hapabapa

Amazon.com, Inc.’s (NASDAQ:AMZN) advertising revenue grew 30% year-over-year (excluding foreign exchange impacts) in Q3 2022, far outpacing its advertising rivals. The e-commerce giant has been successfully penetrating the advertising market, growing its market share from 7.8% to 11.6% between 2019 and 2021, and should continue to gain market share from incumbents given the prowess of its advertising solutions, albeit at a slower pace going forward.

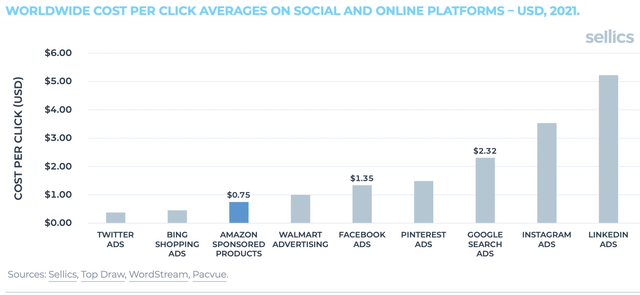

Amazon advertising Cost-Per-Click [CPC] lower than most other platforms

Note: this study only incorporates one type of advertising solution, ‘Sponsored Products’, along with comparable competitor solutions. Results may differ for different types of advertising solutions across the platforms. (Sellics)

Amazon’s relatively cheaper advertising solutions coupled with a recurring traffic of high-intent shoppers makes it an ideal advertising platform over alternatives. That being said, CPC rates are determined through auction bidding processes, driven by supply and demand dynamics. Amid the increasing demand for Amazon’s advertising solutions, costs have been rising, in turn diluting the Return on Ad Spend (ROAS). According to a JungleScout study, the 14-day Average ROAS for Sponsored Product ads declined by 17% in 2021.

That being said, Amazon has been successfully innovating new advertising solutions, namely “Sponsored Display” ads, offering more effective targeting mechanisms. Sponsored Display ads delivered a 68% increase in ROAS in 2021. Amazon continues to innovate and advance its solutions to allay declining ROAS trends.

Nevertheless, keep in mind that advertising demand shifting from other ad platforms towards Amazon not only drives Amazon’s CPC higher, but in turn lowers competitors CPC rates. Declines in competitors’ CPC rates coupled with their e-commerce initiatives (as discussed later) could indeed make competitors’ advertising solutions more competitive over time, enticing advertisers that seek to flee Amazon’s increasingly competitive marketplace.

A persistent rise in advertising costs on the Amazon platform (and corresponding declines in ROAS) could indeed subdue demand for its advertising solutions over time, as advertisers explore alternative channels. Hence while Amazon enjoys high advertising revenue growth today, unfavorable supply and demand dynamics for its advertising solutions could indeed moderate revenue growth rates over time.

It is also important to note that while CPC is one type of advertising metric, there are alternative measures that may vary in suitability across different types of advertising campaigns. Hence, while Amazon offers attractive CPC rates, other platforms could offer better performance on other metrics for sustainable growth, such as the number of first-time buyers, number of repeat customers, and share of voice. Hence advertisers seeking alternative forms of marketing performance and corresponding measurements may still pursue competitors’ advertising solutions over those of Amazon.

Apple’s privacy policy changes a boon to Amazon

Apple’s (AAPL) privacy policy changes in April 2021 made targeted advertising using third-party data more difficult on iPhones, augmenting the value of first-party data. While both Amazon and Google are well-armed with first-party data to aid targeted advertising efforts, the policy change seems to have benefitted Amazon more than Google, as the search giant has been losing digital advertising market share to Amazon for a few years now, including in 2021.

Moreover, amid worsening economic conditions and tightening advertising budgets, businesses are not only looking for reliable ROAS, but also attributable measurement tools to aid advertising budgeting and spending decisions. Apple’s privacy policy changes have undermined the effectiveness of such attribution measurement tools, which ad platforms and advertisers use to determine how successful an ad campaign has been in driving sales conversions. While Apple released its own measurement tool, SKAdNetwork (SKAN) as a replacement to traditional attribution measurements, it has not been an effective solution, as Snap (SNAP) detailed in its Q3 2021 earnings call:

Over time, we saw SKAN measurement results diverged meaningfully from the results we observed on other first and third-party measurement solutions, thinking SKAN as an unreliable of a standalone measurement solution. Furthermore, as our advertising partners have explored and tested SKAN solutions, they have serviced a variety of concerns about its limitations. Every advertiser has their own unique, fine-tuned perspective on their optimal parameters to measure ROI for their business. But SKAN requires them to use Apple’s fixed definitions of advertiser success.

For example, advertisers are no longer able to understand the impact of their unique campaigns based on things like time between viewing an ad and taking an action, or the time spent viewing an ad.

While Apple is updating its SKAdNetwork to fix attribution issues, advertising platforms like Snap are unlikely to faithfully rely on Apple’s solutions, especially given Apple’s own advertising ambitions, making it yet another rival. Instead, these ad platforms will need to work towards developing alternative sources of data, primarily first-party data, to improve targeted advertising and attribution efforts.

While other advertising platforms, particularly social media platforms, work to develop their own first-party data sources in response to Apple’s policy changes, Amazon is currently well-positioned to meet advertisers’ immediate needs for effective and attributable advertising solutions, resulting in accelerated advertising revenue growth. Social media platforms can indeed recover advertising revenue as they eventually adapt to the new industry dynamics, which can slow Amazon’s advertising revenue over time. That being said, the recent industry shifts indeed pronounce Amazon’s advertising prowess, and its continuous innovations in this space will toughen competitors’ ability to take back market share.

Amazon is strongly positioned to attract purchase-minded web visitors

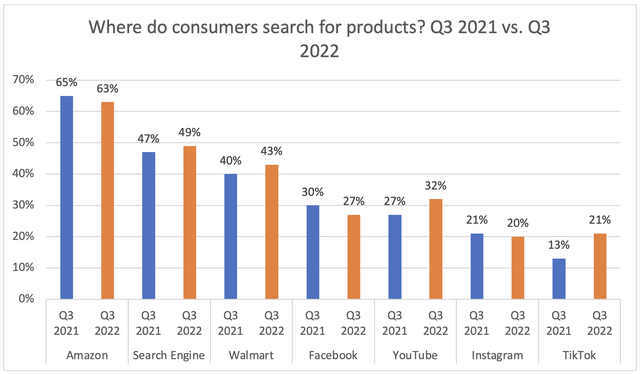

Inevitably, the e-commerce leader is better positioned to attract purchase-minded consumers, leading to appealing conversion rates for its advertising solutions thanks to high shopping intentions among web visitors. According to a JungleScout study, majority of shoppers (63%) still search for products on Amazon compared to other platforms.

Source: Generated using data from JungleScout Consumer Trends Report Q3 2021, JungleScout Consumer Trends Report Q3 2022

However, the proportion has declined slightly by 2% since Q3 2021, while other avenues (excluding Facebook, Instagram) have witnessed growth over the same period. YouTube and TikTok in particular are becoming increasingly popular channels for product searches, as consumers seek more engaging ways to explore new products.

Social media platforms have been striving to encourage e-commerce activities through their own platforms, including YouTube’s livestream shopping initiative, aiming to attract more purchase-minded web visitors, conducive to more appealing advertising solutions.

While social media platforms are not yet able to match the prowess of Amazon’s advertising solutions (given Amazon’s superior revenue growth last quarter), they are indeed making progress in influencing consumers to increasingly search for products on their respective platforms over Amazon. If this trend continues, it will subdue Amazon’s advertising revenue growth rate going forward.

Summary

Any industry that Amazon enters is a threat to incumbents, and the advertising industry is no different. Amazon’s cost-effective advertising solutions augmented by a treasure of first-party data and a recurring stream of purchase-minded web visitors have undoubtedly been successful at luring advertisers to the platform, resulting in superior revenue growth over competitors.

That being said, resolute endeavors by competitors to build their own sources of first-party data, shopping innovations, streams of purchase-minded web visitors and consequent advancements in advertising solutions will inevitably moderate growth in Amazon’s advertising revenue over time.

Nevertheless, Amazon is strongly positioned to continue driving strong advertising revenue growth through constant and effective innovations, and the advertising segment will continue to be an important source of revenue growth for the company. Over the near term, however, worsening macroeconomic conditions should inevitably diminish consumer spending and contract sellers’ advertising budgets, undermining overall revenue growth and hence inducing a “hold” rating on Amazon stock.

Be the first to comment