CalypsoArt

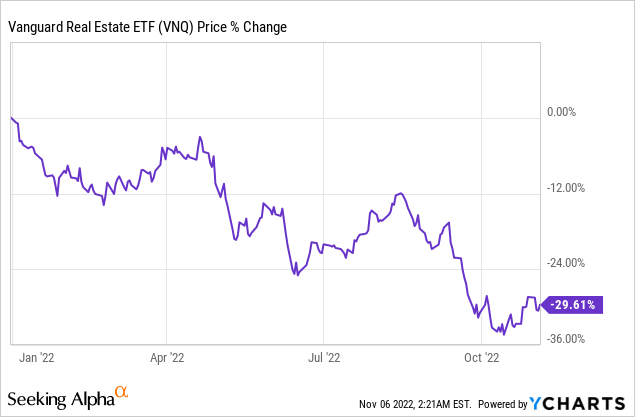

As I write this article, the REIT market is hitting new lows last seen following the pandemic crash of 2020. The Vanguard Real Estate ETF (VNQ) is down 30% year-to-date and increasingly many REITs are getting deeply undervalued:

But where is the best value?

There are over 200 REITs in the US alone, and there are 33 countries in the world that have adopted REIT legislation.

The REIT market is often mistakenly perceived as a fairly homogenous sector with little differences from REIT A to REIT B, but in reality, being a REIT is just a corporate status just like some other entities decide to become C-corps or L.P.s.

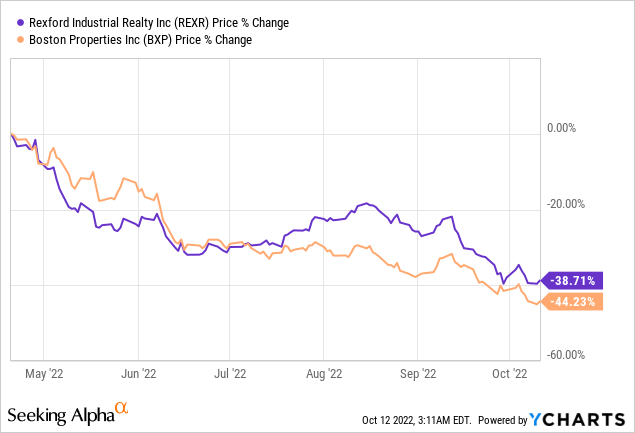

Some REITs like Boston Properties (BXP) invest in office buildings in coastal markets. Other REITs like Rexford (REXR) invest in e-commerce warehouses in the sunbelt markets.

Both are REITs, but their fundamentals are completely detached. Despite that, they will often experience high correlation in the short run as if they were running similar businesses.

YCHARTS

When the REIT market sells off, they often all drop, whether it makes sense or not, and as you can imagine… this often leads to compelling buying opportunities.

Today, REITs are out-of-favor because the market fears that the rising interest rates will negatively impact their future profitability. This is a fair concern for those REITs that use a lot of leverage, but what about those REITs that have conservative balance sheets with little debt?

You would expect those to suffer less volatility, but contrary to all logic, they have dropped just as much, and in some cases, even more than the average of the REIT sector.

In what follows, we highlight 2 such REITs that are now steeply undervalued after having dropped heavily in 2022 for no good reason. They were simply lumped in with the rest of the REIT market, but their fundamentals are a lot more resilient and their valuations have now become very opportunistic to long-term oriented investors:

EastGroup Properties (EGP)

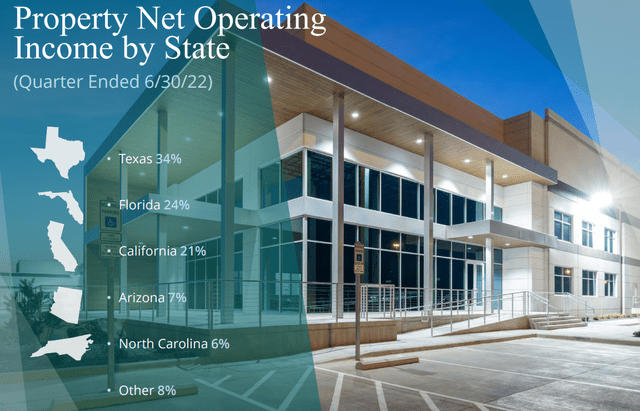

EGP is a leading industrial REIT that specializes in urban warehouses and distribution centers in rapidly growing sunbelt markets, mainly in Florida and Texas:

These are very attractive properties because they are located in in-fill, urban locations that are hard to replicate. We aren’t making any more land, but there is growing demand for the best urban, industrial locations. This is particularly true in cities like Austin and Miami. As a result, EGP enjoys high barriers to entry and strong bargaining power with its tenants.

For the first time in its history, EGP’s occupancy rate just surpassed 99% in the last quarter, new leases keep getting signed with large 20%+ rent bumps, and EGP is now accelerating its development pipeline to meet the growing demand.

This has led to 13.3% FFO per share growth so far in 2022 and the company has guided for the strong growth to continue.

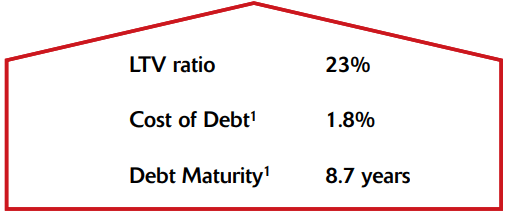

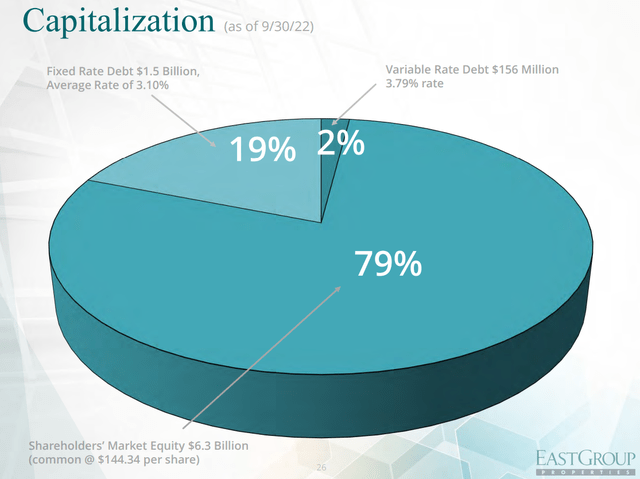

What’s more… EGP has one of the least leveraged balance sheets in the entire REIT sector. Its LTV is just 19% based on the current share price of the company, and since it trades at a discount to NAV, the real LTV is closer to ~14% based on our estimates of property values:

In any case, that’s extremely low and EGP is not facing any issues related to the rising interest rates. In fact, it just hiked its dividend by another 13.6%!

Despite that, its share price is down very heavily in 2022, even more so than the rest of the REIT market:

Was it overvalued prior to the sell-off? No, it wasn’t. It was reasonably valued in our opinion, and as a result, it has now become deeply undervalued, trading at just 19x FFO and an estimated 35% discount to NAV. This is too low for a REIT with such assets, such rapid growth prospects, and such a balance sheet. It appears that the market really soured on EGP because of statements made by Amazon (AMZN), which is slowing down its leasing of industrial space, but Amazon only represents 2% of EGP’s portfolio and it never suggested that it would move out of these properties.

We expect 50%+ upside, and while we wait, we earn a rapidly growing 3.7% dividend yield.

In many ways, SEGRO is very similar to EGP, but the main difference is that it focuses on the UK and Europe.

It also focuses on urban, in-fill, last-mile distribution centers.

Segro

It also has a strong balance sheet with a low 23% LTV and no significant maturities in years:

Segro

It has also been growing rapidly. In fact, it has been growing even faster than EGP over the years, and its FFO per share is up 13% so far this year.

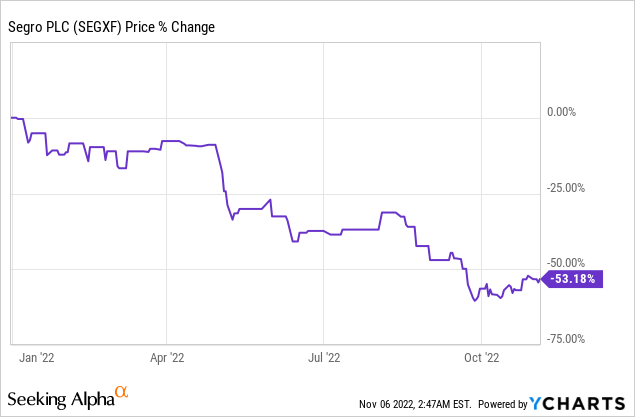

And despite that, its share price is down 53% year-to-date!

SEGRO is down even more than EGP because it is a British REIT and Europe is today out of favor due to the war in Ukraine, the energy crisis that it created, and the likely recession that they will face in the near-term.

But what the market appears to have ignored is that SEGRO’s rents are already deeply below market because its historically long leases have prevented it from hiking rents. Now, its leases are gradually expiring, which allows SEGRO to push for large rent bumps. This explains why its cash flow is up 13% in 2022, despite the tough economic environment.

A severe recession could of course slow down its growth in the near term, but recessions typically don’t last for longer than a year or two and companies should be valued based on decades of expected cash flow, not a year or two.

Therefore, we think that the recent repricing of the stock is way overdone. The company is now priced at a 40% discount to NAV, which is truly expectational given that the company still traded at a premium to NAV earlier this year.

Just to return to its NAV, the share price would need to rise by 80%, and even ignoring any upside from repricing, SEGRO is set to deliver double-digit total returns from its 3.5% dividend and its path to double-digit annual growth.

Bottom Line

Some REITs have dropped way too low way too fast and now offer you the chance to buy real estate at a steep discount to fair value.

EGP and SEGRO both own high-quality real estate that’s enjoying rapid growth and they have conservative balance sheets with very little debt. Despite that, they are now priced at just 60-70 cents on the dollar, a historically large discount that will only grow larger as they keep growing their cash flow.

We think that these are historic buying opportunities. It won’t be long before private equity players like Blackstone (BX) come along and take these REITs private if the market fails to reprice them at more reasonable valuations.

We are buying these opportunities hand over fist while they still exist.

Be the first to comment