Denis_Vermenko

It’s not hard these days to find high quality REITs that yield over 3%, as the era of TINA (there is no alternative) is now over. That’s because income asset classes such as REITs, BDCs, and MLPs have plenty of competition for investment dollars, especially with the 10-year treasury note now yielding slightly above 4%.

Some investors, especially retirees, may prize a higher initial yield, as this can help to satisfy RMD requirements on retirement accounts without them having to sell their holdings. Moreover, higher yielding stocks simply provide more financial flexibility to fund everyday living expenses and opportunities for dividend reinvestment.

This brings me to Omega Healthcare Investors (NYSE:OHI), which is an income favorite for many. With the stock now back to a 9% yield, I highlight why it’s time to revisit this holding, so let’s get started.

Why OHI?

Omega Healthcare Investors is the largest publicly-traded owner of skilled nursing facilities. It’s been publicly traded for 30 years, and at present, has 921 properties spread across the US and UK, comprising 63 operators and 92K beds. It’s also geographically diversified with exposure to nearly every U.S. region, and its top 3 states are Florida, Texas, and Indiana.

Starting with the negatives, it’s no secret that the skilled nursing segment is a low margin business, as it relies on government programs for funding. This industry is known for having low rent coverage, and labor shortages and wage inflation have only exacerbated these issues over the past year, putting pressure on operators.

While these are legitimate concerns, we shouldn’t ignore the fact that SNFs are mission critical and serve as a far lower cost of care setting than acute hospitals. Management noted that while the increased post-COVID cost structure may be permanent, a number of states have announced significant increases in Medicaid rates to help offset the higher costs.

It appears, however, that the industry is starting to turn the corner, as management has completed its restructuring work related to its Gulf Coast operator, and is well down its restructuring path with Agemo, which represents 6% of contractual rent, none of which was recognized during the second quarter. Notably, management noted that its other tenants with liquidity issues have generally agreed to pay contractual rent as they work through various asset sales or transitions to new operators.

Importantly for income investors, OHI’s $0.67 per quarter dividend remains covered by AFFO per share of $0.76 and funds available for distribution of $0.71, at 88% and 94% payout ratios, respectively. Given the restructuring progress OHI is making with Agemo, I would expect for OHI’s payout ratios to improve in the third quarter and beyond.

Meanwhile, it appears OHI has prepared for this type of adversity, as it has a strong BBB- rated balance sheet with a safe net debt to EBITDA ratio of 5.3x, and a strong 4.2x fixed charge coverage ratio. Plus, 98% of OHI’s debt is fixed rate, making it less vulnerable to rising rates. It also means that it will take a number of years for OHI to realize higher cost of debt, as not all of its debt matures at once, and this assumes a bad case scenario that interest rates and inflation remain elevated for years to come.

Looking out long-term, I believe OHI remains well-positioned as the largest owner of skilled nursing facilities. This is considering the growing population of seniors over the next decade and the fact that 86% of states have a moratorium on new beds or CON (certificate of need) restrictions on new builds.

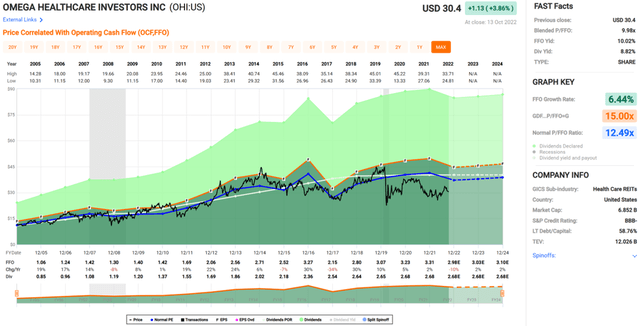

I find the recent drop in OHI’s price from near $34 to $30 as presenting another opportunity to layer into this high yield. It currently carries a forward P/FFO of just 10.2, sitting well below its normal P/FFO of 12.5.

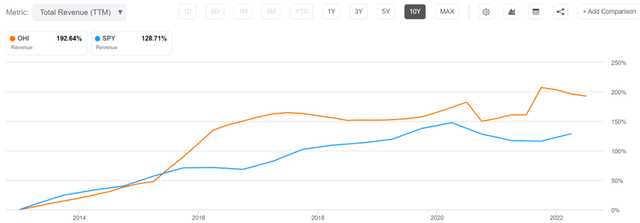

Thanks to OHI’s chronic undervaluation and a high dividend yield, OHI has actually handily beaten the S&P 500 (SPY) on a total return basis over the past decade, as shown below.

OHI Total Return (Seeking Alpha)

Investor Takeaway

Omega Healthcare appears to be turning the corner, as occupancy is rising and states are raising Medicaid funding to offset wage inflation in the skilled nursing segment. The dividend remains covered, and I would expect for the payout ratio to improve for the remainder of the year as management works through restructuring activities. The recent drop in OHI’s share price has pushed up its dividend yield close to 9%, making it an attractive option for income investors.

Be the first to comment