Iuliia Korniievych

Introduction

2020 Bulkers (OTCPK:TTBKF) [2020.OL] is a Bermuda-incorporated company operating a fleet of 8 Newcastlemax dry bulk carriers. Despite macro headwinds (China slowdown), it continues to produce a significant amount of free cash flow, thanks to its low cash breakevens and smart management locking in some good fixed rate contracts at the beginning of the year. Almost all of the free cash flow is paid out as monthly dividends. While the dividend yield is volatile, even a modest recovery in capesize rates should push it well into double digits. I am keeping the company on my watchlist as a way to play the China reopening theme, should it materialize shortly. I am bullish on longer time-frames because of the company’s competitive advantages and the most favorable dry bulk supply-side dynamics in the last 30 years.

Most modern fleet among peers

2020 Bulkers fleet is very modern, consisting of 8 Newcastlemax dry bulk vessels acquired between August 2019 and June 2020. The average fleet age is only 2.5 years. This is the lowest among listed peers. Considering that the dry bulk market is currently weak, the lower fleet age represents a strategic advantage. In addition, modern vessels are more efficient, which means lower fuel consumption and lower costs. Finally, all 8 vessels are equipped with scrubber systems, which translates into additional profits, since the company gets paid a share of the fuel savings earned by the charterer.

This is especially true considering that the spread between low-sulfur fuel oil (LSFO) and heavy fuel oil (HFO) remains at historically high levels. According to data provided by shipandbunker.com, the heavy IFO380 fuel that can be burned by scrubbers is currently trading at around $420 per tonne in Singapore, while the lighter VLSFO is trading at $700 per tonne. This is equivalent to an almost $300 per tonne savings. Similar numbers hold for other main ports around the world. Scrubber fuel savings are therefore substantial and lead to higher effective rates compared to older vessels.

Another related tailwind comes from the adoption of tighter environmental controls. The International Maritime Organization (IMO) is targeting a 40% decrease in CO2 emissions from 2008 levels by 2030. To this end, two important pieces of regulation are expected to be implemented by January 2023: EEXI (Energy Efficiency Existing Ship Index) and CII (Carbon Intensity Indicator). To be compliant with both, shipowners will be forced to either raise capital expenditures to improve efficiency, or reduce the engine’s power output. This has two consequences: part of the trading fleet is going to be scrapped, as it becomes uneconomical to operate, thus further exacerbating the supply-side imbalance, which is already at record levels; another part of the fleet may be forced to lower its average sailing speed. More efficient vessels will be able to charge a significant premium, more than compensating for the shorter charters. According to estimates from the American Bureau of Shipping (ABS), about 80% of bulk carriers are currently not compliant with EEXI and CII. While this represents a headwind for many companies, it is a competitive advantage for operators with more modern fleets. ABS puts 2020 Bulkers in the top 8% for efficiency of the global capesize fleet.

Track record of outperformance

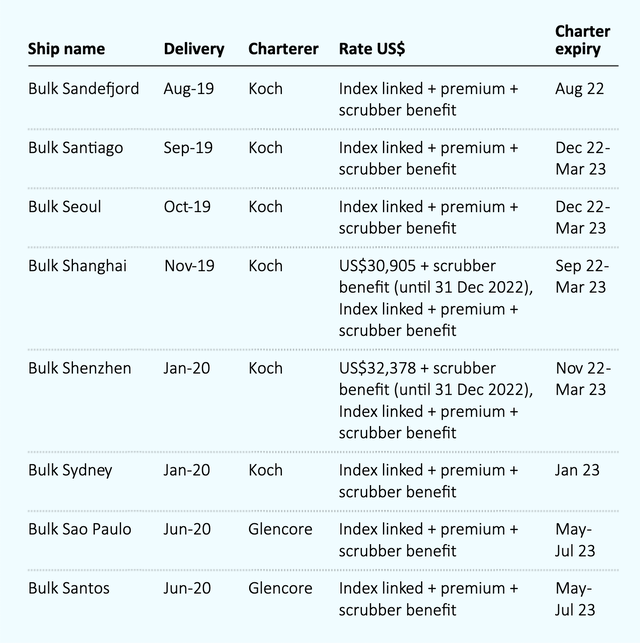

The company has a track record of smart management and commercial outperformance, with higher average time charter equivalent (TCE) compared to competitors. Since delivery of its first vessel, 2020 Bulkers has outperformed the Baltic 5TC index 27 out of 31 months. At the moment, six of its carriers are trading on index-linked time charters, with the remaining two on fixed time charters. The decision to convert these two vessels at the beginning of the year from index-linked to fixed contracts has proved particularly successful, considering they are now earning an average of $31,600 per day / ship gross (plus scrubber profit share), which is significantly above current rates. In general, the company’s strategy is to have high exposure to index-linked contracts, while maintaining the flexibility to convert these charters to fixed rate based on prevailing FFA market conditions.

Fleet composition and charters (company’s annual report 2021)

Generous dividend policy

The company is fully committed to returning capital to shareholders in the form of dividends. Dividends are paid monthly and comprise the majority of operational free cash flow, minus debt repayments. Dividends are not subject to any withholding tax, thanks to the company’s Bermuda incorporation. 2020 Bulkers has already returned more than 70% of the paid-in equity to shareholders through dividends since inception.

I would prefer the company to pay slightly smaller dividends and keep a higher cash balance during downturns, though it must be admitted that the balance sheet is robust, with a liquidity position of $18.4 million and total debt of $228.7 million, or around $28.5 million per vessel (the price of a new capesize vessel today is around $40-50 million). The debt will be repaid by approximately $15 million per year, which corresponds to an average annual debt reduction of $1.85 million per vessel.

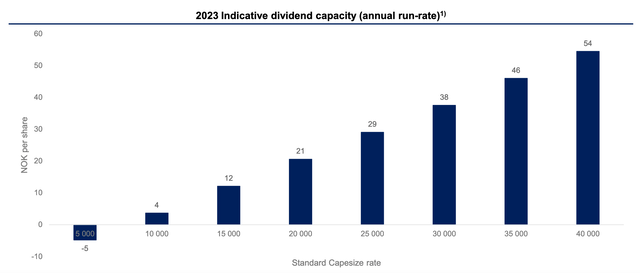

If market conditions are favorable, the dividend potential is huge. The following estimates for 2023 from the company look extremely attractive. However, nobody really knows where the capesize rate will trade next month, not to mention next year. FFA estimates do not look pretty at the moment. Needless to say, the situation can change in a heartbeat.

Dividend capacity for 2023 (company’s estimates)

Based on Q2 conditions, the company can generate around $15 million per quarter, or $60 million annualized. The current market cap is around $190 million. The EV / FCF multiple is therefore around 6.5x.

Macroeconomic picture is mixed

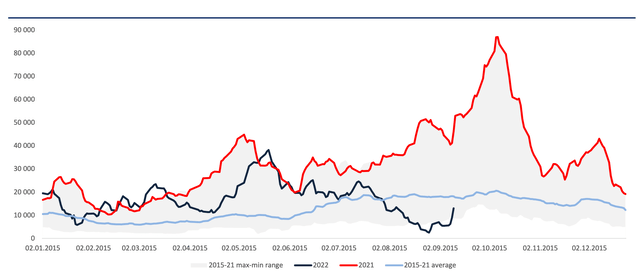

Despite many positive factors, I am still on the fence regarding 2020 Bulkers. The main reason is that the short-term outlook for dry bulk is clouded by macroeconomic uncertainties. Fundamentals are particularly weak, considering that capesize rates are strongly correlated with iron ore exports from Brazil to China, and therefore with demand from Chinese steel manufacturers.

Vale production vs Capesize rates (company’s presentation, Pareto Energy Conference 2022)

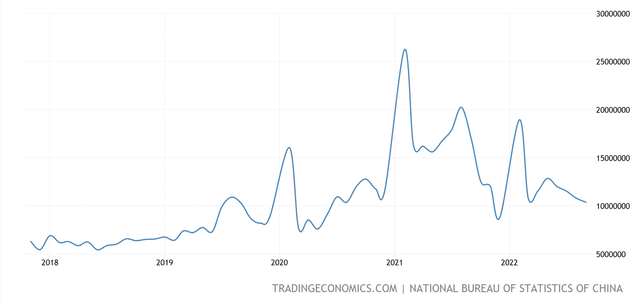

Chinese imports of iron ore have declined significantly from their peak in 2021, in the face of a slowing economy.

China Imports of Iron Ores & Concentrate (tonnes) (National Bureau of Statistics of China)

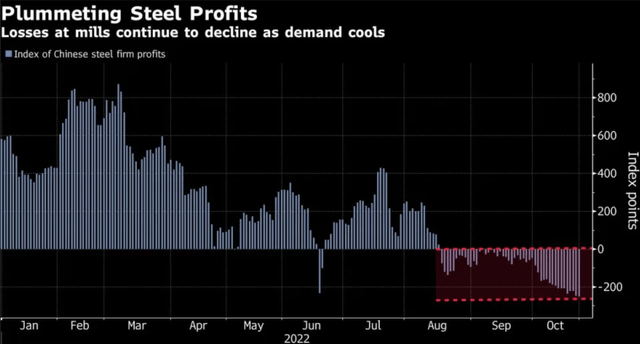

The Xi administration seems determined to deflate the property bubble, using zero-covid policies as a tool to achieve this objective. This means reduced steel demand, collapsing prices for steel products and squeezed margins for steel makers. October was in fact a month of record losses for Chinese producers. This is bearish for iron ore imports.

Chinese steel producers’ losses (Bloomberg)

However, the situation is more nuanced than it might seem. The end of last week saw a rally in many value-related sectors, including dry bulk. The probable catalyst was the circulation of rumours concerning plans for a possible China reopening. The rumors started from a few screenshots of supposedly official government documents and were later picked up also by the main media. I remain pretty skeptical: it is more likely an example of investors seeing what they want to see. Nonetheless, a reopening will come sooner or later.

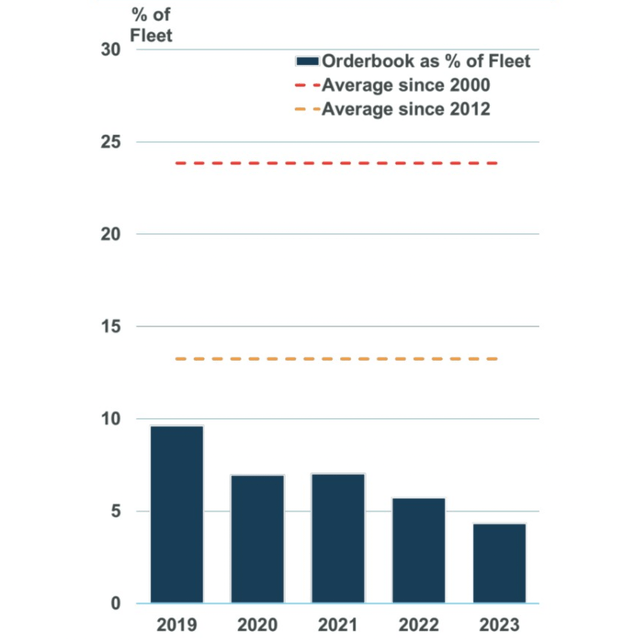

However, the main reason for being bullish on dry bulk in the longer term is more fundamental. While all the focus is currently on the demand side, the supply side will grow in importance, as more and more vessels are scrapped and not replaced. The orderbook for new vessels is at historic lows, with new carriers under construction representing only 7% of the existing fleet.

Orderbook as % of existing fleet (Maritime Strategies International data)

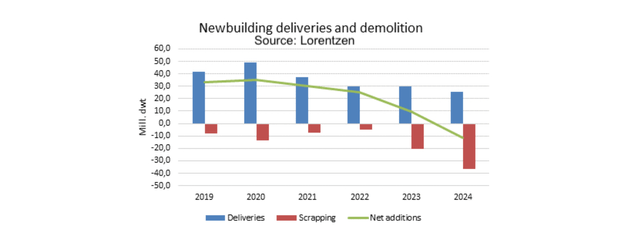

This implies that 2023 will be the first year in 30 years with almost no net growth in the fleet. The year after that, the market will go into deficit, with more tonnage leaving the market than coming in.

Deliveries vs scrapping of bulk carriers (Lorentzen & Co data)

With inflation getting entrenched, replacement costs are going to rise, and 2020 Bulkers fleet is brand new. Dry bulk has been a capital destroying business for years, and the lack of investment has created structural imbalances that will take time to resolve. Unfortunately for central bankers, it is not possible to print hard assets such as dry bulk vessels (or, for that matter, drilling rigs, refineries, copper mines, uranium mines, and so on). This is the fundamental reason I am bullish on so many old economy sectors, and dry bulk in particular.

Conclusion

2020 Bulkers is a rare gem. It is refreshing to find in the shipping sector a company that is managed in the interest of the shareholders, as it should be. It also enjoys several competitive advantages, related to its Bermuda incorporation and best-in-class modern fleet. The long-term outlook looks bright, with stricter environmental regulations, the rise of the world middle class, and the most bullish supply-side dynamics in 30 years providing powerful tailwinds. However, the short-term future looks grim, unless China does reopen and stimulate its economy.

For this reason, I am not a buyer yet at this price. I will re-evaluate should the rumours of a Chinese re-opening fade away and the price fall further to the 70 NOK / share range. I am also ready to re-evaluate should the rumors actually be confirmed, which I am sure would lead to a massive rally in the whole dry bulk sector. However, given the current uncertainty, I am not ready to chase the stock here. In other words, the margin of safety is not enough to warrant a buy rating. Until then, I will keep it on my watchlist.

Be the first to comment