CRobertson/iStock Editorial via Getty Images

Introduction

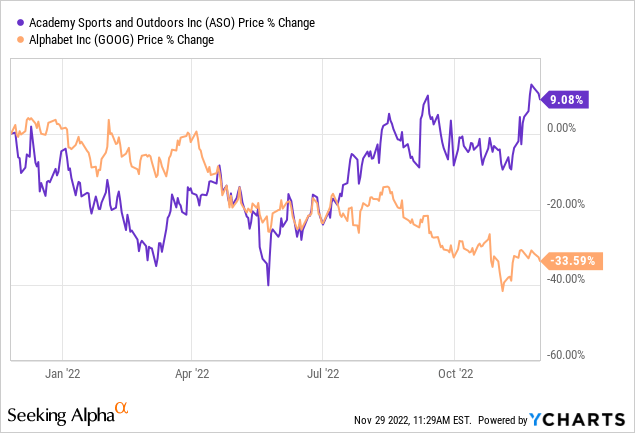

It is no mystery that even during bear markets, there are stocks that perform quite well. It is the case of Academy Sports and Outdoors (NASDAQ:ASO), a sporting goods and outdoor recreational products retailer. Just take a look at this chart where I compare its YTD stock price versus Alphabet’s (GOOGL). Of course, the two belong to different industries, but it is sometimes striking how a relatively small retailer that is present in only 18 states can outperform a massive business like Google that has an almost undefeatable moat.

When I lived in Texas, I enjoyed shopping at Academy, and its IPO in October 2020 was an event I really liked. Now, in this article I would like to use the data the company provides us with to forecast what business development trajectory this company will undertake in the next five years in order to assess if it is correctly priced or if, though near its ATH, it still is in undervalued territory.

Summary of previous coverage

When I initiated my coverage on the company, I published my bull-case with this article: “Why I Am Long Academy Sports And Outdoors”. The stock was trading around $46.5, and I stated that I thought it was still very cheap considering the current business.

The company operates in 18 states in the South and the Midwest, with recent new openings in Virginia and West Virginia. I highlighted how the geographical footprint of the company encourages me to think that Academy still has ample room to grow before it saturates the domestic market. One of the key aspects of my bull-case is this: there is plenty of room for Academy to grow in the U.S.

In addition, the company seems to be able to consolidate its outstanding results boosted by the pandemic, when the retailers saw its sales spike.

Finally, the company has started a share repurchase program and has initiated a dividend that, given its 3% payout ratio, has ample room to grow and reward long-term shareholders.

Academy’s expansion plan

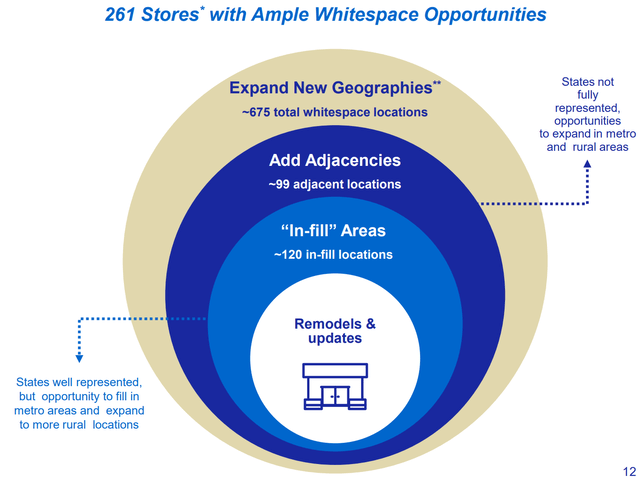

In the past few years, the company has turned into growth mode and is targeting to become the largest sporting goods retailer in the country. Its expansion plan is focused on three main opportunities, as shown from the infographic below.

- Filling metro areas where the company is already present. Most of these markets are fast-growing metro areas, such as Dallas, Houston, Atlanta and Charlotte.

- Expanding into adjacent markets like Panama City, Florida, and Lexington, Kentucky, where it just opened new stores. This is a thoughtful way to plan expansion while leveraging the logistic and the warehouse infrastructure that has already been built to support the existing stores.

- New geographies. The company is targeting to become a nation-wide retailer, and it is slowly expanding east in Virginia and West Virginia. We can probably expect the company to aim at Pennsylvania and Ohio and New York soon.

ASO Investor Presentation

Academy’s Goal is to open 80 to 100 stores over the next 5 years (fiscal 2022-2026). We will see later on in this article that if we consider that net sales per store are at least $20 million, we are before an opportunity of potential $2billion in additional annual revenue. Ken Hicks, Academy’s President, Chairman and CEO, explained this plan during the last earnings call:

While it is early, the new stores opened in 2022 are overall exceeding our initial sales expectations, which is a good indication that customers are drawn to our broad assortment of top national and high-quality private brands at an everyday value. Thanks to all of the team members who helped execute these highly successful store openings. We’re excited to be in a growth mode and expect to open nine new stores this fiscal year and 80 to 100 stores over the next five years. Academy stores have the highest store productivity in our peer group making our new stores a compelling use of our capital with a high return on investment.

The company has also revisited its store model, and it is running its stores with a new operating model which makes the company state that every new store will have a return on invested capital of at least 20%, and will reach its ramp to maturity in four to five years. Last, but not least, they are all to be EBITDA accretive after the first full year being opened.

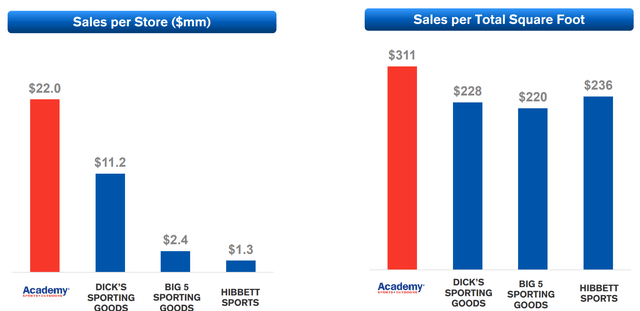

The company also leads the industry in terms of sales per square foot, that in the TTM were $356 that generated an operated income per store of $3.4 million. As of now, 100% of its existing stores are profitable and accretive to earnings.

ASO Investor Presentation

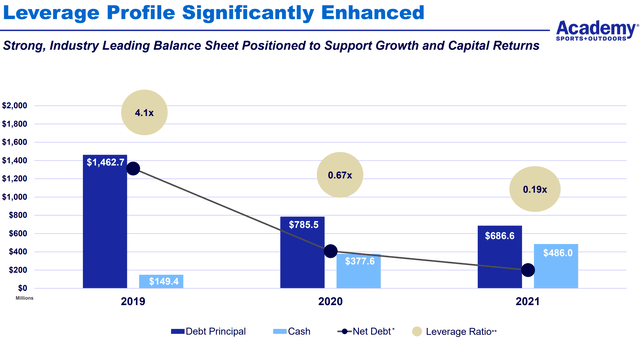

One last point: the company has been laser-focused on improving its leverage ratio, drastically reducing it in just three years, as this graph below shows.

ASO Investor Presentation

This is important because Academy is not funding its expansion through excessive debt, but through its own financial strength.

Here are the table and the graph

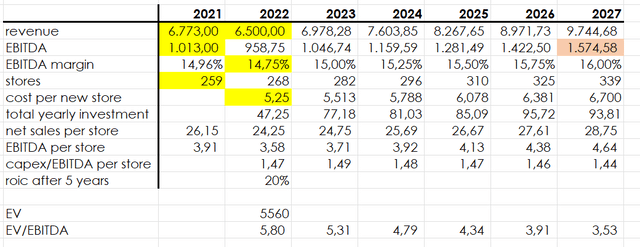

Now, what I believe is that Academy is still quite cheap, even though it is trading near its highs. Here is a table that projects what Academy could become in five years if it executes its plan in a conservative way, thus opening only 80 stores by the end of 2027.

In yellow are data that have actually been reported (2021) or that are quite easy to forecast, given the fact that we are close to year end. In fact, we already know that total revenues in 2022 will come in a bit below the results achieved in 2021. However, Academy saw an incredible sales boost in 2021 due to the pandemic, and it seems like the company is managing to consolidate this increased traffic and demand even in different economic conditions.

The box highlighted in light orange shows the final EBITDA that we can expect at the end of this five year expansion. As we can see, it should be 57% higher versus last year’s EBITDA.

Author, with data from ASO guidance

Here is how we can walk through this table to understand the future development of the company.

We start from 259 stores in 2021. Dividing the revenue by the number of stores we have the net sales per store and, in the same way, we can calculate the EBITDA per store. In 2021, they were, respectively, $26.15 million and $3.91 million. This calculation is done year over year while assuming that, apart from 2022, the company’s revenue will grow by 4% and its EBITDA margin will improve by an annual 0.25%, which I think is rather conservative.

Since Academy has announced last year that it plans to open at least 80 new locations through the end of 2027, I put that at the end of 2027 it will have 339 stores (259+80), forecasting the lower range of the guidance. Then I spread over the years an average number of new openings.

Thanks to these numbers we can forecast the expected revenue and the expected EBITDA per store through the years, taking into account that the new stores become EBITDA accretive after one year (this is why I assumed that stores opened in 2022 will be EBITDA accretive in 2023).

We also know that the cost per new store in 2022 is $5.25 million. This leads to a capex/EBITDA per store ratio that is always below 1.5, confirming what the company is saying about the fact that after one year the stores are really EBITDA accretive. In my forecast I assumed that every year, the cost per new store will increase, on average, by 5%.

We see that this helps us calculate the total yearly investment that Academy will have to fund to execute its expansion plan. This is a very important number because Academy states that after five years it receives a ROIC of 20%. This is why, starting from 2026, we see that EBITDA growth runs much faster than the revenue growth because the investment made for the new stores in 2022 is now giving to the company is full return. In other words, in this table, from 2026 I add to EBITDA a sum that is 20% of the invested capital of 2022 ($47.25 million).

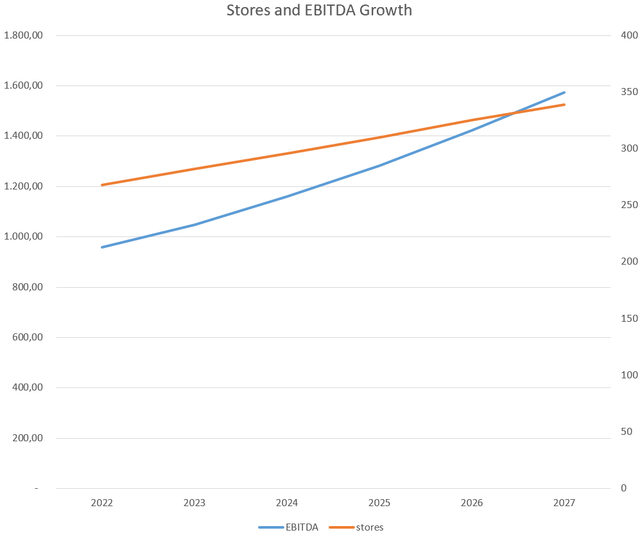

This leads to this graph below, which shows that between 2026 and 2027, EBITDA growth will pick up speed and will grow at an even faster pace compared to the growth of new openings.

Author, with data from ASO guidance

In other words, not only will we see a steady growth of revenues and EBITDA, but we are before a plan that will deliver stronger and stronger compounding power as the years go by.

Yet, when we go back to the table, we see that I calculated the current EV/EBITDA and I then calculated the fwd EV/EBITDA ratio for the following years.

We get that the company is currently trading around 5.8, but this ratio could be as low as a 3.5 when we consider a fwd 2027 EV/EBITDA.

Seeking Alpha Quant Ratings suggest the same when it shows that the sector median ratio is around 9.

Conclusion

In my previous article, I shared a discounted cash flow model that showed another way to understand the company is undervalued by, at least, 30%. Since then, the company’s market cap has increased only by 3.6%, so the assumptions shared there are still pretty accurate. However, in the meantime one thing has changed: short interest is now almost at 20% and some insiders are selling significant amounts of shares. So, there might be more volatility around this stock compared to other picks. However, the more I look at the whole picture and at the growth of the company, the more I believe we are still before a stock that could actually start being fairly valued around $63.

Be the first to comment