Not That Kind Of Firebird kenmo/iStock Editorial via Getty Images

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Harvard Business School 1, Reed Hastings 0

As everyone knows, the trick with capital-intensive companies is that at some point you have to show that the revenue and cashflow are achieving returns to scale – in other words that the money that the management team throws into a deep dark hole called “machine tools” or “Gigafactories” or “exclusive content” does at some point prove to be a useful asset. Rather than just a never-ending waste of shareholders’ money.

Now, capital intensive companies that were born and/or have spent much of their lives operating in the free-money environment of 2009-2021 don’t know so much about return on capital investment. Management teams who believe this period was the norm rather than the exception have a tendency to treat cashflow as something that is handed to them by equity- or bondholders for them to then splurge on the latest project. (Ladies and gentlemen, we give you Twilio (TWLO)).

You could be forgiven for thinking that Netflix (NASDAQ:NFLX) was amongst these names. For these and other offenses against economic reality we assigned a short rating to Netflix what feels like a hundred years ago in January 2020.

This was a terrible call for quite some time, until it became quite a good call. You can read our logic, here.

NFLX Article Prior (Cestrian Capital Research, Seeking Alpha)

In essence our view was, content is going to get ever more expensive and NFLX’s cashflow is going to get ever more pressured.

Well, along came the dot-Covid bust and whoops! There went all the subscribers and “subscribers” – we’ll call them “subscribers”, better termed “users” and NFLX was forced to think the unthinkable, i.e., advertising revenue. Bill Ackman came and went.

NFLX Article Prior II (Cestrian Capital Research, Seeking Alpha)

If you read that second note you’ll see that in staff personal accounts we had bought along with Bill Ackman (just before he announced it, so we felt rather smug at the time, always a harbinger of doom!) and we had decided to hold. We’ve held since then and continue to do so. And the reason? Reed Hastings never knows when he’s beaten. He should have been beaten when DVDs were eclipsed by streaming in 1927 or 2010 or whenever in prehistory it was. He certainly should have been beaten when the whole world from Disney (DIS) to AT&T (T) to Google (GOOG) (GOOGL) to Roku (ROKU) realized that streaming was going to be one bonanza of an opportunity and piled in with fattened balance sheets. It’s just that, has anyone told Hastings he was beaten? He singularly failed to read the memo.

For this reason alone, we have stuck with NFLX on the long side, and earnings yesterday boosted our conviction. The revenue line was unimpressive, gross margin declined, accounting earnings margins declining – etc. So far so blah.

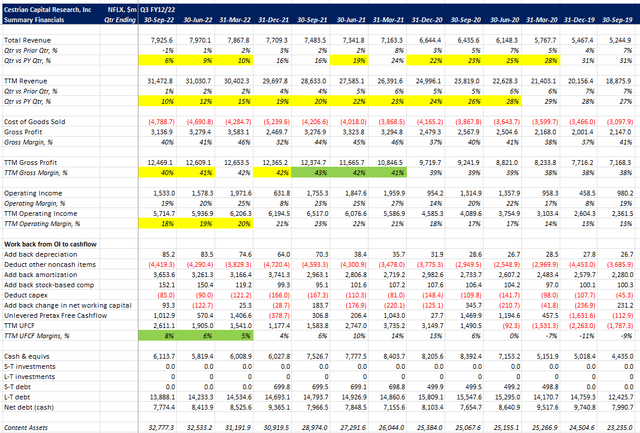

But the cashflow. Check the cashflow. The table we use below is bespoke to our NFLX coverage, it steps through the bridge from accounting concept (operating income) to reality (unlevered pretax free cashflow) without bothering with EBITDA. This is because all the action in NFLX is in the content costs and the amortization of those costs, all of which crop up outside of the depreciation charge of course.

Here’s the numbers.

NFLX Fundamentals (Company SEC filings, YCharts.com, Cestrian Analysis)

The important part is those TTM UFCF margins. Trailing twelve month measures are slow-burn measures, so when they step up sequentially like that, it’s good news. These three little numbers tell you that NFLX is starting to achieve real returns to scale on its content spend. It can change tomorrow of course – but we don’t think it will. We think Hastings is off on a new mission for a new time.

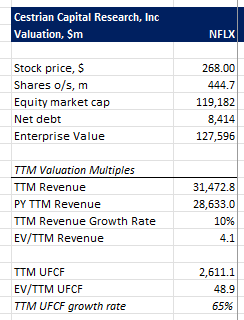

Valuation?

NFLX Valuation (Company SEC filings, YCharts.com, Cestrian Analysis)

Not cheap still on fundamentals unless that cashflow keeps growing. 49x TTM cashflow is fine at 65% cashflow growth or something close to it – not fine if not. So the same point holds – can the company keep its cashflow ramping?

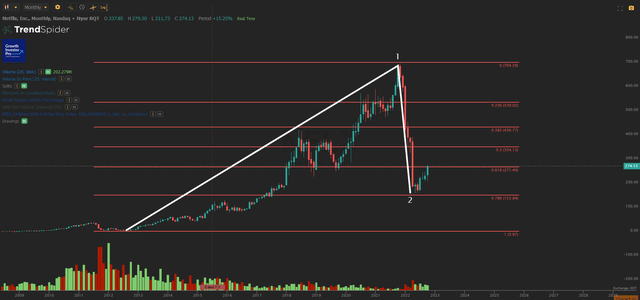

On technicals, NFLX stock is hugely beaten-down. It has put in a giant Wave 2 down off of the move from 2011 to its Covid peak. That bodes well for a reversal to the upside, particularly as the stock found support at pretty much the 78.6% retrace of that up move – a textbook Wave 2 down. We haven’t bothered to put in a Wave 3 up because nobody would believe it, but if the pattern plays out, we could see new highs in 3-4 years.

Here’s NFLX on the monthly (you can open a full page version, here).

NFLX Chart, Monthly (TrendSpider, Cestrian Analysis)

And here’s the pattern on the daily since the Wave 2 low. (Full page version, here).

NFLX Chart, Daily (TrendSpider, Cestrian Analysis)

The stock is hitting its head right now on the upper bound of that short-term channel (chart below) and on the 0.618 retracement of that huge Wave 1 up. It may take a little battle or two to surmount that but if, as we expect, we see some happiness return to the market, NFLX’s own compelling logic to move up will we believe be supported by the market at large.

For now? We continue to hold the stock in staff accounts. We rate the name at Accumulate on a long-term basis. Price target? You wouldn’t believe us if we told you. In the short term we believe $350 should be possible. If trading short term we would probably wait to see if the stock got up and over the $272 level (that’s the 0.618 retrace we refer to above) and if so, buy above that with a stop just below – in the $260 zone let’s say – with a goal of selling at say $340-350. So, maybe a buy at $280 with $20 downside vs. $60-70 upside so 3-3.5:1 risk/reward for a short-term play.

Long term? We’re playing it long term in staff personal accounts. We own the thing and plan to keep owning it. Because in Reed Hastings’ mind, it’s likely this thing has yet to fulfil its potential. So we’re happy to tag along for the ride.

Cestrian Capital Research, Inc – 19 October 2022.

Be the first to comment