anton5146

This article was co-produced with Cappuccino Finance.

Investors are going through a stormy patch right now caused by supply chain disruptions, high inflation, and hawkish monetary policy. The stock market has been going up and down like this family pictured above on a roller coaster.

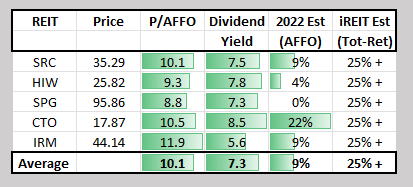

Of course, income investors should also recognize that this pullback sparked, by Mr. Market, has made many REITs in our coverage spectrum much cheaper to buy. And of course, when prices go down, dividend yields go up.

This setup has created a terrific opportunity to own some of the most attractive names with very juicy dividends.

Of course, we shouldn’t just trust the dividend yield at face value.

Our job at iREIT on Alpha is to examine each company with a key focus the balance sheet, income being generated, dividend safety, and management.

The following five REITs check all of these boxes – strong balance sheet, excellent operation, and high liquidity – and we believe that they will successfully weather these tumultuous times.

In the meantime, they are raining high dividend yields to shareholders, and I expect that to be the case for quite some time.

Spirit Realty (SRC)

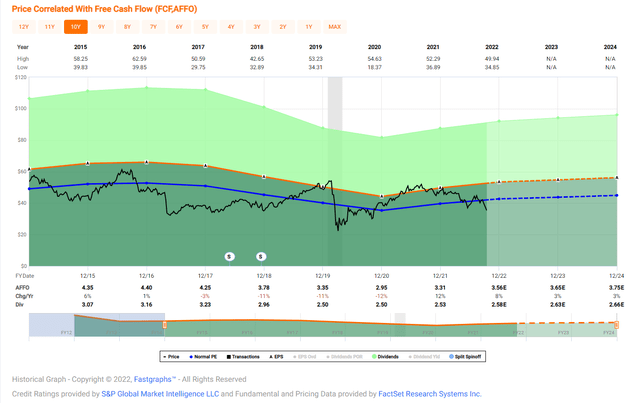

Spirit Realty primarily invests in single-tenant, operationally essential real estate assets in the U.S. They have in-house capacity to acquire properties, perform credit research, manage assets, and finance the transaction.

Spirit Realty has well over 2,000 properties in 35 different industries, and their assets are 99.8% occupied. None of their tenants represent more than 5% of their portfolio.

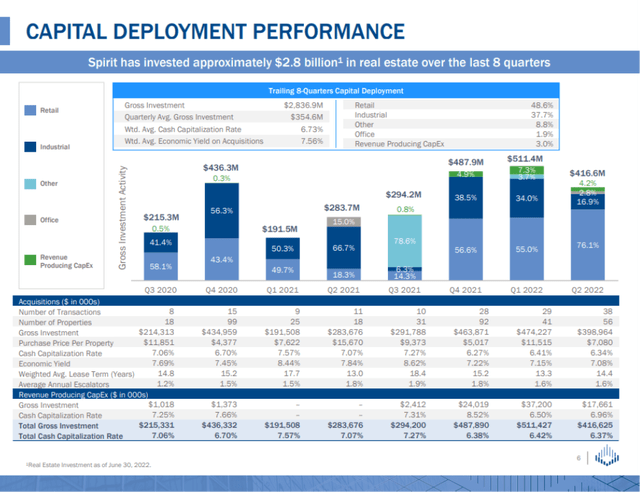

Spirit Realty has been consistently deploying their capital to maintain their assets at a high level of quality and add new assets. In the past two years, they invested about $2.8 B at regular intervals throughout those eight quarters.

Even better, these assets are nicely spread across retail, office, and industrial segments. I expect their total income and dividend payments to continue to grow.

Spirit Realty reported solid results during the latest earnings call. Adjusted cash NOI increased by $23 M to $647 M, and all performance metrics (occupancy, unreimbursed property costs, and lost rents) are in line with or above expectations.

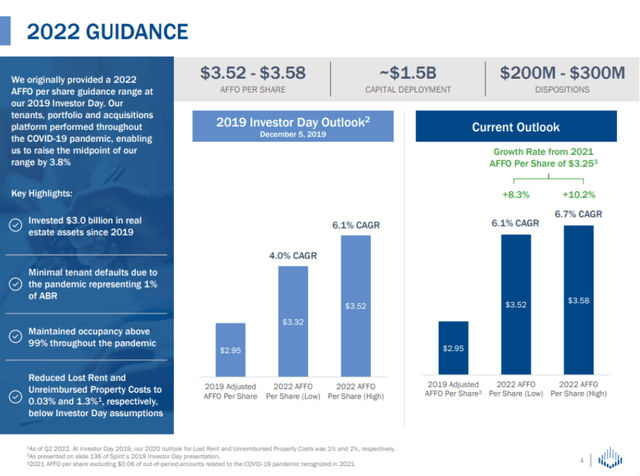

Their guidance for AFFO per share remained unchanged at $3.25 to $3.58, and they expect to deploy $1.5 B, while disposing of $200 M to $300 M of current assets.

Their dividend yield is very attractive at 7.33%, and it’s safe, given their cash dividend payout ratio of 73.15% and FAD payout ratio of 75.64%. Based on their solid portfolio, high demand for their assets, and strong balance sheet, I expect them to continue their strong performance.

Highwoods Properties (HIW)

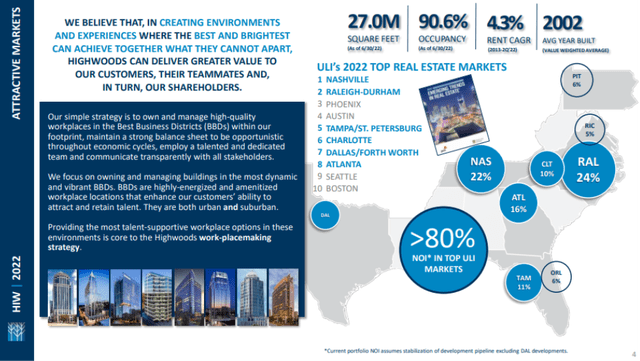

Highwoods Properties is an office REIT that owns, develops, acquires, leases, and manages properties in Atlanta, Charlotte, Nashville, Orlando, Pittsburgh, Raleigh, Richmond, and Tampa.

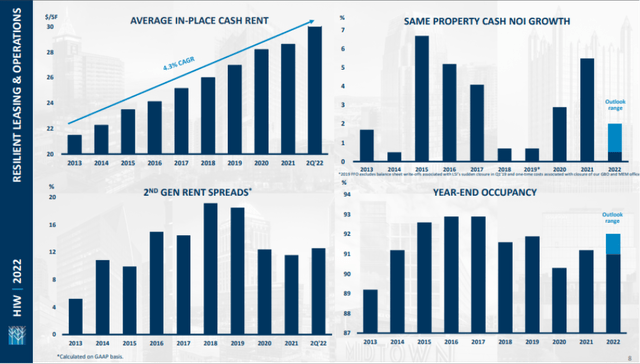

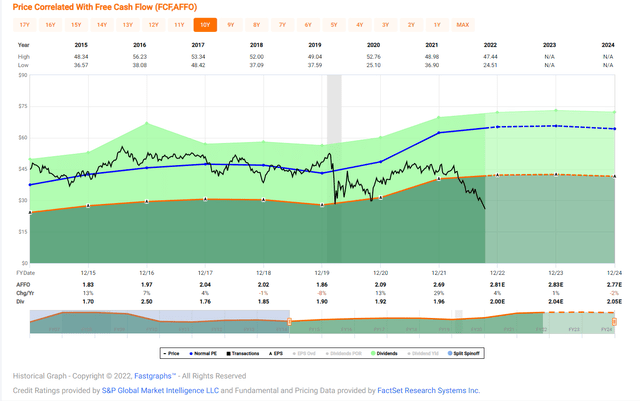

Highwoods has been growing steadily over the past decade, shown by the average in-place cash rent growth of 4.3% CAGR. Their assets are in high demand, demonstrated by over 92% occupancy rate, and same property cash NOI has consistently grown.

Highwoods Properties had a very good quarter in 2Q 2022. They achieved GAAP rent growth of 12.6% and net effective rents of $16.98 per square foot, which was 10% higher than their previous five-quarter average.

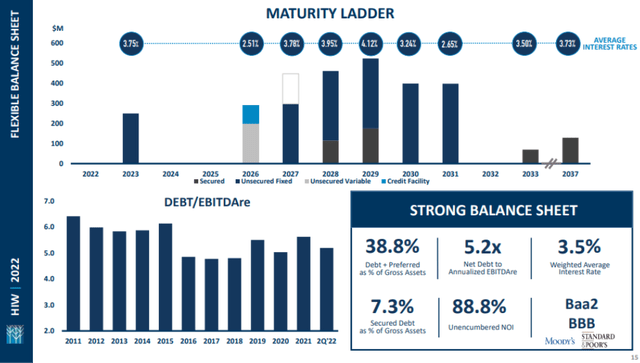

Their FFO per share grew 8% YoY, while still maintaining a strong balance sheet. Their Net Debt to Annualized EBITDAre stands at 5.2x, and weighted average interest rate stayed low at 3.5%. Highwoods Properties is doing an excellent job at managing their debt maturity schedule.

The high dividend yield (7.82%) is well covered through their operations. The cash dividend payout ratio is at 50.27%, and FAD payout ratio is at 49.40%. Given their strong asset portfolio, stable operation, and strong balance sheet, I expect Highwoods Properties will keep raining dividends on their investors.

Simon Property Group (SPG)

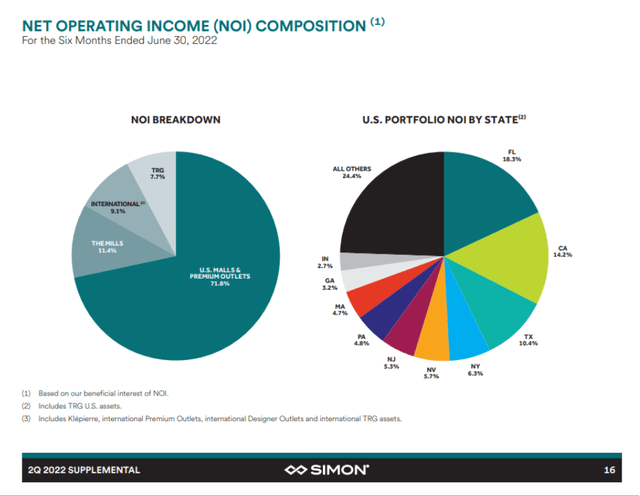

Simon Property Group owns, develops, and manages shopping centers, restaurants, entertainment, and mixed-use properties. They have $33 B of assets under management across the world.

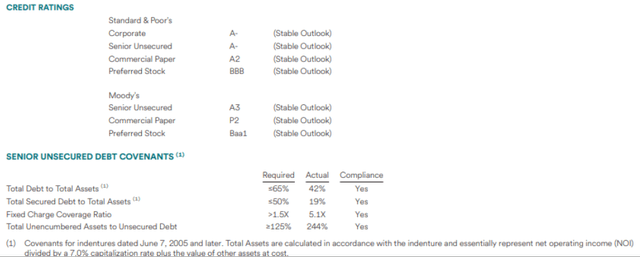

They hold a well-diversified portfolio both geographically and industry-wise. With their well-managed debt and portfolio, they have received a solid credit rating with a stable outlook from Standard & Poor’s and Moody’s.

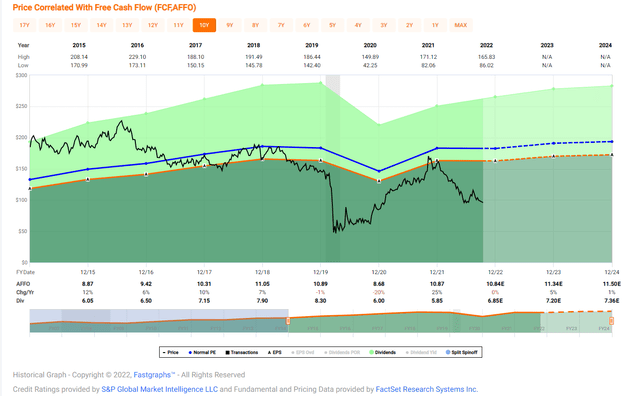

Simon Property Group had excellent performance during 2Q 2022. FFO was $1.1 B ($2.96 per share), and the free cash flow was $1.2 B, which was $200 M higher than the same quarter last year. Domestic property NOI increased 3.6% YoY, and 5.6% for the first half of the year.

The occupancy rate remained solid at 93.9%, indicating high demand for their properties. Based on this solid performance, they increased their dividend by 17% to $1.75 per share for the third quarter.

Simon Property Group continues to maintain an outstanding balance sheet. Their total debt to total assets ratio is 42%, while total secured debt to total assets is at 19%. Fixed charge coverage ratio stands at 5.1x, and weighted average interest rate is at 3.2%.

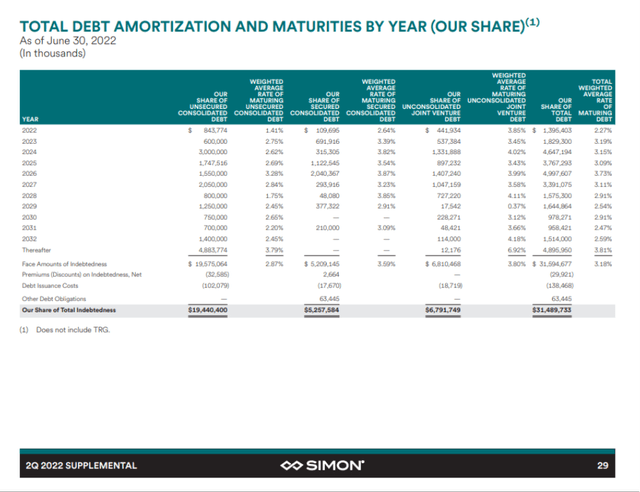

Also, their debt maturity schedule is spaced out over the next couple of decades. Given this strong balance sheet and solid operating performance, I believe they will continue to grow and have no problem executing their capital expenditure plan to increase their footprint.

Their generous dividend yield (7.56%) is well covered, demonstrated by FFO payout ratio of 57.06% and AFFO payout ratio of 61.19%. As they keep expanding and improving their portfolio (Capital expenditure for the first six month of 2022 at 84 M), I believe their dividend will continue to increase, and shareholders will be rewarded with showers of dividends.

CTO Realty Growth (CTO)

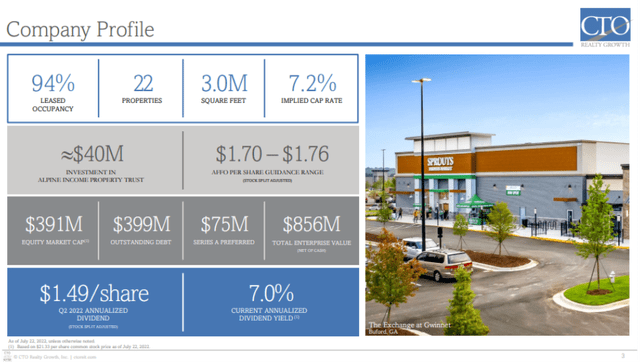

CTO Realty Growth is a REIT that primarily focuses on owning and managing retail-oriented properties. They have 22 properties over 10 different states and have been raising the dividend consistently in the past several years. They have now paid a dividend for 46 consecutive years.

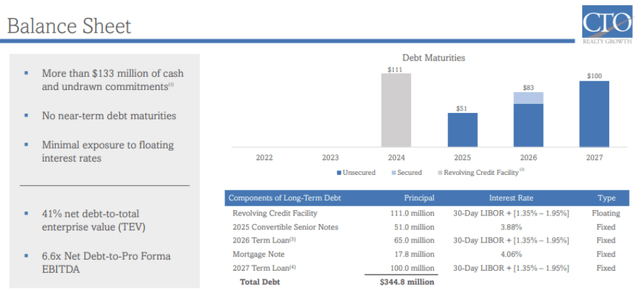

CTO Realty Growth has been doing a great job at maintaining a strong balance sheet. Their net debt-to-total enterprise value is at 41%, and net debt-to-pro-forma EBITDA is at 6.6x.

They do not have any debt maturing until 2024, and their debt maturity is well spread out afterwards. CTO Realty Growth also has minimal debt at an adjustable rate, which reduces the risk during this current environment of increasing interest rates.

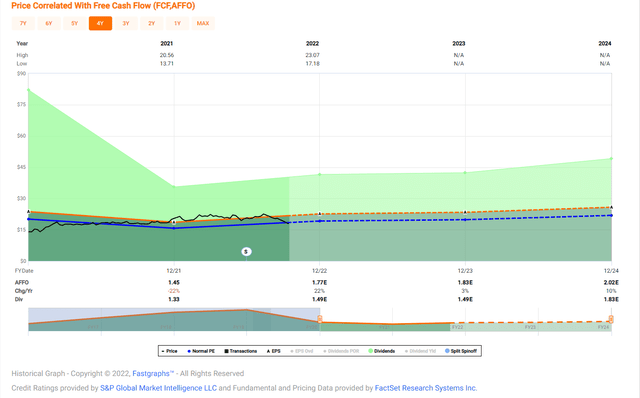

CTO Realty Growth had a solid 2Q 2022. The total revenue for the quarter increased by 36%, and year-to-date revenue grew by 26% ($36.7M). Their same-store NOI expanded 13% YoY, and core FFO expanded 60% to $1.41 per share. AFFO grew 38% to $1.48 per share.

Their portfolio was 91.3% occupied at the end of the quarter. The current dividend yield of 8.51% is very attractive given the strength of their portfolio and balance sheet.

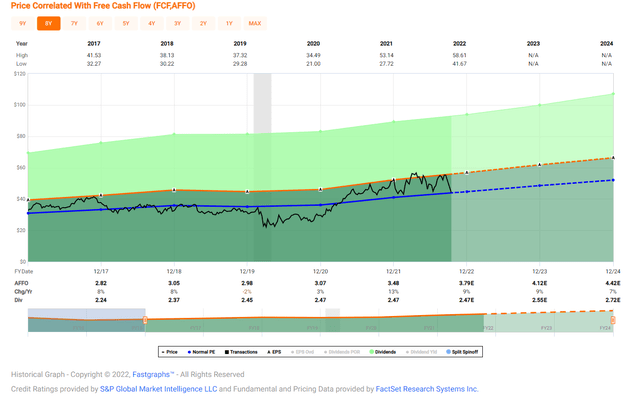

Iron Mountain (IRM)

Iron Mountain is a REIT that provides IT infrastructure. They offer comprehensive records, and information and data management services.

Following the macro trend of vastly increasing data center needs, Iron Mountain has been growing rapidly, and now they have a massive footprint. They have over 200,000 customers in 63 different countries.

Reflecting their strong growth, they had a very successful quarter in 2Q 2022. Their review of $1.29 B was 15.2% higher than the last year, and adjusted EBITDA of $455 M was 12.1% higher YoY.

AFFO of $271 M (AFFO/Share of $0.93) was up 10.1% YoY. As more and more corporations of various sizes are utilizing more data, the need for Iron Mountain’s services will only increase.

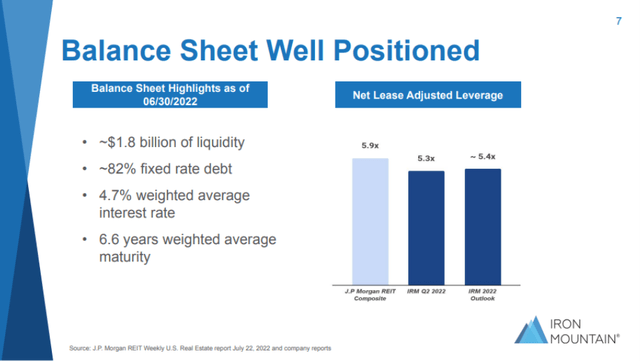

Iron Mountain has a solid balance sheet to support their growth and pay out the dividend. They have a total of $1.8 B liquidity, and their let lease adjusted leverage is at 5.3x. The weighted average interest rate is at 4.7%, while the weighted average maturity is at 6.6 years. I’m confident that they won’t struggle with financial hardships anytime soon.

Currently, Iron Mountain’s dividend yield is at an attractive 5.42%. Looking at their growth potential and strong balance sheet to support this growth, I expect them to maintain their dividend payment going forward.

As many of us know, there is a great deal of uncertainty about the economic outlook. Some are expecting stagflation, while others are expecting a shallow recession. It seems like an economic slowdown is almost inevitable given the high inflation rate and the hawkish monetary policy from Federal Reserve.

If the recession materializes, the retail industry will be negatively impacted. Also, there will be less demand for office space. These trends may negatively impact retail, shopping mall, and office-oriented REITs.

Meanwhile, tech companies expanded substantially during the pandemic era, and many companies have greatly increased their data usage. Iron Mountain and other Data Center-related REITs greatly benefited from the trend.

As the economy slows, companies may need to tighten their purse strings. Some major data center customers (e.g., Amazon) have announced a hiring freeze or layoffs. If the negative trend continues, it may impact Iron Mountain’s growth trajectory.

Conclusion

These five REITs have a strong balance sheet and excellent operations to carry them through any economic cycle. Their strong liquidity positions should help them continue an upward growth trajectory.

The stock market may stay volatile for a while, causing stock prices of these REITs to fluctuate.

However, collecting more than a 5% dividend yield, while waiting for the storm to pass by, might not be a bad position to be in. These five REITs are raining dividends all over their shareholders right now.

iREIT

Be the first to comment