vgajic/E+ via Getty Images

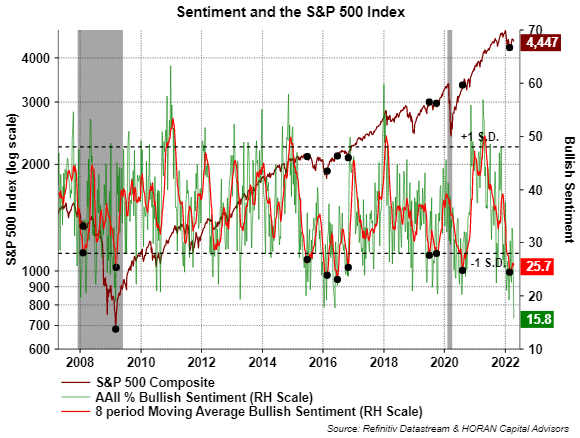

This week’s individual investor Sentiment Survey released by the American Association of Individual Investors shows the percentage of investors expressing bullishness on stocks over the next six months is near a record low at 15.84%. This is the ninth-lowest reading for the weekly survey’s bullish sentiment going back to 1987.

Refinitiv Datastream & HORAN Capital Advisors

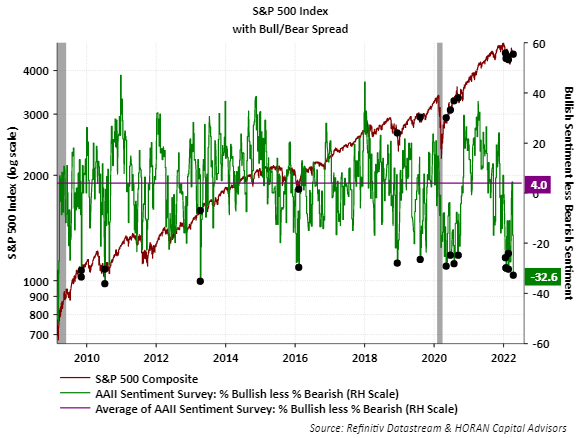

The spread between the bullish and bearish readings equals -32.6 percentage points and has reached wider negative levels in the past; however, this week’s reading is near the spread level reached during the 2008/2009 financial crisis. In fact, the spread equaled -32.8 percentage points for the survey released during the week of November 20, 2008, when the S&P 500 Index traded at 806.58

Refinitiv Datastream & HORAN Capital Advisors

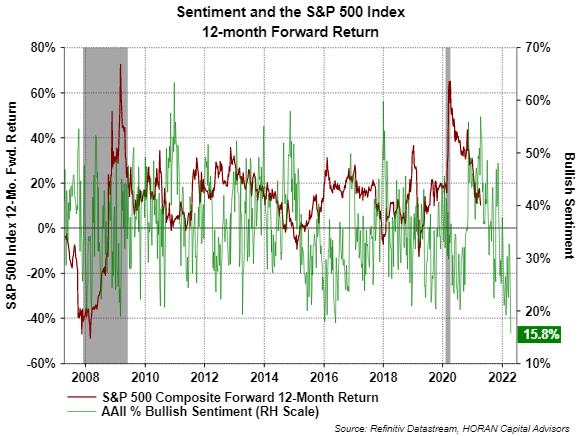

As I often remind readers, the sentiment measures are contrarian ones and are most actionable at their extremes. And as the following chart shows, forward 12-month returns tend to be higher when bullish sentiment is at an extremely low level.

Refinitiv Datastream & HORAN Capital Advisors

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment