TasfotoNL

ABN AMRO (OTCPK:AAVMY) is a great income play within the European banking sector, due to the combination of a low-risk profile, high capitalization, undemanding valuation, and high-dividend yield.

Company Overview

ABN AMRO is a Dutch bank, focused on the retail and commercial banking segments. The bank performed a wide business restructuring following the global financial crisis (GFC) of 2008-09, focusing its business mainly in its domestic market.

ABN AMRO received a state bailout during the GFC and the Dutch state remains its largest shareholder, with a stake of about 56%. While the government has decreased its stake since 2015, when the bank performed its IPO and the state made several divestments in the following years, but a weak share price has made it more difficult for subsequent reductions over the past five years (without incurring losses).

This means that ABN is still majority-owned by the government due to historical reasons, even though the Dutch government does not want to be a long-term shareholder in the bank. This also means that there is some overhang risk, as the major shareholder is a potential seller, this risk in the short to medium term is quite low given that ABN’s current share price is about €12 per share, and the last sale was made at more than €23 per share in 2017. Therefore, further sales aren’t likely in the short term, unless the stock doubles from its current value, which is not very likely to happen considering its historical stock pattern.

ABN has a long history in the Dutch banking industry and its business strategy is not expected to change much in the near future, being mainly focused on the domestic market. Thus, considering its business profile and geographical exposure, its main competitors are other large Dutch banks, such as Rabobank and ING Groep (ING).

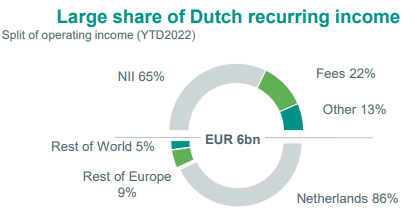

During the first nine months of 2022, some 86% of its revenue was generated in the Netherlands, and about 57% of its loan book is in mortgages, which means that ABN is a bank with a relatively low risk profile. Moreover, some 65% of its revenue comes from net interest income and 22% from fees, thus its exposure to more volatile activities, such as related to capital markets, is quite low.

Revenue (ABN AMRO)

Going forward, the bank’s strategy is not expected to change much and should be focused on its domestic market, targeting digitalization as a way to reduce costs and offer a better customer service. What this also means is that ABN should have a rather stable business performance over the next few years, and growth isn’t one of its top priorities, preferring instead to have a low-risk profile and provide an adequate return on invested capital.

Financial Overview

Regarding its financial performance, ABN has a relatively good track record in recent years, having reported a double-digit ROE from 2015-19, a trend that only reversed in 2020-21 due to the impact of Covid-19 on its provisioning level.

However, this negative effect was temporary as credit quality remained quite resilient during the past couple of years, and the bank improved rapidly its profitability during 2022. Indeed, after reporting a net loss regarding 2020, ABN returned to a net profit in 2021 (ROE of 6.3%), while during the first nine months of 2022 was able to improve its ROE to more than 8%.

This positive operating momentum is supported by a recovery in operating margins, some gains on disposals and a low level of impairments. In Q3 2022, ABN’s net interest income (NII) increased to more than €1.3 billion, an increase of 6% YoY, justified mainly by higher interest rates that lifted the profitability on the asset side and were not fully reflected in the cost of deposits.

This trend is expected to continue in the coming quarters, as the European Central Bank only started its hiking process last July, thus NII should continue to increase supported by higher market rates. On the deposits side, higher rates aren’t expected to be reflected much because Dutch banks have relatively low loan-to-deposits ratios and don’t need to increase the deposit base in the short term.

Beyond higher NII, ABN’s revenues were also supported by increasing fees, which amounted to €441 million in Q3, up by 7% YoY. Total revenue was also boosted by one-time gains in other operating income, which increased to €446 million from €119 million in Q3 2021, leading to overall revenue of €2.16 billion in the quarter (+25% YoY). However, this strong growth is mainly explained by one-off items, which have a much smoother effect on the cumulative nine months, with revenue up by 13% YoY to nearly €6 billion.

Regarding costs, the bank reported very good trends despite the inflationary pressures on wages and overall costs, being able to reduce operating expenses in Q3 by 4% YoY, to €1.25 billion. This lead to an efficiency ratio of 58%, much better than its ratio of 75% in Q3 2021, but still a higher ratio than compared to the most efficient banks in Europe. This means that there is still some scope to cut costs in the coming years, which can be a positive contribution to earnings growth.

On its asset quality side, ABN’s cost of risk ratio was very low at only one basis point (bp) in the quarter, showing that there hasn’t been much effect yet on its credit portfolio of a slowing economy in Europe. However, this ratio is likely to increase in the coming quarters, even though it is not expected to reach a level much higher than 20-30 bps, as the Dutch economy is quite strong and the unemployment rate was only 3.7% at the end of Q3.

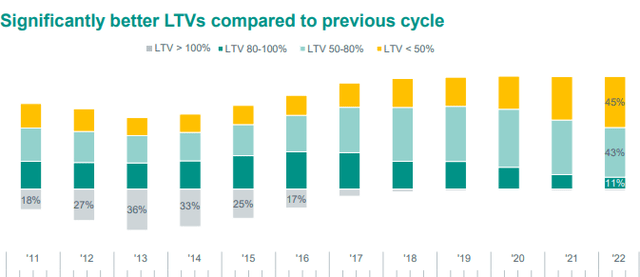

Moreover, while in the past the Dutch mortgage market was somewhat leveraged, with a significant portion of mortgages with high loan-to-value (LTV) ratios, this has changed since the European debt crisis of 2012-13. After that period, new mortgage loans started to be made at much lower LTVs, and the current stock now has a much better profile (the vast majority have LTVs below 80%), which is positive to keep low levels of credit losses when the economy enters into a recession.

Due to the combination of higher revenue, lower costs, and muted levels of credit provisions, ABN’s net income amounted to €902 million in Q3, up by 103% YoY. During 9M 2022, its net income stood at close to €1.9 billion, an increase of 73% YoY, showing that ABN is currently facing a very positive cyclical operating environment due to higher interest rates in Europe. Its ROE during the first nine months of 2022 was 9.4%, very close to its medium-term target of 10%.

Going forward, ABN should continue to benefit from higher interest rates in Europe, which are positive for its top-line as the bank has high exposure to NII. On the other hand, the impact of a potential recession is the major uncertainty in the coming quarters, and what will be its effect on the bank’s credit quality and provisioning levels.

Capital & Dividends

Regarding its capitalization, one of ABN’s key strengths has been its good level of capitalization, which enables it to provide one of the most attractive shareholder remuneration policies in the European banking sector. At the end of last September, ABN’s capital ratio (CET1) was 15.2%, which is above the sector’s average and also higher than its medium-term target of at least 13%.

This means that ABN has an excess capital position, which seems to be a conservative approach given that ABN has a relatively low risk profile and therefore doesn’t need to have a high capital ratio. Thus, as the bank is well capitalized and does not need to retain much profits, it can distribute a good part of its earnings to shareholders in a sustainable way.

Indeed, ABN’s distribution policy is to pay at least 50% of its annual earnings through dividends, and perform share buybacks if its capital ratio is above 15%.

While the bank suspended dividend payments during the pandemic, due to the regulator’s ban on dividends, it resumed dividend distributions in 2021. Its last annual dividend, related to 2021 earnings, was €0.61 per share, and more recently the bank changed its dividend frequency to semi-annual. It already paid an interim dividend of €0.32, while the last dividend should be paid by the middle of 2023.

According to analysts’ estimates, its total dividend is expected to be close to €0.80 per share, which means that at its current share price, ABN offers a forward dividend yield of about 6.5%. Moreover, ABN is also likely to perform share buybacks during 2023, which will improve even further its shareholder remuneration policy.

Conclusion

ABN AMRO is a bank with strong fundamentals in Europe, due to its low-risk profile, good level of capitalization and positive operating momentum supported by higher rates. While the bank’s growth prospects are not particularly impressive, its income appeal is quite good and, in my opinion, the major reason to buy its shares.

Nevertheless, its current valuation of only 0.5x book value and 7x forward earnings is also quite undemanding, making ABN a good income play for long-term investors.

Be the first to comment