5%, depending on the level of risk-taking/risk aversion. We could up-rate this by the level of historical beta however in this case, ACWI’s beta matches the S&P 500 (1.00x) which is supported by the high level of diversification that ACWI’s large portfolio affords the investor.

So, our cost of equity should probably be in the region of 7.86-9.16%. Morningstar currently estimate three- to five-year earnings growth of 10.97% for ACWI’s portfolio. In the much longer run, we would probably assume that the fund’s long-term earnings growth will be closer to the fund’s weighted 10-year yield and below. If we start with 2-3%, that would take our cost of equity to 5.5-6.5%, if I take the midpoint of 7.86-9.16% and subtract 2-3% for long-run earnings growth into perpetuity.

Therefore, I think that a fair forward earnings multiple at the present juncture might be in the region of 15.38-18.18x. ACWI’s benchmark’s forward price/earnings ratio was 13.29x as of September 30, 2022, indicating likely under-valuation in line with my prior view. Even Morningstar’s projected one-year forward multiple was 12.84x more recently as of October 24, 2022. While we might have some near-term earnings misses, ACWI is fundamentally cheap, indicating an elevated underlying equity risk premium and therefore higher-than-average forward returns at present prices.

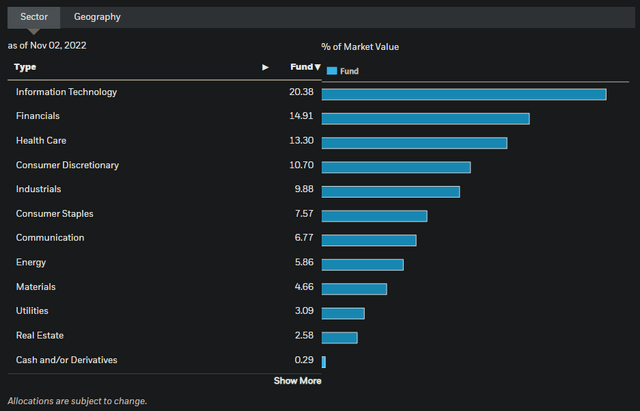

Sometimes it is difficult to buy into equities when they appear to be falling every week and/or every month. However, given all available information, it makes sense that ACWI will perform well over the long run. The fund also has some strong sector exposures, with biases toward technology (20% of the fund), financials (15%), and health care (13%).

The elevated tech exposure makes the fund sensitive to changes in the economy, while financial companies tend to perform well on cyclical rebounds (we are currently in a slowing-growth phase of the global business cycle). Health care is more defensive, but the sector has become increasingly sophisticated in recent decades, and has therefore become more aligned with other more sensitive sectors. ACWI also has a 10% exposure to consumer discretionary, another economically sensitive sector.

I think that once inflationary pressures ease further, and long-term yields top out as the Federal Reserve finishes its present hiking cycle (the Federal Reserve recently raised rates with an expectation that the “terminal rate” but might be toward 4.5-5%), we will then be able to look forward to stronger cyclical positioning. Right now, while ACWI might continue downward, I would be comfortably buying on the way down, and even on the way up, as present prices are likely to engender healthy long-term returns on an annualized basis. Investors should view ACWI on a five-year time horizon. At the very worst, you are buying equity beta that is arguably even more diversified/safer than investing in the U.S. equity market alone.

Be the first to comment