svetikd

Optimizing the Seeking Alpha Value Proposition

As a full-time researcher, I tend to enjoy spending all day searching for hidden opportunities in the market. These typically are not reflected in broad quant organization or ranking systems, perhaps for good reason. However, I decided to take a cursory look at current Seeking Alpha Quant ratings to see what opportunities abound.

Interestingly, I have recently found five “Strong Buys” that I actually agree with, rather than the ones where the best returns are already in the past. Also, it only took me a few minutes to find these companies and I believe Seeking Alpha offers many useful selecting tools to take advantage of for investors that want the best time-to-value proposition.

How I Found The Strong Buys

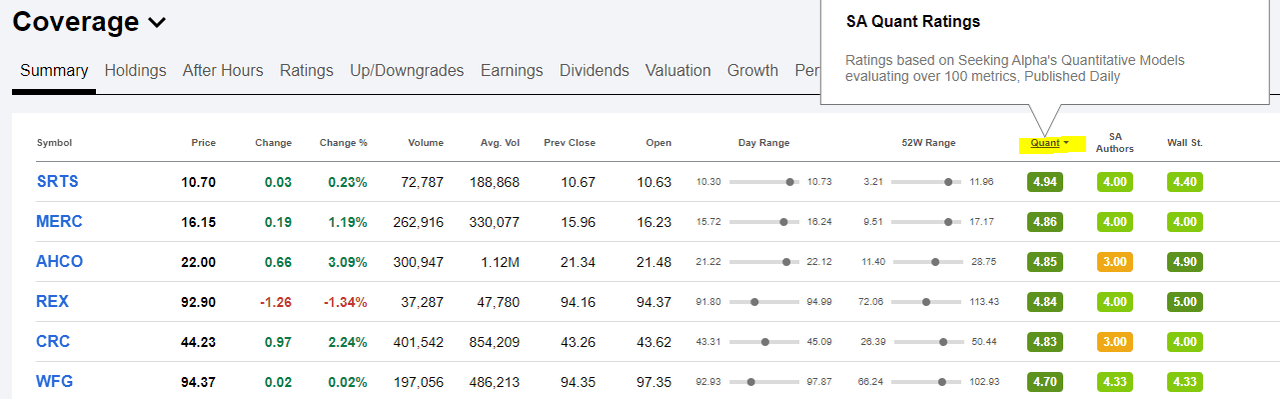

One of my favorite capabilities of the Seeking Alpha platform is the ability to follow an endless amount of holdings in multiple portfolios. When researching I often come up with companies that I would like to research later and place them in the appropriate portfolio. Then after I forgot to revisit the company after some time, I go back and can easily double check the performance. Not to mention that all articles and news posts show up on the timeline. However, now that I have hundreds of tickers to sift through, I decided to just list them in order of Quant rating. Then I had a smaller number of companies to peruse through in order to see what opportunities are present.

Seeking Alpha

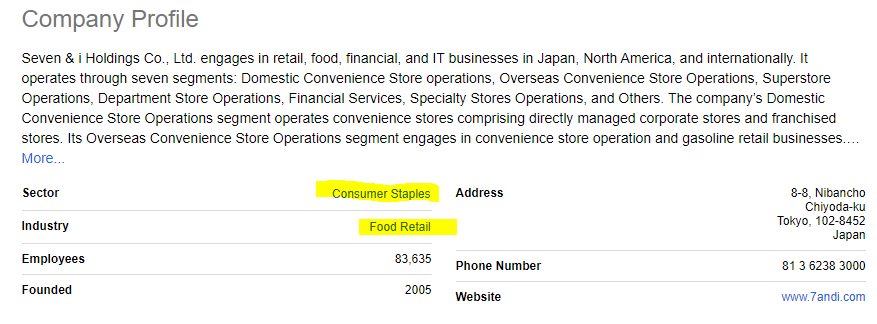

Another feature I often utilize is the individual sector lists. If you do not know where this is, go to a ticker’s “Summary” page and scroll down. Then there is a “Company Profile” section that lists both what sector a company is in and the particular industry. An example below is with Seven & i Holdings, the $35 billion market cap owner of the worldwide 7-11 brand. This company falls under the Consumer Staples sector, and in particular, the Food Retail industry.

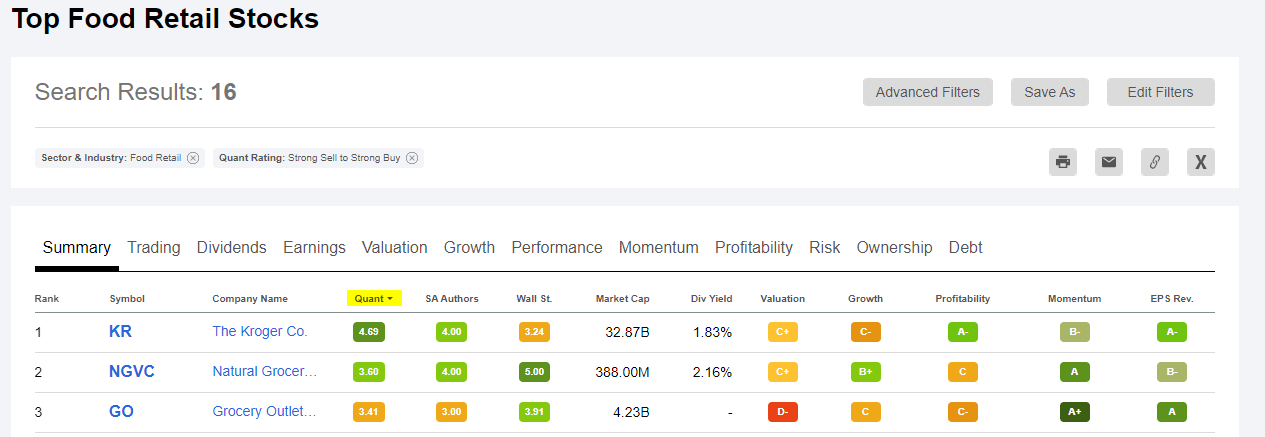

While I looked up 7-11 due to their popularity, they are not rated by the Quant system due to being listed over the counter (the main listing is on the Tokyo Stock Exchange). However, it is easy to look for comparable peers by just going to the industry and ranking by Quant Score. Then, you can see that Kroger is a highly ranked US-listed company to consider.

Seeking Alpha

Seeking Alpha

The Five Strongest “Strong Buys”

Now, I will discuss the five companies I believe offer both true opportunity and rank highly by the Quant scores. They are as follows based on market cap: Alphabet (GOOG), Taiwan Semi (TSM), Catalent (CTLT), Kirin Holdings (OTCPK:KNBWY), and California Resources (CRC). This list is not conclusive, and I own none, but I do agree with the rankings as all offer opportunity. I hope the list is insightful and complementary to your own research.

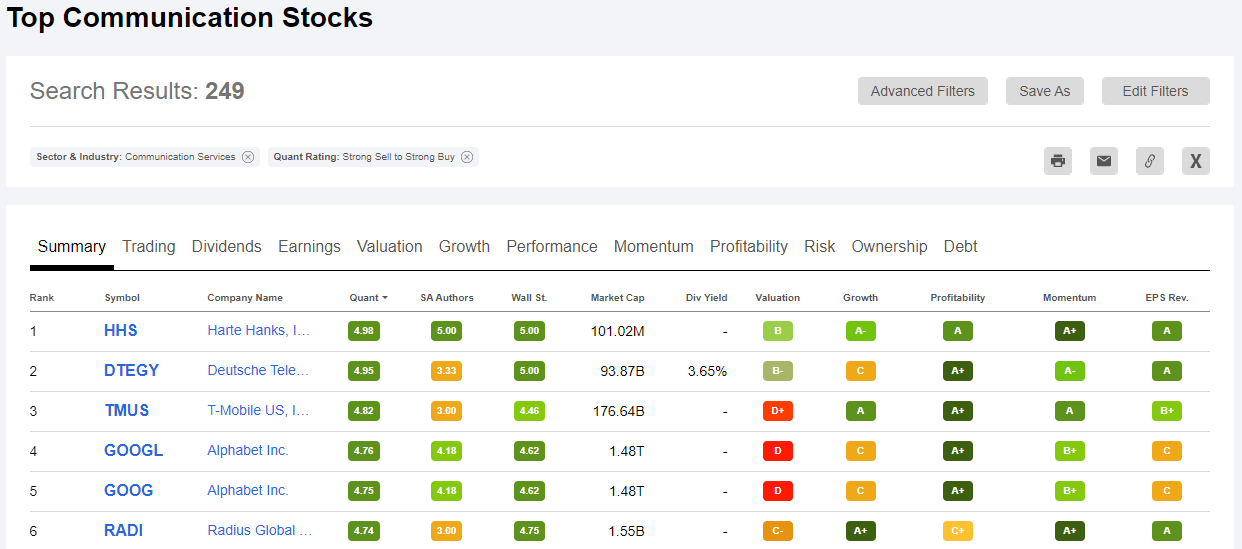

Alphabet

Alphabet is one of the most discussed companies on the market, and is now ranked among the top five of the entire Communication Services sector. Alphabet’s score also leaves peers Twitter (TWTR), Meta (META), Tencent (OTCPK:TCEHY) in the dust. Thanks to daily updates, the quant score is updated to reflect the recent earnings report. In fact, based on the new financial data, the score has reached a recent high of 4.75, up 24 basis points from yesterday. However, there is still room for improvement as three areas face scores of C or below: Valuation, Growth, and EPS Revision. I would recommend sifting through each data page to see why GOOG may be scoring so high.

Seeking Alpha

Diving deeper, we can see that Alphabet often trades at a premium valuation to peers across the sector. However, the score may take into consideration that GOOG now trades at a historically low valuation, between 20-30% off five-year averages. At the same time, revenue and earnings growth is higher than average, at least for revenues and gross margins. Investors have sold off recently due to bottom line weakness, but operations remain growing strong.

Further, Alphabet remains A+ ranked in terms of profitability thanks to perfect margins across the board, no debt, and steady returns. Alphabet is on top for a reason, and that is thanks to the indestructible business profile that is intrinsically bound to nearly all of our modern society.

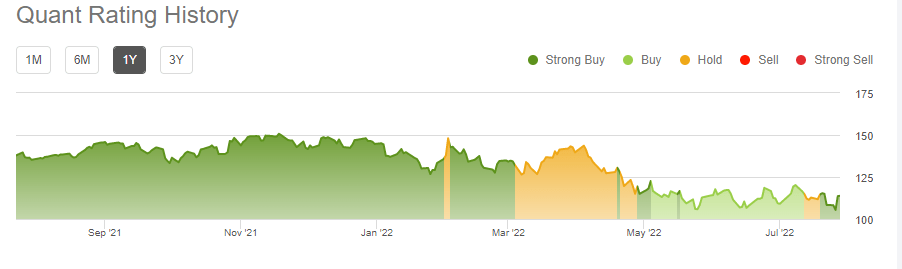

Investors remain the biggest risk point to Alphabet. This is highlighted by the fact that GOOG had a high quant score last fall, but investor sentiment soured and shares sold off. Now after six months of being ranked either a hold or a minor buy, GOOG has returned to a strong buy. I believe this is an important signal as it is one of the few high score companies that is close to 52-week lows. This means that the likelihood of outperformance is high as the valuation has reset.

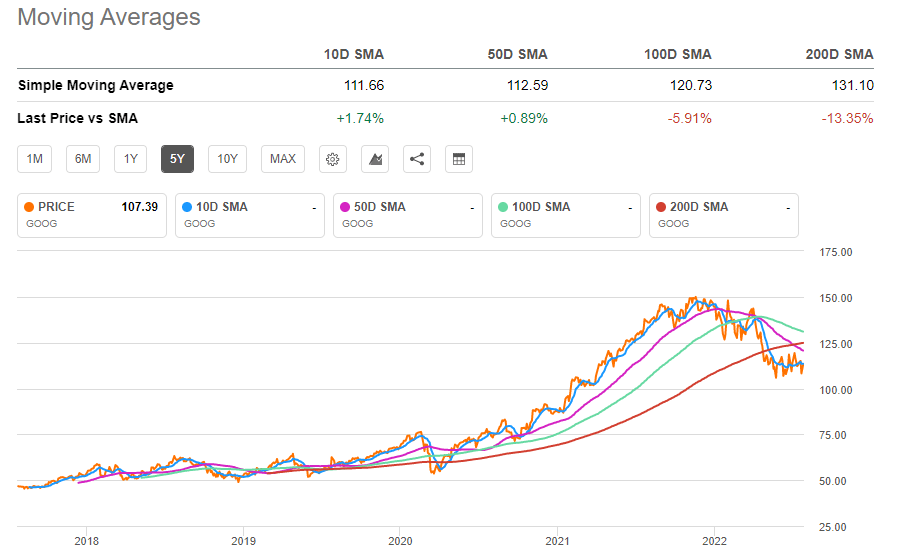

Google also has multiple other catalysts to leverage, as I discussed in my recent article on their drug discovery initiatives. Just taking a look at the simple moving averages highlights how disconnected the share price is now from recent highs. For the following companies, I will just discuss the qualitative data surrounding each company, but I would recommend perusing each data page for more information.

Seeking Alpha Seeking Alpha

Taiwan Semi

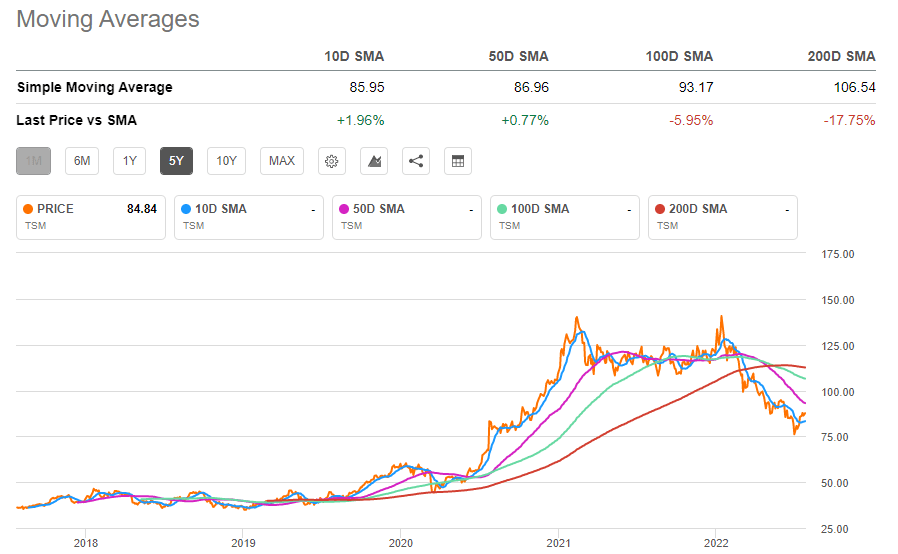

Another tech focused strong buy is Taiwan Semi, the company that makes all the chips that run our lives. As the world’s largest chip foundry, TSM is also an indicator of the health of other technology firms such as NVIDIA (NVDA) and AMD (AMD). Similarly to Alphabet, Taiwan Semi’s strength lies in the opportunity of the recent sell-off in share price.

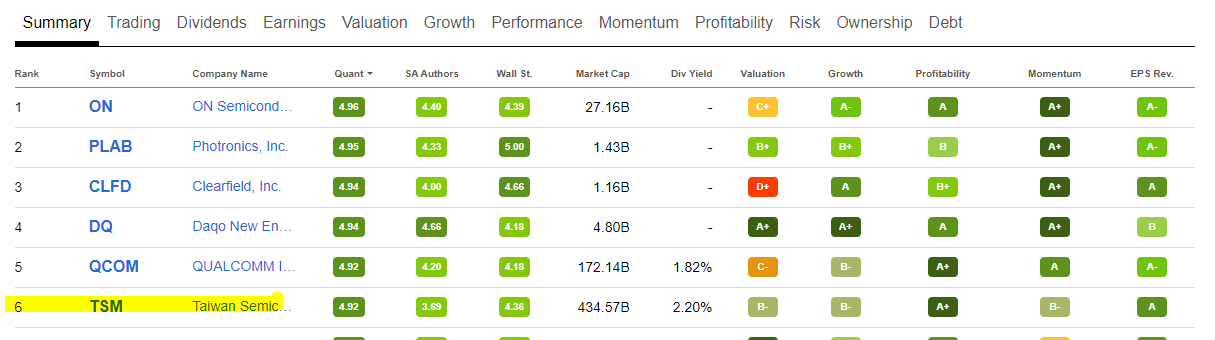

TSM also has a similarly profitable moat business that is currently outperforming across growth and profitability metrics. Considering that the two major peers Samsung and Intel each offer far more investment risk (consumer exposure, lagging growth, no access to next gen chip production equipment, etc), I believe TSM will remain a viable investment for some time. The quant would agree as they are ranked number six in the semiconductor industry.

Seeking Alpha

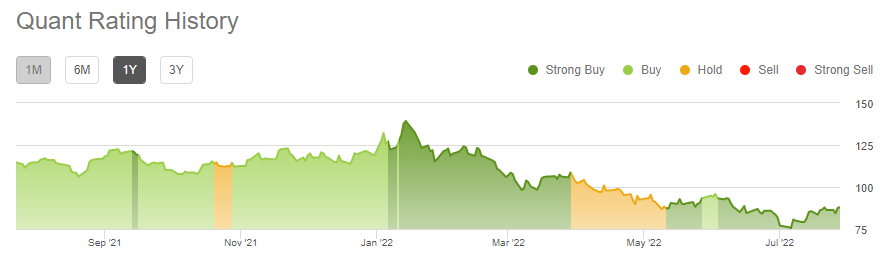

Although cyclicality remains a risk for the semiconductor industry, I find that the share price has fallen enough to provide stable returns. Every year the world becomes more digital and applications of TSM products grow. This secular growth allows me to remain confident in forward momentum. Outlook for the industry is also bolstered by the fact that silicon wafer supplier Sumco (OTCPK:SUOPY) is sold out of production until 2026, which I discussed in an article on the VanEck Semiconductor ETF (SMH). Now that TSM may soon see growth weakness and reduced profitability, I find the opportunity to collect shares at a deal increases.

Seeking Alpha Seeking Alpha

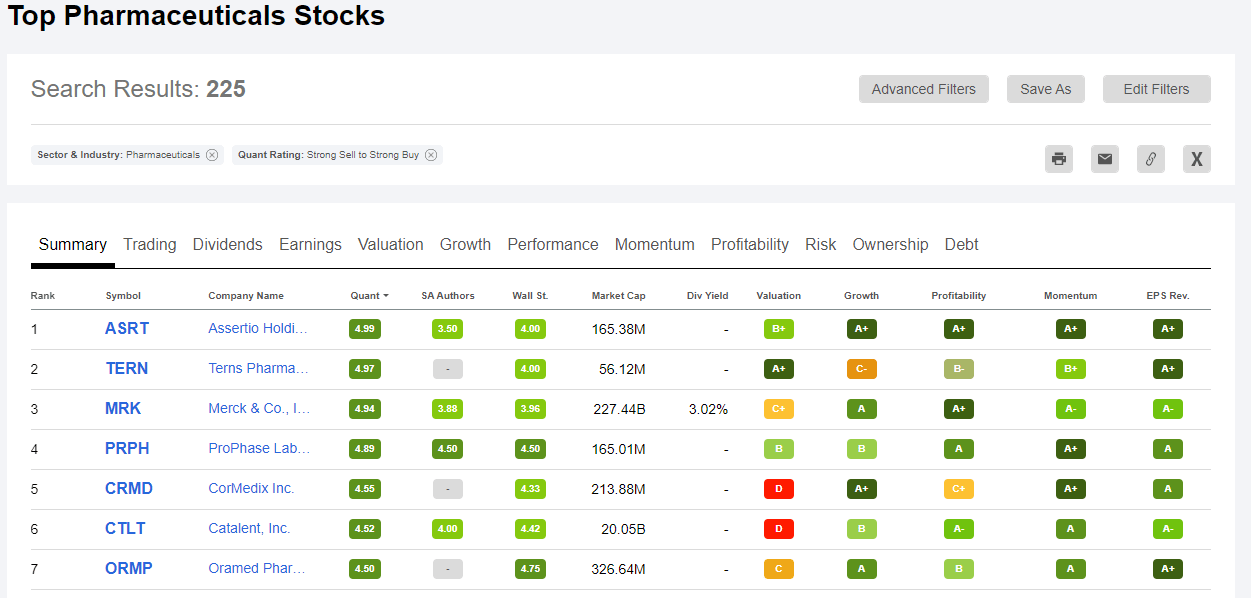

Catalent

Catalent (CTLT) is ranked number 6 across the large pharmaceutical industry. However, the comparison is not entirely fair as Catalent is part of a far smaller sub-group called contract drug manufacture organizations (CDMOs). This means that other biotech and pharma companies contract with Catalent to mass produce their pre-clinical or approved therapies to then distribute. This allows drug developers to off-load in-house risk in the difficult mass production step, a common cause for a drug to not be approved. After many years of successful work in this field, Catalent is now the second largest pure-play CDMO after Lonza Group (OTCPK:LZAGY), a Swiss company I have discussed. I find that Catalent offers the safest US-listed exposure to the industry, but will remain preferring a far smaller peer, Avid Bioservices (CDMO).

Seeking Alpha

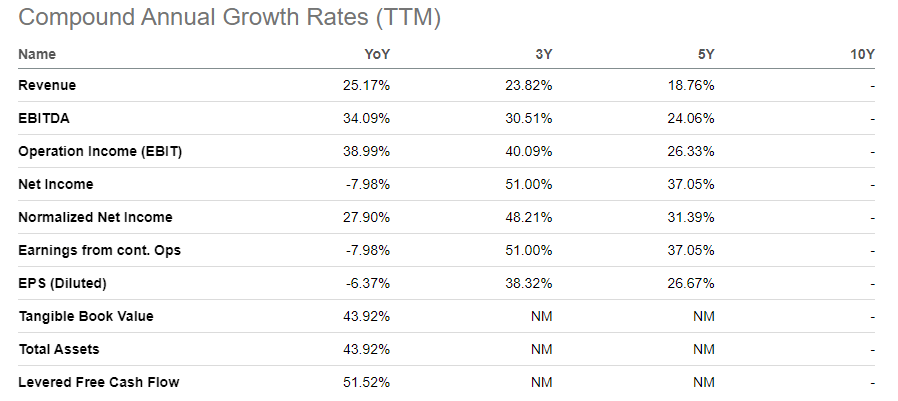

Catalent stands out due to its extreme stability. As a pure compounder, Catalent has seen superb growth across both the top and bottom line. While profitability has recently hit a peak due to favorable pricing, the outlook remains excellent as the drug development industry remains well-funded. Also, with the advancement of modern drug therapies that are complex and difficult to develop, more drug discoverers are likely to outsource production to a company with a track-record of being able to produce these forms of therapies correctly. As such, I remain positive on the entire industry, and CTLT is an excellent choice for a wide range of investment styles.

Seeking Alpha

One of CTLT’s issues is the fact that the company trades at a rightful premium. Also, it is important to consider the industry as partially cyclical, and any weakness in pharma or biotech development may be reflected on Catalent. However, there are no signs of this, and the recent sell-off has helped to tamper the high valuation. Therefore, although the current price to earnings may rise as profit margins return to historical levels, adjusting for this risk also indicates that the current price is also at five-year averages.

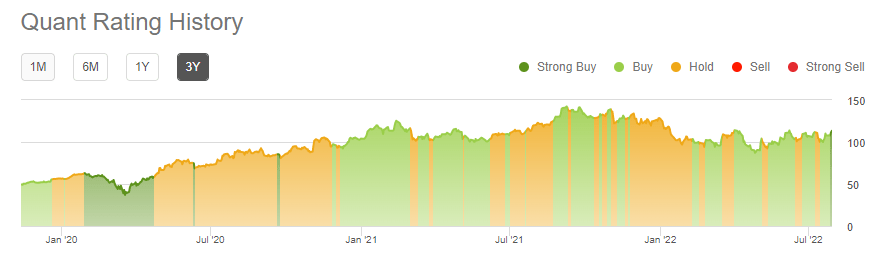

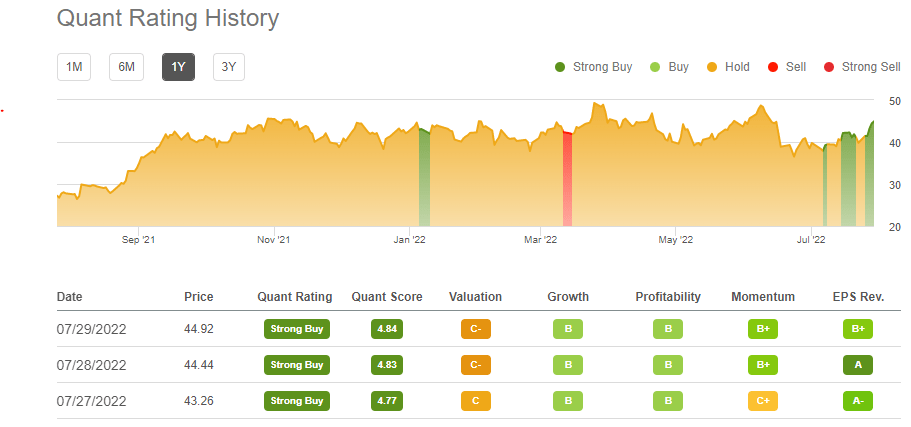

Based on the current Quant metric, which happens to be fairly accurate historically (as shown below), the recent new flash of a Strong Buy ranking should be considered as a fair entry point. Remember to always stagger your investments over time to negate the risk of volatility (which is rare for CTLT).

Seeking Alpha

Kirin Holdings

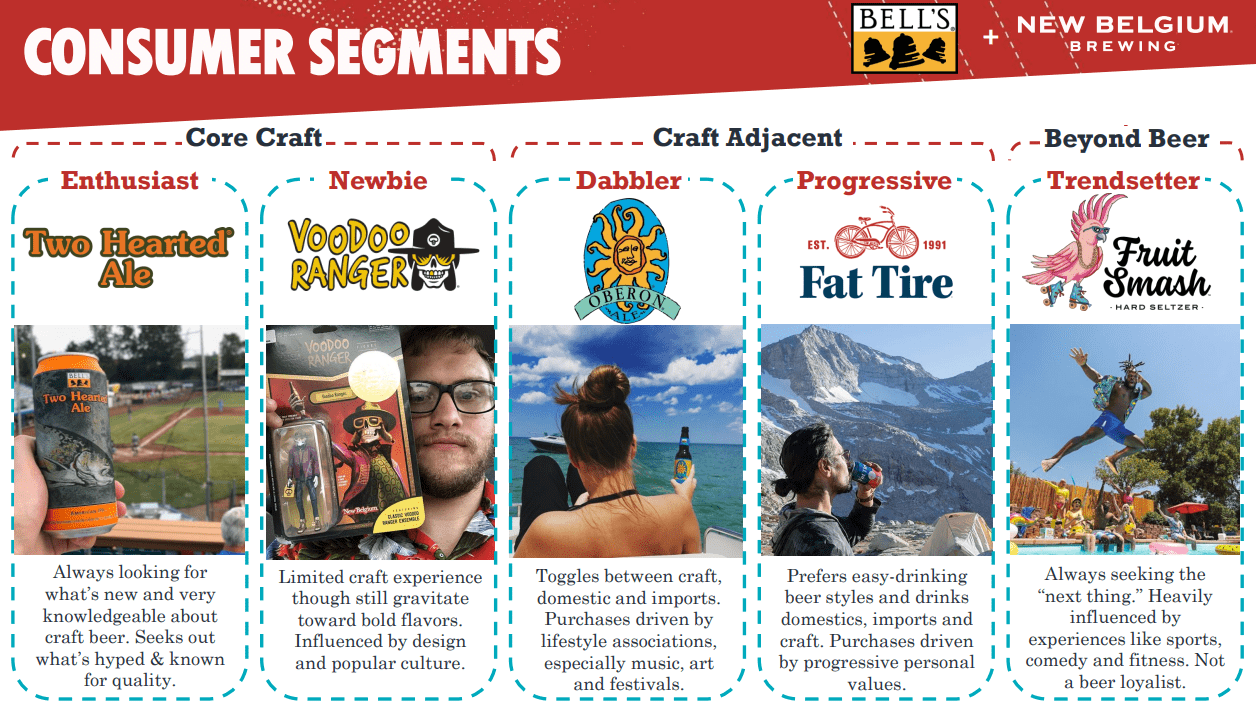

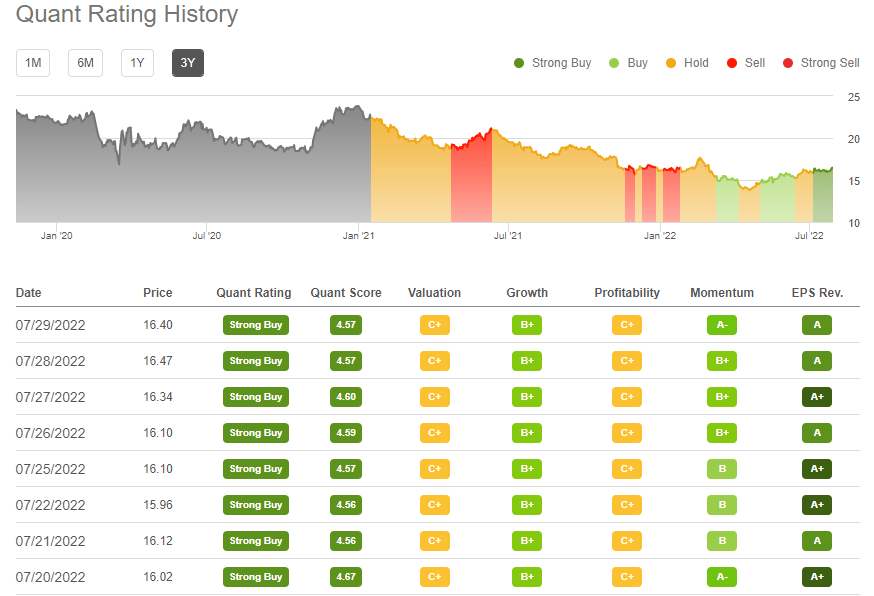

Now, we move on to a very interesting brewing company that has recently flashed a Strong Buy score: Kirin Holdings (OTCPK:KNBWY). Fans of Japanese cuisine may be familiar with Kirin brand beers, but may not know that the company also has fairly extensive holdings of both US-based craft beers, non-alcoholic food and drink, and even fairly substantial exposure to pharmaceutical development.

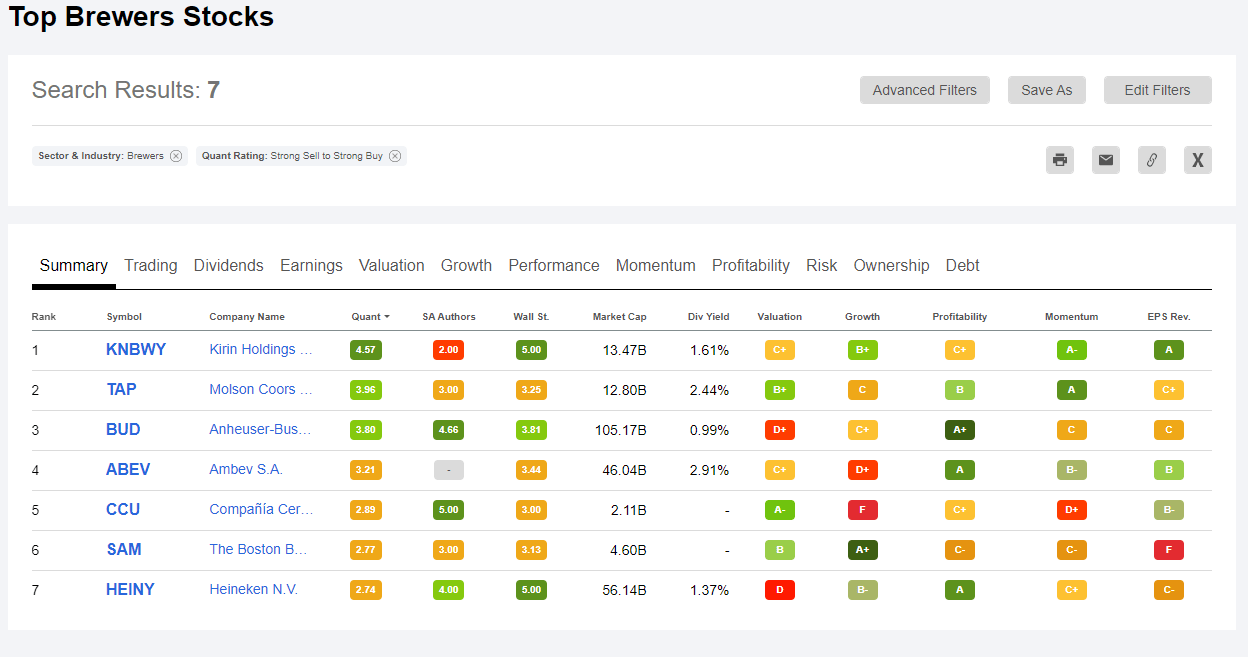

While the ownership stake of Kyowa Kirin is unlikely to find a blockbuster therapy to drive growth anytime soon, having global sales and operations benefits the Japan-based company as a weak Yen supports foreign currency. In fact, Kirin now has the opportunity to outperform western brewing conglomerates such as Heineken (OTCQX:HEINY), AmBev (ABEV), and Anheuser-Busch (BUD).

Seeking Alpha Kirin Holdings Investor Presentation on Short to Medium Term Outlook

Unfortunately, the entire industry is facing weakness as first the pandemic took away higher margin restaurant-based sales, along with a secular decline in alcohol sales in general. The difference now is that there are three major catalysts that will lead to short-term opportunity for Kirin shareholders. First, as lockdowns subside, COVID becomes less impactful, and tourism returns to the peak seen in 2019, a significant increase in revenues is possible. Then, Kirin is likely to grow earnings at a significant rate as forex benefits from their foreign exposure brings in stronger currencies. This will allow for reinvestment in operational efficiency back in Japan.

Lastly, the diversification present thanks to non-alcohol subsidiaries and the 54% ownership of Kyowa Kirin (OTCPK:KYKOF) allow for access to growing fields. The quant system seems to understand this as Kirin has now earned its first Strong Buy score since being analyzed. I certainly believe that there may be short-term opportunity for investors on their feet, but certainly would not recommend the company for more passive or long-term focused investors.

Seeking Alpha

California Resources

Lastly, we come to one of the few oil and gas industry companies that I agree with the Strong Buy sentiment: California Resources (CRC). This company sees 100% of their operations within the state of California, a headache for certain (and perhaps a reason why Occidental spun-off the assets (OXY).

Also, the company faces weakness as California offers a difficult production setting, as seen by the high break-even points. The thing is that CRC has one benefit of being based in California: the government’s willingness to support carbon capture. As such, CRC is likely to be one of the first full-scale carbon capture companies on the market to hopefully provide the first “net zero” barrels of oil to the large economy.

While I am unsure whether the Quant system can pick up on this opportunity, I suppose the newly earned Quant score reflects the positive investor sentiment and improved company guidance. CRC is still a few years out from receiving financial benefit from their carbon capture systems, but I believe the opportunity will continue to support the stability of the share price. This is especially true when considering that California energy prices do not typically move in-line with the rest of the nation, or world. Also, California is an island of both anti-fossil fuel sentiment and their own production infrastructure. Therefore, there may be less risk present in California Resources moving forward when compared to non-carbon capture-exposed O&G companies. It is certainly worth further consideration and due diligence.

Seeking Alpha

Conclusion

As you can see, the Quant system can be an important way to find assets to buy. There are issues with using the quant system for timing the market, as cyclicals tend to score well at the end of their cycle then fall. At the same time, undervalued companies may score poorly such as the case with small cap companies now. It is important to remember that the Quant system puts a lot of weight on momentum, and often the best opportunities are when shares have the opportunity of a turnaround.

However, I hope these Strong Buys buck the trend and offer solid outlook from these prices. But, like always, recurring investments are likely to perform better than timing the market, and Seeking Alpha is an excellent way to sift through competitors to find the best. Also remember that special situations often offer great returns, and to not rely solely on the Quant system scoring metrics. In time, I am sure the system will continue to be optimized and I look forward to the opportunities that will be presented.

Thanks for reading. Feel free to share your thoughts on the Quant system below.

Be the first to comment