baona/E+ via Getty Images

GE to Pass the Baton

General Electric Company (NYSE:GE), once the pride of American industrialism, has weakened significantly over the past decade. In fact, the company is preparing to split itself into three separate companies: healthcare, aviation, and energy. While diversification and economies of scale often help a company drive profitability, it seems debt and disorganization have only hampered GE. Now, investors cannot benefit from the tremendous capabilities of GE’s product lines and innovation.

To combat this, I have set out to look for alternative industrial conglomerates to consider that have industry-leading capabilities, a worldwide scope, and significant diversification of the revenue base. Other benefits would be a healthy balance sheet, hearty organic growth, and exposure to future-focused technologies to promote longevity.

One company I have found that meets these goals is Nidec Corporation (OTCPK:NJDCY, OTCPK:NNDNF) (TSE:6594), a relatively diversified Japanese conglomerate (of course, not to the same degree as GE). Nidec has two proud goals: to reach 10 Trillion Yen in sales for 2030 and to become “#1 in the world.” This sales goal would be equal to GE’s 2021 revenues, so investors can look for Nidec to reach GE’s scale within a few years. At the moment, this $30 billion USD company is a leader in electric motor production for a variety of uses, including market share leadership in electric drivetrain components and hard disk drive motors.

Since its founding in the 1970s, founder and CEO Shigenobu Nagamori has made good on his promises thanks to tremendous growth over the years. And, Nidec is not done yet, even after the market cap has risen from a mere $700 million in the ’90s. In fact, the leader is an icon in Japan, and this has even led to a manga being written about his life. As GE falls, I find it is likely that Nidec will become a global leader, rather than one just in Japan. This makes the company a suitable replacement in my eyes, and I will discuss why.

Nidec Corporation Website

While founder Nagamori is now preparing to pass the baton to a new CEO, he is not planning to retire until his sales goal is met. He hopes his protégé is able to follow in his footsteps of success into the future. To do so, the new CEO has a pledge, to continue to lead in Nidec’s current leadership segments and diversify into turnaround plays to find organic growth (buying money-losing companies but reorganizing to an advantage).

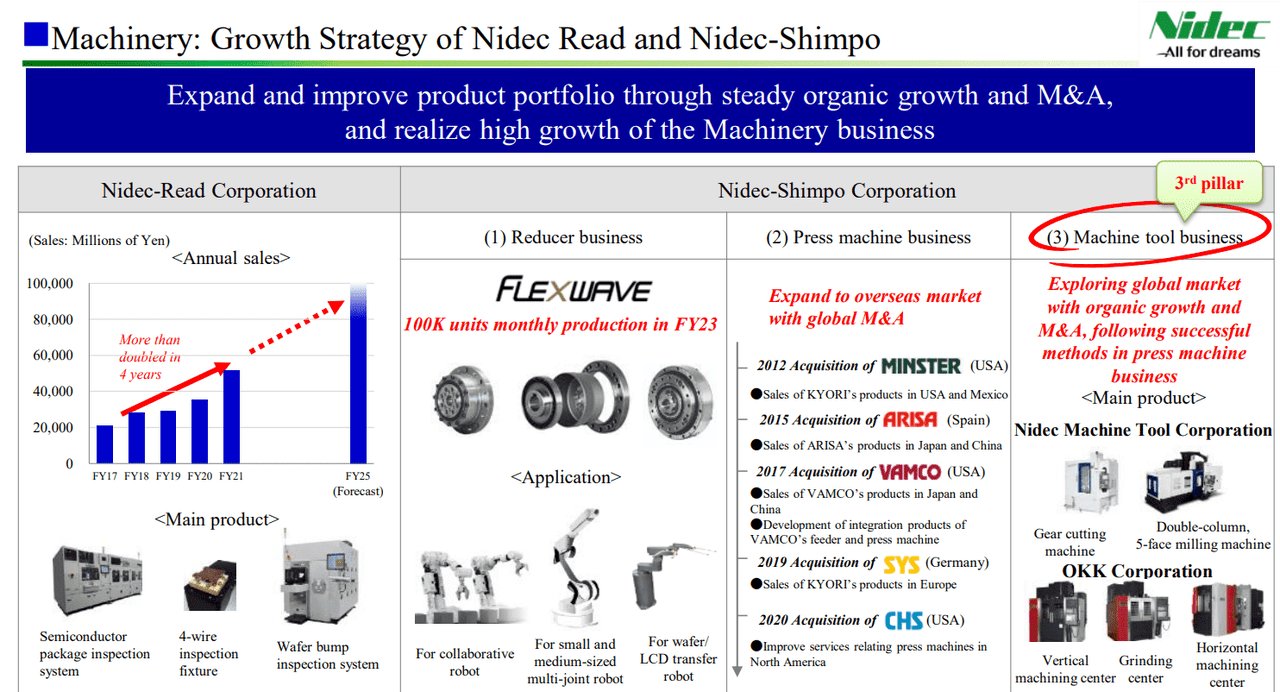

An example of this is the recent acquisition of OKK Corp, a CNC machine manufacturer that is now turning to automation as working-age population issues plague Asia. As Nikkei puts it:

Nagamori himself is leading the charge to revive money-losing OKK as Nidec seeks to turn robot components and machining equipment into a new growth engine.

Manpower shortages are driving the growth of industrial robots. “As artificial intelligence evolves, factories will become unmanned, and demand for industrial robots will soar,” Nagamori said.

“Mr. Nagamori’s plain speak draws employees in,” said OKK President Yoshihide Morimoto. His marketing know-how of visiting five customers a day seems to have made an impact at OKK. Its orders jumped roughly 140% on the year in April to an all-time high.

Nidec FY21 Integrated Report

While Nidec’s founder is certainly no Thomas Edison, I certainly believe that his performance has reflected skill so far. A 20%+ annual market cap growth rate over the past 30 years is certainly a strong base to use for future expectations. This is especially when compared to the falling growth and uncertainty surrounding General Electric. Many investors in GE seek safety through diversification and leadership, and while Nidec is no major dividend payor, there are many other favorable metrics to consider. As such, here are three additional reasons why Nidec is set to outperform GE in both the short and long term.

1.) EV Supply Chain Moat

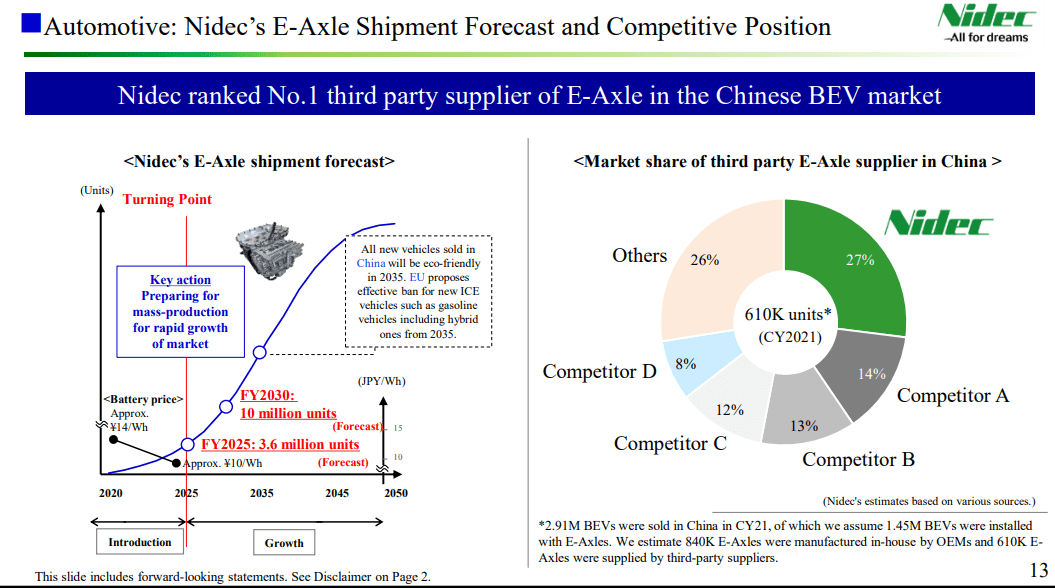

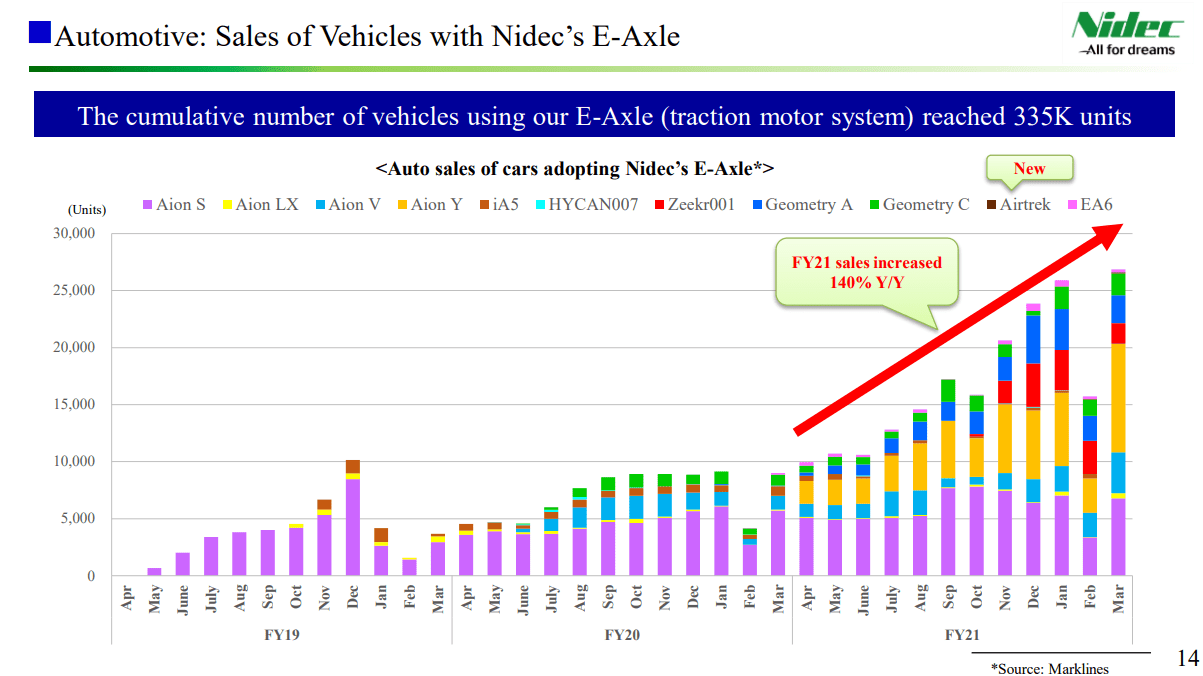

While Nidec is most famous as owning an incredible 80%+ market share moat on small precision motors (in uses for tech, consumer goods, and industrial uses), the company is leveraging significant growth in a new market: electric vehicle (“EV”) drivetrains. In fact, Nidec is now the largest third-party E-Axle supplier in China, the world’s largest EV market. Total unit sales have reached over 335k even though sales only commenced over the past three years.

While automakers produce motor drives in house, I believe Nidec will dominate the segment in due time, as they have in other E-motor markets. This is similar to GE’s leadership in the aviation engine market, while EV vehicles have far more secular growth in store. Remember, the data below is third-party sales, so companies like BYD (OTCPK:BYDDF, OTCPK:BYDDY) that have in-house production will need to be wooed via partnerships down the road.

Nidec FY 21 Presentation

The sheer growth available in the EV market is apparent by the total sales so far. Sales increased 140% in 2021 and the number of customers is also increasing at a rapid rate. While focused on China for the moment, a joint venture with Stellantis (STLA), bodes well for geographic diversification worldwide. The equal-part JV is set to produce up to 1 million motors per year by 2024. Also, Nidec has recently broke ground on a factory in Serbia to continue targeting EV component sales in the region. As high fuel prices and net-zero goals continue to drive sales towards EVs, Nidec will have an extremely favorable market to grow into. I expect the 140% growth rate to be sustained over the next few years, especially if further production contracts commence.

Nidec FY 21 Presentation

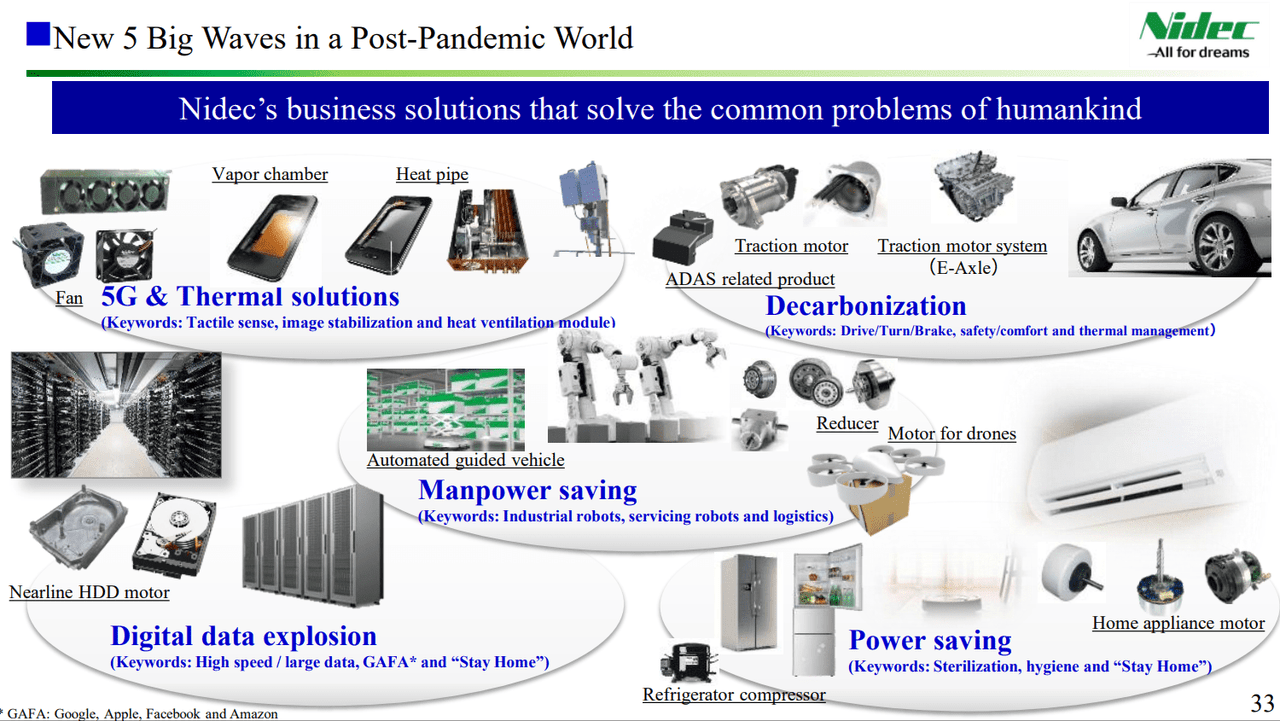

2.) Diversified Industrial Segments

Providing electric motor components is not enough of a diversifier to compete with GE. While GE certainly benefits from airplane turbines, they still have other industrial and healthcare product lines. Thankfully, Nidec does have other revenue segments in growing industries. As I discussed earlier, Nidec remains the leading provider of electric motors, especially in small use cases. While the HDD segment is in secular decline as SSDs take the market, there is continued use in the ever-growing data center market that requires plenty of storage capacity. Further, the company is continuing to drive growth in power-saving applications, as electric motors can drive countless consumer and industrial applications. Considering that Nidec is also looking for multiple acquisitions to diversify their revenue sources, capabilities, and growth, I expect a significant transformation over the next ten years.

Nidec FY21 Presentation

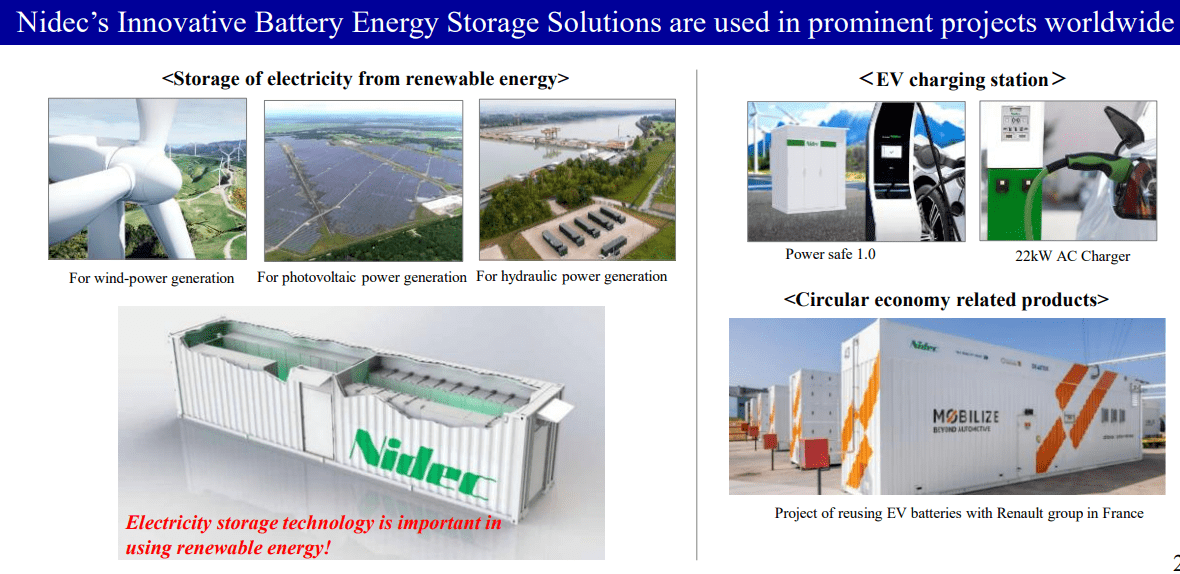

Two interesting growth segments are in renewable energy systems and automation processes. Along with electric motor drives, Nidec also manufactures transmission and conversion products that support full renewable and electric industrial applications. There are currently many opportunities for converting renewable sources into usable electricity thanks to the shift away from fossil fuels. This also ties into the rise of the EV drivetrain segment and relates in scope to General Electric’s renewable energy segment.

However, Nidec does not get tied down by legacy low-margin boilers, wind turbines, and other components. Instead, the company is moving forward with our societies’ progress toward a low-carbon future while still providing the same level of industrial strength.

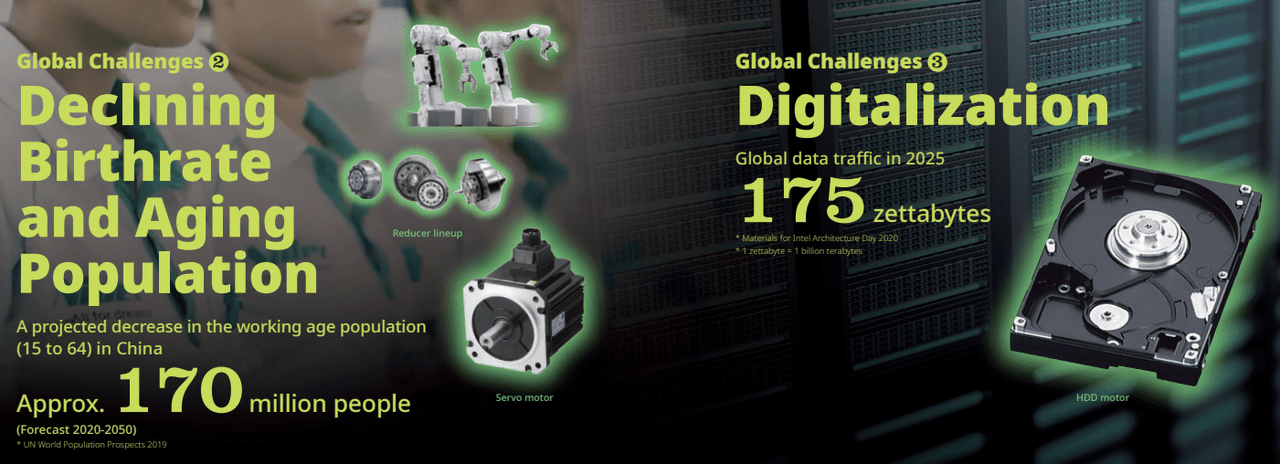

Nidec FY21 Presentation

Another important area of growth is a direct result of having feet on the ground in Japan. Population declines are evident in many areas of the world. As economies such as Japan, China, and Western Europe lose their working-age population, the need has arisen for a viable replacement. This comes in the form of automation and robotics, and Nidec is an important component manufacturer. Along with providing the necessary motors for robotics arms, Nidec also has moved into the creation of automatic machining equipment. Combined with a foot in the semiconductor production space, Nidec has significant exposure to the entire industry, especially when compared to the small amounts of R&D done by GE. Look for much of Nidec’s future M&A to be in this space.

Nidec FY21 Presentation

3.) Financial Outperformance

So far, I have focused on comparing the product lines of GE and Nidec. While Nidec wins in terms of secular growth market exposure, GE has the true scale and diversification of America’s ultimate conglomerate. While Nidec is certainly driving towards diversification and leadership in a variety of markets, investors are unlikely to see the benefits in terms of an investment. Therefore, I will show the true difference between GE and Nidec with a few financial charts.

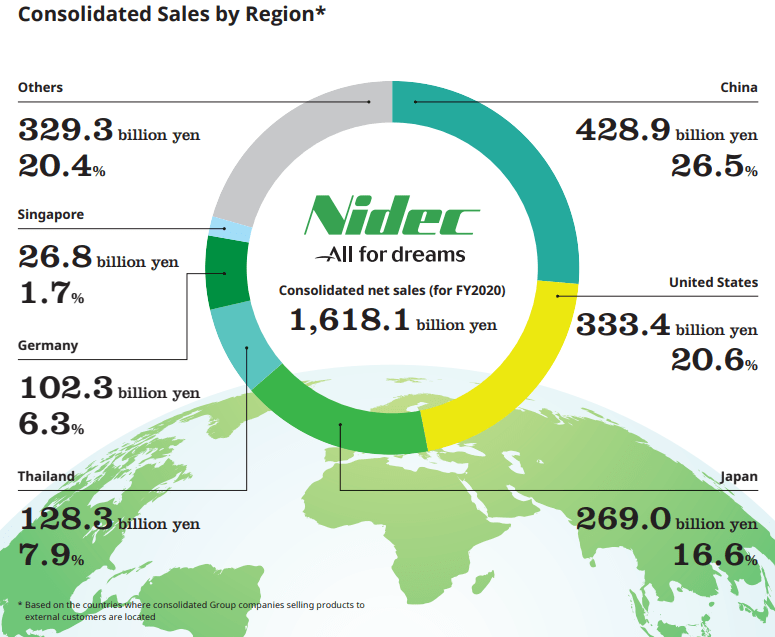

First, I will show how Nidec is in fact a global company like GE, as only 16.6% of revenues are from their home country. In fact, the major economies of China and the U.S. are the two main client regions, and this will provide growth for the future. One also has to consider the lasting forex implications as the Japanese yen remains weak and earnings will have at least a 20% YoY boost from foreign sales. This contrasts with U.S.-based GE, as the USD remains strong compared to most other currencies.

Nidec FY Integrated Report

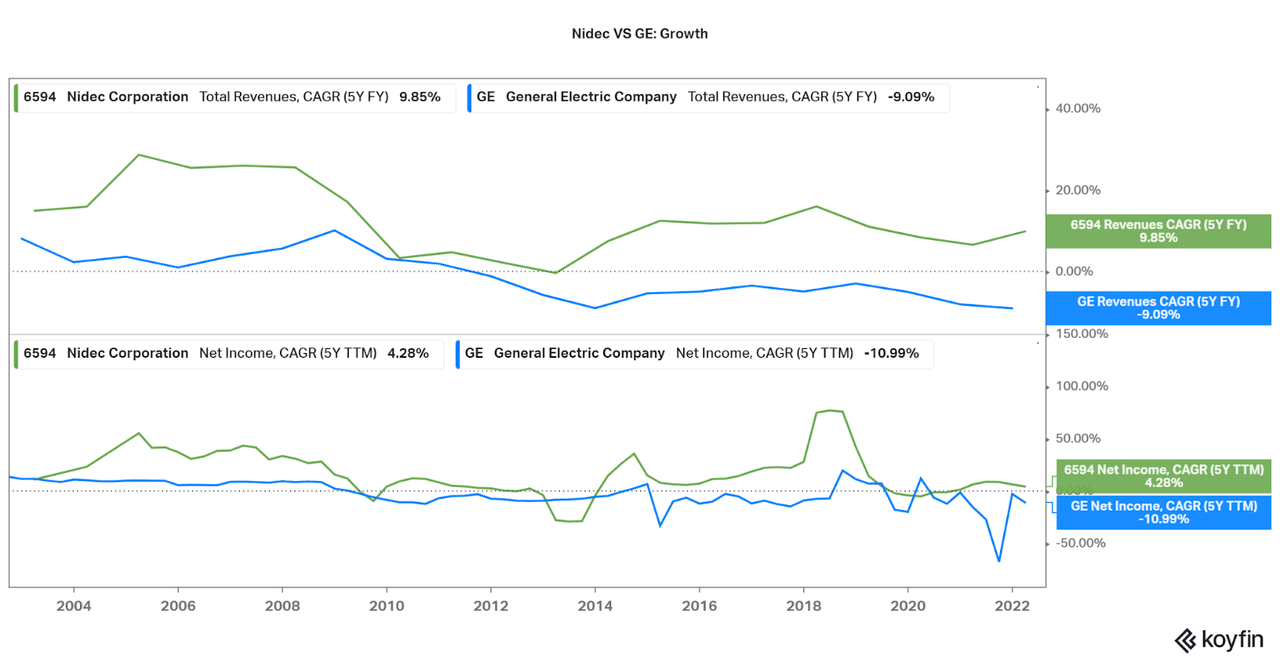

Next, let’s begin the direct comparison with pure revenue and earnings growth measurements. In the graph below, Nidec, in green, and GE, in blue, offer quite different growth prospects. While Nidec has seen positive revenue growth nearly every year over the past 20 years, at a fast 10% average CAGR, GE has slowly seen smaller and smaller revenues each year. While one can consider the benefits of reorganization and the spin-offs, I still expect Nidec to outperform GE into the future. Even more extreme is the difference in net income growth, as Nidec has grown earnings slightly faster than revenues over time, GE has seen fluctuation between losses and poor overall profits. Strictly, GE has seen a decline in EBIT of 15% per year (over ten years), while Nidec has grown EBIT by 9% per year.

Koyfin

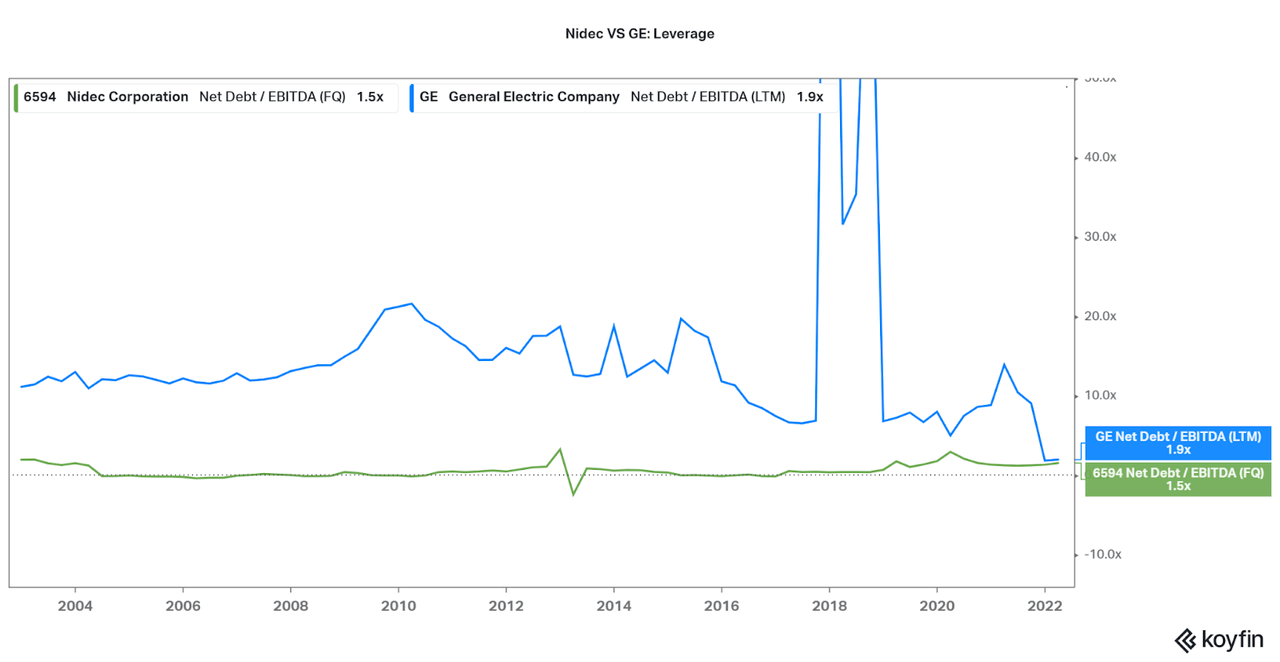

To understand the issue behind GE’s decline, I measured the difference in leverage between the two companies. While Nidec has historically not been hampered by debt and has maintained significant EBITDA, GE has been paying off debt since 2009. While GE certainly has done well to reduce debt, one would have to watch for minor misconduct in terms of offloading debt to the healthcare and energy spinoffs or reconstituting the financials in a favorable way for investors. At the same time, Nidec will slowly be moving forward with little debt risk (not to mention low interest rates in Japan). As I will highlight next, Nidec offers similar levels of safety as to GE’s earlier years.

Koyfin

To press my point, I will insert analysis from other firms. While bonds are not what I am targeting, credit agencies often have premium analyses on hand in regards to the safety on an investment. First comes Fitch who rates GE at a low, but stable, BBB rating with the following commentary:

GE’s scale and diversification provide considerable operating and financial flexibility that support its competitiveness with large global industrial peers although the company’s pending separation will significantly change its profile. Other industrial companies in the sector, such as Siemens AG (A/Stable), Honeywell International Inc. (A/Stable) and Raytheon Technologies, are well capitalized and have global scale, making them strong competitors…

… GE is more highly leveraged compared with some highly-rated industrial peers, but debt reduction, improving operating performance and GE’s exit from its finance business with the recent divestiture of GECAS align it more closely with these peers. GE generates solid margins in certain key segments, such as Aviation and Healthcare, that are comparable to peers. However, overall margins are affected by challenging conditions in the Power and Renewable Energy segments.

To summarize, Fitch believes GE scale and diversification to be the strongest metrics, but that competition, the pending break up, and leverage are major risks. Improvements help maintain a stable outlook, but weaknesses in some parts of the company are dragging all of GE down. If GE can see improvement, then Nidec must support a far stronger outlook. For this, I look to the newly upgraded JCR rating (AA) that states as follows:

With the progress in its business portfolio transformation, the Company’s earnings capacity has been increasing. Earnings capacities of the automotive products and ACIM segments have been pushed up through the PMI (post-merger integration) of acquired subsidiaries and the raising of the in-house production ratio, among others, in addition to expansion in sales of new high-value-added products. Moreover, in the small precision motors segment, the Company maintains high profitability by developing demand in new fields, implementing profitability improvement measures, etc…

… JCR judged that the Company will be able to continue ensuring a high level of profits going forward by expanding businesses through ongoing growth investments such as M&As, as well as by conducting drastic cost structure reforms, including reduction of fixed expenses and cost cutting. Financial discipline is maintained even while aggressive investment continues. Based on the above, JCR has upgraded the ratings on the Company by one notch and changed the outlook to Stable.

When comparing the summaries of both companies, it seems that GE is fighting an uphill battle while Nidec has both positive momentum and room for optimization. In terms of long-term outlook, GE is stable, but at a far higher risk level than Nidec. This should drive home the point of safety of the investment, especially as GE has not been the standard bearer for at least 12 years.

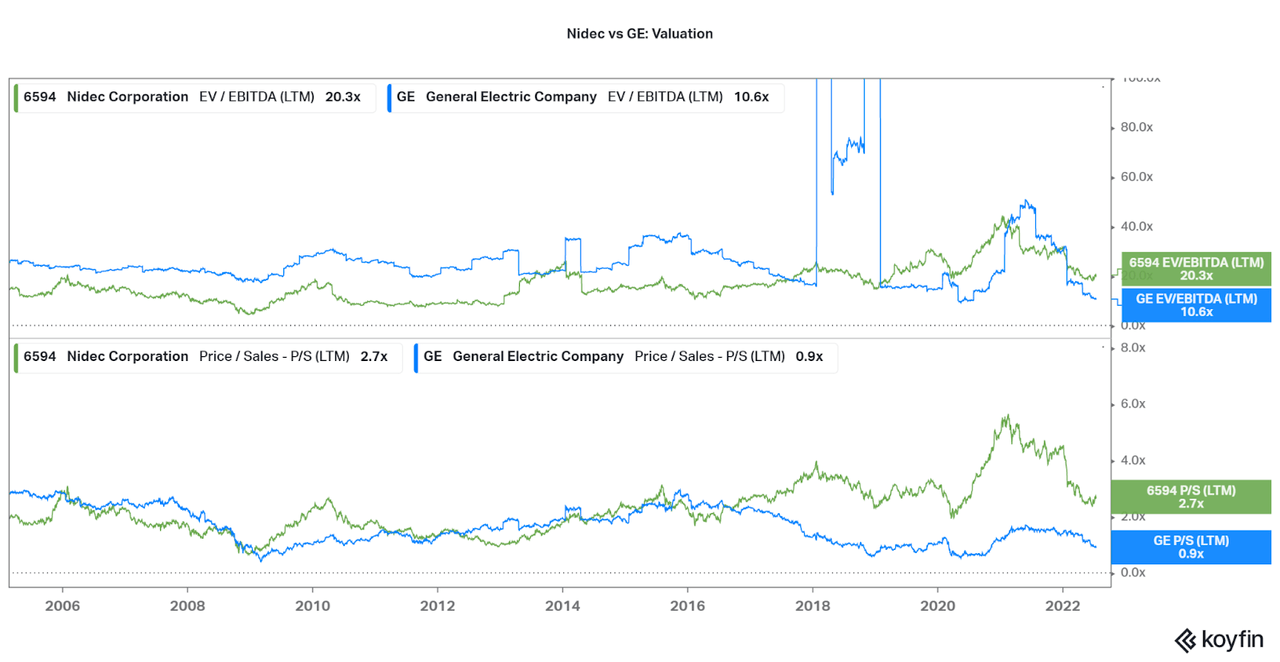

Valuation

The last point I would like to bring up is what many will call the major risk point to investing in Nidec: the valuation. As shown below, Nidec is more expensive in both EV/EBITDA and P/S (although GE does not even show up on a P/E chart). It is easy to contribute the difference in value to the relative performance and outlook of the companies. Therefore, I do not believe the difference in valuation to be a worthy talking point for this comparison.

However, the valuation is important to consider based on your individual investment preferences. For those small investors with a long-term outlook like myself, Nidec is at a strong valuation to begin loading up shares for the future, but recurring investments will take advantage on any volatility that may be present over the next few years. At the same time, I believe GE’s downward trend will continue, especially as the uncertainty around the breakup remains.

Koyfin

Conclusion

Nidec is a worthy replacement for General Electric. While there are multiple differences, the glaring benefit of Nidec is the financial state of the company. Then, similarities such as global scale and market leadership will provide a similar level of safety to back in General Electric’s heyday. Any current GE shareholders should sell now, although I do find there is some merit in re-initiating a position in GE Healthcare (the strongest segment) when the time comes. As for the aviation segment, I believe Nidec offers a suitable replacement with EV drivetrain components, but perhaps one day we will see electric aviation motors as well.

If you are a small investor, then do not worry about the OTC listing. Or, try to see if you can buy some Tokyo Exchange shares on a platform such as Interactive Brokers. Then, just add some funds to your portfolio occasionally, then enjoy as I believe Nidec will continue to meet their lofty goals of becoming World #1. I, for one, will be following along.

Thanks for reading.

Be the first to comment