hapabapa/iStock Editorial via Getty Images

Introduction

I don’t really like bank stocks that much, to be honest. While this might be the worst possible way to start an article covering a bank, I have to say that there are exceptions. I own one bank stock in my portfolio: Huntington Bancshares (HBAN). I bought my position at low prices during the first months of the pandemic of 2020. The reason why I am usually not into banks is that I prefer dividend growth over high yields. However, whenever opportunities present themselves, I like to expand my banking exposure. After all, banks are tremendous sources of high dividends. Even better, the star of this article, KeyCorp (NYSE:KEY) offers a high yield and high (historic) dividend growth. The company is a good source of income and total returns.

Thanks to sky-high recession risks and a hawkish Fed, it looks like investors might be able to buy this stock with a 5% yield soon!

This Environment Is Tricky For (Bank) Investors

The worst thing about this market is the fact that we’re now in a situation where the financial numbers and company comments we get (mainly third-quarter earnings and comments) are still mostly positive despite deteriorating economic conditions. That makes trading so hard (a lot of traps).

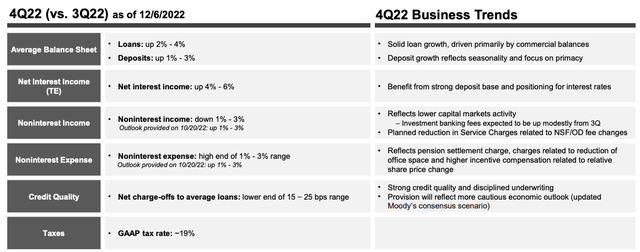

For example, KeyCorp’s 4Q22 outlook (as of December 6) was still rather good. The company sees solid loan growth from commercial businesses, strong deposits, and healthy credit quality.

KeyCorp

Now, don’t get me wrong. I’m not calling BS on these numbers. I’m sure management was right and honest when it published this outlook.

What I’m a bit worried about is the transition to a weaker economy. The ISM manufacturing index is in contraction, yield curves are deeply inverted, and small businesses are struggling big time.

Wells Fargo

It looks like the chances of a recession are now well above 90%. If the yield curve remains inverted until the summer, we could be looking at a severe recession.

Hence, Wells Fargo expects the Fed to be forced to pause rate hikes in 2023 with a rate cut in early 2024.

We expect the Fed to continue tightening policy through the first quarter of next year, with the fed funds rate peaking at 5.25% this cycle. We expect the dramatic rise in rates will hit demand in the back half of 2023 with a recession starting in Q3-2023. That said, we do not expect the Fed to cut rates immediately at the first sign of weakness. Specifically, we expect the Committee to stay on hold for the rest of 2023, and we look for the first rate cut in Q1-2024.

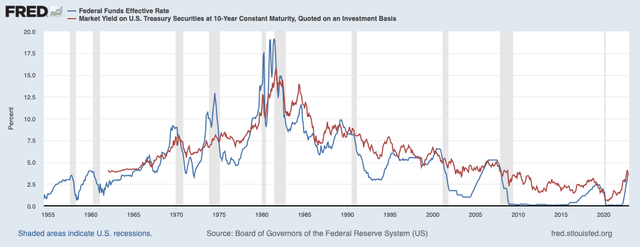

I think that makes sense as the Fed has always acted in a situation where economic conditions developed the way we’re witnessing now. Historically speaking, the Fed was always close to acting when the Fed funds rate was higher than the yield on the 10-year bond. That’s currently the case.

St. Louis Federal Reserve Bank

While there are other complications that come with that, one thing is for sure, economic indicators are likely to deteriorate further.

That’s bad for the market. Yet, it’s good for investors looking to buy quality yields.

On a side note, I discussed this “new investment era” in a recent article. This includes my game plan, which is based on buying more high-yield.

KeyCorp Is A Source Of Growth & Income

With a market cap of $15.7 billion, KeyCorp isn’t *that* large. The company is the 10th-largest stock-listed regional bank in the United States.

Headquartered in Cleveland, Ohio, the bank plays a big role in the Midwest, Northeast, and North West. On a side note, high Midwest exposure is a great thing as I expect that the Midwest will increasingly benefit from supply chain re-shoring back to the US and less post-pandemic globalization. It’s one of the reasons why I like my Huntington Bancshares holding. That bank is also Midwest-based.

KeyCorp

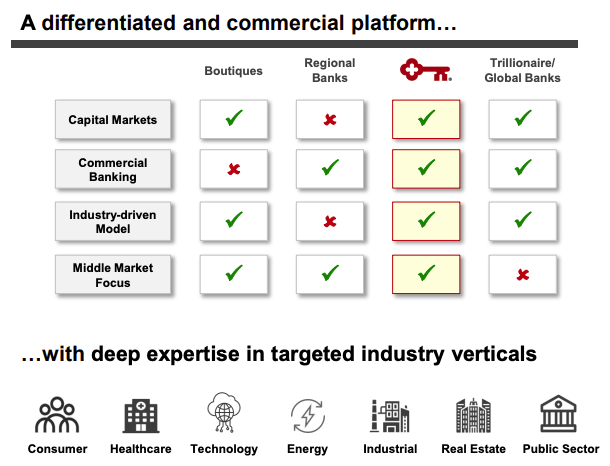

KeyCorp, which is mainly known by the name of its largest subsidiary KeyBank believes it achieves a competitive advantage over its peers by offering a broad range of services including capital market services, commercial banking, operating an industry-driven model, and middle-market focus.

KeyCorp

Besides “regular” lending activities, the bank aims to grow faster by focusing on healthcare M&A (5% annual compounding growth), renewable lending (supported by government subsidies), and affordable housing (huge shortages).

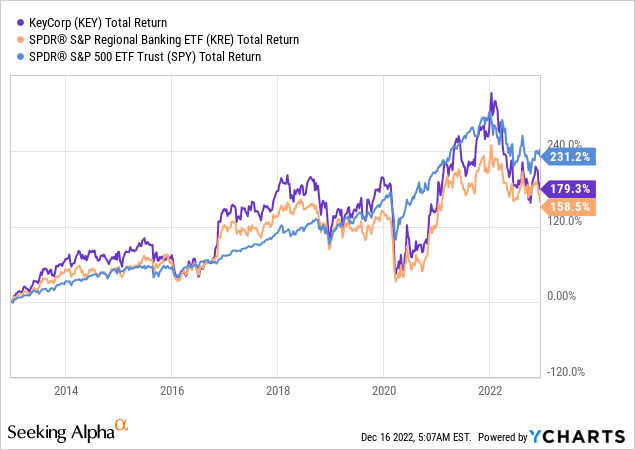

Over the past ten years, the company’s diversification has worked. The company outperformed its peers by roughly 20 points. Unfortunately, it failed to beat the market, which added 231% including dividends.

It needs to be said that the biggest drawdown of buying banks is the volatility. You’re basically buying an industry that gets beaten down hard during severe recessions. That makes it hard to outperform on a long-term basis. As the chart above shows, the bank easily beat its peers and the market going into this year. However, market expectations that economic conditions are about to get much worse pressured banking stocks.

Going back to January 2007, KEY shares have returned -1.5% including dividends. This turns $10,000 into $7,800. The S&P 500 turned that amount into almost $40,000.

Don’t get me wrong, this does not make the current KeyCorp a bad company, it is just an example of why low-volatility strategies are often better. Or, in my case, I do buy high-yield in the banking space, I just keep my exposure limited for risk reasons.

Moreover, the bank is in a different place now – like most of its peers. The company has strong credit quality and a strong position in a high-rate environment.

Current swaps and short-term treasuries would add $1.2 billion to net-interest income while 70% of total loans are floating rate loans, often tracking SOFR (LIBOR successor) and 1-3M LIBOR rates.

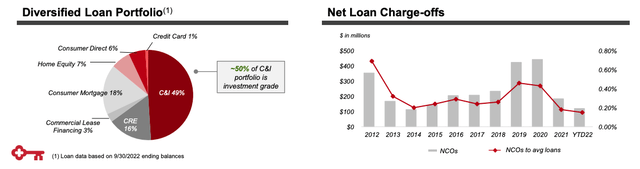

It also helps that credit quality remains strong. The company’s portfolio has 50% investment-grade loans, allowing it to lower net charge-offs to less than 0.2% of total loans in 2022 (excluding 4Q22).

Moreover, KEY has only 13% construction loan exposure. That’s down from 42% in 2008. The Common Equity Tier 1 ratio is at 9.1%, which is in the company’s target range of 9.0% to 9.5%. This ratio is required to be at least 6.0%.

KeyCorp

The company expects that net charge-offs in the fourth quarter come in at the lower end of its 15 to 25-basis-point range. The company remains upbeat when it comes to supporting shareholder returns:

We will continue to support our clients while maintaining our moderate-risk profile, which positions the company to perform well through all business cycles. Our capital remains the strength, providing us with sufficient capacity to support our clients and return capital to our shareholders. Our fourth quarter guidance keeps us on a path to deliver positive operating leverage again in 2022, and concurrently, make progress against each of our long-term goals.

This brings me to the next important thing.

The KEY Dividend

Paying and growing the dividend is the company’s second priority after organic growth. The third priority is share buybacks.

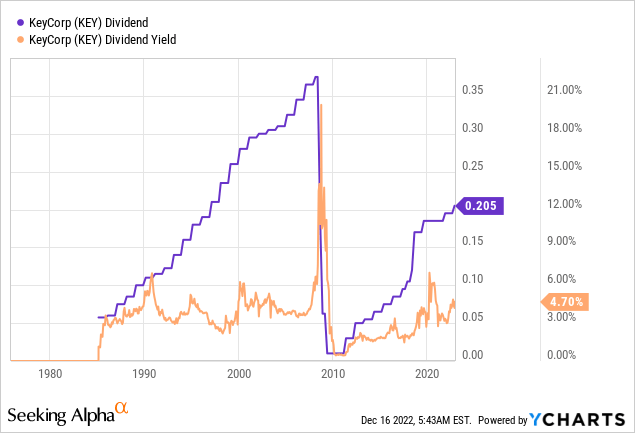

KeyCorp shareholders currently enjoy a $0.205 per share per quarter dividend. That’s $0.82 per year. This translates to a dividend yield of 4.9%. The sector median yield is 3.2%, which gives KEY investors a benefit when it comes to income.

The current yield of 4.9% (the yield below has not been updated) is one of the highest since the Great Financial Crisis. The yield is now back to the long-term median, which makes sense given the new macroeconomic environment.

Over the past ten years, the average annual dividend growth rate was 15.9%. That’s a big number. However, that number has come down over the past three years as economic challenges started to build. The three-year average is 3.6%. The sector median is 6.0%.

These are the latest hikes:

- November 2022: +5.1%

- November 2021: +5.4%

- July 2019: +8.8%

The GAAP dividend payout ratio is 36%. That’s slightly higher than the sector median of 32%. Bear in mind that KEY has a significantly higher yield.

Good Valuation, Overshadowed By Risks

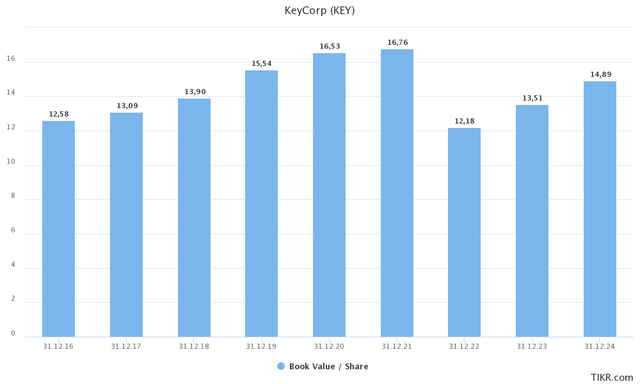

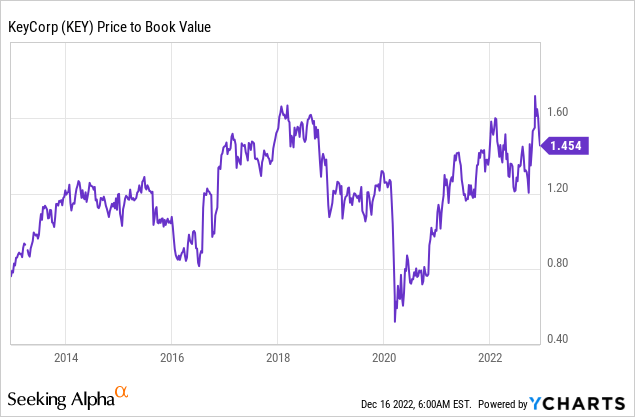

KEY is attractively valued. Not only is its dividend yield at an attractive level, but we’re also dealing with a favorable price/book value.

Using the chart below, KEY is trading at 1.24x the 2023 book value.

TIKR.com

This is a decent valuation and the result of a 38% stock price decline from the 52-week high.

A move below 1.0x book would be a terrific deal.

A lower valuation is not impossible. Or even that unlikely.

I do agree with a recent assessment from JPMorgan (JPM), which states that risks remain elevated. As reported by Seeking Alpha:

J.P. Morgan analysts keeping a bearish stance on small- and mid-cap banks given downside risk factors on net interest margins and credit quality, two of the biggest “needle movers” for regional banks’ earnings.

[…] “In terms of NIMs, we see a deposit beta playbook being used by management teams as being overly optimistic, and in terms of credit, given how strong the current environment remains, we don’t think that provision assumptions will move to more realistic levels until the industry start working through an actual economic downturn,” Alexopoulos wrote in a note to clients.

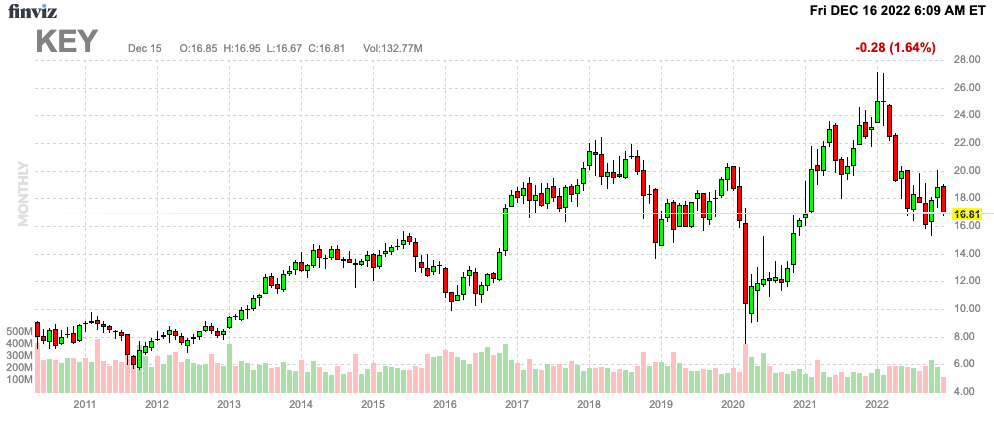

With that said, investors looking for exposure might benefit from starting to buy in the $14 to $16 range.

FINVIZ

Given elevated economic risks (a lot has been priced in already) and the company’s decent yield, I believe that investors should start by buying small positions. Adding gradually over time allows investors to average down if things get ugly. If stocks suddenly take off, investors have a foot in the door.

Takeaway

In this article, we discussed KeyCorp. This regional bank offers a high-yield dividend of 4.9%. It has a business model allowing it to outperform the average (boring) regional bank and a balance sheet that is much healthier than it was at any point since (and prior to) the Great Financial Crisis.

Reason one for this decent yield is solid growth. Even in 2022, KEY is doing well, growing thanks to strong loan and net interest income.

Reason two is a steep stock price decline of almost 40% as investors are pricing in weakness in the quarters ahead.

I believe that KEY has more room to fall due to elevated credit risks that (I believe) are not yet entirely priced in.

Investors interested in a decent banking yield (without buying preferred shares) might enjoy KEY shares. However, as I mention in the article, I advise investors to start small and add gradually over time to spread the entry risk.

Other than that, I am fairly sure that KEY is in a good spot to keep outperforming its peers on a long-term basis. Especially in a situation where loan demand and credit quality rebound.

(Dis)agree? Let me know in the comments!

Be the first to comment