Justin Sullivan/Getty Images News

Not The Flavor Of The Season

The stock of Lowe’s Companies, Inc. (NYSE:LOW) – the world’s second-largest home improvement retailer, with close to 2000 stores across North America – has faced a challenging year so far; adverse sentiment towards the US housing market, and generally weak discretionary purchasing dynamics, in the face of steep inflation, have weighed heavily on the share price. It could also be argued that Lowe’s looks poised to lose some market share over the next couple of years. According to data from Statista, the home improvement market in the US will hit $597.5bn in sales by FY24, this would translate to a market CAGR of 3.5% from current levels. On the other hand, consensus estimates for Lowe’s suggest that it will only witness a topline CAGR of 2.1% over that period.

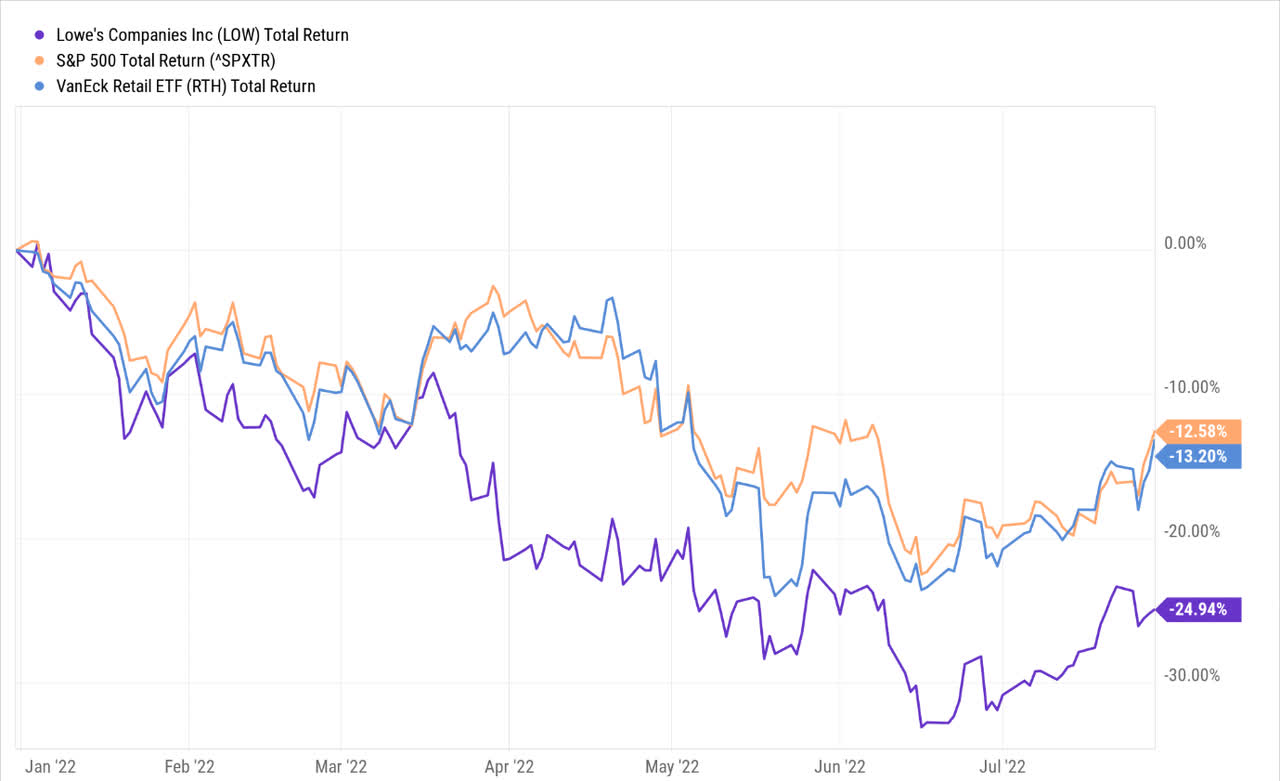

Nonetheless, all this has dampened sentiment towards LOW stock, and on a YTD basis, it has grossly underperformed not only its retail peers (by ~2x), as represented by the VanEck Vectors Retail ETF (RTH), but the broader markets as well.

Whilst LOW stock may have fallen out of favor with investors, I would take this opportunity to highlight a few reasons why investors should not dismiss the stock at current levels.

At The Current Share Price, Investors Can Pocket A Shareholder Yield (Not Just Dividend Yield) Which Is Close To Decade Highs

Lowe’s has a remarkable track record of paying and growing its dividends for 59 straight years now; this is in stark contrast to what one typically witnesses in the sector where companies have been paying dividends only for 10 years on average, and growing them for only over a year. Most recently, the company hiked its quarterly dividends by 30%, which puts its forward yield in a very attractive spot relative to the historical average; at the current share price, you get to lock in a yield of 2.2%, which is a good 60bps higher than the stock’s long-term average of 1.6%.

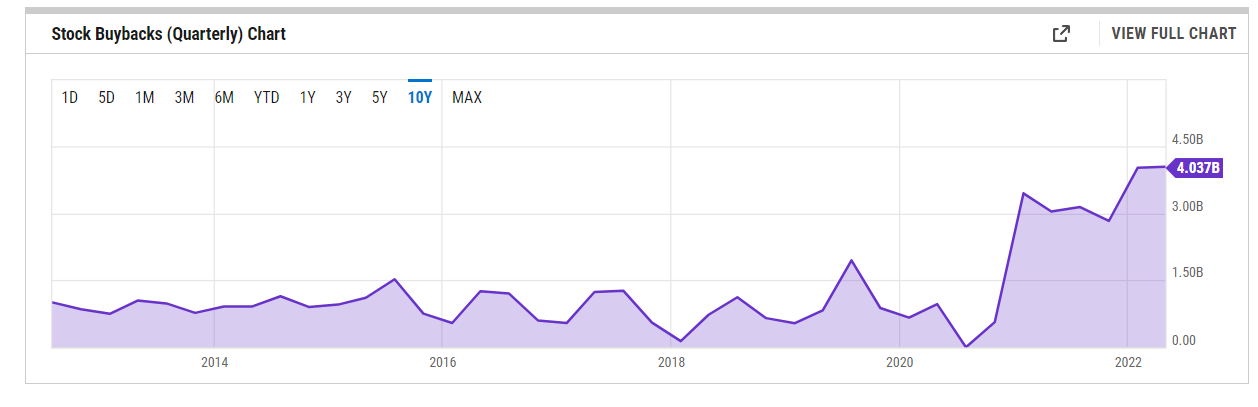

It isn’t just the dividend theme that stands out with Low; I would also urge investors to consider the generosity with which the company buys back its stock, which is quite underappreciated; besides, if anything, the pace of this initiative has only picked up over time, with the buyback run rate currently at decade highs. Until the last couple of quarters, Lowe’s had been indulging in buybacks to the tune of $2.8-$3.4bn per quarter. However, in Q4 last year, and in Q1 this year, they’ve ramped it up significantly to a run rate of well over $4bn per quarter.

YCharts

At the end of April 2022, they still had close to $16bn of buyback ammunition yet to be deployed, and Lowe’s management did confirm that they would indulge in $12bn of buybacks for the whole of 2022. Such has been the ferocity of the company’s recent buyback pace, that it currently holds the second largest weight in the Nasdaq US Buyback Index which was only rebalanced as recently as June.

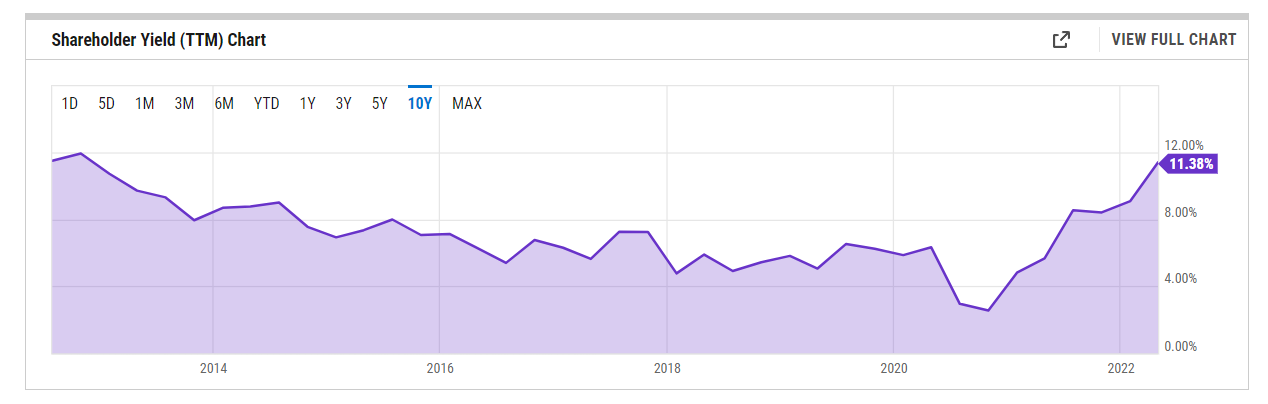

All in all, it’s worth noting that at around current price levels, investors can lock in a handsome shareholder yield (which is a function of dividends, buybacks, and debt pay downs) in the low double-digits. This is the highest it’s been in almost a decade and is almost twice as much as the stock’s historical shareholder yield of only around 6%.

YCharts

For a company to be so generous with its distributions, it would first need to generate ample free cash flow, and Lowe’s is no slouch when it comes to this. In fact, it is also one of the top-10 names of the US Cash Cows Growth ETF (BUL) which measures the top 50 large-cap growth stocks based on the FCF yield. What’s interesting to note is that even to qualify for consideration as part of the initial screening mechanism of BUL’s tracking index, these stocks are measured based on the “projected” FCF and earnings; so evidently, despite a challenging market environment ahead, Lowe’s still looks like it will generate ample enough FCF that could serve as the foundation for potentially attractive distribution prospects.

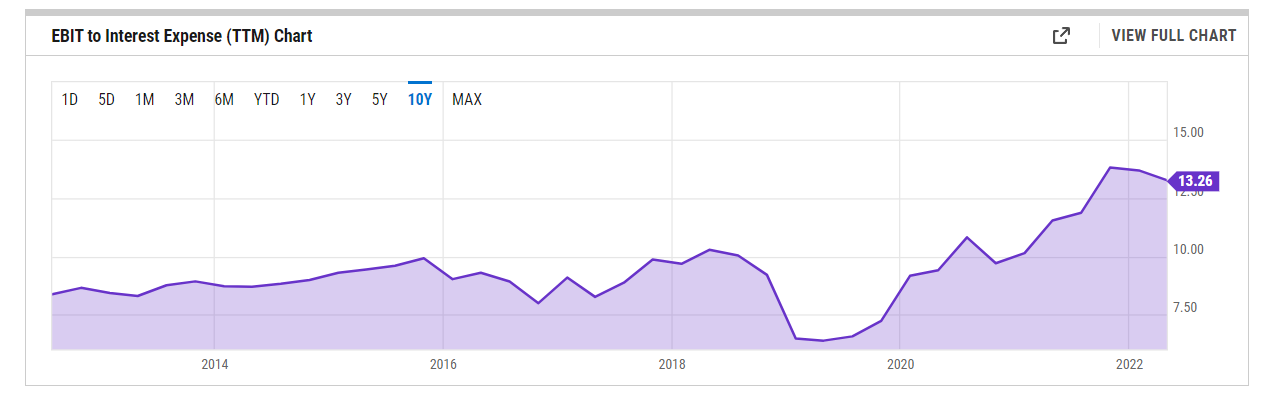

Also consider that despite having a sizeable debt to the tune of $33bn, Lowe’s operating prowess is such that it comfortably generates ample EBIT to cover its interest bill; currently, the interest coverage is well over 13x (the 5-year average is a lot lower at 10x), the highest it’s been in over a decade. Thus. even if we are in the throes of an aggressive rate environment, LOW still has ample elbow room to mitigate a potentially pricier interest bill.

YCharts

Forward Valuations No Longer Look Pricey

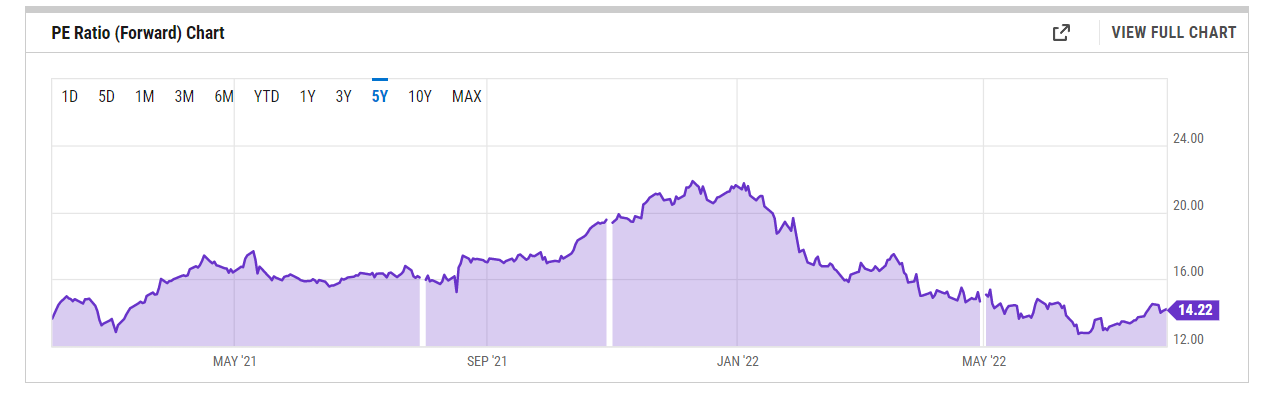

Under normal circumstances, a stock with multiple yield-generating levers such as LOW would be an expensive proposition to own; fortunately, the sell-off in 2022 has tilted the forward valuations to more accessible levels. This is the case, both with regards to the company’s own average valuation levels, as well as, in comparison to other home improvement retailers.

During the Q1 results, LOW management had guided towards an annual EPS range of $13.10-$13.6. Consensus estimates are currently closer to the upper end of that range at $13.47, implying 12% EPS growth. Given the current market environment, this healthy bottom-line growth of early teens is no mean feat. This would also translate to a forward P/E ratio of only 14.2x, which works out to a 14% discount to the stock’s long-term forward P/E average of 16.55x. It’s worth noting that only 8 months ago, this was a stock trading at P/Es closer to the 20-22x level.

YCharts

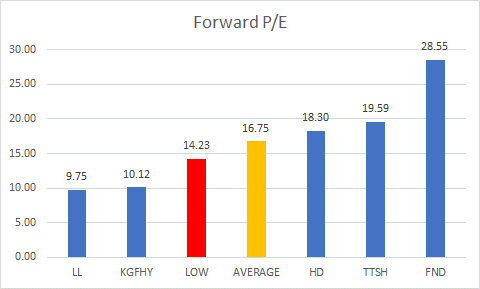

Even relative to its peers in the home retailing space, Lowe’s stock can be picked up at a discount of 15% relative to the sector average of 16.75x.

Seeking Alpha

Better risk-reward on the charts now

Towards the back half of last year, one could be forgiven for feeling wary about getting on board with the LOW stock as it had been on a relatively strong uptrend since August 2021, with no pauses whatsoever; thus, there was always the risk of getting trapped right at the top. Prospective investors don’t have to feel overwhelmed about that risk anymore. Admittedly, whilst the bears have dominated proceedings for much of this year (since the start of the year, we’ve seen six straight red-bodied candles with lower lows and lower highs, even as the stock broke down from its post-pandemic ascending channel) there’s reason to believe the selling may abate in the near term at these levels, and the stock could potentially attempt to build a base at around current levels. I say this because the $180-$150 range had previously served as a congestion zone from Aug 2020- Feb-2021 and we may see this terrain serve as some form of support.

Investing

I’d also point to an image highlighting how LOW stock is positioned relative to its peers in the retail space (as measured by RTH). Even as recently as March this year, this ratio had looked rather overbought trading above its ascending channel; that is no longer the case, implying much better rotational prospects for LOW for those interested in retail stocks.

Stockcharts

Be the first to comment