At the end of last week, the price of nearby NYMEX crude oil futures fell below the December 2018 low. After trading to a high of $65.65 on January 8, when tensions between the US and Iran reached a boiling point, the price fell to a low of $41.77 on March 6, as the energy commodity took an elevator to the downside and slipped by 36.4%. The most recent low took out the December 2018 low of $42.36 per barrel.

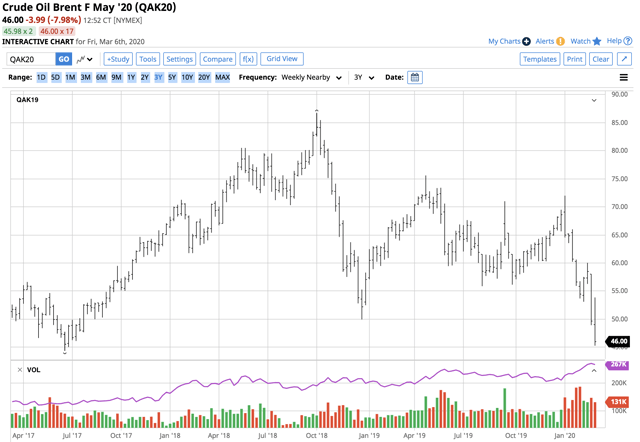

Nearby Brent futures also declined sharply, falling from a peak of $71.99 per barrel on January 8 to its most recent low of $45.29 per barrel as Brent moved 37.1% lower. Brent futures settled near the low at the end of last week.

Last week, the oil ministers of OPEC gathered to assess the impact of its increase in output reductions from late 2019. The oil cartel expanded its production cut from 1.2 to 1.7 million barrels per day. Saudi Arabia kicked in another 400,000 barrels lifting the total reduction at the end of 2019 to 2.1 million barrels. However, crude oil moved lower since the end of last year when WTI futures closed 2019 at $61.21, and Brent was at $66 per barrel. As of the end of last week, the two crude oil benchmarks remained falling knives since the January 8 peaks.

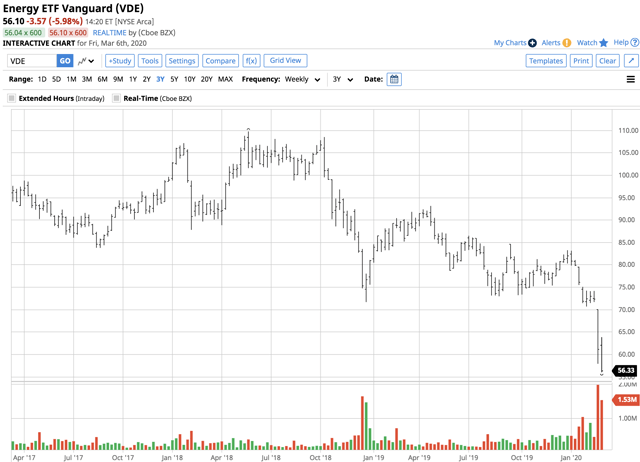

In 2019, oil-related equities underperformed the price of crude oil, and that trend continues in 2020. The Vanguard Energy Index Fund ETF Shares (VDE) holds long positions in many of the leading oil companies.

The Fed emergency rate cut was not bearish

On March 3, the US Federal Reserve responded to rising fears and risk-off conditions in markets across all asset classes with the most aggressive move since the 2008 global financial crisis. The central bank slashed the Fed Funds rate by fifty basis points sending the short-term rate to 1.00-1.25%. Last year at this time, the Fed Funds rate stood at 2.25-2.50%.

Falling US interest rates and risk-off conditions in markets weighed on the value of the US dollar.

Source: CQG

The daily chart of the March dollar index futures contract highlights the decline from a new high of 99.815 on February 20 to a low of 95.685 on March 6. A falling dollar and dropping interest rates are typically supportive of commodity prices, and crude oil is no exception. However, the current landscape in markets is anything but typical.

OPEC runs into a brick wall

The outbreak of Coronavirus in China and its spread across the globe quickly replaced concerns over the trade war between the US and China. The two sides signed a “phase one” deal on January 15, and it did not take long for another crisis to weigh on markets. China is ground zero for Coronavirus, but it has spread around the world. As the Chinese economy ground to a halt with quarantines and rising fear spreading across the nation that is home to almost one billion and one-half people, the demand for crude oil declined. The spread to other countries in Asia, Europe, the US, and around the world pushed the price of crude oil to the lowest price since December 2018.

Source: CQG

The weekly chart shows that the price of nearby crude oil futures on NYMEX fell to a low of $41.77 per barrel on Friday, March 6. The price fell below the late 2018 bottom in the energy commodity. Price momentum and relative strength indicators fell into oversold territory. Open interest rose to the 2.233 million contract level, and weekly historical volatility rose from 25% at the beginning of the year to over 41% late last week. The price of crude oil took an elevator to the downside, causing the price variance metric to move higher. Since the January 8 high, the price of crude oil fell by over 36% at the most recent low.

Source: Barchart

The chart of Brent crude oil, the benchmark pricing mechanism for two-thirds of the world’s petroleum, fell from $71.99 per barrel in early 2020 to its most recent low of $45.29 on March 6, a decline of over 37%.

OPEC cut production in late 2019 by increasing its output reduction from 1.2 to 1.7 million barrels per day. Saudi Arabia increased the cut to 2.1 million. In late 2019, OPEC agreed to meet in early March to assess the impact of its production cuts. In late 2019 the concern was the trade war between the US and China and its effect on the global economy. While the de-escalation of the dispute and signing of the “phase one” deal on January 15 was good news for the oil market, Coronavirus dealt the energy commodity a far more severe blow leading the price to its latest low. As the Chinese economy ground to a halt, the demand for the energy commodity dropped. The spread to other nations around the world caused the central banks to add significant monetary policy stimulus. Based on the latest price action in the oil arena, the bottom line for OPEC was that the existing level of production reductions was not enough to balance the supply and demand equation.

Saudi Arabia went into the meeting last week, advocating for a one million to 1.5 million barrel per day reduction on top of the current quotas. The Russian oil minister Alexander Novak balked at the suggestion as it appeared that the Russians favored no change to the existing quotas. While Saudi Arabia has always been the dominant member of the cartel, since 2016, Russia took over that role. The Russians, one of the top three producers of crude oil in the world, cooperated with OPEC in 2016, which lifted the price of the energy commodity from a low of $26.05 on NYMEX futures and $27.11 per barrel on the Brent benchmark. The market had been looking for at least a one million barrel per day reduction in output from the cartel and the Russians. As of the end of business on Thursday, which was the end of the member’s meeting, there was no decision. OPEC had to wait for the Russians on Friday to make the final determination about quotas for the coming months. Ecuador quit the cartel on Thursday.

On Friday, Russia stood firm saying it would only agree to a 500,000 barrel per day reduction creating tension with Saudi Arabia. The price of April NYMEX crude oil was trading at just over the $42 per barrel level in the aftermath of the decision. Many analysts were calling for a decline to $35 per barrel with some saying we could see the price of the energy commodity drop to the 2016 low of $26.05 per barrel. The OPEC meeting turned out to be a disaster for the energy commodity at a time of the year when the price is typically weak. Crude oil fell to the 2016 during February. In 2020, it is possible that the low will come in March as the price of oil is wasting no time evaporating.

U.S. politics and crude oil

OPEC’s impact to lift the global price of oil has declined dramatically over the past years as production from the United States rose. The standoff between Russia and the Saudis complicated financial problems for both producers as the price fell after a meeting that was supposed to provide support. The US surpassed both Russia and Saudi Arabia as the leading producer of crude oil. Last week, the Energy Information Administration said that US output rose to a new record of 13.1 million barrels per day for the week ending on February 28. The new high was 100,000 barrels higher than the prior peak. Many analysts have opined that US output would drop with the lower number of rigs in operation. According to Baker Hughes, the rig count as of March 6 2020 was 682, up four from the previous week but 152 lower on a year-on-year basis. At the same time, the lower price of oil should cause a drop in US output, but that has yet to occur. The latest new peak in production came as the price of oil futures was a falling knife. OPEC rubbed salt into the open wound in the oil market. The cartel’s target range for Brent crude oil is $60-$70 per barrel. At the end of last week, the price was $14 below the bottom end of that band.

The US Presidential election in November will stand as a referendum on President Trump’s performance as well as the current path of US policy initiatives. The President has been a supporter of the energy sector via significant regulatory and tax reform. Under the Trump administration, the US has become the world’s leading producer of crude oil and natural gas. The opposition party’s platform is likely to embrace the “Green New Deal,” which would reduce the production of hydrocarbons. The shift of power in the world of crude oil could shift from the US back to OPEC and Russia if Democrats capture the White House in November. While OPEC production cuts and output policy will have a limited impact on the price of the energy commodity in the current environment, the price of oil is likely to move higher and lower with the political polls as the November election approaches. As of the end of last week, the price action in the oil market was beyond ugly.

The equities continue to look awful

Crude oil and energy-related equities are already indicating a dramatic shift in US policy. As the stock market was rising to a new high after new high over the past months, the energy sector did not participate in the bull market. However, when risk-off conditions gripped markets, energy stocks fell further alongside the rest of the stock and crude oil futures markets.

The price of crude oil stood at around the $42 per barrel level on NYMEX WTI futures and $46 per barrel on Brent futures on the Intercontinental Exchange at the end of last week. Both prices were below the December 2018 low by 36 cents on WTI and around $4 on Brent. However, the E-Mini S&P 500 futures contract at the 2925-level last Friday was over 600 points above its late 2018 bottom. Meanwhile, energy stocks were significantly lower than both crude oil and the overall stock market.

Source: Barchart

The chart of the Vanguard Energy Index Fund ETF Shares shows that at $56.10, VDE was 18.5% below its December 2018 lows at $68.84 per share. The price action in oil services companies has been even worse.

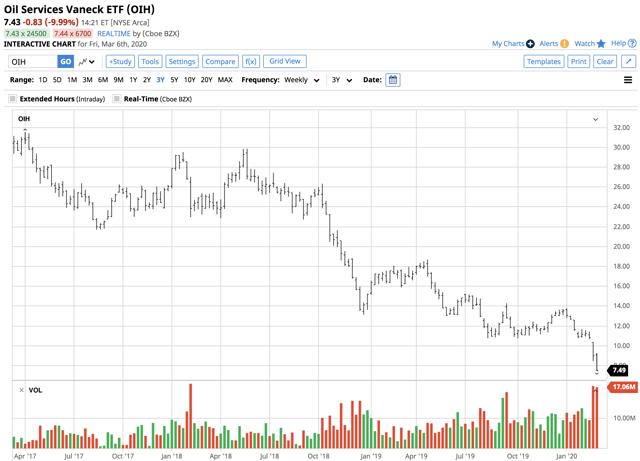

Source: Barchart

The chart of the VanEck Vectors Oil Services ETF (OIH) highlights that OIH fell to a low of $13.13 per share. On Friday, March 6, the price of the oil services ETF was 43.4% lower at $7.43 per share. The price action in the shares for the leading oil and oil services indicates that the potential for bankruptcy in the debt-laden oil patch was high.

It is always darkest before the dawn – the oil sector could experience a significant rebound

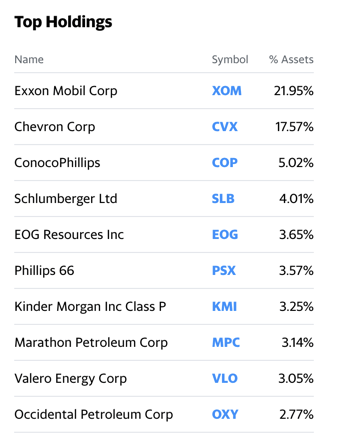

The VDE and OIH ETF products are highly liquid instruments that hold shares in the top energy-related companies. The top holdings in VDE’s portfolio include:

Source: Barchart

VDE has net assets of $2.91 billion, trades an average of 768,547 shares each day, and charges a 0.10% expense ratio. The blended dividend yield pays holders 4.55% at the current share prices. The top holdings of OIH include:

Source: Barchart

OIH has net assets of $497.25 million, trades an average of 11.38 million shares each day, and charges a 0.35% expense ratio. The blended dividend yield pays holders 3.24% at the current share prices.

These two ETF products hold the companies that are the cream of the crop in the oil sector that has been beaten like a redheaded stepchild. VDE and OIH are two candidates that offer a diversified approach to buying energy-related equities for a recovery. It is always darkest before the dawn, and markets tend to look their worst when hitting bottoms. In the energy sector, share prices could not look worse these days. OPEC may have created a disaster in the oil patch at the end of last week. Coronavirus continues to threaten to thrust the world into a recession. Last week, the US Fed took the threat seriously, but OPEC did not.

The Hecht Commodity Report is one of the most comprehensive commodities reports available today from the #2 ranked author in both commodities and precious metals. My weekly report covers the market movements of 20 different commodities and provides bullish, bearish and neutral calls; directional trading recommendations, and actionable ideas for traders. I just reworked the report to make it very actionable!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The author always has positions in commodities markets in futures, options, ETF/ETN products, and commodity equities. These long and short positions tend to change on an intraday basis.

Be the first to comment