bazilfoto/iStock via Getty Images

Thanksgiving, Food, & Stocks

It’s that time of year again when holiday ads and bargains have the masses wanting to know who is offering the best discounts. With guests coming to town, people want to eat. And when it comes to food prices at the grocery store, I think everyone’s looking for a deal.

% Changes in CPI (BLS Food Index)

According to the Bureau of Labor Statistics, the food index experienced a 10.9% increase over the last year. Poultry prices are some of the highest in the meat category, with Thanksgiving turkeys up 75% to 112%, according to CPI data. Egg prices have also surged to their third-record high of $4.18 per dozen, with many retailers selling eggs 200% above their normal $1.45 a dozen. Bird flu outbreaks and supply chain issues are factors adding to increased costs. American Farm Bureau Foundation (AFBF) President Zippy Duvall said, “All of us are feeling the pain of higher prices at the grocery store. HPAI outbreaks in the spring and an uptick in cases in the fall are taking a toll, but farmers remain dedicated to ensuring America’s food supply remains strong.” Given the unprecedented times, consumers must be able to focus on affordability. But not all discounts are alike. Cheaper does not mean better, and anyone who has previously read my articles understands how important fundamentals are to me when picking stocks. I don’t want you to get caught by a bear, which is why my quant model identifies stocks that look good – and point out the bad – on the collective investment metrics of Valuation, Growth, Profitability, Earnings Revisions, and Momentum relative to their peers. Avoid stocks with poor fundamentals, so I have selected three top consumer staple stocks for Thanksgiving.

Best U.S. Food Consumer Staples Stocks

As the Fed raises interest rates to curb inflation, look for companies with a strong and consistent sales history and attractive valuations. Like all investments, there are risks and rewards, and 2022 has been riddled with volatile price swings. But consumer staples tend to be less volatile than other investments, defensive in nature given their products are always in demand, even in times of inflation and economic uncertainty, like we’re seeing. Although people may budget or cut back on spending, most people do not stop drinking coffee, eating, bathing, or shaving during “tougher” times. This is why consumer staples offer a great opportunity for investors wanting a more reliable investment for a longer-term outlook.

1. Performance Food Group Company (NYSE:PFGC)

-

Market Capitalization: $8.79B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 11/15): 1 out of 194

-

Quant Industry Ranking (as of 11/15): 1 out of 7

Despite the labor shortages and impacts of the pandemic on the food service industry, the third-largest U.S. food-service distributor, Performance Food Group Company (PFGC), has been resilient through its subsidiaries. Marketing and distributing food products throughout the United States, its large brand family that includes a rich mix of pizzerias, helped soften pandemic impacts while allowing the company to return to pre-pandemic sales by April 2021. A cheap company with strong momentum, PFGC’s organic growth, and attractive margins make this a stock to consider for portfolios, especially as it has gained a 9% market share just behind leaders like Sysco (SYY) and US Foods (NYSE:USFD).

PFGC Valuation & Momentum

Specializing in national chains and independent restaurants (38% pizzerias), PFGC’s large network of more than 142 distribution centers, more than 200,000 products, and 125,000 customers has allowed it to achieve desirable growth while continuing to trade at discounted levels.

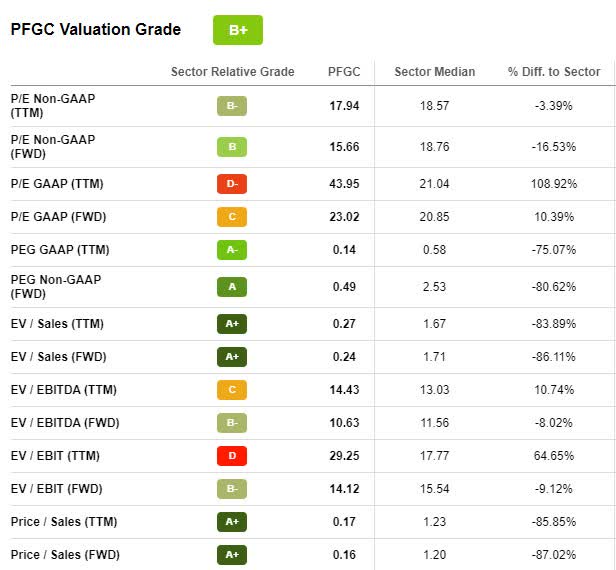

PFGC Valuation Grade (Seeking Alpha Premium)

With a Non-GAAP forward P/E ratio of 15.66x compared to the sector median of 18.76x and forward PEG of 0.49x, more than 80% difference to the sector, these figures, along with EV/Sales should appeal to long-term value-oriented investors, and hopefully investors looking for bargains this time of the year.

PFGC is also on a bullish trend, with investors actively purchasing shares. The stock’s price is trending higher, YTD +24% and, over the last year, +23%. Many analysts call the stock overbought, which is why it may be a good time to get in on the action, especially given its latest earnings beat.

Performance Food Growth & Profitability

On November 9, 2022, PFGC reported Q1 2023 earnings showcasing top- and bottom-line earnings beats. EPS of $1.08 beat by $0.28, and revenue of $14.72B beat by nearly 42%. With total case volume growth of 16% and better than expected results from all three of its business segments: Foodservice, Vistar, and Convenience, robust growth has allowed the company to raise sales and adjusted EBITDA guidance confidently.

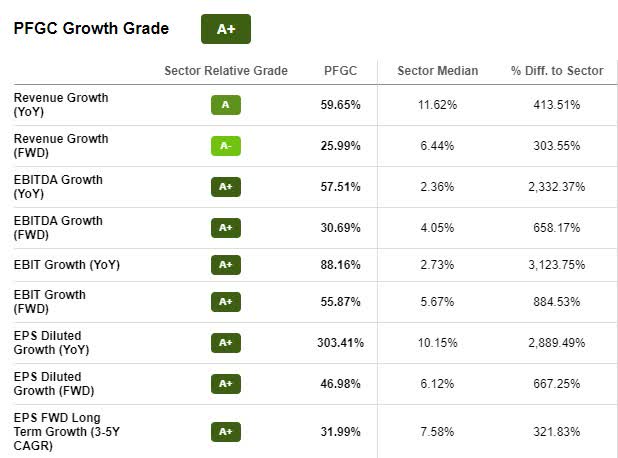

PFGC Growth Grade (Seeking Alpha Premium)

PFGC’s strong focus on pizzerias has provided revenue stability in the uncertain times post-pandemic and current environment, where many of its competitors have faltered. PFGC’s diversified products and services allow it to grow and increase its profit margins. Its private-brand products like Braveheart, grass-fed beef, and Bay Winds, top-tier seafood, give a competitive advantage and differentiation. During the Q1 2023 Earnings Call, Performance Food Group CEO George Holm said:

“Our consolidated results put us on track to exceed our original outlook for fiscal 2023 and to hit the three-year outlook we provided at our Investor Day in June. Our three-year targets are for $62 million to $64 billion of revenue and $1.5 billion to $1.7 billion of adjusted EBITDA in fiscal 2025. The backdrop for our business remains positive…The slight moderation in restaurant traffic was more than offset by our market share gains, a continued recovery across Vistar channels, and steady growth in our convenience segment. We closely follow the macroeconomic conditions and various outlooks for calendar 2023. As we have highlighted, we feel very good about our positioning in the market, which is reflected in our overall top and bottom line performance.”

One of the biggest successes for Performance Food Group has been the $2.5B acquisition of Core-Mark last year, a top wholesale distributor that has collectively added to PFGC’s stellar sales of $50.89B for FY22. A company with strong financials and momentum, making strategic moves for growth, and the ability to pass rising food costs onto consumers, PFGC is a defensive play that could outperform the broader market, similar to its competitor, US Foods.

2. US Foods Holding Corp. (USFD)

-

Market Capitalization: $7.66B

-

Quant Rating: Buy

-

Quant Sector Ranking (as of 11/15): 22 out of 194

-

Quant Industry Ranking (as of 11/15): 2 out of 7

A leading food distributor in the U.S. that partners with approximately 300,000 restaurants and food service operators in over 70 locations, U.S. Foods Holding Corp. (USFD) is on a mission to deliver great food solutions and business tools to its partners. With cost advantages amid inflation that are allowing it to gain market share organically, USFD has demonstrated consistent returns and tremendous growth and momentum, as evidenced in the below Factor Grades.

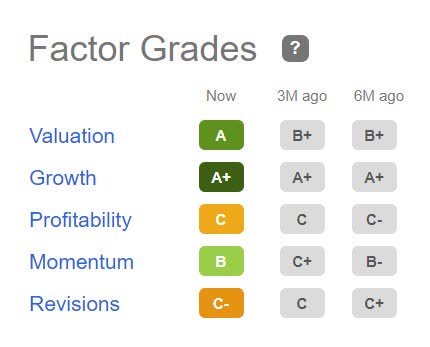

Seeking Alpha Factor grades rate investment characteristics on a sector-relative basis. Showcasing an ‘A’ valuation grade, A+ growth, and solid grades for profitability, momentum, and revisions, USFD is fundamentally sound compared to the sector. With bullish momentum, USFD is being actively purchased, driving its share price higher.

USFD Factor Grades

USFD Factor Grades (Seeking Alpha Premium)

US Foods Valuation & Momentum

Although USFD is -3.12% YTD, the stock is on an uptrend with attractive valuation metrics. US Foods’ forward Non-GAAP P/E ratio of 15.83x is a -15.61% difference to the sector, and its forward PEG OF 0.22X is a -91.44% difference to the sector. In addition to its discounted valuation, USFD’s price performance has outperformed its sector median peers quarterly.

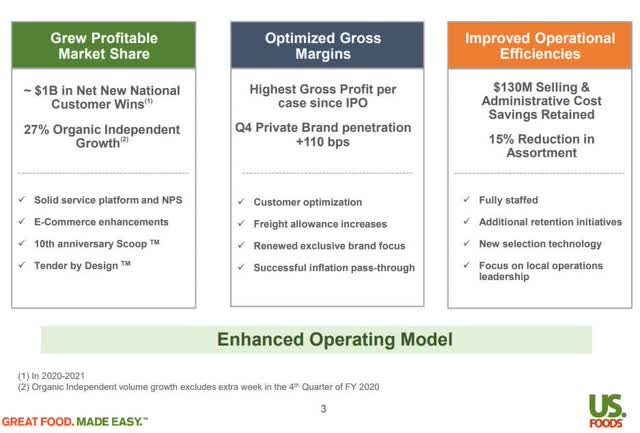

Since Q4 FY2021 earnings results, management is focusing on its Long Range Plan that includes:

-

Organically growing its restaurant sales at 1.5x the market.

-

Optimizing its gross margins through pricing and more private-label brands

-

Improving operational efficiencies through cost savings

US Foods 3 Step Plan (US Foods Q4 2021 Investor Presentation)

So far, the company has been taking cost-cutting measures and is investing for growth, eliminating more than $100M in fixed costs while raising $1B for new business opportunities. As we dive into US Foods’ growth and profitability, U.S. Foods’ commitment and focus on serving its customers has translated into continued success in beating revenue projections.

US Foods Growth & Profitability

Like PFGC, U.S. Foods has a diversified portfolio of products and has differentiated itself by offering independent restaurant consultancy services to improve operations and profitability. In addition, it has its own line of private-label products, enhancing its margins and giving it a competitive advantage, accounting for more than 34% of its 2021 sales.

USFD Growth Grade (Seeking Alpha Premium)

Despite a Q3 2022 EPS of $0.60 missing by $0.01, U.S. Foods’ revenue of $8.92B beat by $202.33M, a more than 13% year-over-year increase. Adjusted EBITDA grew nearly 21% for Q3, and to tap into the digital market and drive market share gains, USFD launched MOXē, its next-generation e-commerce digital tool.

“US Foods has been a pioneer and leader in food service technology solutions for more than a decade,” said Gene Carbonara, US Foods VP of e-commerce and digital for US Foods. “With MOXē, we’ve taken a major step forward in the evolution of the customer e-commerce experience from a performance and ease-of-use perspective. Our new technology offering will continue to set US Foods apart from the competition for many years to come as we deliver on our promise to help our customers Make It.”

Given strong results and cash flow this year, the company announced a new $500M share repurchase program that will deliver long-term shareholder value, adding to why this stock is one of the best to buy, according to the quant ratings.

3. United Natural Foods, Inc. (NYSE:UNFI)

-

Market Capitalization: $2.64B

-

Quant Rating: Buy

-

Quant Sector Ranking (as of 11/15): 24 out of 194

-

Quant Industry Ranking (as of 11/15): 3 out of 7

Food distributor United Natural Foods (UNFI) offers grocery and general food service products in the U.S. and Canada. Operating in two segments, Wholesale and Retail, UNFI benefited from tremendous growth during and post-pandemic, with its largest customer being Amazon’s (AMZN) Whole Foods.

Our consumer staples in food retail are trading at severe discounts and offer bullish momentum. Demand for groceries is strong, despite astronomical prices. As we see with the inflationary price hikes, UNFI stands to benefit, so why not take advantage of this stock, like our other consumer staples?

UNFI Valuation & Momentum

UNFI possesses an A- valuation grade. With A’s comprising most of UNFI’s underlying valuation grade, this stock’s valuation metrics look great. Its forward P/E ratio is 9.96x, trading more than 50% below the sector, and its forward PEG of 1.18x is -53.13%.

UNFI Valuation Grade (Seeking Alpha Premium)

I’m also highlighting that UNFI has a P/B ratio of 1.33x compared to the industry average of 3.02x. The P/B is significant because it measures the stock’s market value versus the book value, and given the above figures, UNFI is very attractive.

UNFI, like my other stock picks, also has stellar momentum. As validated by Kroger’s (KR) $24.6B deal, the industry must have good prospects to acquire Albertsons Companies (ACI). The Kroger-Alberton’s merger will collectively result in Kroger owning nearly 5,000 grocery stores, making it the second-largest grocer behind Walmart (WMT). Despite this news, investors still love food names because they are defensive in nature and offer more recession-resilient characteristics. As stated by Goldman Sachs analysts in an SA News article, “while relative valuation levels for consumer staples stocks, in general, look daunting, food stocks are still attractive on a valuation basis for investors. The firm is positive on the food sector with price increases seen being larger and longer lasting than previously thought, which should support margins even after input costs subside.” UNFI remains bullish, and despite its rough road following its 2018 acquisition of Supervalu, which nearly made the company bankrupt, the company has improved significantly despite challenges and continues to deliver solid results.

UNFI Growth & Profitability

UNFI possesses a solid ‘A’ growth grade, with recent earnings reports delivering an EPS of $1.27 that beat by $0.01. Despite revenues of $7.27B missing by $61.11M, the company has benefited from increased efficiency and growth, new technology, and investment in automation to help bring down costs, and its partnership with customers have allowed it to grow organically.

In addition to cross-selling efforts, since 2020, UNFI has more than doubled sales, contributing to $1B of the fiscal 2022 sales.

UNFI Cash Flows and Balance Sheet Strategy (UNFI Q4 2022 Investor Presentation)

We’re approaching the holidays, and in tough economic times, it’s essential to thoroughly evaluate investment opportunities. UNFI experienced record Q4 wholesale growth of $7.3B, and their gross margin rate improved. While the company has been benefiting from strong grocery demand and reinvestment for future growth, UNFI focuses on leverage reduction and reinvestment for shareholder returns, as shown in the above chart. As inflation continues to be a hot topic and we see rapid increases in food prices, companies like UNFI in the food sector stand to benefit. Aside from getting a bargain with the three stocks mentioned in this article, value stocks should be a part of your portfolio because they are a great way to diversify, and PFGC, USFD, and UNFI are also attractive on growth and EPS. Each of my food stocks should give you something to chew on.

Feast Your Eyes On My Top 3 Food Stocks To Take A Bite Out Inflation

Identifying stocks in the right sector is essential for investors who want to consider the best stocks to buy for future gains. Fear and market volatility have created buying opportunities, so it’s essential to be alert and look for investments that can thrive in a high-rate environment. A ‘Christmas Rally’ may provide an opportunity to purchase these stocks on a seasonal dip as investors temporarily rotate into growth stocks.

This year, people are looking for discounts – a good value. All three of my stock picks UNFI, UFD, and PFGC are very attractive on value and growth and offer tremendous momentum. This Thanksgiving, consider my food stocks which are established yet undervalued companies possessing strong Factor Grades, and they’re some of the Top Consumer Staples people want over the holidays.

Be the first to comment