gorodenkoff

Many long-time followers of mine are familiar with my rather outsized long position in AbCellera Biologics (ABCL). Currently, it makes up a whopping 46% of my speculative portfolio; and as such, when they report, I tend to pay very close attention.

In this article, I would like to review my thoughts about the quarter and cover some developments that may have been missed in the conference call and over the last few months.

Q3 Results and Conference Call Thoughts

AbCellera reported earnings after the bell on November 8th, beating both revenue and earnings estimates.

- AbCellera Biologics press release: Q3 GAAP EPS of $0.08 beats by $0.03.

- Revenue of $101.38M beats by $18.02M.

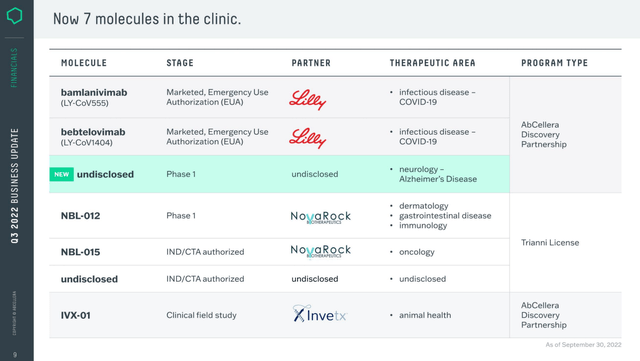

In addition, the company announced 4 new program starts, taking the total to 92 programs in active status, along with news that a new partnered molecule had entered phase 1 clinical trials for the high value indication of Alzheimer’s disease. This now takes the company up to 7 partnered molecules currently in the clinic.

The company also reported having $868 million in cash on the balance sheet with nearly $106 million in additional accounts receivable and zero long-term debt. For a quick reminder, AbCellera is currently engaged in a large infrastructure buildout, which may cause the cash balance to fluctuate quarter-to-quarter, along with the timing of accounts payable and receivable.

During the conference call, I noted the continuation of a distinct shift among managements commentary towards moving up the royalty and ownership value chain. This is certainly not a new shift, however, each quarter, the company further explains and clarifies its intentions.

In the call, CEO Carl Hansen mentioned that the company currently has 7 programs under development with co-development opportunities. In these programs, the company has negotiated a starting 50/50 ownership structure in the molecules that AbCellera develops with partners and owns the right to co-invest, at the company’s discretion, in the development of these molecules at certain points in development, to retain that 50% ownership.

The company clearly is pushing the business to a place that gives it more control of the development process; and also more potential value in the case of success. Think of this as similar to doubling down at Blackjack when dealt an 11, you already have chips at risk when the cards are dealt, but if you see an advantage, along with a good chance of success, you clearly want to double your bet. It does not guarantee success, but your odds certainly go up of hitting a home run on that hand.

AbCellera, for nearly all of 2022 has telegraphed that fact that they will be focusing on quality, not quantity going forward in regards to deal volume, gone are the days of 10 to 15 deals being announced in a given quarter. Going forward, I would expect that the total programs are likely to grow quite slowly, yet the economic impact of each is likely to be much, much higher.

As the company has become more integrated and capable, AbCellera clearly feels that they are able to take programs much further along “in house” and as such, command much more beneficial economic terms for each deal. A good example of this is the CD3 panel that the company will be presenting at the Society for Immunotherapy of Cancer (SITC) 37th Annual Meeting on Friday November 11th.

The company believes that it has created and is currently validating the world’s largest CD3 antibody catalogue in existence today. CEO Carl Hansen continues to remark on the high levels of interest the company is receiving to partner this panel, however, the company wants to continue to develop these targets in house to receive a greater economic benefit in an eventual deal.

A very similar playbook is also occurring with the notoriously difficult GPCR and Ion channel platform. The company appears to have made significant strides in both Ion channel and GPCR’s given that during the call Mr Hansen noted that they have already begun work on, or delivered 12 molecules to partners and internal programs in this difficult area to target and plan to release some exciting info in 2023.

News you may have missed

Throughout Q3, the company announced a few interesting developments, including the first GCPR candidate to advance to preclinical development from its partnership with drug development powerhouse Regeneron (REGN) inked in 2020 and was previously an undisclosed partner.

AbCellera (Nasdaq: ABCL) announced today that Regeneron has elected to exercise its right to advance a therapeutic antibody candidate, discovered in partnership with AbCellera as part of a multi-target collaboration between the companies, into further preclinical development. The partnership, which commenced in March 2020 and allows for four discovery programs selected by Regeneron, leverages AbCellera’s antibody discovery engine and Regeneron’s VelocImmune® mice to identify novel therapeutic antibodies. This is the first potential candidate selected by Regeneron to move into further evaluation, and it targets an undisclosed G-protein coupled receptor (GPCR).

Under the terms of the agreement, Regeneron has the right to develop and commercialize therapeutic antibodies resulting from the collaboration. AbCellera receives research payments and is eligible to receive downstream clinical and commercial milestone payments and royalties on net sales of products. AbCellera received a milestone payment for this antibody candidate and the amount of the payment was not disclosed.

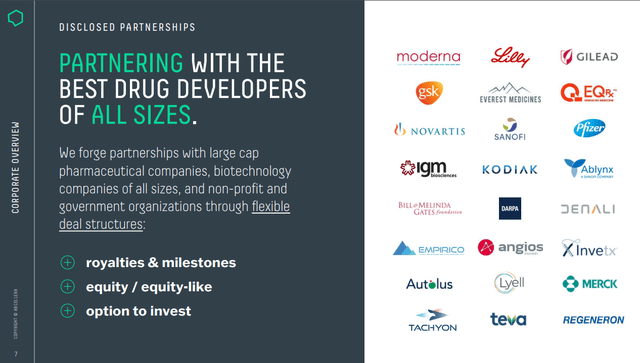

Regeneron is widely considered to be a premier, tier 1 drug developer and its research efforts are highly respected in the industry, so, advancing a partnered, difficult to treat class, such as a GPCR molecule from AbCellera is certainly notable and provides further validation to the company’s platform.

As you can see below, AbCellera has forged discovery partnerships throughout the truly heavy hitters class in drug development and whenever a target or molecule advances in the clinic, people tend to take notice.

In addition, during the quarter, the company announced further development in its facilities expansion, which is a key part of the plan for future growth. The company broke ground on phase two of its facility integration plan which includes advanced laboratory space at the Vancouver campus headquarters.

The long held vision of CEO Carl Hansen has been to combine both the discovery of antibody therapeutics as well as to integrate these discoveries with manufacturing to allow for potential targets to reach the clinic faster.

“With our current capabilities, we are able to find optimal clinical antibody candidates with greater precision and speed, ultimately helping our partners bring medicines to patients sooner,” said Murray McCutcheon, Ph.D., SVP, Corporate Development at AbCellera. “Upon completion of this expansion, AbCellera will stand alone in providing a fully integrated solution for partners to bring novel antibody-based medicines from target to the clinic. For many partners, integration allows them to focus resources on their core business.”

It is clear to me that AbCellera has a thoughtful and fully funded plan to both speed up the development of its partnered products, allowing the company to generate royalties faster and to move up the value stack and allowing the company to receive greater royalty percentages along with potential revenue and profits from the manufacturing facility.

From public statements made by AbCellera, the company expects to occupy its new headquarters in late 2023, the new, state of the art lab space in 2025 and to open the clinical manufacturing facility to production in late-2024.

A Potential End To COVID Cash… Or Is It?

Regarding the company’s COVID antibody therapeutic bebtelovimab, the FDA on November 4th announced that the antibody is unlikely to neutralize two emerging Omicron subvariants called BQ.1 and BQ.1.1 that are quickly becoming dominant in the USA.

This news, while not yet confirmed, likely marks the end to the commercialization of bebtelovimab; and as such, any further significant near term cash flows from this molecule. While this news is not ideal for AbCellera and certainly the massive cash infusion provided by bebtelovimab will be missed and perhaps punished by the market, the company appears to have a potential ace up its sleeve.

In a twist, announced in the conference call, the company stated that they have discovered yet another antibody to provide a solution to the new variants, that is currently ready to go directly into the clinic, if given the green light by its partner Lilly (LLY), the FDA and payors.

This new antibody may or may not eventually reach the clinic, however, the speed at which AbCellera worked to develop a further solution, ahead of literally everyone else, is highly encouraging and continues to validate their approach and platform.

Bebtelovimab has had a rather remarkable run and turned out to be the last of the COVID antibodies still standing, outfoxing multiple big name pharma company’s along the way, including, its now disclosed partner Regeneron in the process. While the current run of Bebtelovimab appears to be over, AbCellera has come through once more with yet another solution to fill the gap, if needed.

AbCellera views any further COVID treatment royalties as a pure luxury and is clearly not driving any business decisions at this point. Extra cash is always a good thing, however, in my opinion, the company will be absolutely fine at this point if nothing further is realized.

Bottom Line

AbCellera is executing a concerted and well thought out effort to move up the value chain, both with internally developed programs, co-developed programs and with the expected late-2024 opening of the GMP manufacturing facility, which tends to be understated in its importance and revenue opportunity.

The potential winding down of COVID revenues may give heartburn to some, including Wall Street analysts; and the market’s reaction is likely to be somewhat volatile, however, COVID revenues have always been an appetizer to the main course yet to come with this company, which is the highly lucrative ownership portfolio of therapies that the company is building.

It is abundantly clear that CD3 and GPCR / Ion channel targets are a highly sought after class of drugs in the pharma world and it is becoming clearer by the quarter that AbCellera may be building a world class discovery engine for precisely these targets.

As I always state in AbCellera articles, this stock is not for the faint of heart and is a very risky investment that is unlikely to explode higher near-term given the length of time to significant non-COVID royalties, however, with no liquidity concerns whatsoever in the near future and a plethora of potential high-value deals emerging on the horizon, I have never been more confident in the long-term return potential of this company.

I look forward to your thoughts below in the comment section. As always, thank you for reading and good luck to all!

Be the first to comment