Maximusnd/iStock via Getty Images

Gene Tannuzzo, CFA, Global Head of Fixed Income

2023 is poised to be a comeback year for fixed income.

The driver of fixed income will shift from rate hikes to the economy (and probably recession)

Rate hikes and tighter financial conditions drove fixed-income returns lower in 2022. Heading into 2023, we should see the economy slow pretty dramatically. I don’t think that we’ll see a repeat of 2008 or 2020, in which the slowdown was extraordinarily deep in specific areas of the economy. Instead, because financial conditions have tightened so much, I think economic pain will hit the tail of every industry. That means that companies and consumers with too much leverage and sovereigns that are not well-positioned to deal with elevated levels of currency volatility are going to come under increased pressure.

Quality and credit selection will be important shock absorbers for investors

Investors no longer have the benefit of policy-based shock absorbers, like quantitative easing or artificially low rates, to protect their portfolios. In the absence of monetary and fiscal stimulus, they will need to find new buffers to cushion the impact of market and economic volatility. From an implementation perspective, this means a higher credit quality portfolio and companies with strong fundamentals, a healthy cash flow, and lower leverage. It can also involve pivoting away from certain risks – including securities that are overexposed to the low end of consumer credit – and owning asset classes like municipal bonds and agency mortgage-backed securities.

Higher yields can mean portfolio protection

The broad repricing of bonds and the higher starting yields we have now can help insulate investors from further losses. The yield curve is very flat and very high, which means even if investors are not comfortable with longer-duration bonds, there are attractive opportunities in short-term corporate bonds, which are yielding 5.5% or 6%.

Don’t try to time the Fed’s pivot from rate hikes

For those who are comfortable with longer-duration bonds, pay attention to the duration narrative. I think it will shift from focusing on the aggressive Fed hiking cycle to focusing on the impact of the Fed pausing (if not cutting) rate increases. We’ve seen negative returns in the bond market followed by high, if not double-digit returns. However, a market response to the end of the hiking cycle generally happens very quickly, and trying to time the bottom can mean an investor misses out.

Fixed-income valuations are very attractive, but pay attention to risk

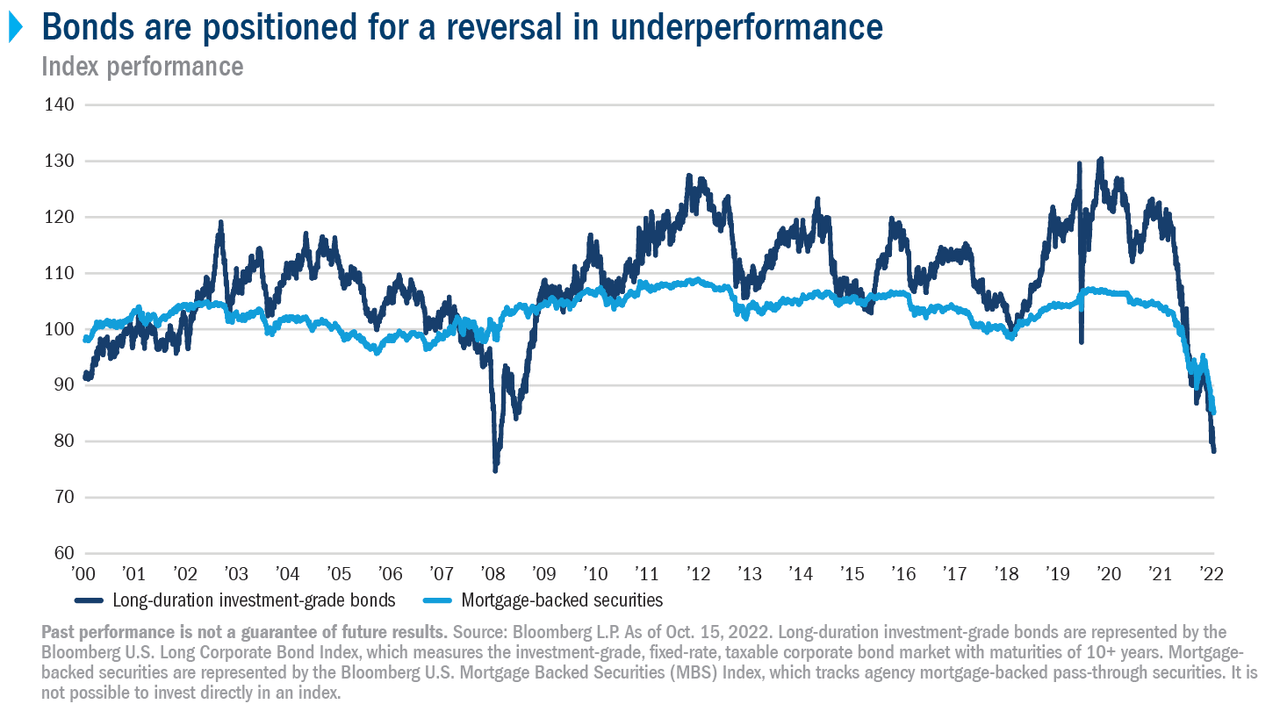

With government-guaranteed mortgage-backed securities priced in the mid-$80s and long-maturity investment-grade bonds in the $70s, the combination of income and price appreciation can generate meaningful total returns once sentiment turns. Similarly, investment-grade bonds, which were down 20% this year, could provide better outcomes because they represent companies that don’t necessarily need to refinance in a less conducive environment. If we look at international bonds, this is probably the first time in many years that opportunities in Europe appear more attractive relative to the U.S. – particularly in investment-grade bonds, which have already priced in geopolitical risk. High yield appears fully valued to us, but could stand to benefit if the economy can avoid a recession in the year ahead.

Optimism for 2023

I don’t think that 2023 will be a repeat of 2022. There are very compelling total return opportunities in high-quality assets. Investors are being compensated in terms of yield, but there are risks and a focus on quality and credit selection will be critical to setting the stage of successful fixed-income outcomes.

DisclosuresThere are risks associated with fixed-income investments, including credit risk, interest-rate risk, and prepayment and extension risk. In general, bond prices rise when interest rates fall and vice versa. This effect is usually more pronounced for longer-term securities. NOT FDIC INSURED · No Bank Guarantee · May Lose Value Columbia Threadneedle Investments is the global brand name of the Columbia and Threadneedle group of companies. Columbia Funds and Columbia Acorn Funds are distributed by Columbia Management Investment Distributors, Inc., member FINRA. Columbia Funds are managed by Columbia Management Investment Advisers, LLC and Columbia Acorn Funds are managed by Columbia Wanger Asset Management, LLC, a subsidiary of Columbia Management Investment Advisers, LLC. Investors should consider the investment objectives, risks, charges, and expenses of Columbia Seligman Premium Technology Growth Fund carefully before investing. To obtain the Fund’s most recent periodic reports and other regulatory filings, contact your financial advisor or download reports here. These reports and other filings can also be found on the Securities and Exchange Commission’s EDGAR Database. You should read these reports and other filings carefully before investing. With respect to mutual funds and Tri-Continental Corporation, investors should consider the investment objectives, risks, charges and expenses of a fund carefully before investing. To learn more about this and other important information about each fund, download a free prospectus. The prospectus should be read carefully before investing. © 2021 Columbia Management Investment Advisers, LLC. All rights reserved. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment