gorodenkoff/iStock via Getty Images

Investment Thesis

I recently covered Medtronic plc (MDT) because I want to increase my exposure to medical device companies in general and diabetes care in particular. I argued that I do not consider Medtronic worth investing in, just because of its (weakly performing) diabetes franchise. In this context, Abbott Laboratories (NYSE:ABT) appears to be a more promising portfolio candidate.

The company has attracted investor attention primarily because of its strong performance during the COVID-19 pandemic, as it plays a critical role as a provider of rapid testing systems. As a result of increasing investor optimism, ABT’s share price reached a high of $140 in December 2021. However, with increasing immunity worldwide and newer SARS-CoV-2 strains leading to less severe infections, demand for rapid tests has declined – and so has investor optimism. As a result, the share price has now returned to more reasonable levels, and I therefore thought it appropriate to take a closer look at the company and compare it with industry giant Johnson & Johnson (JNJ).

In this article, I will point out why I personally would not buy Abbott Laboratories because of its COVID-19 franchise and instead focus on three other aspects:

- Abbott is the price leader in continuous glucose monitoring and insulin dosing – a rapidly growing field.

- The company is broadly diversified via medical devices, diagnostics equipment, specialized nutrition and pharmaceuticals, and thus shares similarities with JNJ – the oft-cited “sleep well at night” stock.

- Same as JNJ, Abbott is very conservatively financed – it has a lot of firepower to fund acquisitions.

Discussion Of Business Segments, Growth And Profitability

Abbott Laboratories dates back to 1888 and has grown into a diversified medical device and healthcare company. Its business is divided into four segments:

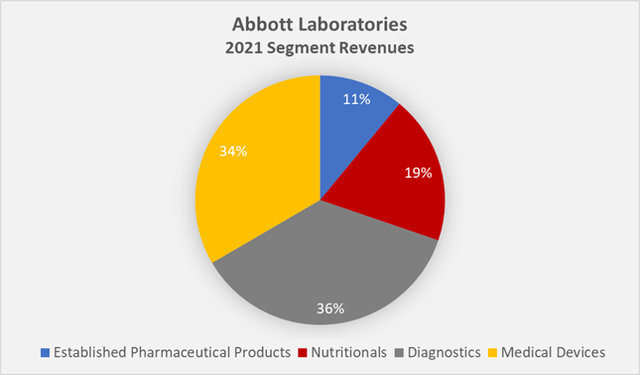

Figure 1: Abbott Laboratories’ 2021 segment revenues (own work, based on the company’s 2021 10-K)

Established Pharmaceuticals is Abbott’s smallest segment in terms of revenues ($4.7 billion), and in contrast to Johnson & Johnson mainly exposed to emerging markets, i.e., countries like India, Russia, China and Brazil. It is important to note that Russia is only a minor contributor (i.e., <3% of 2021 net sales) to Abbott’s top-line, as it is not listed in Note 15 in the 2021 10-K, which shows sales-related geographic information.

Abbott’s business relations with Russia remain operational. Abbott’s pharmaceutical products relate mainly to gastroenterological, cardiovascular, metabolic, respiratory and central nervous system indications, with names such as Creon (pancreatin), Dicetel (pinaverium bromide), Duspatal (mebeverine), Lipanthyl and Tricor (fenofibrate), and Synthroid (levothyroxine). The segment’s operating margin is relatively stable at around 20%, but is obviously sensitive to exchange rate fluctuations. In the first half of 2022, segment sales grew 4% year-over-year, which can be considered a reasonably good performance given the headwinds from foreign exchange rates. On a two-year basis, segment sales grew at a compound annual growth rate (CAGR) of 2.6%.

Nutritionals accounted for 19% of Abbott’s sales in 2021 ($8.3 billion), and the segment posted healthy growth at a CAGR of 5.8% on a two-year annualized basis. However, in the first half of 2022, sales declined 7% year-over-year (-4.5% organically), primarily due to a voluntary recall and a discontinuation of production of infant nutrition products. At the time of writing, production has partially resumed. In addition to infant nutrition, Abbott also manufactures and distributes adult nutrition products, such as diabetes nutrition (Glucerna brand), benefiting from cross-selling opportunities. The segment is similarly profitable to the pharmaceutical segment, with a normalized operating margin in the low 20% range.

Medical Devices is the segment that piqued my interest in Abbott. It is the company’s second-largest segment, with net sales of $14.4 billion (34%) in 2021, and it is also the fastest-growing segment except for Diagnostics (see below). On a two-year annualized basis, net sales grew at a CAGR of 8.3% – operating income grew nearly 50% in 2021. Operating profitability is very good at typically 30%. Abbott manufactures and sells, among others, blood glucose monitoring systems, pacemakers, ablation catheters, stent systems, and neuromodulation products. In diabetes, the Libre Freestyle (continuous glucose monitoring) device is worth noting as it allows the company to generate recurring revenue and growth through innovative ideas and cross-selling opportunities. The product, which does away with the painful and annoying pricking of the finger, enjoys a high profile – as underscored by product sales of $3.7 billion in 2021, up 37% from the previous year. It should be noted that this is not a one-time effect due to the pandemic and potentially lower intermittent demand in 2020, as sales in that year increased nearly 43% year-over-year. Personally, I think Abbott is a much better choice to get involved in the diabetes medical device space than Medtronic (see my recent article). Investors looking for exposure to this space should also take a look at DexCom (DXCM), the quality leader.

Diagnostics comprises a wide range of laboratory systems in the fields of clinical chemistry, hematology, transfusion medicine, and immunoassays. Like Roche (RHHBY, OTCQX:RHHBF), for example, Abbott also offers polymerase chain reaction (PCR) systems (e.g., detection of virus RNA), as well as lateral flow tests such as the well-known SARS-CoV-2 antigen tests. It is Abbott’s largest segment, with 2021 sales of $15.6 billion. On a two-year comparison, revenue grew at a CAGR of 42%, which is indeed spectacular. Even more so, operating income grew by 68% in 2021. Abbott has proven that it is able to respond quickly and monetize an acute healthcare crisis very well. The segment’s operating margin is in the mid-20% range, but pandemic-related tailwinds boosted profitability to 40% in 2021. Through June 2022, the company generated $5.6 billion in revenue from COVID 19 testing material and equipment, but projects annual revenue of only $6.1 billion. SARS-CoV-2 is obviously a seasonal virus, and the pandemic (and related measures) appear to be coming to an end, but the sharp decline in expected revenue going forward is still somewhat conservative, in my opinion. The emergence of a more virulent strain, or even a strain that leads to a more severe disease course, could easily result in a continuation of mass testing.

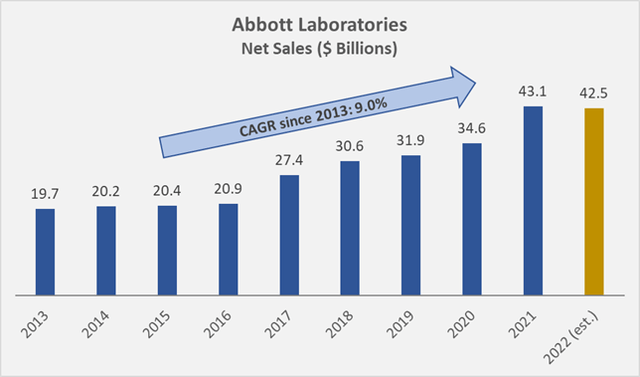

At the company level, sales have grown at a CAGR of 9% since 2013 (Figure 2), the year Abbott spun off AbbVie (ABBV). For 2022, analysts expect sales to remain about flat due to declining demand related to SARS-CoV-2 detection material and equipment. By comparison, JNJ sales grew much more modestly at a CAGR of 3.1% since 2013, but it should be remembered that much of Abbott’s growth in recent years has come from SARS-CoV-2-related diagnostic devices and material.

Abbott’s gross margin is typically around 58%, indicating strong bargaining power and – from this perspective – fairly low operating leverage. Yet investment services provider Morningstar has assigned ABT only a narrow-moat rating – JNJ rightly receives a wide-moat rating, in part because of its much stronger gross margin in the mid-60% range. Abbott’s operating margin is typically between 11% and 15%, much weaker than JNJ’s (approximately 30%), but has nevertheless improved significantly due to strong growth in its diagnostics business (see above). Depending on how well Abbott continues to grow and optimize its Medical Devices portfolio, one can expect an operating margin in the mid-10% range going forward. After all, together with the Diagnostics segment, this is the company’s most profitable segment.

Figure 2: Abbott Laboratories’ total net sales since 2013 (own work, based on the company’s 2013 to 2021 10-Ks and analyst expectations according to Seeking Alpha)

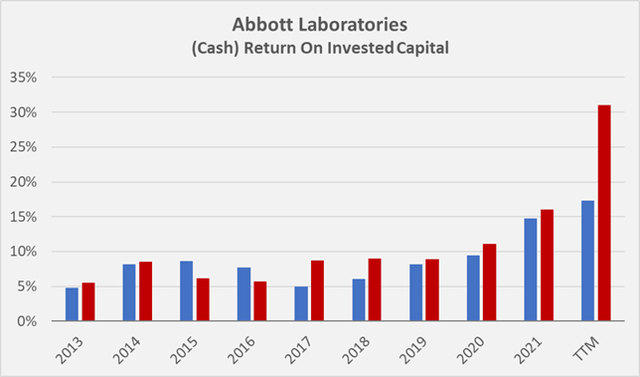

Abbott’s weaker economic positioning compared to Johnson & Johnson is also evident from Figure 3, which shows Abbott’s historical return on invested capital (ROIC) and cash return on invested capital (CROIC). JNJ’s ROIC and CROIC are much less volatile and are generally in the high teens. Abbott’s recent increase in profitability should not be overstated, as it is due to the strong contribution from SARS-CoV-2 diagnostics equipment and material, which is certain to decline in the near future – management already expects to generate only $500 million in test-related revenue in the remainder of 2022. Frankly, I expected stronger returns from this relatively high-margin business. Depending on the equity risk premium employed, Abbott could even be seen as having been unable to generate meaningful returns in excess of its cost of capital prior to the pandemic. Of course, considering the conservative nature of the company’s balance sheet (see below), its cost of capital is generally relatively low – gurufocus.com estimates Abbott’s current weighted average cost of capital in the mid-6% range. Abbott’s current weighted average cost of debt is approximately 3.3%, as calculated from the data in Note 9 “Debt and Lines of Credit” in the company’s 2021 10-K.

Figure 3: Abbott Laboratories’ return and cash return on invested capital, based on net operating profit after taxes and free cash flow, respectively (own work, based on the company’s 2013 to 2021 10-K and the second quarter 2022 10-Q)

Balance Sheet Quality And Dividend Safety

According to the company’s 2021 10-K , its long-term debt was rated A+ by Standard & Poor’s as of December 31, 2021. FAST Graphs shows a current credit rating of AA-. These are certainly strong debt ratings, but they obviously don’t compare to JNJ, one of the few companies with a AAA rating.

Abbott’s debt-to-equity ratio was 1.1, based on data as of the end of fiscal 2021. In the hypothetical (and highly unlikely) event of a suspension of dividends and share buybacks, the company would need about three years to pay off all of its financial debt with its free cash flow – hardly an uncomfortable leverage level.

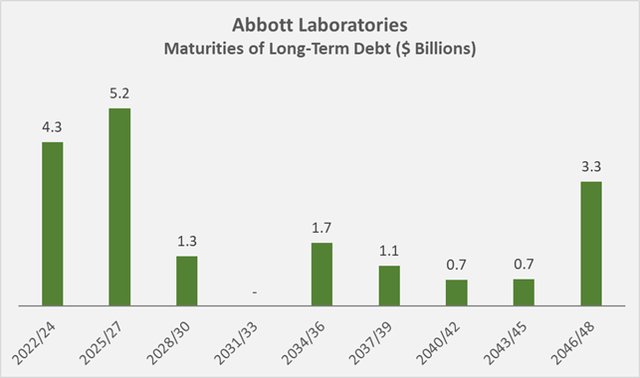

More than 50% of Abbott’s long-term debt matures in the next five years, so it seems reasonable to expect the company to spend a higher proportion of its operating income on interest expense (Figure 4). However, with a current interest coverage ratio of over 12 relative to normalized free cash flow before interest, and given the company’s strong credit rating, a rising interest rate environment is not a concern for Abbott.

Figure 4: Abbott Laboratories’ long-term debt maturities as of December 31, 2021 (own work, based on the company’s 2021 10-K)

The dividend (current yield 1.7%) is very safe considering Abbott currently pays out about 50% of its normalized free cash flow. Declining demand for SARS-CoV-2 diagnostic material and equipment will certainly weigh on free cash flow going forward, but given the strength of Abbott’s medical device segment, I would sleep very well at night as an investor in the company. Management is very shareholder friendly and has increased the dividend at a CAGR of 9% over the past nine years. In recent years, growth accelerated (three-year CAGR of nearly 14%). In this regard, JNJ is somewhat weaker, but its dividend growth rate remains remarkably stable for such a mature company – typically at 6% per year. Given JNJ’s higher initial yield of currently 2.6%, I would not overstate ABT’s higher dividend rate. Abbott would need to maintain 9% annualized dividend growth through 2038, so an investor buying the shares today would benefit from the same yield on cost (6.8%) as a new JNJ investor, assuming that JNJ continues to grow its dividend at 6% through 2038.

Valuation

Abbott shares have fallen more than 20% since their all-time high in December 2021. However, even at the current level of $110, I think the stock is a bit expensive. Since the spinoff of AbbVie in 2013, Abbott has grown quite strongly in terms of earnings per share – a CAGR of over 10% certainly justifies a premium price-to-earnings (P/E) ratio. By comparison, JNJ’s earnings per share grew at an average CAGR of 5.5% over the same period.

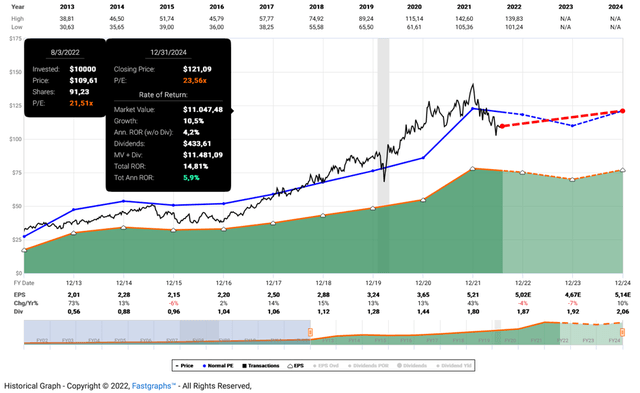

The “normal” P/E ratio of 23.6 assigned by the market seems a bit far-fetched (Figure 5), given that earnings estimates for the next few years are essentially flat and it remains unclear how well Abbott can offset declining demand for SARS-CoV-2 diagnostics, for example, through growing medical device sales.

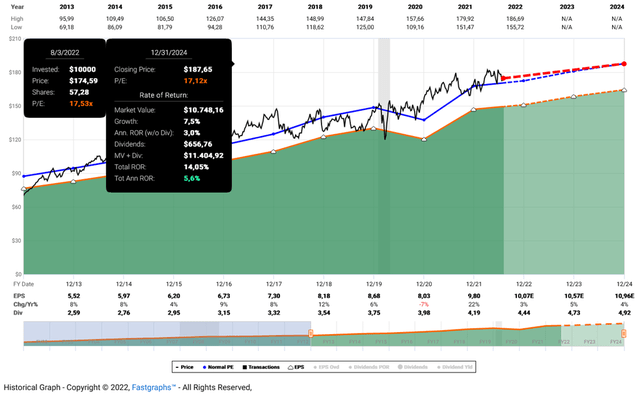

ABT currently trades at a blended P/E ratio of 21.5, while JNJ is much cheaper at 17.5 times earnings. I would argue that Abbott could surprise to the upside given the uncertain course of the pandemic, but JNJ remains the safer investment. The market is likely expecting a positive surprise related to the pandemic – otherwise, I can’t quite understand the premium P/E ratio currently assigned to ABT, even though I acknowledge the strong growth of Libre Freestyle. Still, an expected annualized total return of 6% through 2024 seems a bit low given the uncertainties. JNJ is expected to deliver a similar return (Figure 6), and analysts have been very accurate in predicting JNJ’s earnings, even based on two-year forecasts. JNJ is simply the industry behemoth, and its management is doing a remarkable job – you can think of the company as a kind of mutual fund of healthcare companies. I also find the normal P/E ratio of 17 much more palatable. Finally, the higher starting yield of 2.6% coupled with a very stable growth rate of 6% per year and a modest payout ratio makes JNJ look like a good dividend growth stock.

Figure 5: FAST Graphs chart for ABT, based on the 12-year adjusted operating earnings history and a market P/E ratio of 15 and a normal P/E ratio of 23.6 (obtained with permission from www.fastgraphs.com, Copyright FAST Graphs) Figure 6: FAST Graphs chart for JNJ, based on the 12-year adjusted operating earnings history and a market P/E ratio of 15 and a normal P/E ratio of 17.1 (obtained with permission from www.fastgraphs.com, Copyright FAST Graphs)

Concluding Remarks

In conclusion, I think Abbott is a good, shareholder-friendly company that is very well managed and operates with a very solid balance sheet. The Medical Devices segment is very interesting and the growth of the diabetes care business is remarkable. It is not comparable to Medtronic, for example, which continues to struggle in this area. If management continues to focus on the highest margin businesses, I see no reason why the company would not be able to generate meaningful excess returns on capital in the future. I can also see management looking to make acquisitions to further strengthen the portfolio, given the very strong balance sheet. At the end of the second quarter of 2022, the company had $8.9 billion in cash and cash equivalents and $350 million in short-term investments on its books.

Abbott is certainly not massively overvalued and has good growth potential. However, I believe the market is still a bit optimistic about Abbott’s current cash cow – its Diagnostics segment and, in particular, its Rapid Diagnostics business unit. The market’s optimism is reflected in the FAST Graphs chart above, but also in the current dividend yield of 1.7%, roughly in line with the historical average. At the current level, I would choose JNJ over ABT, even though the latter has a very strong position in diabetes care, which I am personally very bullish about. JNJ is a mutual fund of healthcare companies of sorts, and management has a very good hand for acquisitions. The current return outlook is similar for both companies, but quite acceptable given the defensive nature of the businesses.

As such, I’m keeping Abbott on my watch list and may reconsider at a price of $100 or less – should Mr. Market offer ABT stock at that price. As for JNJ, I am reinvesting the dividends but am not really a buyer at current prices either.

Thank you very much for taking the time to read my article. In case of any questions or comments, I’m very happy to read from you in the comments section below.

Be the first to comment