studio-fi

This article first appeared in Trend Investing on June 16, 2022 when Fisker was trading at US$8.74; but has been updated for this article.

Today’s article looks at Fisker Inc.’s 2022 key news and why Fisker Inc looks to be a 2022 beaten down bargain.

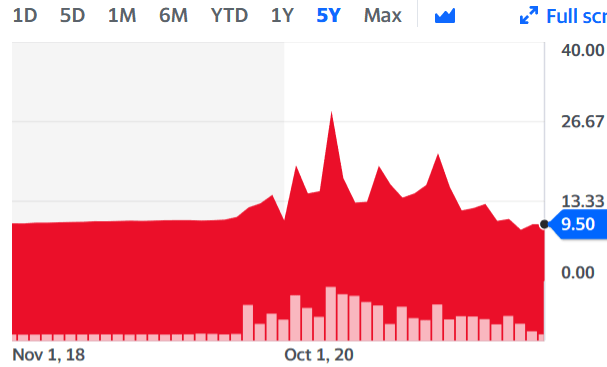

Fisker Inc.’s closing stock price peaked on February 1, 2021 at US$28.50. Today the stock is at US$9.50, or 67% lower.

Fisker Inc. (NYSE:FSR) – Price = USD 9.50

Yahoo Finance

Fisker Inc.’s plans and business model

Fisker’s business model is an asset-light, fast to market, contract manufacturing model. It involves digital (online) sales of its premium electric vehicles (“EVs”) at affordable prices.

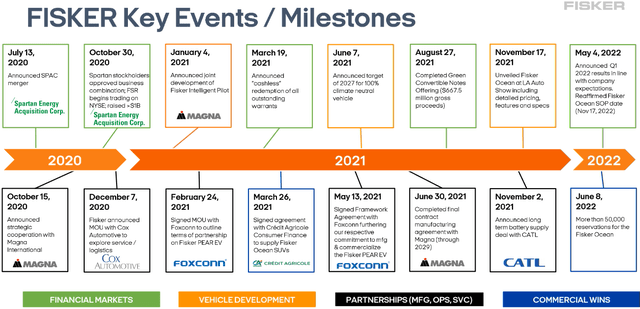

Fisker Inc. had a successful 2021. Key milestones being the long term manufacturing agreement with Magna International for the Ocean production in Austria, starting November 17, 2022, the Foxconn agreement for manufacturing a new US$30,000 electric car (Project PEAR) in the U.S starting in 2024, and the agreement with CATL as a battery supplier for the Ocean.

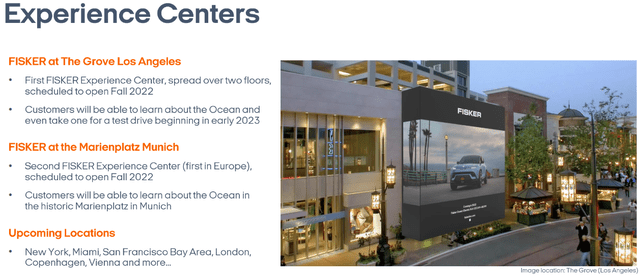

Fisker will sell online and use experience centers similar to Tesla, Inc. (TSLA)

Fisker company presentation June 2022

2022 Fisker key news summarized

- January 3, 2022 – “Letter from CEO: A reflection of 2021 and a look into 2022 by Henrik Fisker.”

- April 12, 2022 – “California EV company Fisker selects Hyderabad as headquarters for initial operations in India.”

- May 4, 2022 – “Fisker Inc. announces First Quarter 2022 Financial Results.

Q1 2022 operating results consistent with company expectations and full-year total spending guidance unchanged. Test and validation phase progressing well, 23 out of 55 complete Fisker Ocean prototypes built. 2022 retail reservations continue at an elevated pace. As Fisker Ocean is entering into pre-production, we have intensified our “hyper” product plan development. PEAR design concept has been signed off and consists of at least three derivatives to be able to reach 1 million units a year by 2027. Our third vehicle is codenamed “Project Ronin”. We are working on a new radical integrated battery pack technology, where we expect to deliver the world’s longest range in a production vehicle. We aim for this vehicle to redefine the luxury sports car segment, with a new concept that currently does not exist. We expect to show the “Project Ronin” in August 2023 with production to follow in the second half of 2024.”

- May 5, 2022 – “Fisker announces its third product, Project Ronin, an innovative, high-tech electric GT sports car……Fisker expects to reveal Project Ronin in August 2023, with production starting in the second half of 2024.”

- May 12, 2022 – “Fisker and Foxconn confirm Fisker PEAR production in Ohio.

- Fisker partner Foxconn has completed its acquisition of an operational 6.2 million-square-foot vehicle manufacturing facility in Ohio.

- Fisker and Foxconn will build Fisker’s second vehicle, the Fisker PEAR, at the factory.

- The Fisker PEAR will start production in 2024 and have an expected base price below $29,900.

- Fisker and Foxconn intend to build a minimum of 250,000 PEAR vehicles a year once the plant ramps up production.”

- May 24, 2022 – “Fisker announces launch of its $350 million At-the-Market Equity Program.”

- June 8, 2022 – “Fisker surpasses 50,000 reservations for Fisker Ocean SUV and reveals additional details about its second vehicle, the Fisker PEAR.”

- July 7, 2022 – “Fisker announces Fisker Finance℠, providing seamless financing options for customers; Reaffirms nomination of retail financing partners.”

- July 13, 2022 – “Fisker Inc. adds experienced global manufacturing executive as company grows toward target of producing one million vehicles annually in 2027…..Alpay’s wealth of hands-on, global manufacturing experience will boost Fisker’s already ultra-fast development process, creating greater efficiency by incorporating the latest in new manufacturing methods….”

Fisker Inc’s achievements to date are quite impressive

Fisker Inc. company presentation

Fisker Inc.’s plan for four new vehicles by 2025

Fisker Inc. plans to bring four new vehicles to market by 2025. They are Fisker Ocean, Fisker Project PEAR (“Personal Electric Automotive Revolution”), and two others (Project Ronin and unnamed).

Fisker Inc’s EV lineup and indicative timetable

Fisker Inc. company presentation

Note: Project Ronin plans to be a luxury sports car.

Fisker Ocean – (to be made by Magna International in Austria)

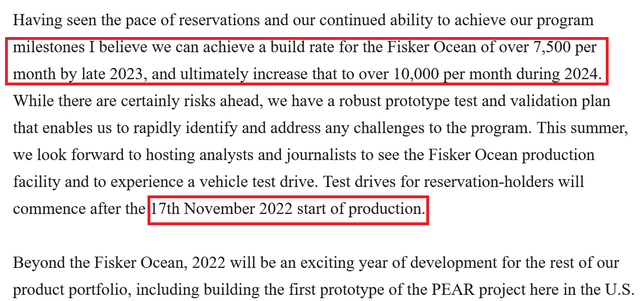

Fisker Inc. has been steadily progressing towards their Fisker Ocean production launch on November 17, 2022 as well as the subsequent ramp up to over 10,000/month (>120,000/year) in 2024.

Fisker Ocean reservations

Source: Fisker news (see links in the table for each number).

Fisker Inc. company presentation

Fisker Inc.’s production plans for the Fisker Ocean and then Project PEAR

Note: Red rectangular highlight boxes done by the author.

Fisker Ocean all-electric SUV – Production starting in Nov. 2022

Fisker Inc. company presentation

Fisker Project PEAR (“Personal Electric Automotive Revolution”) (To be made by Foxconn in the USA)

The Fisker Project PEAR is a sporty crossover, smaller and cheaper than the Fisker Ocean SUV.

The Fisker Project PEAR has over 3,200 reservations, prototype testing slated for late 2022, and production expected to begin in 2024 by contract manufacturer Foxconn in the USA.

Fisker stated:

The Fisker PEAR’s cool new features and technologies – and affordable pricing below $29,900 – are designed specifically for the customer of the future”. The Fisker PEAR will have the first-ever Fisker Houdini trunk, an alternative to traditional rear cargo hatches. Intended for a metropolitan lifestyle, Fisker PEAR’s interior will offer a new level of storage for its segment. Design-wise, the beltline and side window area are extremely low, with a large, wraparound windscreen affording a commanding view when driving. The Fisker PEAR will be available in rear-wheel-drive (single motor) and all-wheel-drive (dual motor) configurations featuring four levels of option packages. The Fisker PEAR offers two battery packs, with the larger Hyper Range pack targeted at over 310 miles and like the Fisker Ocean, will feature the Fisker SolarSky panoramic roof, adding emissions-free range to the battery…….

Fisker PEAR futuristic sporty crossover (to be fully revealed in H2, 2023)

Fisker Inc.

Fisker PEAR crossover concept

Fisker Inc. website

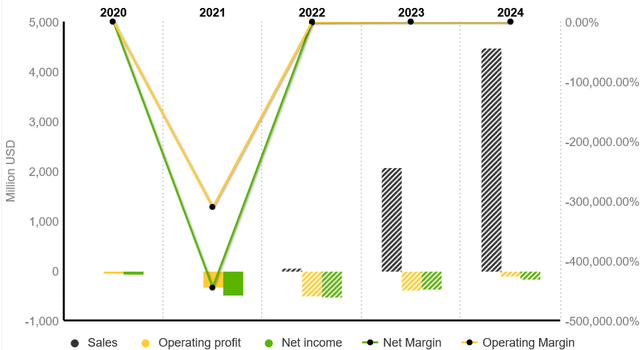

Valuation

The current market cap of Fisker Inc. is US$2.82b. Fisker Inc. has over US$1b in cash (as of March 31, 2022) and a Green Convertible bonds (2.5% pa until June 15, 2026) liability of US$667.5m.

For some perspective, Tesla has a market cap of US$746b, approximately 264x higher than Fisker Inc.

Yahoo Finance shows a 1 year analyst’s price target of US$17.27. Market Screener also shows a 1 year analyst’s price target of US$17.27 representing 82% upside.

Our end 2025 price target is US$51.37, representing 5.4x upside. See table below for details.

Note: Our target has been slightly reduced due to a lowering of the estimated production volume for 2025 due to a projected later start to Project PEAR production than previously anticipated and some future equity dilution due to the announced US$350 million At-the-Market Equity Program.

Our Fisker price targets using a simple EV sales and earnings model

| 2023 | 2024 | 2025 | |

| No of Ocean EVs sold | 60,000 | 120,000 | 130,000 |

| No of PEAR EVs sold |

60,000 |

120,000 | |

| Est. PE ratio | 40 | 40 | 40 |

| Our Price Target (US$) | N/A | 34.66 | 51.37 |

|

Upside potential (from current $8.74) |

3.65x |

5.41x |

Assumptions

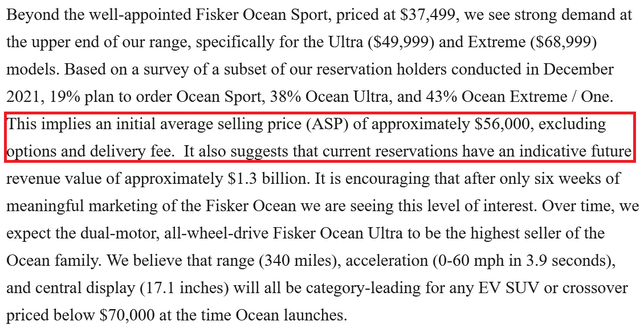

Fisker Inc. makes a US$6,000 gross profit (~10% gross profit margin, Fisker Inc. guides a US$56,000 average ASP, excluding options) on each Ocean (starting in late 2022) and US$3,000 gross profit (~10% gross profit margin) on each PEAR (starting in late 2024), based on our production estimates for 2023 to 2025, which are roughly based on Fisker’s guidance. We have allowed for US$400m pa in expenses (increasing at 10%pa) related to experience centers, R&D, warranty expenses, and admin costs. We also assume debt interest expenses of US$16.688m pa from the US$667.5m Green convertible senior notes at 2.5%pa. CapEx for factory fit-outs and R&D facilities is from existing over US$1b in cash reserves (as of end March 2022) and the US$350 million At-the-Market Equity Program until end 2025.

As Fisker grows as a brand there may also be further potential revenue in areas such as insurance and onboard entertainment. Our forecasts above for now are based “only” on EV sales revenue and for the Ocean and PEAR, noting Fisker Inc. plans two more new models by 2025 (Project Ronin and unnamed).

Fisker’s financials and forecast financials

Fisker is seeing strong orders for their upper end Ocean SUV’s and has an average ASP of US$56,000 across variants (excluding options)

Risks

- Electric vehicle sales may stall or slow down perhaps due to reducing or removing of subsidies or some macro-economic event.

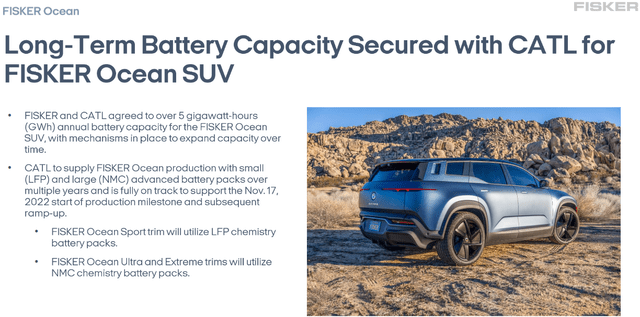

- EV production risks – Delays, costs overrun, supply chain issues etc. In this case Fisker Inc. has some risks associated with Magna and Foxconn as the contract manufacturer. Fisker has sourced batteries (5GWh+ pa) for the Ocean from CATL, but nothing has been announced yet for Project PEAR.

- Competition – There are numerous EV start-ups as well as the existing EV and ICE companies all fighting for market share in what can sometimes be a low margin industry. Fisker may not sell as many cars as they have targeted to produce and would then need to reduce production.

- Management risks – Henrik Fisker is a great designer, but can he run a car manufacturing business. Fisker’s effort a decade ago with Fisker Automotive failed to succeed. There is key-person risk as the Company is heavily dependent on founder and CEO Henrik Fisker. Some past ideas such as the US$130,000 EMotion all-electric sedan have not come to fruition. Will Fisker’s future product designs be popular.

- Business risks – Debt (US$667.5m green convertible senior notes at 2.25% due 2026), currency, car industry risks (recalls, warranty expenses, litigation etc). Fisker Inc.’s costs may go up making it harder to make a profit on each vehicle.

- The usual stock market risks (liquidity, dilution, sentiment etc).

Further reading

Fisker Inc. is on track to be a new 100% electric car producer in only 4 months from now

Fisker Inc. company presentation

Conclusion

Fisker’s business model is designed to reduce capital expenditure and time to market by using contract manufacturers. They also use an online selling platform for sales and service to reduce overheads and middlemen.

Fisker Inc. is progressing very well and looks to be on track to begin production of their first vehicle (Fisker Ocean) in Nov. 2022 and their second vehicle (Project PEAR) in 2024. Project Ronin should also follow soon after followed by a fourth model. Fisker Ocean reservations are now over 50,000 and PEAR reservations are at 3,200. In 2027 Fisker is targeting to produce 1 million EVs pa.

Valuation looks very attractive based on both analyst’s targets and our model which looks further out than just one year. The one-year analyst’s consensus target price is US$17.27, representing 82% upside. Our end 2025 price target is US$51.37, representing 5.4x upside.

Risks revolve around achieving the stated targets in the stated time frames to make profits. Please read the risks section.

We rate Fisker Inc. as a very good speculative buy for investors with a mid to long-term time frame.

As usual, all comments are welcome.

Be the first to comment