imaginima

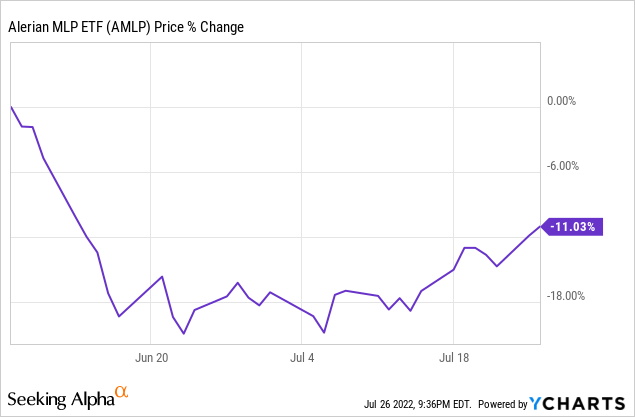

The midstream sector (AMLP) has pulled back in recent weeks amid fears of a recession leading to demand destruction:

While it is certainly true that a steep decline in economic activity would likely lead to a decline in demand for energy, Energy Transfer (NYSE:ET) recently signaled confidence to the market by announcing its third distribution hike of 2022.

In announcing the distribution increase, management stated:

Energy Transfer today announced a quarterly cash distribution of $0.23 per Energy Transfer common unit ($0.92 on an annualized basis) for the second quarter ended June 30, 2022, which will be paid on August 19, 2022 to unitholders of record as of the close of business on August 8, 2022.

The distribution per unit is more than a 50 percent increase over the second quarter of 2021 and is a 15 percent increase over the first quarter of 2022. This distribution increase represents another step in Energy Transfer’s plan to return additional value to unitholders while maintaining its target leverage ratio of 4.0x-4.5x debt-to-EBITDA. Future increases to the distribution level will be evaluated quarterly with the ultimate goal of returning distributions to the previous level of $0.305 per quarter, or $1.22 on an annual basis, while balancing the partnership’s leverage target, growth opportunities and unit buy-backs.

Here are three important implications from this announcement for ET.

#1. ET Is A Table-Pounding Strong Buy

What this hike effectively means is that 8.6% yielding ET is also growing its distribution by at least a whopping 50% this year, resulting in a yield plus growth of 58.6% relative to the current unit price. Given that ET also boasts a solid investment grade credit rating, has one of the best diversified business models in the midstream sector, and believe it or not trades at one of the very cheapest valuations in the midstream sector (as well as trading at a steep discount to its own historical valuation metrics), it is clearly a table-pounding strong buy.

On top of that, ET is not done growing its distribution. As management stated in the distribution announcement, they are still focused on increasing the distribution even more to a $1.22 annualized rate. This would be an 11.5% yield on the current unit price. On top of that, ET would likely still be growing EBITDA thanks to a pretty sizable organic growth investment pipeline while also incrementally boosting DCF per unit thanks to continued debt reduction and potential unit buybacks in the future.

#2. ET Has A Very Strong Cash Flow Profile

In addition to painting a mouthwatering total return image for investors, this distribution hike also means that ET has considerable confidence in the cash flow profile of the business, even in the face of a potential recession and plunging oil prices.

In their distribution hike announcement, ET’s management reiterated their target leverage ratio of 4.0x-4.5x debt-to-EBITDA. Given that management is hiking the distribution so aggressively despite just recently hitting its debt-to-EBITDA ratio (or possibly not even quite making it to that target level yet), this hike signals immense confidence in the forward cash flow profile even if the economy descends into a recession.

This is largely due to the fact that ET generates its cash flow from five different midstream subsectors with 30% or less of its EBITDA coming from each business segment. On top of that, it is very well geographically diversified with assets that service every major production basin in the United States. Most importantly, 10% of its adjusted EBITDA is sensitive to commodity price fluctuations, with 90% of its adjusted EBITDA coming from long-term inflation-linked fixed-fee take-or-pay contracts.

As we wrote in a recent piece:

ET is quite recession and commodity price resistant…During the Great Recession, EBITDA increased from ~$1 billion in 2007 to over $1.4 billion in 2009 while distributable cash flow per unit increased from $0.40 in 2007 to $0.55 in 2009. During the energy price crash of 2018, distributable cash flow per unit continued to grow and EBITDA soared by 29.9% that year and grew by another 17.9% in 2019.

#3. Management Has Genuinely Changed Course (For The Better)

While the first two takeaways are pretty straightforward, it is also important to note that the most important takeaway from this third distribution hike of 2022 is really that ET’s management has genuinely changed course for the better.

While management’s rhetoric was nice ever since they cut the distribution in half in 2020, it was hard to fully believe it. Back when it halved the distribution, management stated:

The reduction of the distribution is a proactive decision to strategically accelerate debt reduction as we continue to focus on achieving our leverage target of 4 times to 4.5 times on a rating agency basis and a solid investment grade rating.

We expect that the distribution reduction will result in approximately $1.7 billion of additional cash flow on an annualized basis that will be directly used to pay down debt balances and maturities. This is a significant step in Energy Transfer’s plan to create more financial flexibility and lessen our cost of capital. Once we reach our leverage target, we are looking at returning additional capital to unitholders.

Many investors scoffed at that announcement, viewing it as the latest example of Kelcy Warren and his cronies shortchanging unitholders in order to further recklessly expand ET’s empire of underperforming midstream assets. They expected that this extra retained cash flow would actually be redirected towards an overpriced and underperforming business or set of assets.

However, to their credit, ET’s management has proved the naysayers wrong. Since then they have aggressively paid down debt to the point where, now in 2022, they are able to aggressively hike their distribution.

In the Q3 2021 earnings call management said:

During the third quarter, we utilized cash from operations to reduce our outstanding debt by approximately $800 million. And year-to-date, we have reduced our long-term debt by approximately $6 billion… We expect to generate a significant amount of cash flow in 2022, and paying down debt continues to be our top priority… we’re going to continue as these maturities – as these maturities come forward, we will continue to pay them down. If some opportunity comes along that maybe you want to term some out, I’m not going to take that completely off the table. But right now, we are continuing to pay down these maturities and even call some early as they come up.

Since its Q3 2-21 earnings call, ET reduced long-term debt by an additional $590 million through Q1 2022 while also announcing in March that it had reached a definitive agreement to sell its interest in Energy Transfer Canada to reduce its consolidated debt by an expected further ~$450 million.

These deleveraging accomplishments enabled management to declare on its Q1 2022 earnings call:

We have made great progress toward moving toward our target of that 4 to 4.5. As you know, each agency calculates that a little bit differently. So I encourage you to reach out to each of them to see kind of where they’re at. But we’re getting closer to the 4.5.

Overall, it truly appears that this is the new ET: one where following through on promises is routine, leverage is kept at a reasonable level, and unitholder returns take precedence over adding shiny objects to the asset portfolio.

Investor Takeaway

While Mr. Market may not be terribly bullish on ET and other midstream equities under the expectation that a recession will lead to demand destruction, ET’s management is signaling to the markets that it is only growing more bullish on its own cash flow profile. Meanwhile, it is also paying down debt rapidly thanks to its impressive cash flow generation.

By significantly accelerating its distribution growth rate, ET is signaling that – with its freshly deleveraged balance sheet and well diversified collection of commodity price resistant assets – it is very confident in its ability to not only weather but thrive through any storms sent its way for the foreseeable future.

As a result, we remain highly bullish on ET and hold it as one of our largest positions at High Yield Investor.

Be the first to comment