abadonian/iStock via Getty Images

In our initiation of coverage, we conclude that Acadian Timber Corporation (OTCPK:ACAZF) is taking advantage mainly due to stumpage rates upside and its carbon considerations; in detail, our focus was not related to the company’s quarterly performance but correlated with the long-term horizon.

Before analyzing the Q3 release, we are looking at two main topics: carbon credit and debt.

As a reminder, the company is one of the largest forest owners in the North-Eastern U.S. and Eastern Canada. In 2021, Acadian Timber Corp. completed its first carbon development project. Carbon credit volumes will need to be verified by third-party agencies. Starting from Q4, credits need to be certified by the American Carbon Registry and then, after that, the company can start to earn. Looking at the details, after the sales, we should take into account the company’s related expenses, and Acadian Timber will approximately expect to receive 84% of the carbon gross revenue credits. This will be a positive catalyst over the course of the latest 2022 quarter. Speaking of numbers, the company’s initial estimate provides a total amount of 1.6 million in credits, and in Q4, Acadian will get 0.7 million.

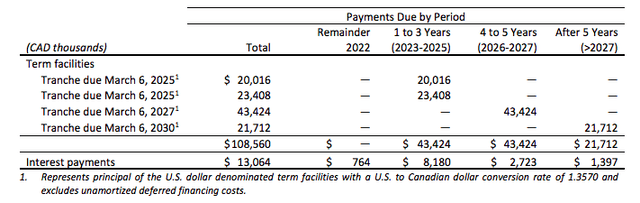

Concerning the debt, the company’s long-term indebtedness is presented below:

Acadian Timber Corp debt (Q3 press release)

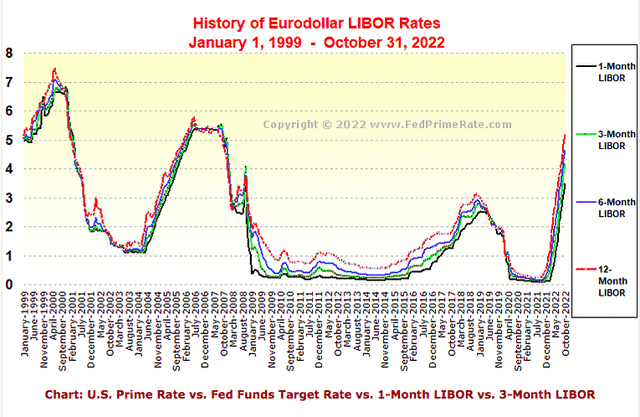

Part of the Acadian interest expenses ranges between 2.7% to 3.0% plus the 90-day LIBOR, this represents a clear risk and negatively impacts the company’s profitability.

LIBOR development (FED Prime Rate)

Thanks to some hedging in place (even at the FX level), the company is partially protected. Looking at the Q3 results, the quarter’s profit stood at $4.8 million versus the $0.3 million achieved in last year’s end results. This was due to unrealized FX gains and an increase in fair value adjustments.

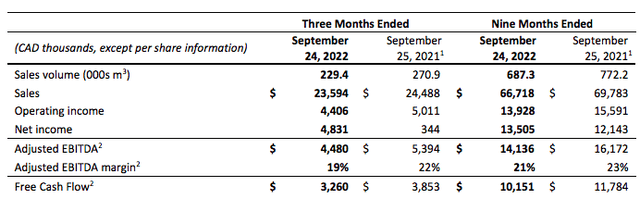

Q3 results

Cross-checking Acadian Timber consensus expectation, the company delivered a reported adj. Q3 2022 EBITDA of CAD$ 4.48 million and missed Wall Street numbers that were forecasting on average a CAD$ 5.16 million EBITDA. In detail, the miss was mainly due to lower volumes linked to limited contractor availability; however, price-positive realization and favorable currency development help the company to partially offset its earnings. Acadian adj. EBITDA margin was 19% versus the 22% performed in the same quarter last year. However, FCF on EBITDA was slightly up on a quarterly basis (72% versus 71%), but not sufficient to cover the quarterly dividend payment.

FCF evolution (Q3 press release)

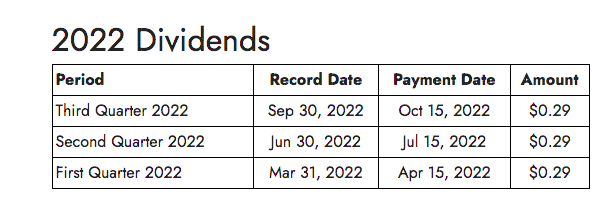

However, at the end of September, the company had sufficient liquidity ($17.1 million) to meet its shareholder dividend policy for the next three quarters (at constant dividend payment), and in Q4 will positively benefit from the sales of its carbon credits.

Dividend per share

Conclusion and Valuation

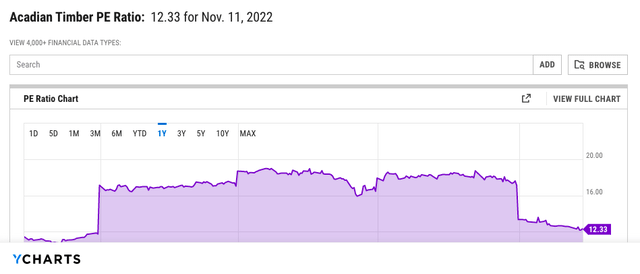

Having reached an EPS of $0.29 per share in the quarter, we are not making changes to our internal model. We were forecasting an EPS of CAD $1.02 and $1.1 for the 2022 and 2023 periods. Applying a historical price-earnings ratio of 16.5x (as presented in the graph below), we derive a valuation of CAD $18 per share. The company yield almost reached 8% and in our forecast numbers for 2023 is at 6.7%. Without considering its carbon credit activities (expected for Q4), Acadian will benefit from local wood market exposure both in Canada and in the US. We should also mention the upside of the higher rates in stumpage. Thus, a regulatory review could be a future positive catalyst. Mare Evidence Lab’s risk paragraph is included in our initiation of coverage.

Be the first to comment