eyecrave/iStock via Getty Images

Foreword

A reader of August 2019’s high-yield, low priced dividend dog list called it, “dangerous advice”. Hence, this information is to be used at your own risk.

I have always advised that high dividends are a sure sign of high risk. Combine that signal with a low-price offer and you have the stuff of legends and horror stories. Especially in light of YCharts declaration that YCharts allows a dividend yield to persist for 365 days after the most recent reported dividend if a dividend is cut. Therefore a few line items you see calculated here could be totally inaccurate. (Most of the time Y-Charts withholds forward yield projections when a dividend is cut, however… but not always.)

These 97 March selected stocks reported total annual returns ranging from -89.53% to 351.08%. Any candidates this month showing yields greater than 20% were removed because their dividends are the most likely to be cut or curtailed. I did nothing about Chinese-based high yielders but China has announced a preference for home-grown investors and could ban Chinese corporations from international stock market listings in the future. Another caveat holds for Russian listings. One can’t be sure how long Russian stocks will stay listed on US exchanges what with Putin’s war with Europe raging.

Happy hunting, and beware of the numbers put up by the top ten by yield on this list of 97. In short, this is risky business. These are Dogs of the Low, not of the Dow. These dogcatcher metrics are set to snag the most unloved and unpopular curs as a contrarian stock selection strategy.

Meanwhile, all but two of the 97 stocks on this list show dividends from a $1K investment greater than their single share prices. Some investors find this condition to be an invitation to, at least, look closer.

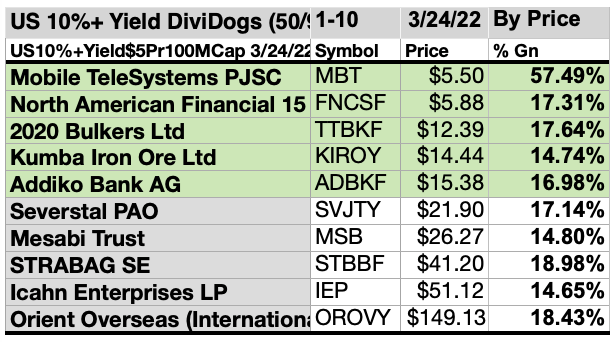

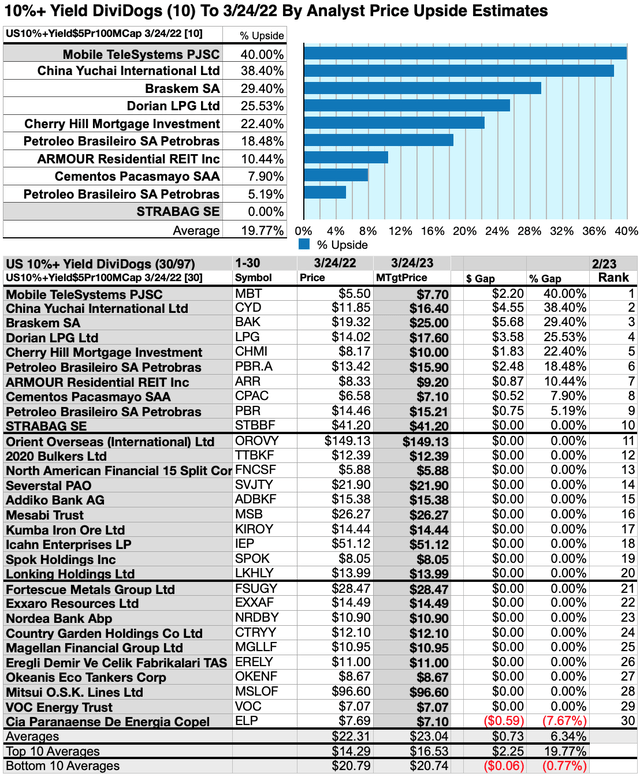

Actionable Conclusions (1-10): Brokers Calculated 18.31% To 57.49% Net Gains For The Top Ten 10%+Yield Stocks As Of March 24, 2023

Two of these ten top-yield 10%+Yield stocks (tinted in the list below) were among the top-ten gainers for the coming year, based on analyst 1-year targets. Thus, this forecast, as graded by Wall St. Brokers, was 20% accurate.

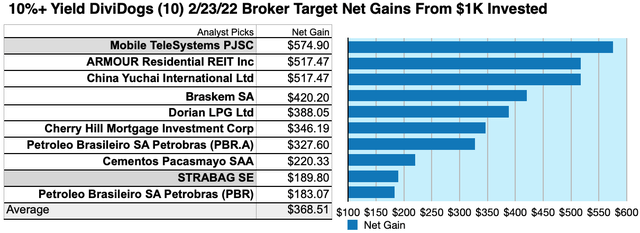

Dividends from $1000 invested in the highest-yielding stocks and the median of analyst-estimated one-year target prices, as reported by YCharts, created the 2022-23 data points for the following estimates. Note: one-year target prices from lone analysts were not applied (n/a). Ten estimated profit-generating trades to March 24, 2023 were:

Source: YCharts

Mobile Telesystems PJSC (MBT) was projected to net $752.70 based on dividends plus the median of target estimates from twelve analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 1% over the market as a whole. This Russian Telecom may not remain listed next month.

ARMOUR Residential REIT Inc (ARR) was projected to net $327.50 based on dividends, plus the median of target estimates from three analysts less broker fees. The Beta number showed this estimate subject to risk/volatility 4% less than the market as a whole.

China Yuchai International Ltd (CYD) was projected to net $784.48, based on dividends plus the median of prices estimated by two analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 29% over the market as a whole.

Braskem SA (BAK) was projected to net $510.48 based on dividends plus the median of target estimates from five brokers, less broker fees. The Beta number showed this estimate subject to risk/volatility 75% over the market as a whole.

Dorian LPG Ltd (LPG) netted $420.80 based on dividends plus the median of target estimates from six brokers, less broker fees. The Beta number showed this estimate subject to risk/volatility 19% over the market as a whole.

Cherry Hill Mortgage Investment Corp (CHMI) was projected to net $711.83, based on dividends plus the median of target estimates from two brokers, less broker fees. The Beta number showed this estimate subject to risk/volatility 14% over the market as a whole.

Petroleo Brasileiro SA Petrobras (PBR.A) was projected to net $249.09, based on dividends plus the median of target estimates from seven analysts less broker fees.. The Beta number showed this estimate subject to risk/volatility 46% greater than the market as a whole.

Cementos Pacasmayo SAA (CPAC) was projected to net $337.39, based on dividends plus the median of target estimates from eight brokers, less broker fees. The Beta number showed this estimate subject to risk/volatility 68% less than the market as a whole.

STRABAG SE (OTCPK:STBBF) was projected to net $189.80, based on dividends alone, less broker fees. A Beta number was not available for STBBF.

Petroleo Brasileiro SA Petrobras (PBR) was projected to net $183.07, based on dividends plus the median of target estimates from twelve analysts less broker fees.. The Beta number showed this estimate subject to risk/volatility 56% greater than the market as a whole.

The average net-gain in dividend and price was estimated to be 36.85% on $10k invested as $1k in each of these ten stocks. This gain estimate was subject to average risk/volatility 7% greater than the market as a whole.

Source: Open source dog art from dividenddogcatcher.com

Open source dog art from dividenddogcatcher.com

The Dividend Dogs Rule

Stocks earned the “dog” moniker by exhibiting three traits: (1) paying reliable, repeating dividends, (2) their prices fell to where (3) yield (dividend/price) grew higher than their peers. Thus, the highest yielding stocks in any collection became known as “dogs.” More precisely, these are, in fact, best called, “underdogs”.

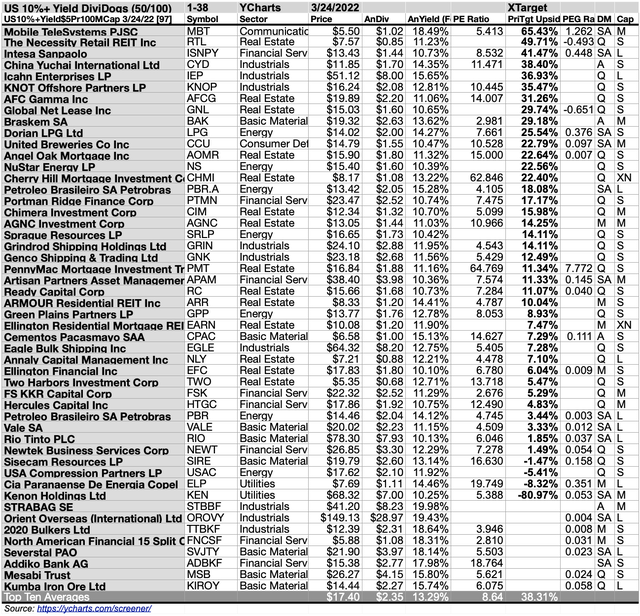

38/97 Broker Price Target Up/Dn-sides

Source: YCharts

50/97 10%+Yield Top-Dogs By Yield

Source: YCharts

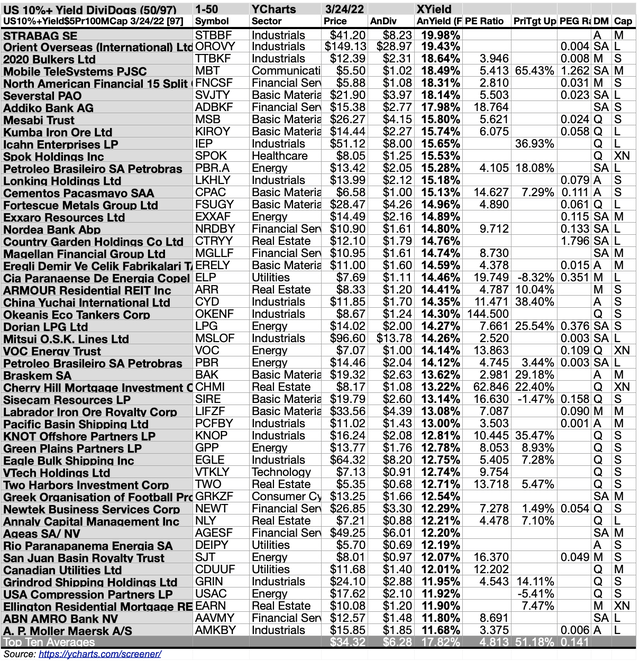

Actionable Conclusions (11-20) Top Ten 10%+Yield March Stock Yields Ranged 15.65%-19.98%

Top ten 10%+Yield dogs selected 3/24/22 by yield represented four of eleven Morningstar sectors.

First place was earned by the first of four industrials sector stocks in the top ten, STRABAG SA [1].The other industrials members placed second, third, and tenth, Orient Overseas International Ltd (OTCPK:OROVY) [2], 2020 Bulkers Ltd (OTCPK:TTBKF) [3], and Icahn Enterprises LP (IEP) [10].

Fourth place was captured by the communication services representative, Mobile Telesystems PJSC [4]. Then fifth and seventh places went to financial services members, North American Financial Split Corp (OTC:FNCSF) [5], and Addiko Bank AG (OTCPK:ADBKF) [7].

Thereafter, Three basic materials stocks in the top ten, placed sixth, eighth and ninth, Severstal PAO (SVJTY) [6], Mesabi Trust (MSB) [8], and Kumba Iron Ore Ltd (OTCPK:KIROY) [9], to complete the 10%+Yield top ten for March, 2022-23.

Actionable Conclusions: (21-30) Nine 10%+Yield Stocks Showed 5.19% To 40% Upsides To MARCH 24, 2023 and (31) One Down-sider Hit A Negative Note

Source:YCharts

To quantify top yield rankings, analyst median price target estimates provided a “market sentiment” gauge of upside potential. Added to the simple high-yield metrics, analyst median price target estimates became another tool to dig out bargains.

Analysts Estimated A 19.29% Advantage For 5 Highest Yield, Lowest Priced, Of Ten 10%+Yield Dogs To March 24, 2023

Ten top 10%+Yield dogs were culled by yield for this March update. Yield (dividend/price) results verified by YahooFinance did the ranking.

Source: Charts

As noted above, top ten 10%+Yield dogs selected 3/24/22 showing the highest dividend yields represented four of eleven sectors in the Morningstar scheme.

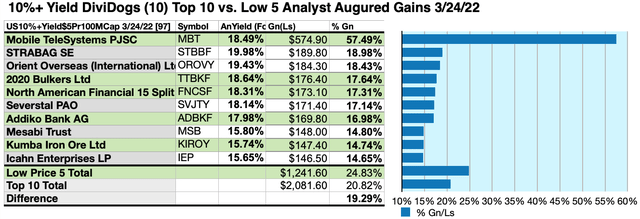

Actionable Conclusions: Analysts Estimated 5 Lowest-Priced Of Top Ten Highest-Yield 10%+Yield Dogs (31) Delivering 24.83% Vs. (32) 20.82% Net Gains From All Ten By March 24, 2023

Source: YCharts

$5000 invested as $1k in each of the five lowest-priced stocks in the top ten 10%+Yield dogs collection was predicted by analyst 1-year targets to deliver 19.29% more net gain than $5,000 invested as $.5k in all ten. The very lowest priced, Mobile Telesystems PJSC, was projected by analysts to deliver the best net gain of 57.49%.

Source: YCharts

YCharts

The five lowest-priced top 10%+Yield stocks as of March 24 were: Mobile Telesystgems PJSC; North American Financial 15 Split Corp; 2020 Bulkers Ltd; Kumba Iron ORE Ltd; Addiko Bank AG, with prices ranging from $5.50 to $15.38.

Five higher-priced >10% Yield dogs from March 24 were: Severstal PAO; Mesabe Trust; STRABAG SA; Icahn Enterprises LP; Orient Overseas (International) Ltd whose prices ranged from $21.90 to $149.13.

The distinction between five low-priced dividend dogs and the general field of ten reflected Michael B. O’Higgins’ “basic method” for beating the Dow. The scale of projected gains based on analyst targets added a unique element of “market sentiment” gauging upside potential. It provided a here-and-now equivalent of waiting a year to find out what might happen in the market. Caution is advised, since analysts are historically only 20% to 90% accurate on the direction of change and just 0% to 10% accurate on the degree of change.

The net gain/loss estimates above did not factor in any foreign or domestic tax problems resulting from distributions. Consult your tax advisor regarding the source and consequences of “dividends” from any investment.

Afterword

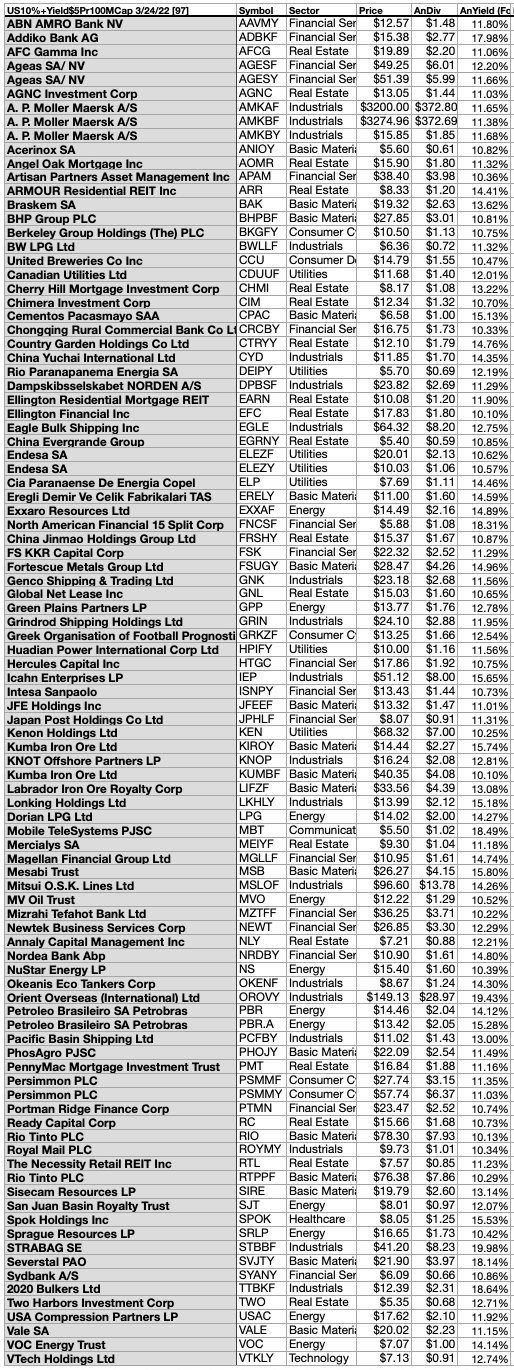

Below is the listing (alphabetically by ticker symbol), of all 97 10%+Yield stocks from YCharts as of 3/24/22.

97 10%+Yield Dogs For March

Source: YCharts

YCharts

Note: All 97 (save two stocks) on this list show dividends from a $1K investment greater than their single share prices. Some investors find this condition to be an invitation to buy or, at least, look closer.

Stocks listed above were suggested only as possible reference points for your 10% Yield-Priced dividend dog purchase or sale research process. These were not recommendations.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment