AndreyPopov

REITs are today priced at steep discounts relative to the value of the real estate they own, and not surprisingly, private equity groups have taken notice of it and M&A is now on the rise.

This year alone, Blackstone (BX) has bought 4 REITs for a whopping total of ~$30 billion and it recently guided for many more buyouts to come:

“The best opportunities today are clearly in the public markets on the screen and that’s where we’re spending a lot of time.” – John Gray, COO of Blackstone

And Blackstone is not alone.

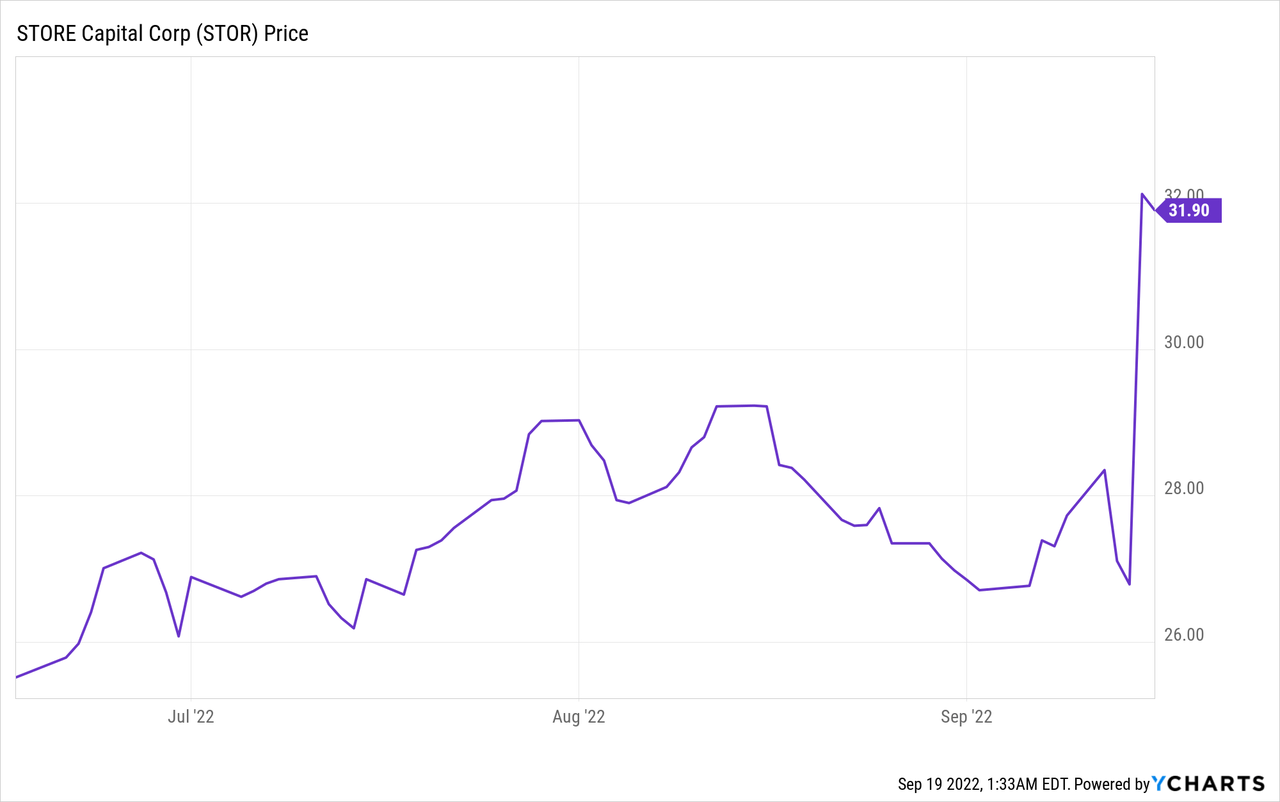

Just the other week, Blue Owl (OWL) and GIC announced that they had entered a definitive agreement to buy out STORE Capital (STOR) in a $14 billion transaction.

With many REITs still trading at large discounts to their net asset value, and private equity being flushed with cash, we think that we will witness many more acquisitions in the coming quarters.

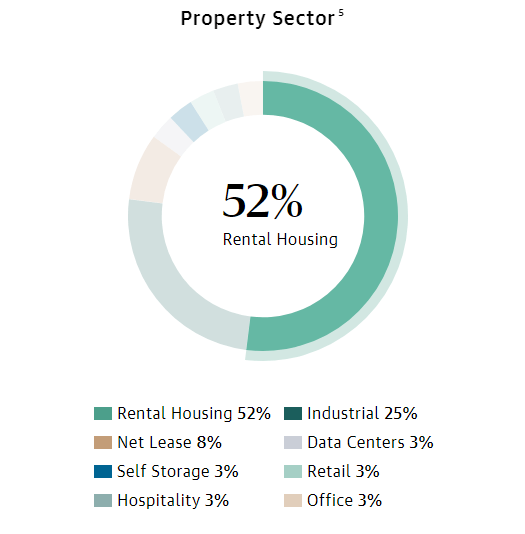

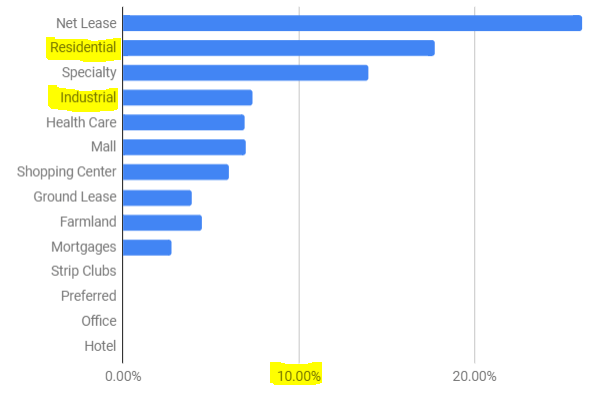

You can profit from it by buying the right REITs at the right time. Today, private equity players appear to be mainly interested in a few specific property types and those are:

This is well-reflected in Blackstone’s primary real estate investment vehicle:

Blackstone

Coincidentally (or not), these property sectors continue to enjoy rapid rent growth, and yet, they are also some of the most beaten-down sectors of the REIT market.

At High Yield Landlord, we are also heavily overweighting these two property sectors in our Core Portfolio in an attempt to profit from future M&A deals:

High Yield Landlord

We have already profited from three buyouts in 2022 (PSB, ACC, STOR) and expect many more in the coming quarters. Below we discuss two likely targets:

Boardwalk REIT (BEI.UN / OTCPK:BOWFF)

Today, most apartment REITs in the US are priced at a 10-20% discount to NAV. We think that there are many attractive opportunities in the US and some of them include AvalonBay (AVB) and BSR REIT (OTCPK:BSRTF).

But the best opportunities are abroad in this sector. Discounts to NAV are even greater with some REITs trading at 30%+ discounts to NAV.

Boardwalk REIT is a good example. It is a leading apartment REIT in Canada. It mostly invests in Class B affordable communities such as the one that you can see below:

Boardwalk REIT

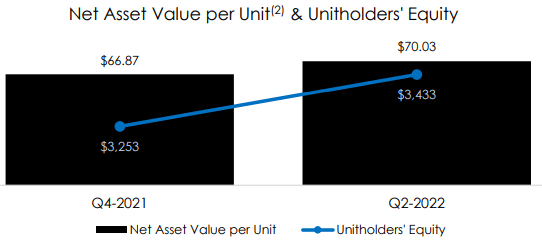

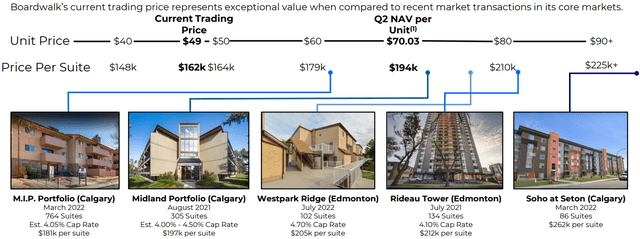

A large portion of its portfolio is located in the energy-producing regions of Canada, which are currently doing very well. Its rents, occupancy, and cash flow are all rising at a healthy pace, and the value of its assets (net of debt) just reached a new all-time high of C$70 per share.

Boardwalk REIT

In comparison, its current share price is just $49 per share, representing a whopping 30% discount.

And that’s not all. We actually think that its NAV of C$70 per share is quite conservative, and based on the latest market transactions, Boardwalk could be worth quite a bit more. They are using a 4.4% cap rate to come to this estimate, which is quite high in today’s market:

Boardwalk REIT Boardwalk REIT

Therefore, we think that Boardwalk’s NAV has further upside. Its rents continue to grow at a healthy pace and its assets, especially in the energy-producing regions, probably have some cap rate compression potential.

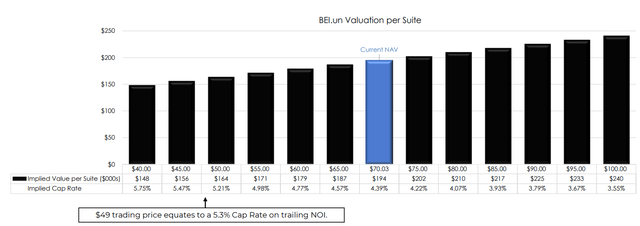

Currently, the shares trade at an implied 5.3% cap rate, which is far higher than the fair value of these assets. Private equity is commonly buying apartment communities in the 3.5-4.5% cap rate range and they would drool over a 5%+ cap rate for these assets and this is why we think that it is a likely buy-out target.

Even if they offered to buy Boardwalk at a 10% discount to NAV, it would still result in 30% upside from here.

And the great thing here is if a deal never occurs, we will do well in the long run regardless. Just between the yield and the growth, the company is on a path to delivering near double-digit annual returns, and on top of that you get a large discount and this discount will only get larger as the company’s fair value continues to rise.

High-quality REITs like Boardwalk have historically traded at a small premium to NAV. Eventually, it will get back there, whether it is thanks to a buyout or on its own.

EastGroup Properties (EGP)

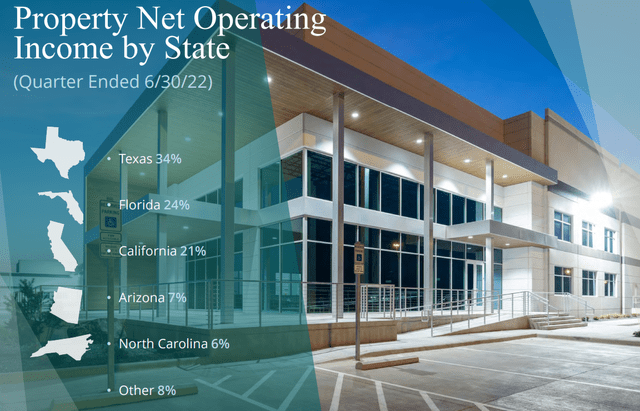

EGP is a leading industrial REIT that owns mainly in-fill warehouses and distribution centers in urban areas of major sunbelt markets.

These are some of the most desirable assets because, for one, they are less affected by new supply since they are located in supply-constrained areas, and for two, they are enjoying rapid demand growth since they are largely located in growing sunbelt markets:

EastGroup Properties

Not surprisingly, the company is doing really well.

Its new leases are being signed with 20%+ rent bumps, and with its occupancy at an all-time high at 99%+, we can expect a lot more rent growth as leases expire, and tenants have nowhere else to go.

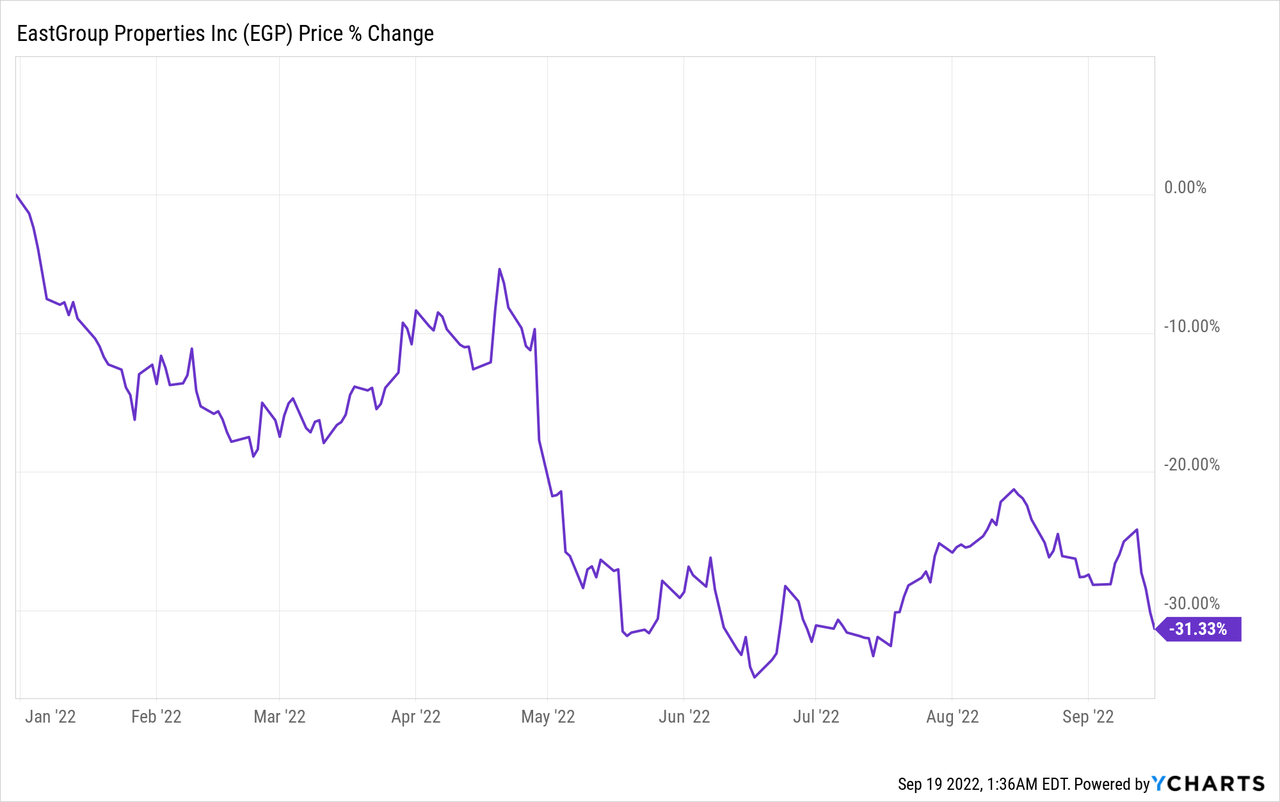

So far this year, the company’s FFO per share is up 13.6%, and this recently led to a 13.3% dividend increase. You would expect a REIT like this to be trading at near all-time highs. The company recently even hiked its full-year guidance. And yet, here’s how poorly its share price has recently performed:

It is down nearly 30% and as a result, the shares now trade at an estimated 20% discount to NAV, and this NAV is growing at a rapid pace.

It is down so much because Amazon (AMZN) is its biggest tenant and it is now scaling back its leasing of new properties. This scared off the market.

But what most investors appear to have missed is that AMZN is only 2% of EGP’s rents and its leases are 10+ years long for the most part. AMZN leased an abnormally large amount of new space in the past 2 years to prepare for its next phase of growth, but this is not reflective of the rest of the market as shown by EGP’s recent results.

Therefore, the steep sell-off is unwarranted in our opinion. Its fundamentals remain stronger than ever with cash flow rising and fair value rising at a double-digit annual growth rate and you can now buy the company at a steep discount.

These are some of the favorite properties of private equity players and the longer the share price remains at this discounted level, the greater the likelihood that EGP becomes a buyout target.

Bottom Line

We have profited from many private equity buyouts over the years and we expect to see many more deals in the coming quarters.

Be the first to comment