koto_feja/E+ via Getty Images

All you need is love. But a little chocolate now and then doesn’t hurt.”― Charles M. Schulz

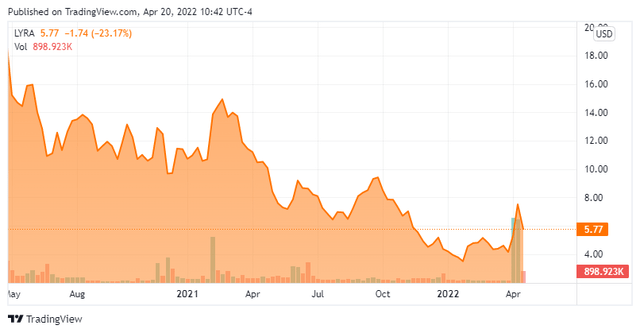

Today, we take our first in-depth look at Lyra Therapeutics (NASDAQ:LYRA). Like so many developmental biotech concerns that came public in 2020 and 2021, the shares find themselves deep in ‘Busted IPO’ territory. The drop in the stock has brought in some significant buying from insiders and beneficial owners of the stock so far in April as they scarfed up a significant portion of a recent capital raise. A sign brighter times are on the horizon? We attempt to answer that question via the analysis below.

Company Overview

February Company Presentation

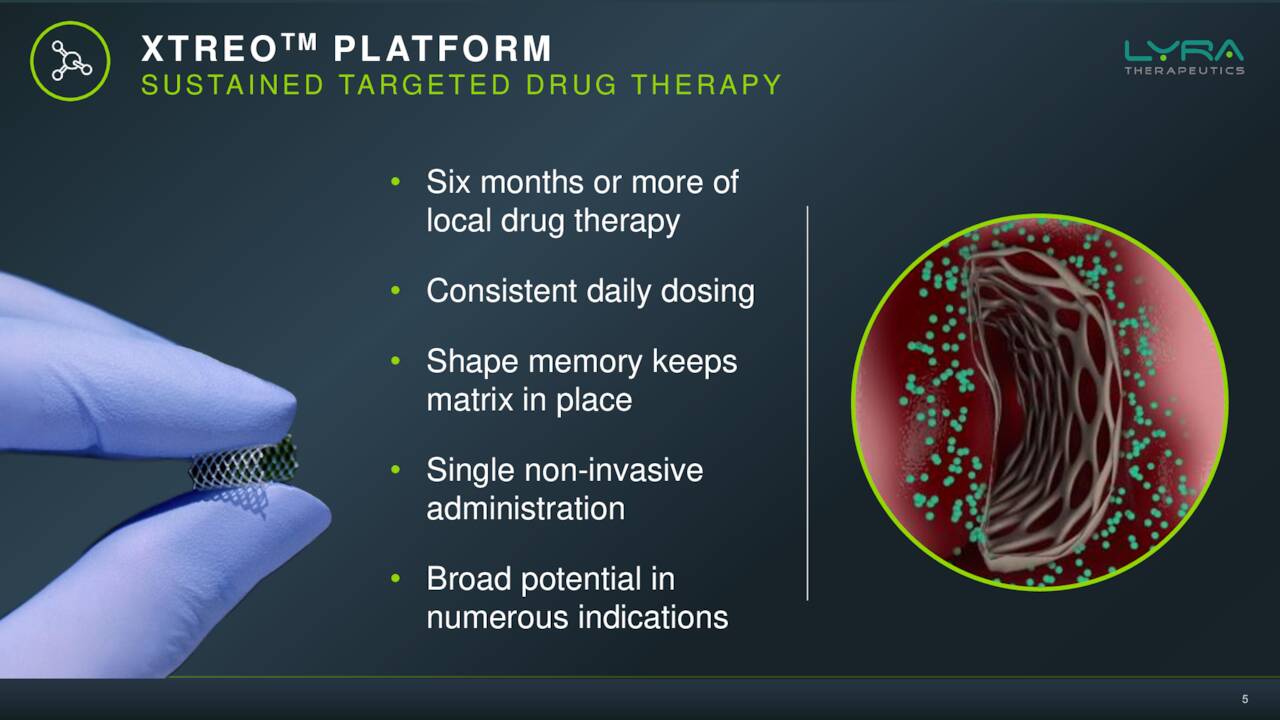

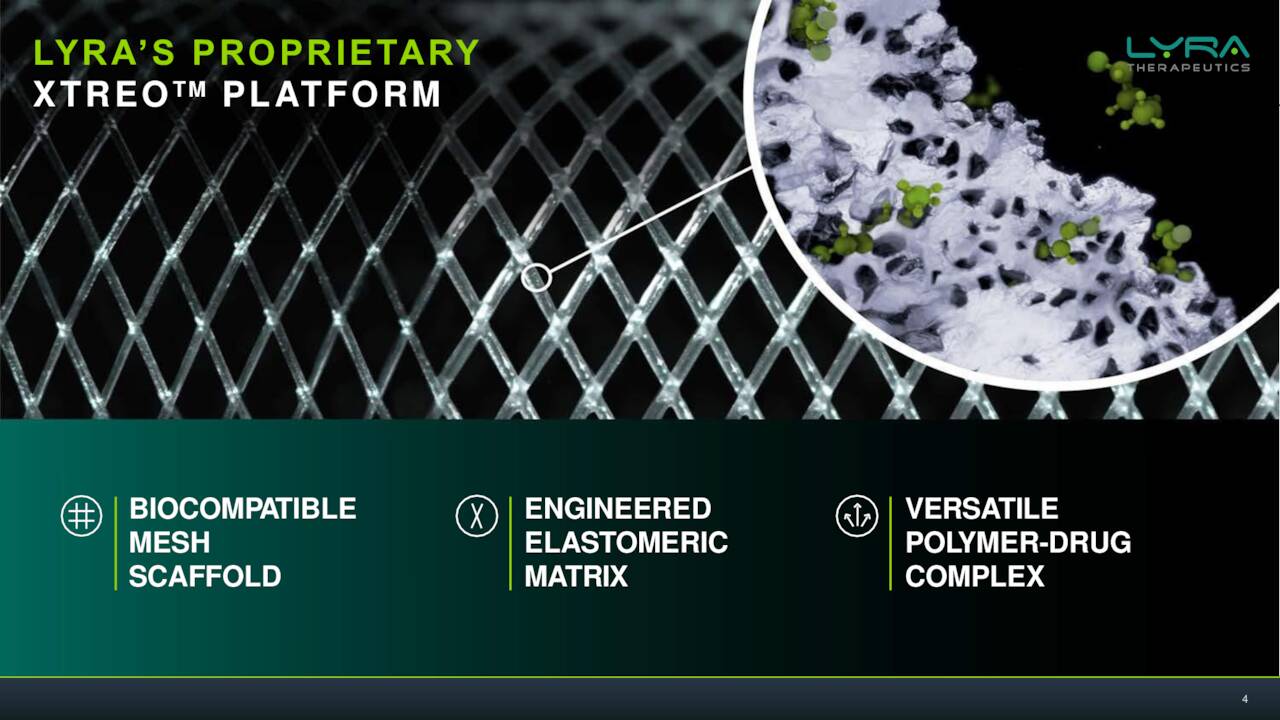

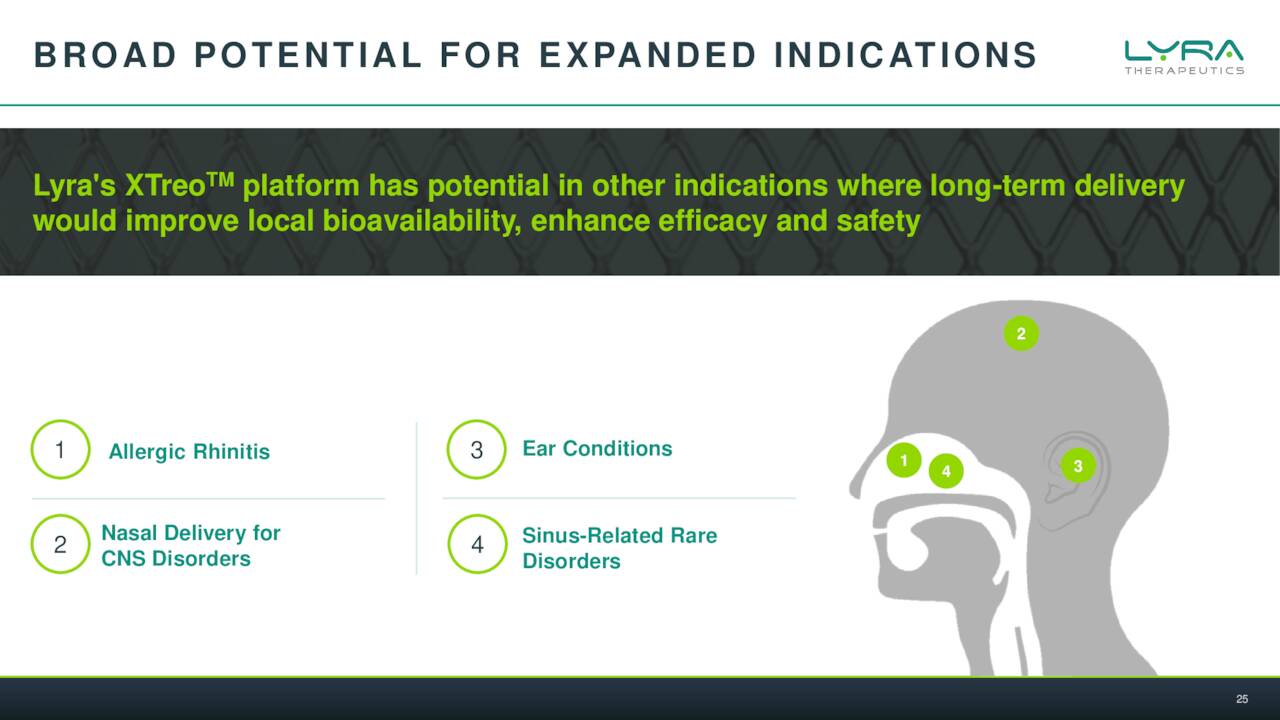

Lyra Therapeutics is a clinical-stage therapeutics company based just outside of Boston that is developing pipeline candidates utilizing its XTreo technology platform that is designed to deliver medicines directly to the affected tissue for sustained periods with a single administration. Lyra is focused on the development of novel integrated drug and delivery solutions for the localized treatment of patients with ear, nose, and throat diseases. The stock currently trades just above $5.50 a share and sports an approximate market capitalization of $240 million.

February Company Presentation

Recent Developments:

February Company Presentation

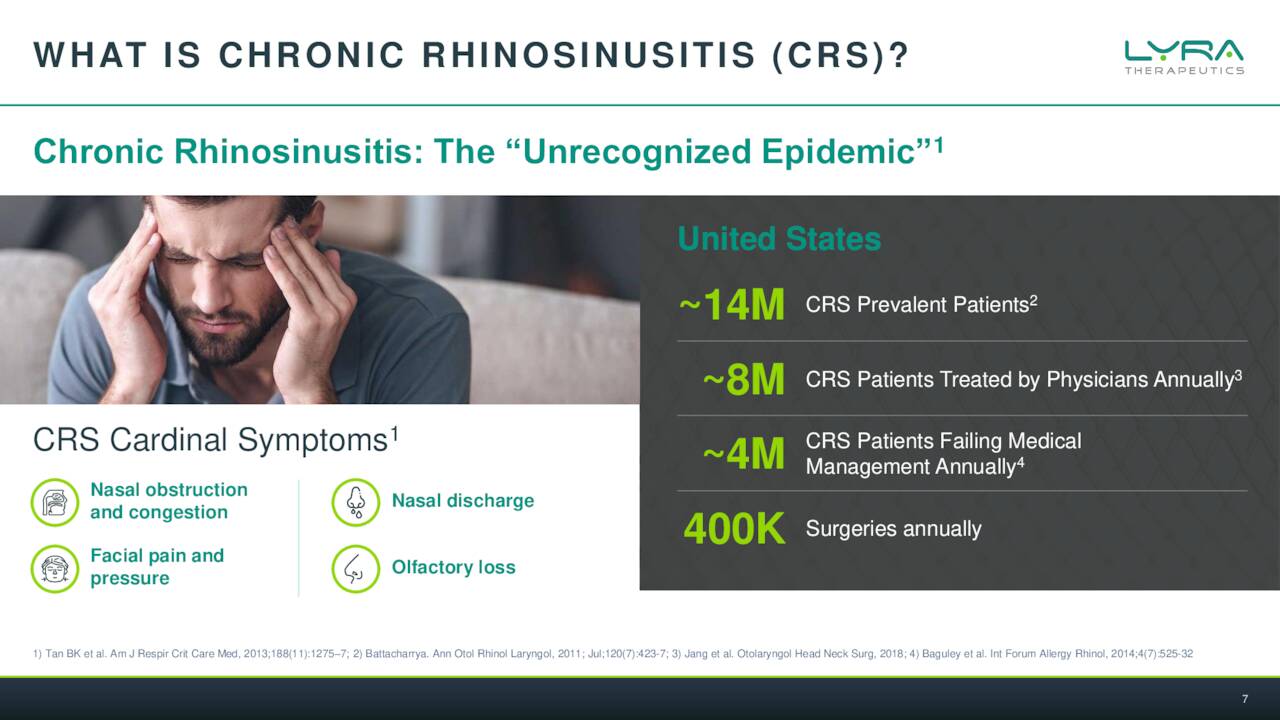

The company is targeting Chronic Rhinosinusitis or CRS via the key assets in pipeline development. Symptoms of this affliction can include congestion, swelling pain, post-nasal drainage and even the loss of taste and/or smell. Lyra’s belief is that the steroids used to treat this condition which affects millions is a very effective therapy for CRS, but the current delivery by nasal spray is highly inefficient.

February Company Presentation

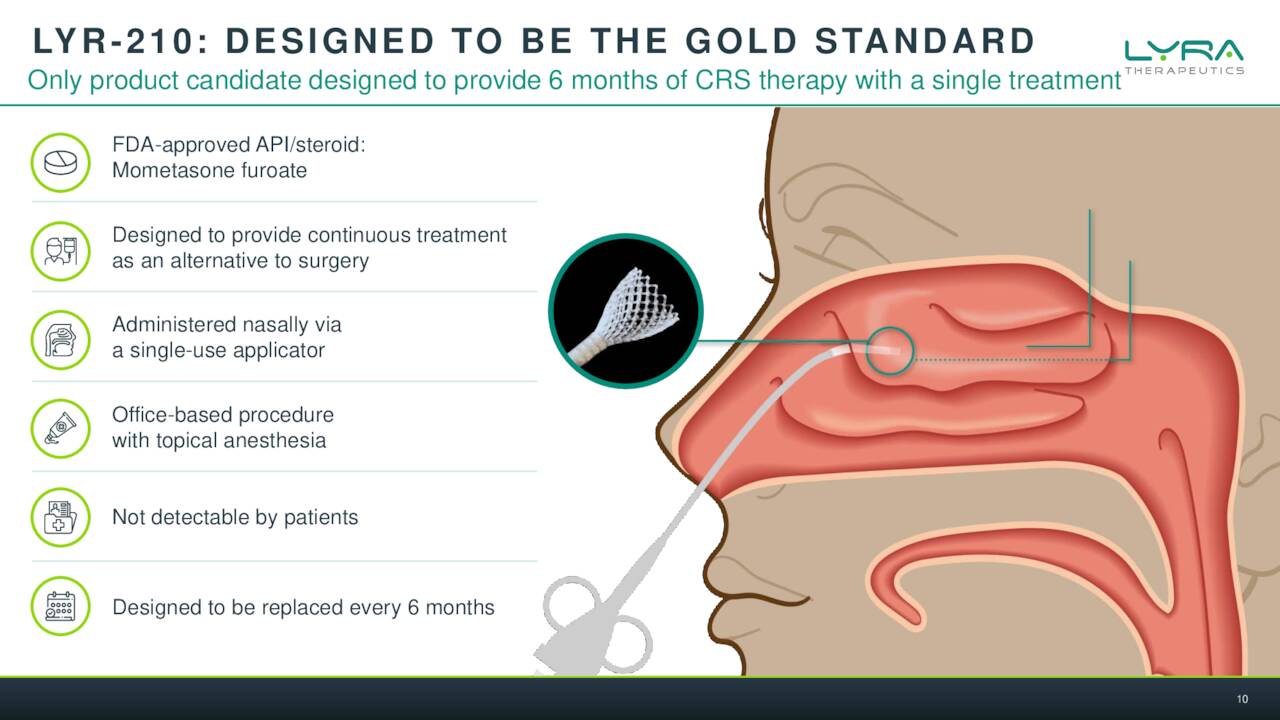

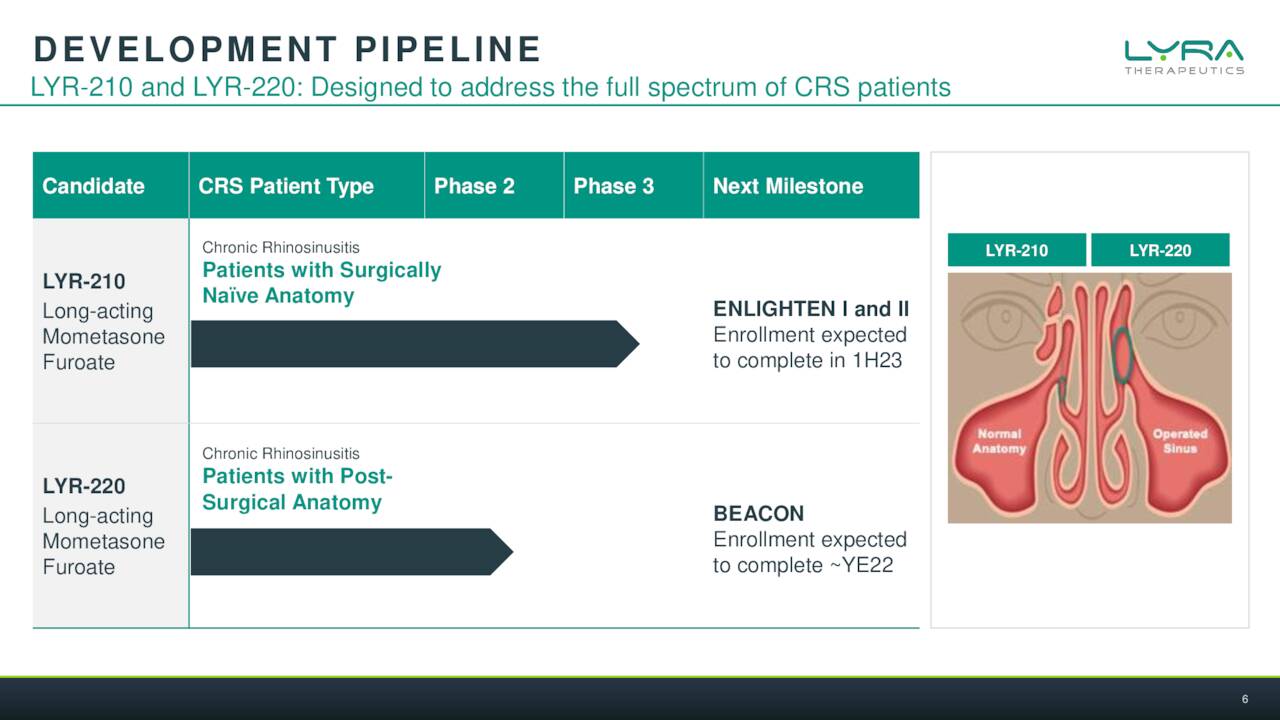

Lyra’s solution is basically an implantable scaffold done through a quick medical procedure with local anesthesia done in a medical office. This can deliver consistent doses of an approved steroid for six months into the sinuses of individuals with CRS. The company has two efforts in this endeavor, LYR-210 and LYR-220. The former being meant for those that have not undergone surgery and the latter is a bigger version that is targeting those that have larger nasal cavities as a result. There was a solid piece out on Seeking Alpha in November that went into solid detail on the current treatment options available for CRS sufferers.

February Company Presentation

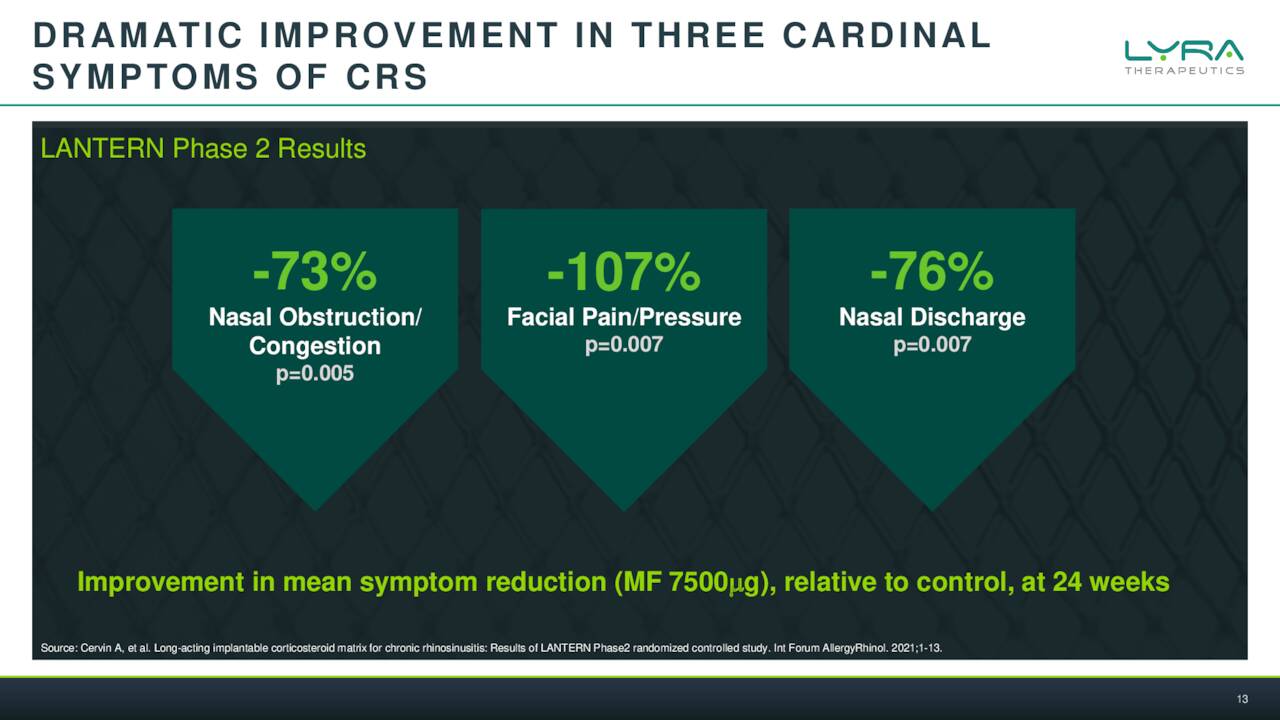

LYR-210 is the furthest along of these efforts and this device showed very encouraging results in a Phase 2 Study called LANTERN.

February Company Presentation

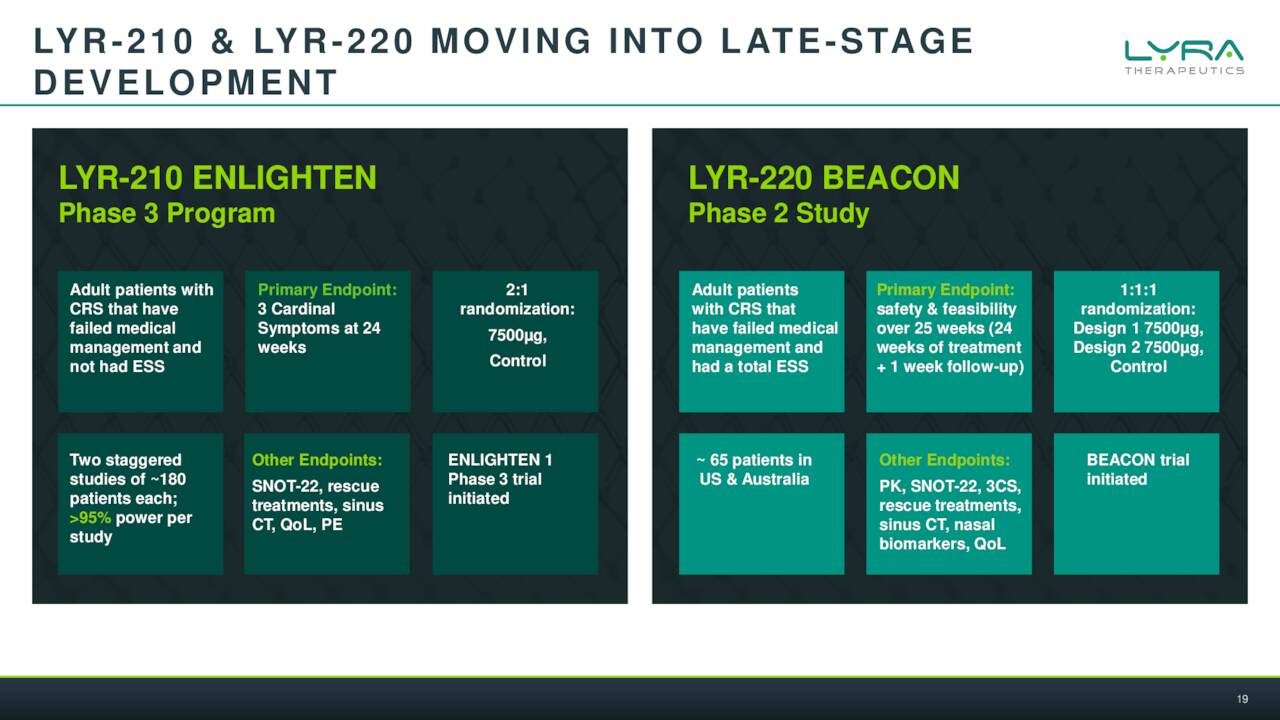

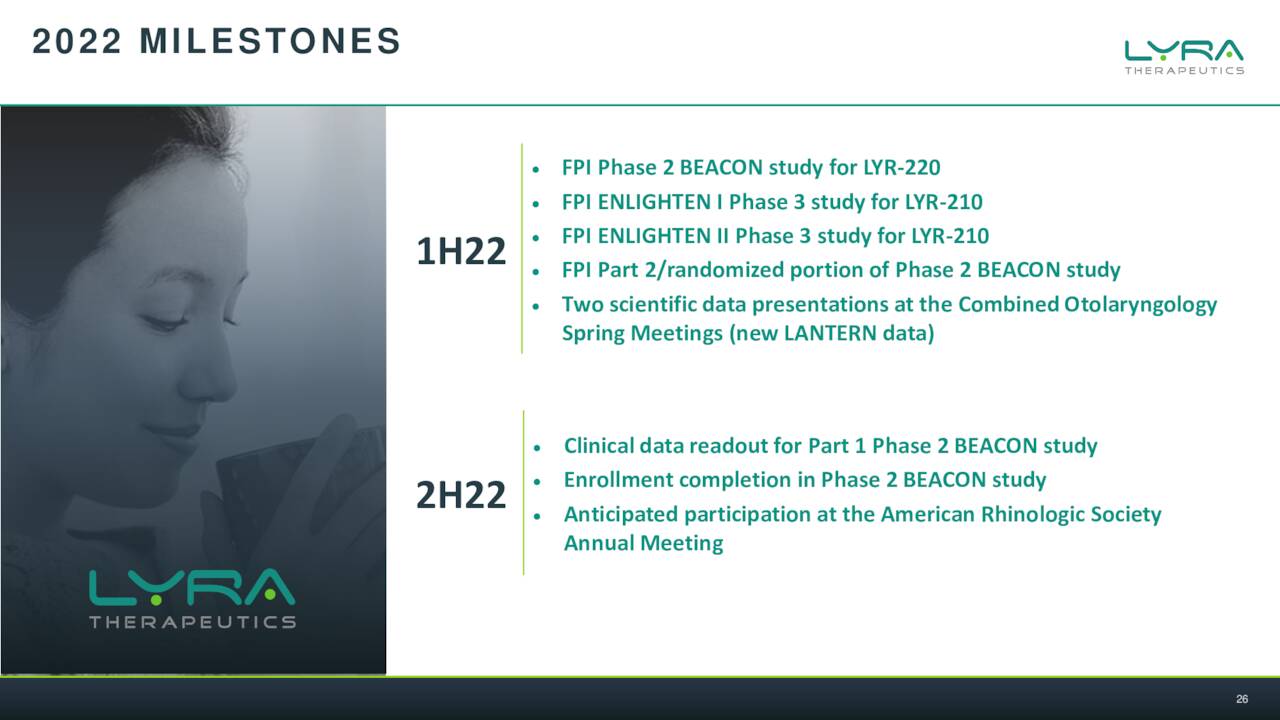

The company has initiated two Phase 3 studies called ENLIGHTEN I and II which test two different dosage regimes. Lyra expects to have enrollment completed in this effort in the first half of next year. A Phase 2 trial for LYR-220 ‘BEACON’ is expected to complete enrollment by year end of 2022. A full Phase 1 readout will be out in the first half of this year as well.

February Company Presentation

Analyst Commentary & Balance Sheet

The company recently did a $100 million capital raise via a private placement. The Executive Chairman bought $1 million worth of stock during that event and three other beneficial owners purchased approximately $45 million worth of shares during this raise as well. The company had ended FY2021 with just over $45 million of cash and marketable securities on the balance sheet after burning through $12.4 million worth of cash in the fourth quarter.

So far in 2022, BTIG initiated the shares as a new Buy with a $28 price target and Bank of America maintained its Buy rating but lowered its price target to $13 from $15 a share previously. Finally, on March 9th, William Blair reiterated its Outperform rating on LYRA with this lengthy commentary from the analyst there.

We believe Lyra is poised to become a major player in the treatment of pre- and post-surgical CRS as the company holds a differentiated technology platform that provides localized and sustained treatment of CRS with a single administration. In our opinion, the company holds less clinical risk than many of its peers given that the active ingredient of LYR-210 and LYR-220 is mometasone furoate [MF], which has been approved for use by the FDA in several indications and nasal spray formulations that are currently part of the standard of care for CRS, especially with PK data in hand that will provide a bridge to the safety profile of MF and supports a 505(b)(2) pathway for NDA submission. We also believe that the impressive Phase II data for LYR-210 de-risks the program and validates the six-month treatment duration provided with a single administration, offering a significant advantage over existing therapies, which can be efficacious but are limited by invasive administration, imperfect distribution within the paranasal sinuses, and burdensome dosing schedules that are compounded by poor patient compliance. Ahead of the enrollment completion and initial safety and feasibility data for BEACON, we anticipate the company will need to raise capital, and currently model a modest $20 million raise in the second quarter of 2022 and would anticipate a raise to remove an overhang on shares. We rate shares of Lyra Outperform, based on our view that LYR-210 has the potential to see significant use in this large population of about 4 million patients, considering the improved convenience over existing therapies and potentially improved efficacy. We do not believe this is reflected in the current enterprise value of about $10 million, which to us represents a significant disconnect in value, and Lyra remains a favorite small-cap name under our coverage.”

Obviously the capital needs, referenced by Blair’s analyst, of the company have been addressed by the private placement this month.

Verdict

February Company Presentation

The company has just addressed its near/medium term funding needs and has several potential milestones on the horizon here in 2022. The company is aiming at a large market with a solution, if approved, that could eventually garner significant market share. LYRA also has a marketing partnership to lead distribution in Greater China and some of rest of Asia. A similar partnership in Europe might come to fruition prior to LYR-210 hitting the market, reducing the challenges for Lyra around a global rollout.

February Company Presentation

If successful for CRS, the company’s XTreo platform development platform could have uses in other indications as well. That said, data from the ENLIGHTEN studies won’t be out until late 2023 at the earliest with potential approval in 2024.

February Company Presentation

That is a long time to wait for initial commercialization given the putrid sentiment that has hovered over the small biotech/biopharma space for the best part of a year. As such, LYRA probably only merits a small ‘watch item‘ holding for patient investors given the current market environment.

If more of us valued food and cheer and song above hoarded gold, it would be a merrier world.”― J.R.R. Tolkien

Bret Jensen is the Founder of and authors articles for the Biotech Forum, Busted IPO Forum, and Insiders Forum

Be the first to comment