Sakorn Sukkasemsakorn

Investment summary

We are in search of selective opportunities within healthcare as we seek to move up the quality spectrum. Within the healthcare universe, there are numerous companies that exhibit the quality like premia investors are rewarding in FY22, whereas the sector traditionally performs well as a defensive in times of economic downturn.

Nevertheless, quality – and in particular, profitability (ROE, ROIC, margins, etc.) – are paramount within the current regime. Here we turn to Accolade, Inc. (NASDAQ:ACCD) and notice it displays a loose fit to these kind of factors. Whilst the company is churning away nicely towards its goals, it becomes a question of opportunity cost in the current landscape. Investors aren’t rewarding just top-line growth in FY22, but bottom-line fundamentals instead. With these in mind, we rate ACCD neutral with a price target of $11.60-$11.80.

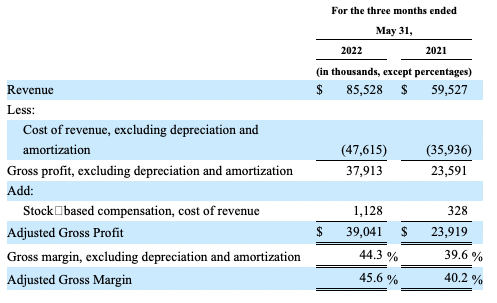

Exhibit 1. ACCD 6-month price action

Data: Updata

Q1 FY23 earnings provide useful insights

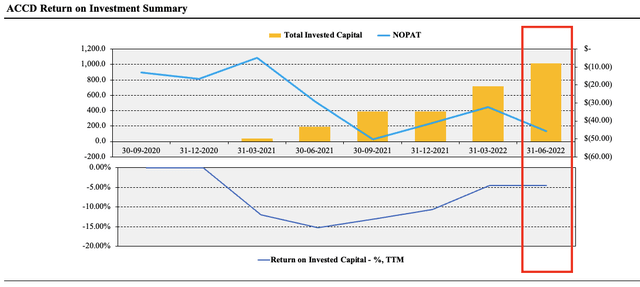

First quarter earnings for the company’s new fiscal year came in with a strong beat at the top of $85.5 million, a 44% YoY growth schedule (although Q1 FY22 didn’t include income from the PlushCare acquisition). ACCD recorded non-GAAP gross margin at 45.6%, up 560bps YoY, as seen in Exhibit 2. The decompression came from greater revenue contribution from the higher margin virtual primary care segment. We choose to refrain from adding back in stock-based compensation as it is realistically an expense in our estimation. Therefore, we estimate ACCD’s non-GAAP gross margin (ex-stock-based compensation) to be 44.3%.

Exhibit 2. ACCD reconciliation of GAAP to non-GAAP income

Data: ACCD 10-Q, Q1 FY23

Moving down the P&L, non-GAAP EBITDA came in at a $15 million loss, worse than the loss of $12.8 million the year prior. The result came in ahead of guidance thanks to a lower operating spend and the impact from other non-cash charges. Following the three acquisitions of FY22, ACCD has grown headcount by 71% to ~2,400. As such, it was a 71% growth in headcount vs. a 44% and each employee generates $35.6K in quarterly revenue, based on Q1 FY23 results. Management says that it completed a strategic review of the business last quarter, and ended up narrowing the headcount down by ~4% as a result. Management also says it is still on track to be cash flow positive within the next 2-3 years.

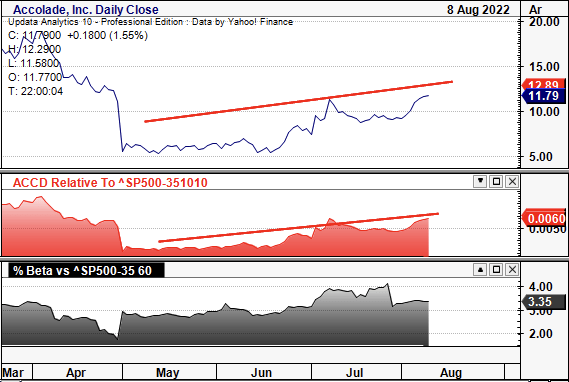

Alas, with the recent acquisitions, we need to see some further upside at the NOPAT level to substantiate this goal. As seen in Exhibit 3, ROIC has remained in the red despite the company’s level of invested capital expanding QoQ since listing. Generating a ROIC that beats the company’s WACC of 7.7% is integral to flourish in the current macro-regime, as the cost of capital is surging in both equity and debt capital markets. At present, ACCD isn’t there yet, and we advocate this is a key litmus test for investors to focus on into the coming quarters to gauge if it is on track to be cash flow positive in 2-3 years as management hope.

Exhibit 3. Return on investment has yet to pull through although trends are improving

We look to ACCD’s ROI as a key indicator on whether it is on track to hit cash flow positive in 2-3 years’ time.

Data: HB Insights, ACCD SEC Filings

As a result, management upgraded FY23 guidance and forecasts a 16% YoY growth at the top, calling for $360 million in revenue at the midpoint of range. It also projects FY23 EBITDA to fall between $35-$40 million for the year. Management also foresees Q2 FY23 sales of $82-$83 million and non-GAAP EBITA loss of ~$20 million. It also reiterated its objective of achieving positive cash flow by FY25 (or around 2-3 years from now).

Valuation somewhat supportive

We note the ACCD share price has caught a bid since May and has curled back up to 3-month highs. It has also gained in relative strength versus the healthcare and healthcare providers sector, as seen in Exhibit 4. However, we also note this is likely to be a function of sector beta versus pure idiosyncratic reasons.

Exhibit 4. ACCD has caught a bid since May however this looks to be sector beta versus company-specific drivers, as seen on the chart below.

This is important – we’re after selective opportunities within the healthcare space we move up into the quality matrix. In that vein, we need evidence of idiosyncratic (company-specific) risk drivers, and would ideally see sector beta reduce with improving relative strength.

Data: Updata

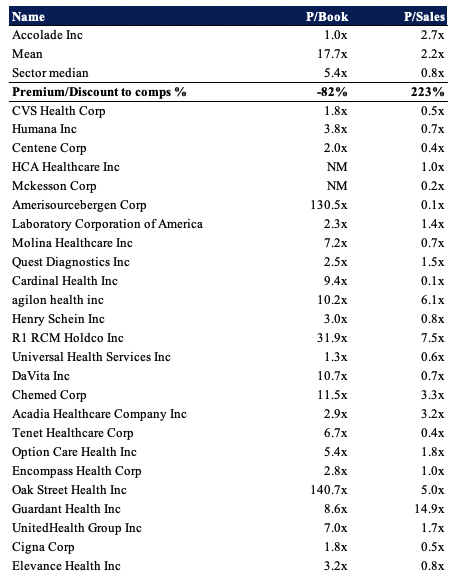

Shares are also fairly priced at 0.98x book and this trades at a deep discount to those in the peer group. Note, there are many long-standing, mature names in the list and therefore on an equity value the discount may be warranted. Shares are also priced at ~2.7x forward sales, implying that investors expect an above-market revenue growth next year for the company.

Exhibit 5. Multiples and Comps (GICS Industry Sector)

Data: HB Insights

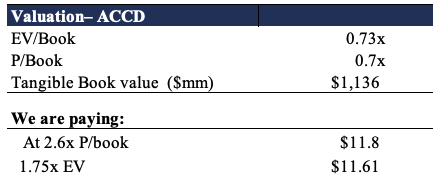

Shares also trade at a discount of 0.7x to tangible book relative to both market cap and enterprise value (“EV”). With this in mind, we’d theoretically be paying roughly fair price for ACCD at $11.60-$11.80, suggesting the stock is fairly priced trading at ~0.7x EV/Tangible book value.

Exhibit 6. Whilst we’d be paying a fair and reasonable price, the element of discounted value must shine through in order to justify investment

Data: HB Insights Estimates

In short

ACCD is churning along nicely and looks to be meeting is earnings targets since listing in FY20. By estimate, the stock certainly isn’t a sell or a short, let’s get that straight. There is probability of ACCD unlocking longer-term potential if and when it reaches cash flow positivity by FY24, as it so plans to do. Moreover, with the suite of recent acquisitions looking for integration into the operating model, additional revenues, operating income (and operating costs, for that matter) are potentially accretive (dilutive) to the bottom line and earnings.

Valuations are supportive of the case and shares look to be fairly priced at 0.73x EV/Tangible book value. We’d be paying a fair and reasonable price at this level, we estimate. However, this also suggests the stock is fairly priced, with little room for upside in valuation. Despite this, there’s a lack of the ‘quality’ premia we are chasing on offer here, namely, profitability. Without the return on invested capital or free cash flow conversion to bite into, we are left feeling under-nourished in this name. With these points in mind, we rate ACCD neutral at $11.60-$11.80.

Be the first to comment