maxsattana/iStock via Getty Images

Thesis

The Aberdeen Global Dynamic Dividend Fund (NYSE:AGD) is a global equities CEF. Back in August, the fund’s board of directors approved its expansion via the incorporation of two funds from the Delaware Management Company, namely the Delaware Enhanced Global Dividend and Income Fund (DEX) and the Delaware Investments Dividend and Income Fund (DDF). The merger is still subject to shareholders’ approvals for the acquired funds.

We have now seen the Delaware Investments Dividend and Income Fund shareholders approve it:

PHILADELPHIA–(BUSINESS WIRE)–Today, Delaware Investments Dividend and Income Fund, Inc. (the “Acquired Fund”), a New York Stock Exchange-listed closed-end fund trading under the symbol “DDF”, announced that it held its adjourned Special Meeting of Shareholders (the “Meeting”) on November 30, 2022. At the Meeting, shareholders of the Acquired Fund voted to approve the reorganization of the Acquired Fund into abrdn Global Dynamic Dividend Fund (the “Acquiring Fund”), a New York Stock Exchange-listed closed-end fund trading under the symbol “AGD” (the “Reorganization”).

As of the record date, August 11, 2022, the Acquired Fund had outstanding 7,611,158.16 shares of common stock. 62.48% of outstanding common stock were voted representing quorum.

The shareholders of the Acquiring Fund approved the issuance of shares of the Acquiring Fund in connection with the Reorganization at a special shareholder meeting held on November 9, 2022. It is currently expected that the Reorganization will be completed in the first quarter of 2023 subject to the satisfaction of customary closing conditions. Further details on the Reorganization date will be made available in a future press release.

With the DDF shareholders now having approved the merger, it is a matter of time and operational mechanics before the move is completed. The mechanics will involve new shares in AGD which will be exchanged for the DDF ones, and a co-mingling of the underlying assets and cash-flows.

When it comes to DEX though, the story is different, with the merger not yet approved:

PHILADELPHIA, December 01, 2022–(BUSINESS WIRE)–Today, Delaware Enhanced Global Dividend and Income Fund (the “Fund”), a New York Stock Exchange-listed closed-end fund trading under the symbol “DEX”, announced that its Board of Trustees (the “Board”) has authorized an issuer tender offer to purchase for cash up to 30% (or 3,186,291) of its issued and outstanding common shares, without par value (the “tender offer”). The tender offer is contingent on the shareholder approval of Proposal 1, the reorganization of the Fund into arbdn Global Dynamic Dividend Fund (the “Acquiring Fund”), a New York Stock Exchange-listed closed-end fund trading under the symbol “AGD” (the “Reorganization”), at the Fund’s upcoming adjourned Special Meeting of Shareholders that will take place on December 12, 2022 (the “Special Shareholder Meeting”).

If shareholder approval of Proposal 1 is obtained at that Special Shareholder Meeting, the tender offer will commence on Thursday, January 12, 2023, and will expire, unless extended, at 5:00pm ET, on Friday, February 10, 2023, and purchases will be made at a price per share equal to 98% of the Fund’s net asset value per share as of the close of trading on the first business day after the expiration of the tender offer. If more shares are tendered than the amount the Board has authorized to purchase, the Fund will purchase a number of shares equal to the tender offer amount on a pro-rated basis. If shareholder approval of Proposal 1 is not obtained at the Special Shareholder Meeting, the tender offer may not take place.

Having failed to obtain share-holder approval for the merger, the fund management is now trying to engineer a large share buy-back, contingent on the merger approval. Since DEX is trading at roughly 10% discount to NAV, this would represent the opportunity for a large bump-up in returns.

Premium / Discount to NAV

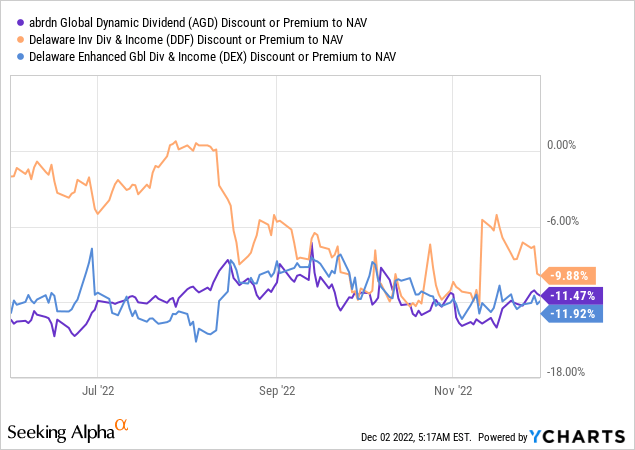

Since the potential merger announcement, we have seen the funds’ discounts to NAV converge:

We can see how DDF was the best regarded CEF from the cohort, trading flat to NAV when the announcement was made. It has subsequently moved to a substantial discount to net asset value, matching AGD’s.

Although the DEX shareholders have not yet approved the merger, its discount performance suggests something will eventually come through for the fund – its discount to NAV has not fallen off a cliff or diverged substantially from AGD’s. The market is telling us a solution will eventually be found here.

Conclusion

AGD is a global equities closed-end fund. The fund’s board of directors approved in August its merger with the Delaware Enhanced Global Dividend & Income Fund and the Delaware Investments Dividend & Income Fund, subject to shareholders approvals. While DDF has now approved the merger, the DEX shareholders have not. DDF’s discount to NAV now matches AGD’s, and the two vehicles are in the process of finalizing the asset co-mingling and retirement of DDF shares. As for DEX, the management there is working on engineering a very large share buyback program that is contingent on the shareholders approving the merger. With DEX trading at a 10% discount to NAV, this would represent a nice bump-up in returns for shareholders in exchange for approving the merger.

Be the first to comment