Jirapong Manustrong/iStock via Getty Images

Investment Thesis

When you start to build your own investment portfolio, you may be confronted with a large number of company characteristics to look at. In this article, I have summarized what I consider to be 5 of the most important characteristics to take into consideration when building your investment portfolio. In addition to a brief explanation as to why I consider these characteristics to be of particular importance, I have also provided two companies as examples that fulfill these criteria.

Here are 5 of the most important characteristics that companies should fulfill in order to be considered for your investment portfolio:

- Strong Competitive Advantages Over Competitors

- Strong Financials

- Low Dividend Payout Ratio

- High Dividend Growth Rate

- Attractive Valuation.

Strong Competitive Advantages Over Competitors

Strong competitive advantages ensure that companies can stand their ground against the competition over the long term and they also contribute to a company’s growth. Companies without strong competitive advantages, however, tend to have a higher risk of bankruptcy. A company you’ve invested in going bankrupt would result in a total loss of your investment. For this reason, I consider strong competitive advantages over rivals to be the most important criterion to look at before taking any investment decision. In addition to that, the stronger the competitive advantages, the better you can sleep as an investor in the knowledge that you will not lose your money overnight. Competitive advantages of a company can be, for example, a strong brand image, patents, cost advantages, high switching costs, customer loyalty, having its own eco-system, economies of scale, technological edge, etc.

Apple Inc. (AAPL)

An example of a company with strong competitive advantages is Apple. Among Apple’s competitive advantages are its strong brand image (with an estimated brand value of $947,062M, according to Kantar BrandZ), high customer loyalty, its own ecosystem, and a broad product portfolio. Proof of Apple’s strong competitive advantages is the company’s high EBIT Margin [TTM] of 30.29%.

In my latest analysis, which I wrote on Apple, I explained how the risk of China affects my investment thesis in relation to the company.

Nike, Inc. (NKE)

Another company which I consider to have broad competitive advantages is Nike. Among others, I consider Nike’s strong brand image, its customer loyalty and contracts with the best athletes and teams in the world to make up its competitive advantages. This is underlined by the company’s high EBIT Margin [TTM] of 13.25%, which is 67.87% above the sector median (with an EBIT Margin [TTM] of 7.89%) and its high Return on Equity of 37.39%, being 181.89% above the sector median (which has a ROE of 13.27%).

Strong Financials

I consider the financials of a company to be a vital piece of criteria to look at in advance of making any investment decision.

Strong financials are of enormous importance for companies to survive in difficult economic times. There are various key figures that indicate whether a company has strong financials or not: one of which, for example, is the EBIT Margin. The higher the EBIT Margin, the less risk a company runs of making losses in times of a recession. The credit rating from one of the three major rating agencies, such as Standard & Poor’s (S&P), Moody’s and Fitch also provide information about a company’s financial strength. The Return on Equity [ROE] is a further indicator of a company’s financial strength. Furthermore, the ROE provides information about how efficiently an organization uses shareholders’ equity to generate income.

Johnson & Johnson (JNJ)

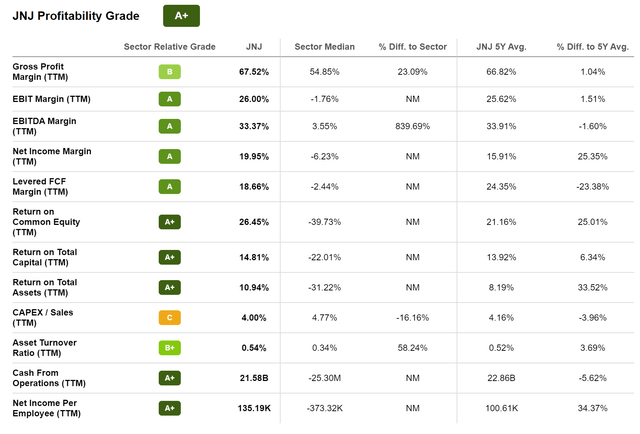

An example of a company with strong financials is Johnson & Johnson. The company receives an Aaa credit rating from Moody’s. According to Moody’s, obligations that are rated with Aaa are of high quality and have a minimal risk. At the same time, Johnson & Johnson shows an EBIT-Margin [TTM] of 26.00% and a Return on Equity of 26.45%, providing evidence of its enormous financial strength. The fact that Johnson & Johnson is rated with an A+ in terms of Profitability according to the Seeking Alpha Factor Grades underlines once again that the company disposes of excellent financials.

Microsoft Corporation (MSFT)

Another company that has strong financials, is Microsoft: just like Johnson & Johnson, the company also has an Aaa credit rating from Moody’s. Microsoft’s high EBIT Margin [TTM] of 41.69% further underlines the company’s financial strength. The theory is also supported by its high Return on Equity of 42.88%. A low Total Debt to Equity Ratio of 44.44% not only provides further evidence of its financial strength but also indicates that the risk of investing in the company is relatively low. Here you can find an in-depth analysis on Microsoft, which discusses the company’s financial strength in more detail.

Low Dividend Payout Ratio

I consider a low Dividend Payout Ratio to be an important criterion since it enables companies to increase its dividend over the long term. It contributes to the fact that you could reach a high Yield on Cost over a long investment horizon. The Dividend Payout Ratio is calculated by dividing the dividend per share by the company’s earnings per share.

Visa Inc. (V)

Visa is an example of a company with a low Dividend Payout Ratio: it currently shows an Annual Payout [FWD] of $1.80 per share. With consensus EPS estimates being $8.30, this results in a Dividend Payout Ratio of 21.68%.

A low dividend payout ratio reduces the risk of a dividend cut and at the same time it reduces the risk of the share price dropping significantly as a result of a dividend cut. For this reason, a low dividend payout ratio contributes to reducing risk for investors.

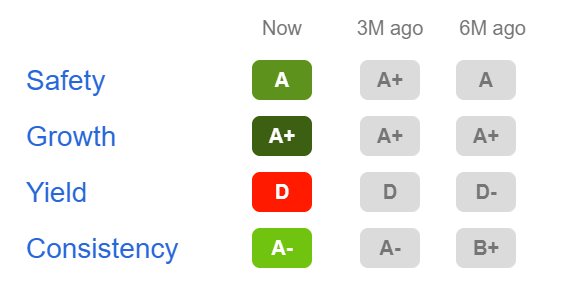

Visa’s strong dividend is underlined by the results of the Seeking Alpha Dividend Grades: Visa is rated with an A in terms of Dividend Safety; for Dividend Growth, the company is rated with an A+, and for Dividend Consistency, it gets an A-. Below you can find the Seeking Alpha Dividend Grades for Visa.

Source: Seeking Alpha

American Express Company (AXP)

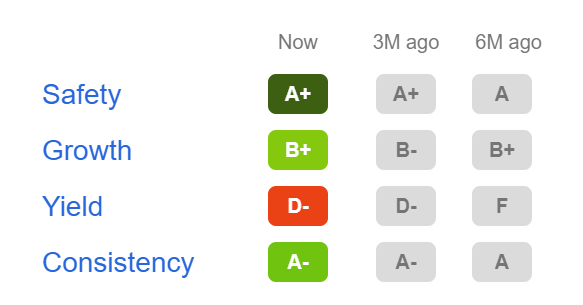

Another example of a company that has a relatively low Dividend Payout Ratio is American Express. At this moment in time, American Express has a dividend payout ratio of 20%, providing the company with plenty of scope for future dividend enhancements. The company’s strong dividend is confirmed by its attractive rating as according to the Seeking Alpha Dividend Grades: for Dividend Safety, American Express is rated with an A+. For Dividend Growth, the company gets a B+ rating and for Dividend Consistency, it receives an A- rating.

Source: Seeking Alpha

High Dividend Growth Rate

In my view, the Dividend Growth Rate is another important criterion to take note of: a high Dividend Growth Rate ensures that it’s possible to reach a high Yield on Cost on your investment.

Various indicators suggest that a company could show a relatively high future Dividend Growth Rate: one of which is the Dividend Growth Rate [CAGR] over the last 10 years. In addition to that, the Average EBIT Growth Rate over the last 5 years or the Average Free Cash Flow Per Share Growth Rate [FWD] of the last 5 years can indicate that a company might be able to show a high future Dividend Growth Rate.

Mastercard Incorporated (MA)

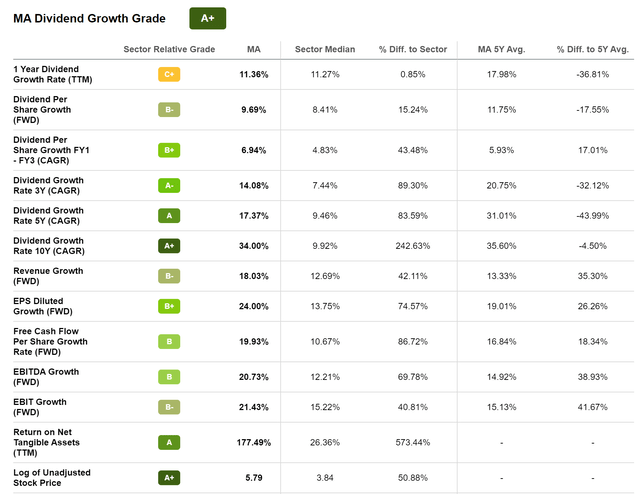

A company that I believe should be able to grow its dividend at a high rate in the future is Mastercard. Mastercard has shown a Dividend Growth Rate [CAGR] of 34% over the last 10 years and 17.37% over the previous 5 years. At the same time, the company’s Average Free Cash Flow Per Share Growth Rate [FWD] of the last 5 years is 16.84%, strengthening my confidence that Mastercard is a great pick for dividend growth investors.

The above numbers reinforce my belief that Mastercard should be able to significantly increase its dividend over the coming decades. Below you can find an overview of Mastercard’s Dividend Growth Grade as according to Seeking Alpha.

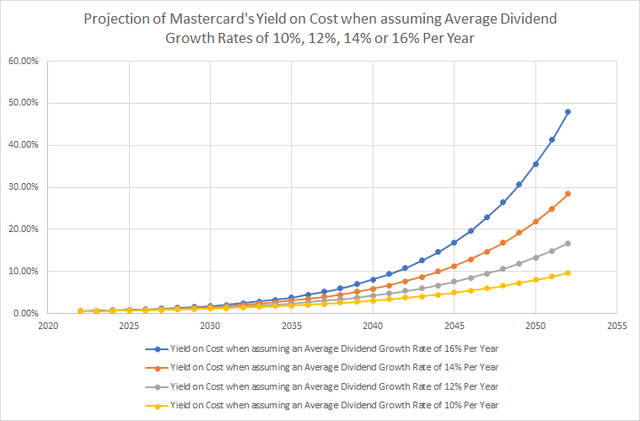

In the graphic below, you can see the Yield on Cost for Mastercard when assuming Dividend Growth Rates for the company of 10%, 12%, 14%, or 16% over the next 30 years. The graphic shows that, when assuming a Dividend Growth Rate of 14% for Mastercard in the following 30 years, you would achieve a Yield on Cost of 28.45% in 2052. Assuming the same Dividend Growth Rate of 14%, you would achieve an accumulated Yield on Cost of 101.56% by 2046, implying that you would get back your investment in the form of dividends until 2046 (no withholding tax is included in this calculation).

JPMorgan Chase & Co. (JPM)

Another company that I expect to show relatively high Dividend Growth Rates in the upcoming years is JPMorgan. My theory is underlined by the fact that the company has shown a Dividend Growth Rate [CAGR] of 14.42% over the last 5 years. In addition to that, the company’s low Dividend Payout Ratio of 33.78% demonstrates that there is plenty of room for future dividend enhancements.

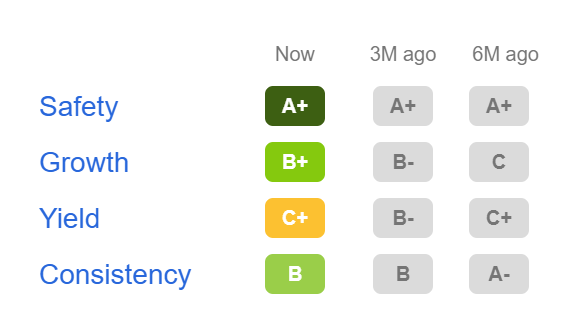

The Seeking Alpha Dividend Grades confirm JPMorgan’s strong dividend. For Dividend Safety, the company is rated with an A+ and for Dividend Growth, it gets a B+. For Dividend Consistency, the company achieves a B.

Source: Seeking Alpha

Attractive Valuation

I consider an attractive valuation to be another important criterion you should take into consideration before making any investment decision.

In the event that you pay a price that is much too high for your investment, even an excellent company may turn out not to be a good decision. Nevertheless, in my view, an attractive Valuation is not as important as having strong competitive advantages. After all, a company with strong competitive advantages could justify a relatively high Valuation through high Growth Rates in the future (to which the strong competitive advantages contribute).

However, if a company has no long-term competitive advantages, an attractive Valuation is not of much value, because in the long run, a company without competitive advantages will struggle to survive; and you therefore run the risk of suffering a total loss.

Alphabet Inc. (GOOG, GOOGL)

A company that I consider to currently have a very attractive Valuation is Alphabet: it shows a P/E [FWD] Ratio of 20.38. This is currently 25.63% below Alphabet’s Average P/E [FWD] Ratio over the last 5 years (which is 27.40). I consider this Valuation to be particularly attractive when taking into consideration that Alphabet has shown an Average Revenue Growth Rate [FWD] of 19.60% over the last 5 years and an EBIT Growth Rate [FWD] of 21.33% over the same period. In my analysis on Alphabet you will find additional information in regards to the company’s Valuation.

General Motors Company (GM)

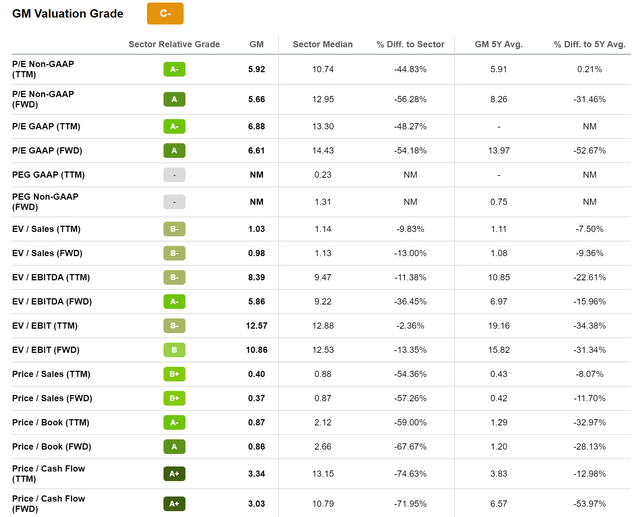

Another company that is currently attractive in terms of Valuation is General Motors. At this moment in time, the automobile manufacturer has a P/E GAAP [FWD] Ratio of 6.61. This is 54.18% below the sector median (14.43) and 52.67% below the company’s Average P/E GAAP [FWD] Ratio of the last 5 years (13.97). Below you can find the Valuation Grade for General Motors as according to Seeking Alpha, which once again provides evidence that the company is attractive in terms of Valuation.

Conclusion

In conclusion, I believe the most important criteria to look for in companies when building your long-term investment portfolio are: strong Competitive Advantages and Financials, a low Dividend Payout Ratio, a high Dividend Growth Rate and an attractive Valuation. There are of course many more characteristics that can be considered, but the five I’ve discussed here should provide you with an excellent basis to start building your investment portfolio from.

Author’s Note: Thank you very much for reading and for providing any feedback on this article!

Be the first to comment