RomoloTavani/iStock via Getty Images

This article was originally published on April 1st, 2022, to members of the CEF/ETF Income Laboratory.

March offered investors a bit of a reprieve from the volatility and fairly steady losses experienced in January and February. Of course, those months offered investors much better opportunities, too, as is often the case when volatility in the market kicks up. I believe that there are still a lot of attractive values in the closed-end fund space—certainly, much better valuations than we saw at the end of 2021.

That being said, I purchase positions every month, no matter the current environment. The only thing that changes is how aggressive or conservative I am when making purchases. This allows for my income to grow month after month. I hit the market with a lot of buying in January. I then allowed February for cash to build up, which meant I wasn’t as aggressive as I should have been in hindsight.

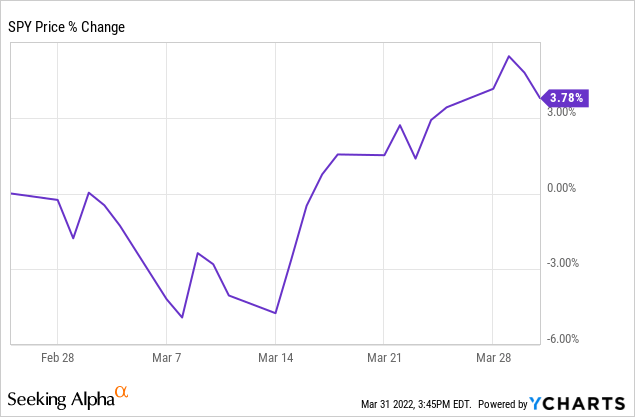

I did the same thing in March, allowing cash to build up in my portfolio. I actually only began making purchases in the latter half of the month. So far, with the power of hindsight once again, it also turned out to be incorrect timing as I should have been more aggressive in the first half of the month. Looking at the S&P 500 SPDR Trust ETF (SPY), we can see the market really began its rebound right near mid-month.

YCharts

With that, here are the three funds I purchased in March to add to my growing income. All of these funds I had previously, I was simply adding to my positions.

BlackRock Health Sciences Trust (BME)

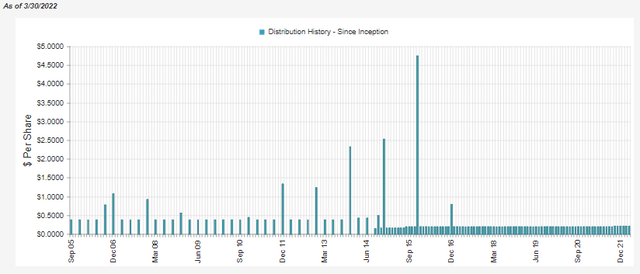

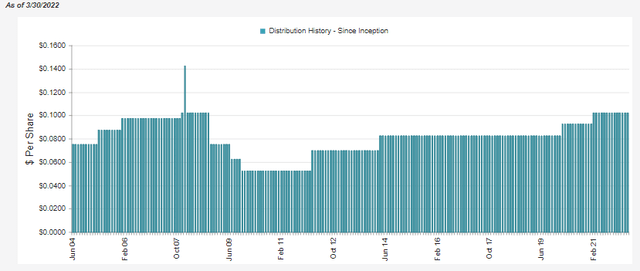

The first I added to was BME. This is a notable fund in that it is only one of a handful of funds with an inception pre-2008, and they haven’t ever cut their distributions to shareholders. They had paid a quarterly distribution but then switched to a monthly payout in 2014. When they made that switch, it was right around when they actually upped their payout too.

In fact, we have relatively recently received another boost from the fund. It is hard to tell from the chart below, but it went from a monthly distribution of $0.20 to $0.2130 starting in October 2021.

BME Distribution History (CEFConnect)

This was a welcomed increase as they paid the $0.20 amount since 2015. At this time, it works out to a distribution yield of 5.70%, and on a NAV basis, it works out to a quite sustainable 5.62%.

I cover BME somewhat regularly, but here are some of the basics for those unfamiliar.

BME’s investment objective is “total return through a combination of income, current gains and long-term capital appreciation.” They will attempt to achieve this by a pretty simple investment policy – “under normal market conditions, at least 80% of its assets in equity securities of companies engaged in the health sciences and related industries and equity derivatives with exposure to the health sciences industry.” They will then implement a covered call writing strategy against positions in their portfolio. Writing against individual positions can generate option premium that enhances what they can pay out to investors.

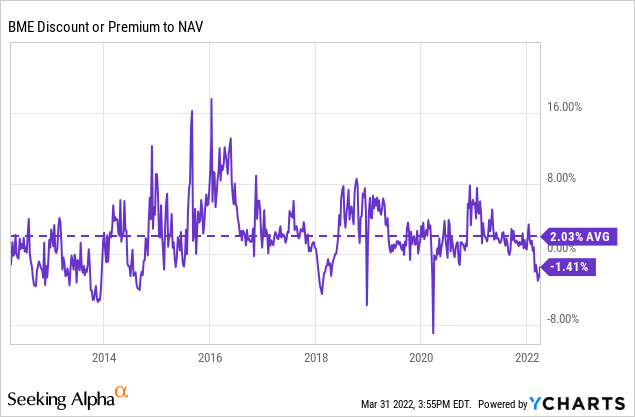

The fund has rarely traded at a discount to the NAV in the last decade. It hasn’t traded at extreme premiums but at a more consistent premium. However, that has changed in March, which spurred me to take advantage of the opportunity.

YCharts

Calamos Strategic Total Return Fund (CSQ)

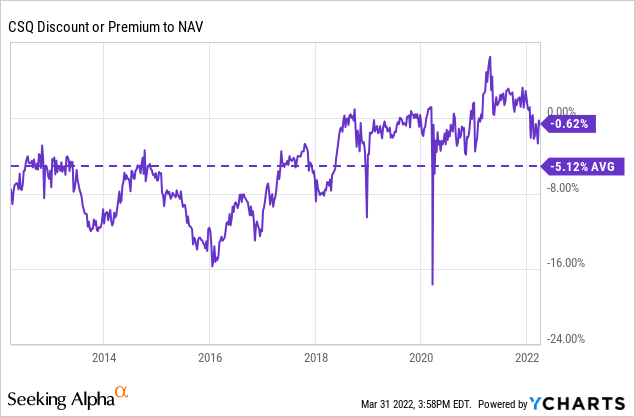

CSQ has been similar to BME in that it doesn’t generally trade at a discount for long periods of time, at least in more recent years. Previous to around 2018, the fund had traded at a discount rather persistently.

YCharts

Still, this is a position that I consider a more core part of my CEF portfolio. I’ve wanted to add to this fund for a while now. The fund touched discount levels, and the overall declines in the broader markets have opened up an attractive opportunity. That is even though its premium hasn’t been quite as consistent as BME over the last decade.

This is another fund I cover regularly, so my more frequent readers are probably familiar with this name.

CSQ’s objective is to seek “total return through a combination of capital appreciation and current income.” They attempt to achieve this simply by; “investing in a diversified portfolio of equities, convertible securities and high yield corporate bonds.”

The fund can invest where they see the best opportunities might be. That is part of the appeal of active management, the flexibility to adapt to different situations. Though it should be noted that the fund will have “at least 50% in equity securities.”

The fund has had a series of distribution cuts in 2008/09, so they can’t quite claim the title of being as consistent of a payer. However, one consistent thing is the frequency, as they’ve paid a monthly distribution since their inception. At this time, the payout is the same $0.1025 a month that they had pre-2008.

CSQ Distribution History (CEFConnect)

The fund’s distribution yield works out to 6.99%. Due to almost trading at parity with its NAV, the NAV yield comes out to a similar 6.95% rate. The fund will rely significantly on capital gains, and they have experienced some considerable losses this year. That will be something to watch or consider going forward; however, I don’t believe the NAV rate is in the danger zone yet.

EcoFin Sustainable and Social Impact Term Fund (TEAF)

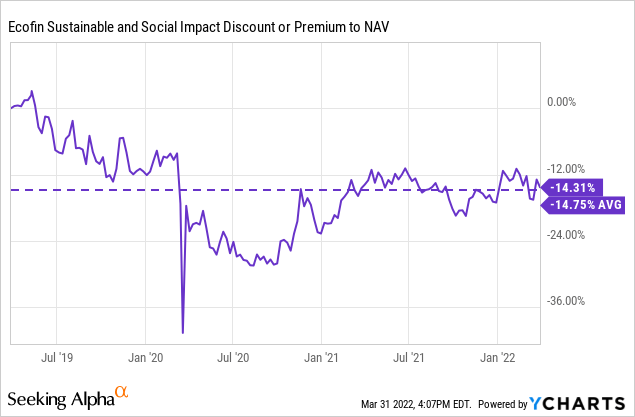

TEAF is a more unusual fund. Unlike BME and CSQ that I bought, this fund trades at a significant discount and has mostly since it has launched.

Tortoise launched TEAF with the goal of “attractive total return potential with emphasis on current income and uncorrelated assets.” Additionally, “access to differentiated direct investments in essential assets” and “investments in tangible, long-lived assets and services.”

TEAF is also targeting a “positive social and economic impact.” Essentially, they are an ESG-focused fund with an emphasis on infrastructure. A meaningful portion of their holdings is associated with energy-related infrastructure with a background in the energy space. Though it is unique from the other Tortoise funds, it also carries a significant exposure to industries outside of the energy field.

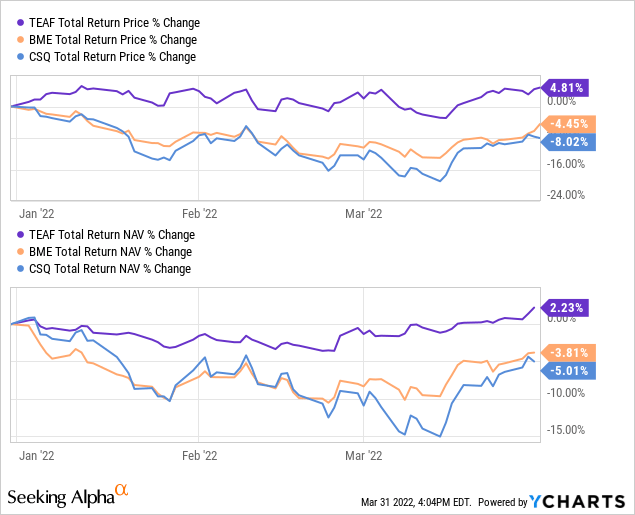

Also, unlike the other two funds I’ve bought this month, it shows positive results YTD in terms of performance. Nothing too spectacular, but positive in this first quarter of 2022 seems worth noting.

YCharts

One of the reasons for this is that it has exposure to energy and utility investments. Energy is leading the sector for the year by a significant amount. In fact, the only other sector that is positive for the year as measured by the SPDR ETFs. That is the utility sector that is hanging on as a defensive play.

The fund is unique because it has significant exposure to private investments and a tilt towards renewable energy. This could also be why the fund’s discount has been so consistent. Private investments can be riskier and harder to value. Therefore, investors sometimes leave a larger margin of safety. Additionally, the fund has performed poorly since it launched, keeping investors away.

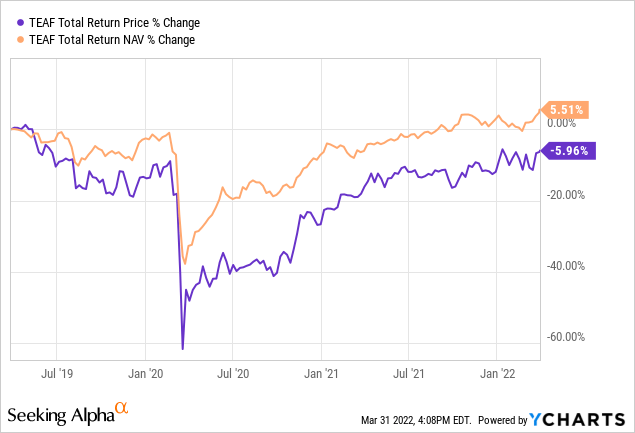

YCharts

Performing poorly since launch is definitely not something worth bragging about. Given the underlying investments, it seems that energy had the most significant negative impact on the fund in 2020. However, it also depends on when you bought this name. My first batch was in September 2021. My second is now this past month as the discount remains attractive, in my opinion. Given this, my share price return only is up almost 40%, not counting any of the distributions.

I also believe that the underlying investments are quite compelling, at least the idea of them. Overall, this is a small position in my portfolio, so it won’t make or break me in the long run. Below is a chart of the performance of TEAF since its inception.

YCharts

Conclusion

March finished up on a positive note for investors. However, it still seems there is a considerable amount of uncertainty going forward. Some caution from investors seems merited. In hindsight, I should have been more aggressive in purchasing in February and early March. That being said, due to these uncertainties going forward, we could get plenty more opportunities. In the end, I’m making new purchases every month and growing my income – and that’s really my main goal!

Be the first to comment