remco86/iStock via Getty Images

Each week I write a piece called “Retirement Income Options” for subscribers to my investment service Margin of Safety Investing. We focus on our top option selling ideas that can help us enter into favorite stocks (cash-secured puts) or take some profits from our appreciated assets (covered calls).

To get started, please consider our 4-step process for analyzing stocks to add some context. When we research stocks, we consider these 4 factors:

- What secular trends are impacting the industry and/or company? We try to only invest in industries with secular tailwinds.

- What is the impact of Federal Reserve or government policy on the industry or company?

- How is the industry and/or company fundamentally, with consideration of balance sheets, growth, shareholder yield (a good indicator of management quality and alignment), moat, potential M&A, ignored assets and other factors?

- Quantitative and technical factors which clue us into institutional and retail investor sentiment. As we like to bottom fish, we primarily focus on institutional direction. Retail sentiment helps inform our shorter term trades and option selling ideas.

This week, I am sharing with you several of our cash-secured put ideas.

Investment Quick Thoughts

Before we go through a few trades, let’s review where we are in the market for context.

There is a lot of conflicting narratives in the markets. Inflation vs. economic slowdown. Oil shortage or oil manipulation. Federal Reserve tighter or looser. Technical analysis to the moon or massive crash.

I think the choppy year I’ve forecast still remains most likely, with the large caps finally selling off at some point and pulling down the indexes. Between now and then, we are, and probably will continue, to see rotating corrections. When the large caps finally sell-off, that will mark the end of the corrective period.

Small-caps, Mid-caps and Emerging Markets are where the bargains are happening first and will, as history supports, likely lead the next rally phase. We are able to buy growth at value prices in many SMID caps, a few EM stocks and occasionally a large cap on sector sell-offs, i.e. PayPal (PYPL) and Block (SQ) which we bought recently and sold cash-secured puts on.

Remember the framework of the global economy. The “slow growth forever” scenario, driven by demographics, is clearly “forever” as far as we’re concerned as investors. That said, I don’t see a recession soon. I see slower growth, but not a complete turnover. Given employment constraints, we can absorb some slower growth in the U.S. We’ll see what happens with the rest of the global economy though, there is some risk for a global recession that drags the U.S. down a bit too.

Within the “slow growth forever” global economy, the U.S. with the Millennial generation has significant economic advantage over China, Europe and Japan – the others of the “big 4” global economies. The aging in Japan, Europe and China are going to be disinflationary or deflationary for decades. Emerging Markets with younger educated populations and at least resource neutral are also in very good spots.

In the long run, we want to be mostly invested in the United States, with some Emerging Markets, a few resource driven economies (i.e. Australia) and a bit of Bitcoin and Ethereum as long-term stores of wealth that will grow in price during the crypto adoption phase.

Over the rest of this year, I see continuing to scale into favorite U.S. stocks, finally getting into an Emerging Market ETF and slowly dollar cost averaging into Bitcoin (BTC-USD) and Ethereum (ETH-USD) (start with an initial investment that is comfortable out of bank savings). Below are a few cash-secured put trades for scaling into favorite positions.

Cash-secured Puts To Sell Soon

Palantir (PLTR)

Palantir is a favorite stock of mine and many Millennials – which is important. What the market is not valuing at all, which is a massive mistake, is its investments in other growing companies. Looking for parts of a company that the market ignores is a key way to find hidden value.

Palantir is already big enough to be on the S&P 500, but is not, so that ETF money is coming as soon as they string together a few more profitable quarters. The company is investing in itself and others, but is maintaining profitability already.

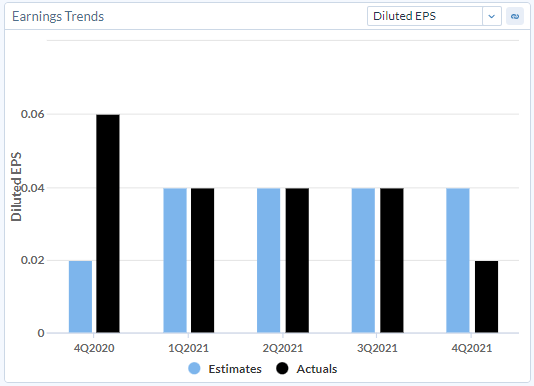

Palantir Earnings (Kirk Spano via Sentieo)

I believe PLTR bottomed on Cathie Wood panic dumping to protect her fund, which, as predicted, got crushed. I have a 1/2 position in PLTR with a cost basis around $15. I am selling cash-secured puts to eventually get to a full position.

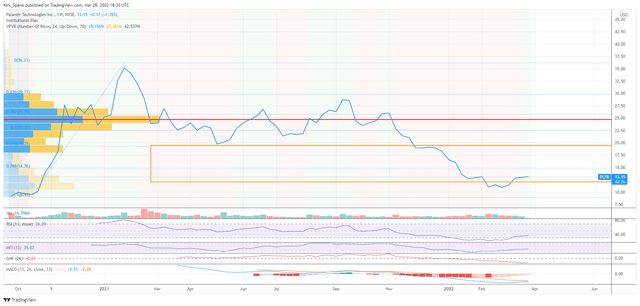

Here is a technical chart (the final step in our 4-step process is analyzing technical and quantitative factors for purposes of buying and selling):

Palantir (Kirk Spano via TradingView)

What you can see is that the stock hit our buy zone (we consider buying near the top line and usually buy near the bottom) after trading significantly above for an extended period.

If you look at the Relative Strength Index, Money Flow Index and Chaikin Money Flow, you see that that money is starting to flow into the stock from a bottom, which I believe was influenced by Wood’s selling. MACD is close to a crossover which would be bullish.

In addition, if you look to the left, you’ll see that there isn’t much resistance until around $20 per share. In the low $20s, we could see some investors who bought before the downtrend try to lighten up. That might be a good area to sell covered calls if we are still waiting on more clarity on earnings.

Here is the put I am selling now to bring in some premium and potentially lower my cost basis if put to me. Either way, I have the cash.

Sell $12 May cash-secured puts for about a buck. Always set your GTC limit order a bit above the ask to see if volatility gives you a good price. Check on it near open, midday and close in case you want to make an adjustment.

If you don’t own any PLTR, you can sell $13 puts for about $2.

Aemetis (AMTX)

Aemetis stands to be a huge winner due to likely price of oil having a floor under it, the shift to cleaner fuels, carbon capture growth and its unique advantages in California and India. This is my favorite small cap energy pick.

The company is not currently profitable, has timeline/execution risks and is partially government policy dependent. It is on the right side of big cleaner fuels and carbon capture trends though.

The stock has been choppy lately as it digests being accumulated by several institutions, including BlackRock (BLK) who bought over 8% of the company, GMO bought over 3% and Renaissance Technologies about 1.5%. Institutional ownership is suddenly over 73%.

Aemetis (Kirk Spano via TradingView)

Looking to the left side of the chart, we can see significant institutional interest in the upper single-digits and low double-digits. If the recent low is held, we will see a bullish pattern developing as support is held and fewer shares are available to the public.

I have a starter position and multiple cash-secured puts sold:

Sell $10 May cash-secured puts for a buck or more.

Sell $12.50 May cash-secured puts for $2.50 or more.

I like selling both of those as part of a scaling in strategy, especially if you don’t have a starter in AMTX yet. I am trying to get to a full position.

Heron Therapeutics (HRTX)

Heron focuses on pain management that does not use opioids. Their product ZYNRELEF is an extended-release pain killer that is gaining expanded indications at a rapid pace.

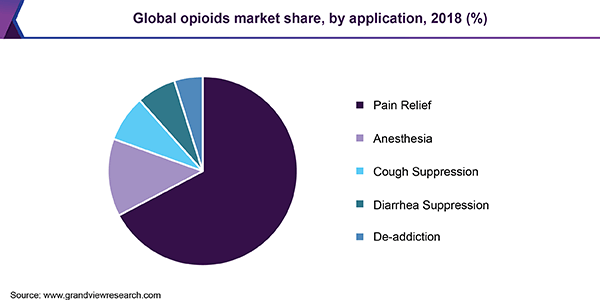

Currently, the global opioids market is about $25 billion per year with a low single-digit growth rate. About 70% of opioids are used for pain relief.

Opioid Use (Grand View Research)

About $4 billion per year of opioids are being misused by patients and considered part of an Opioid Use Disorder. That is the immediate addressable market for Heron.

However, I think we should consider that the impact of addiction is potentially understated by the data. This could be why the Biden administration has taken a keen interest in combating opioid prescriptions in general.

I think Heron is going to be my next biotech 10-bagger following Exact Sciences (EXAS) which I chronicled over several years on MarketWatch and Seeking Alpha. I don’t say things like that lightly and you haven’t heard me push many biotech stocks the past few years.

Those of you who followed me on Exact understand my level of research and commitment. Take that for what it is worth; I’m putting my money where my keyboard is.

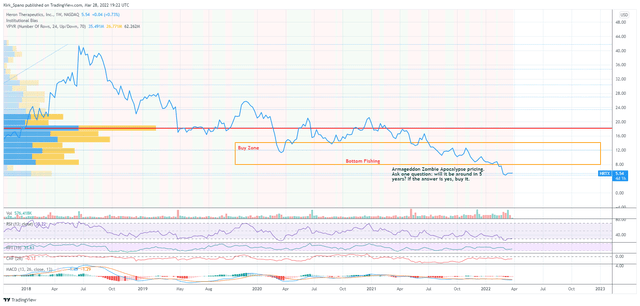

HRTX (Kirk Spano via TradingView)

All of the money flow indicators have stopped falling and are teasing a rally. There was a bit of short covering in the middle of March. The stock is still subject to a solid week of potential short covering soon. There would be some resistance in the upper single-digits short-term. However, once it breaks out, it can hit the $20s pretty quick and could shoot to new highs with any institutional accumulation that triggered FOMO.

I have a 1/2 position and have sold:

$5 June cash-secured puts for 75¢.

I am actively looking for more opportunities to get this to a full 3-4% portfolio position and if it starts to run, I will trade it even longer.

Closing Thought

“Embrace the variance” is a phrase in the poker world. I’ve cashed a few professional poker tournaments and I try to keep it in mind. It means to just keep doing the right things despite the chance you might lose a hand to a random card.

For us as investors, we want to just keep doing the right things too. Most of the time it will work out. And, when it doesn’t, so long as we’re only down temporarily, it works out in the end.

We can’t be afraid of volatility if we are going to beat the markets. We need to use volatility to beat the markets.

I am willing to trade the pains (forget about the pleasures) of substantial short term variance in exchange for maximization of long term performance. However, I am not willing to incur risk of substantial permanent capital loss in seeking to better long term performance.

Warren Buffett

Selling cash-secured puts has been my best investment strategy for scaling into companies I think can be great investments for over 20 years now. Scale in slow and far apart. Embrace the variance.

Be the first to comment