smshoot/iStock via Getty Images

I never think about the future – it comes soon enough. – Albert Einstein

Introduction

The stock market isn’t doing too well this year. The S&P 500 is down 24% year-to-date, which makes it the worst performance since 2009, as even the 2020 bear market was followed by a steep rally, causing the market to end the year in deep positive territory. In the past few days, I have spent a lot of time discussing market turmoil and the drivers behind what could be a nasty and lasting downtrend until the Federal Reserve pivots. In this article, we will also talk about that. However, the main reason I’m writing this article is to show you the two stocks that I aggressively added to this week, as I am a firm believer in buying stocks whenever the valuation is good. I added to two positions. The first one is Home Depot (HD), which I discussed in prior articles as well. The second stock is Norfolk Southern (NSC), one of my all-time favorite dividend growth stocks, which is now trading at a price so attractive that I simply cannot refuse to buy.

In this article, I will walk you through my thoughts and explain what else is on my radar.

So, bear with me!

A Truly Nasty Bear Market

Some people use the phrase “this time is different” in a mocking way more often than not. However, I truly believe that every single bear (and bull) market is different. While we can compare certain time periods – as I often do – it is so important to look for unique factors and market drivers more than anything else.

On September 27, I wrote a lengthy article covering the bear market, the reasons why we’re in this mess, and how we could eventually get out of it.

Essentially, we are dealing with the way governments and central banks dealt with the pandemic. We got massive monetary easing and fiscal spending like there was no tomorrow. At the same time, supply chains were structurally damaged, which means an increasing amount of money was chasing a decreasing number of goods and services.

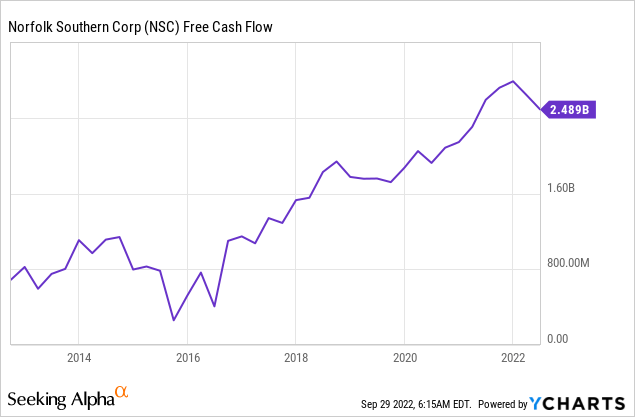

The result is sky-high inflation at levels not seen since the 1980s:

Now, the problem is that the Fed needs to react to this while the economy is slowing dramatically.

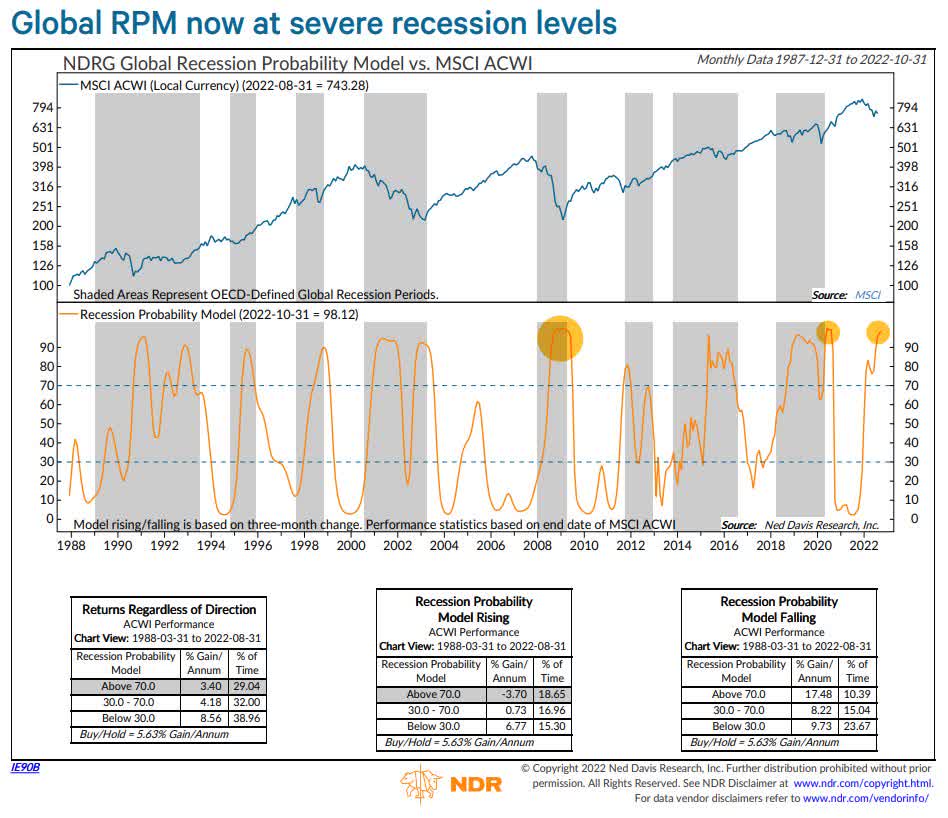

According to Ned Davis, global recession models are indicating a severe recession as the overview below shows.

Ned Davis Research

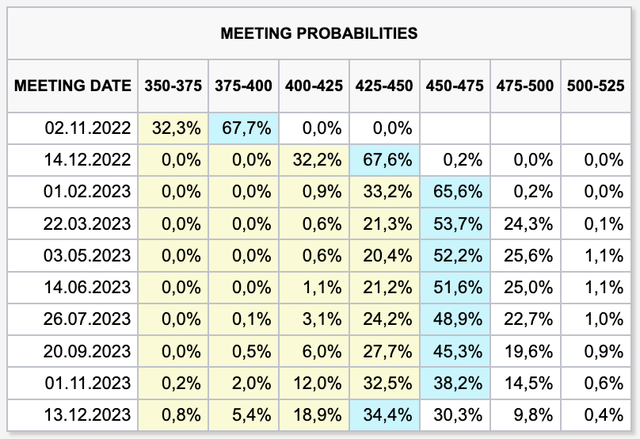

The difference, this time, is that the Fed isn’t expected to jump in to rescue the market. After all, it’s still fighting inflation. Right now, the Fed is expected to end up with a terminal rate (range) of 4.50% to 4.75% going into the first quarter of 2023. The current rate is 3.00% to 3.25%, which means we’re looking at another 150 basis points of hikes.

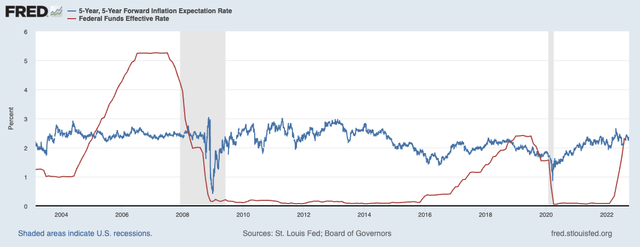

Moreover, the Fed isn’t even *that* hawkish. Historically speaking, a federal funds rate close to longer-term inflation expectations indicates a “neutral” rate. In the past, that was not enough to fight inflation and central banks often hike further than the neutral rate.

This pretty much confirms that investors and traders do not expect the Fed to step in when things get ugly.

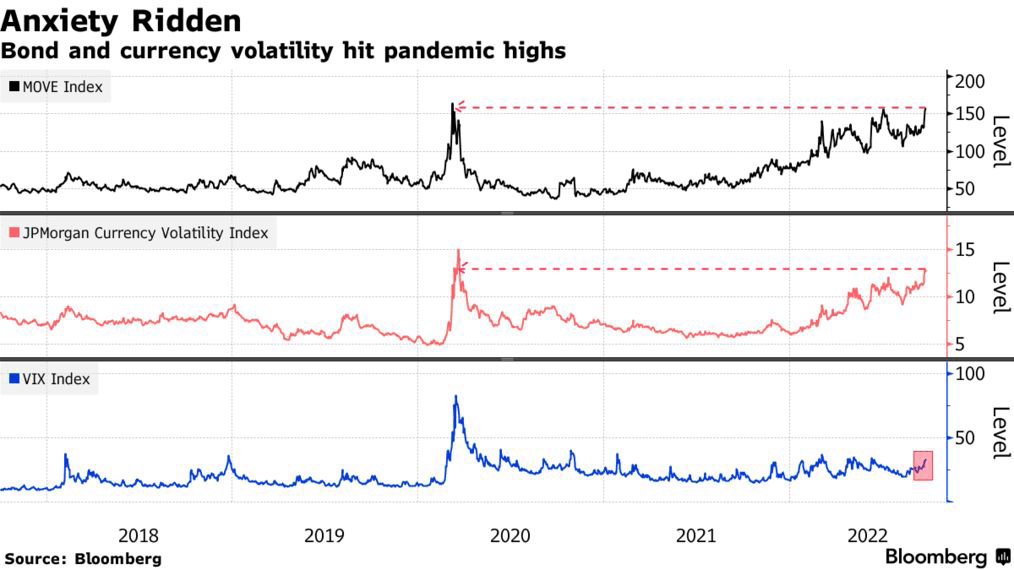

Hence, the market is currently anxiety-ridden, as Bloomberg called it the other day when it showed that bond (“MOVE”), currency, and stock price volatility were at elevated levels:

Bloomberg

Or as Max Kettner put it:

“If it’s no longer confined to just one asset class, but spreading across multiple asset classes then this is the ultimate sign of contagion,” said Max Kettner, chief multi-asset strategist at HSBC Holdings Plc. “So far the spillover into credit is missing, which is where we see most spillover risks into equities in the coming weeks and months.”

So, Why Am I Buying?

I have invested almost every penny of my net worth in long-term dividend stocks, which means I have been in a better place before, financially speaking.

However, I am far from worried. After all, everyone who invests in long-term assets signs up for this kind of stuff. I believe that on average, every investor who is in the market for at least 50 years experiences 14 bear markets.

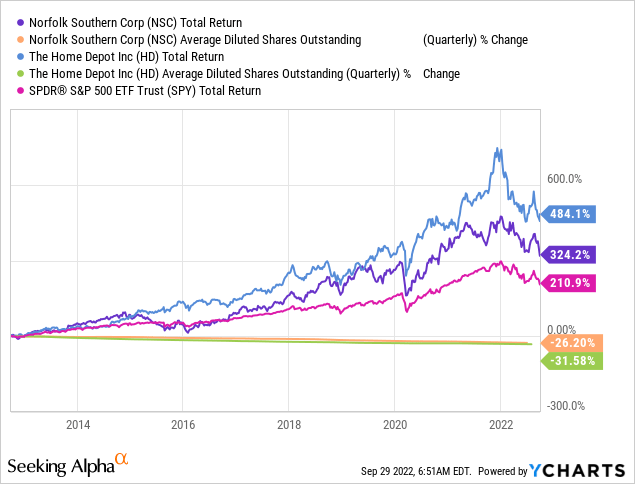

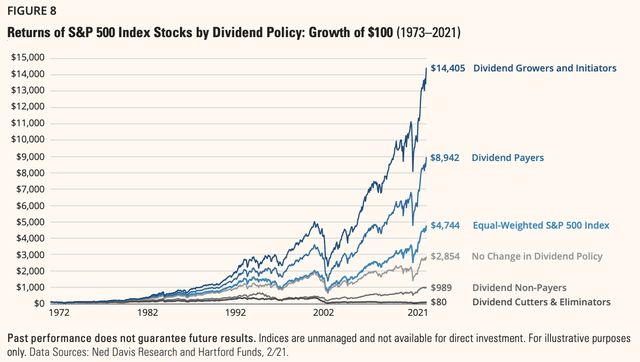

Moreover, I am a firm believer in using bear markets to one’s advantage. Bear markets allow us to buy stocks at yields that we can only dream of in bull markets. Especially high-quality dividend growth stocks that tend to outperform the market thanks to subdued volatility as the chart below shows.

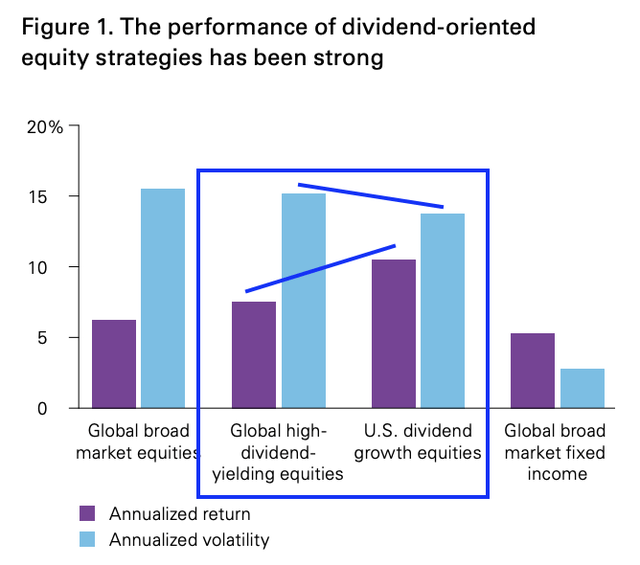

The chart below adds to this as quality-dividend growth stocks are the way to go on a long-term basis as investors tend to benefit from outperforming capital gains and lower annualized volatility.

When it comes to timing, I often buy as soon as I like the valuation. That’s my strategy because I am more “afraid” of missing the upside than buying before a stock bottoms. NSC and HD are two good examples of that as I will show you in this article.

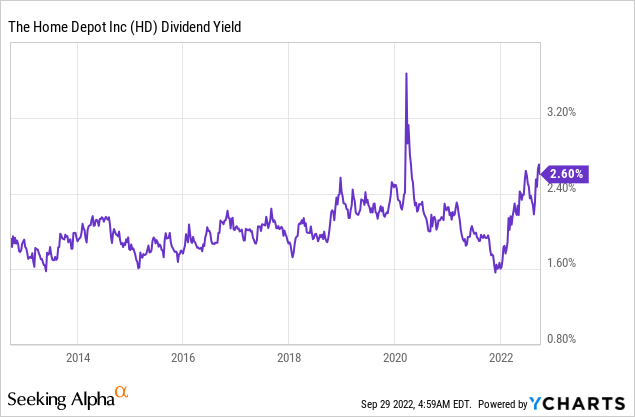

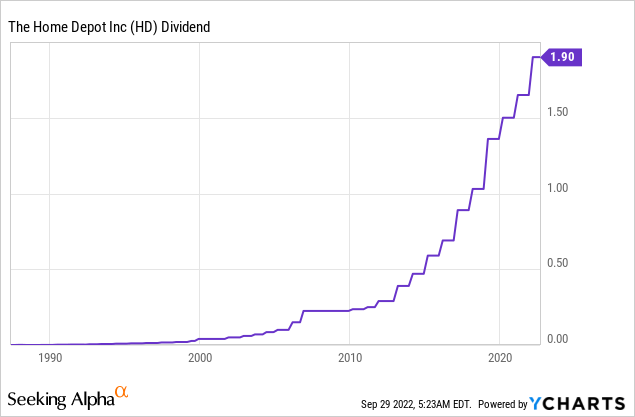

For example, Home Depot is currently yielding close to 2.70% (not 2.60% as the chart below suggests), which is the highest number in more than 10 years if we exclude the spike during the 2020 panic sell-off. Buying a dividend growth stock like HD with a yield that high is a good deal in my book. Even if I don’t manage to buy the bottom.

Now, let me elaborate on that.

What Did I Buy?

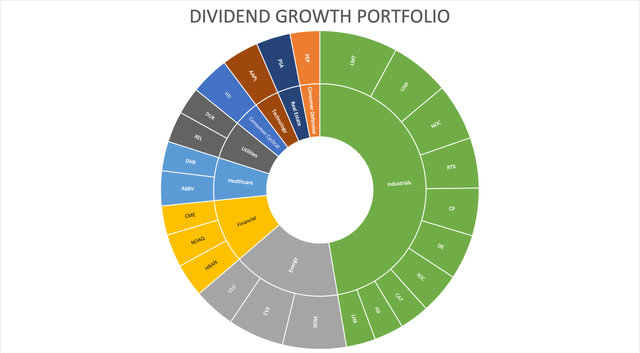

While I have been constantly reinvesting my dividends, I did buy a lot more Norfolk Southern and Home Depot this week. As the overview below shows, NSC is not my smallest industrial anymore while Home Depot has become a bit larger as well. For now, it remains my only consumer cyclical stock – although I consider Apple (AAPL) to be a consumer stock as well (it’s officially in the tech sector)

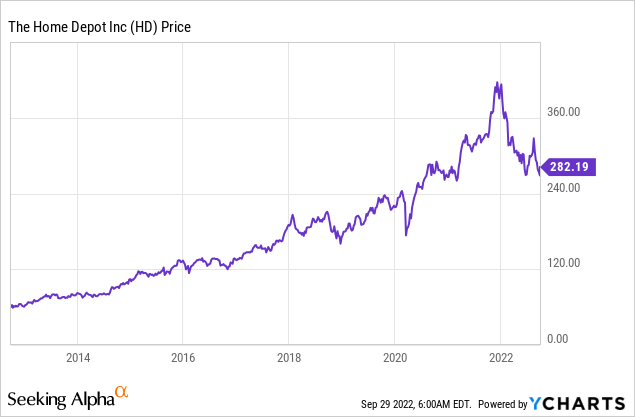

I added Norfolk at $216.36 and Home Depot at $272.09, to be precise.

As I said, I have a good feeling about these valuations as I will show you now, but I am of course far from sure that I bought the lowest price.

Home Depot

Home Depot doesn’t require a long introduction. It’s America’s largest do-it-yourself store with significant “Pro” exposure, meaning it is highly connected to the housing market and a great way to benefit from the consumer market.

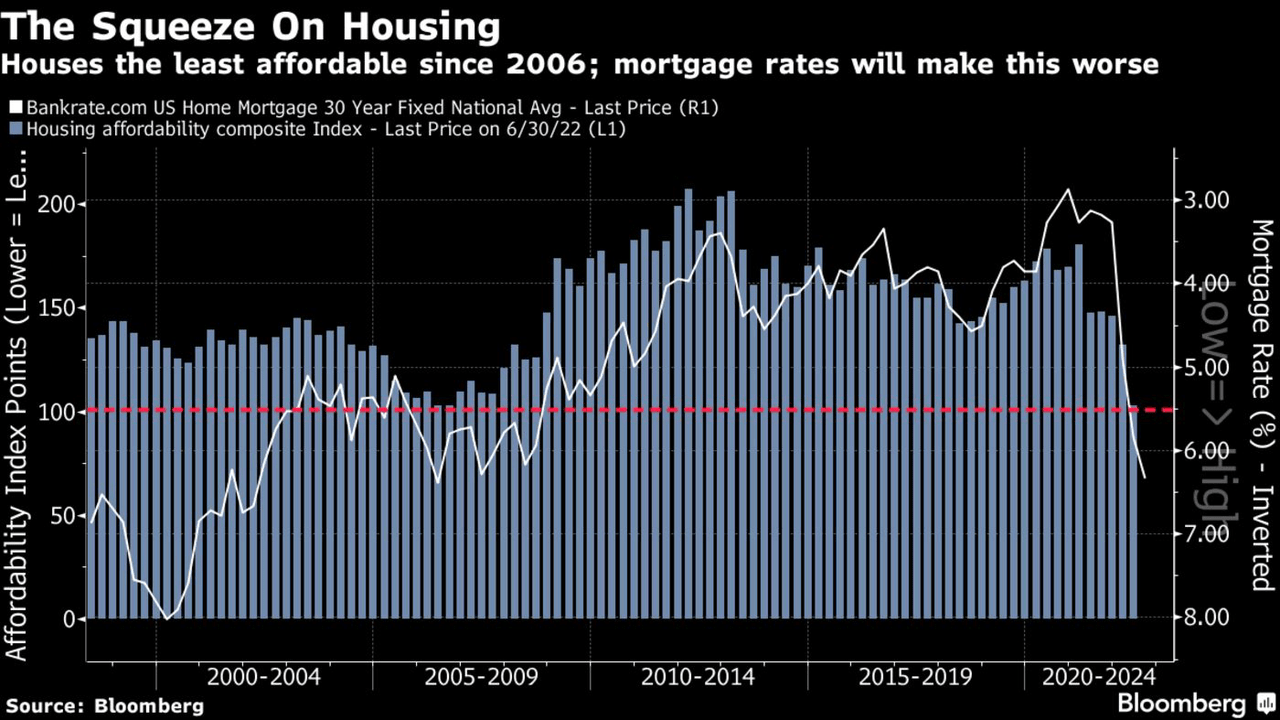

Right now, housing is in a very bad spot as I discussed in this article. Rates have gone through the roof, affordability is plunging, and home sales have gone through the gutter.

Bloomberg

“Everything” that made Home Depot a buy in the past is now a reason why we can buy it below $300. The consumer (accounting for almost 70% of GDP) is in a very bad spot due to high inflation, construction is slowing, people have finished a lot of projects at home during the pandemic, and an aggressive Fed is not giving people the feeling that they should start buying a house soon.

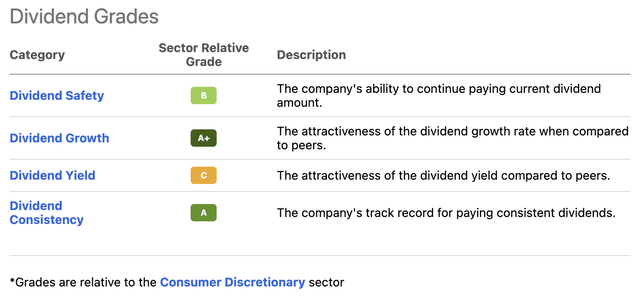

That said, thanks to the bad news, we now get to buy a stock with a beautiful dividend scorecard – provided by Seeking Alpha.

The company scores very high on growth and consistency, which is no surprise as the company is a reliable dividend payer with high dividend growth. The company did not cut its dividend in the Great Financial Crisis and has a 10-year average annual dividend growth rate of 20.3%.

The current yield is 2.70%, which means a high dividend growth rate really adds up. This is one of the reasons why I preferred to buy rather aggressively now rather than to bet that the stock might fall even further. I just could not pass on this opportunity.

These are the most “recent” hikes:

- February 2022: 15.2%

- February 2021: 10.0%

- February 2020: 10.3%

Moreover, the payout ratio remains at 47% using LTM net income.

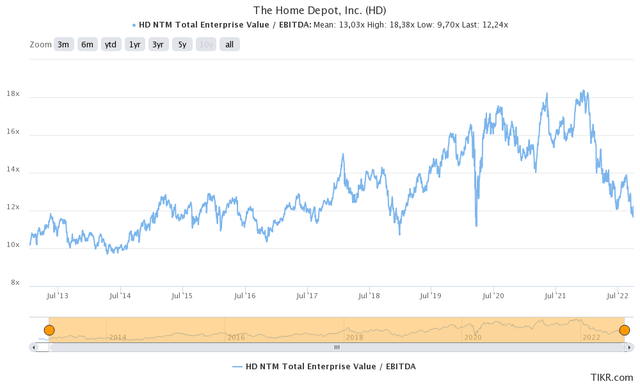

The valuation has come down a lot. Using the company’s $289 billion market cap and $40 billion in expected FY2024 (starting in February of 2023) net debt give the company a $329 billion enterprise value. That’s 12.0x FY2024E EBITDA of $27.5. Using the historic EV/EBITDA (next twelve months) valuation range, we’re now dealing with a valuation close to the pandemic lows.

Norfolk Southern

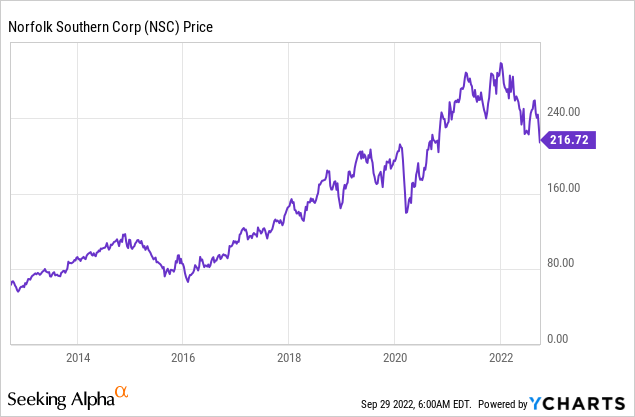

Norfolk Southern is similar, but different – if that makes sense. The railroad is dominating America’s East Coast with its larger competitor CSX Corp. (CSX).

Norfolk Southern

Norfolk Southern is an industrial company with significant consumer exposure as it not only connects America’s industrial hubs (on the East Coast) but also retailers to their suppliers. Roughly 56% of the company’s shipments are intermodal shipments, which cover containers and trailers. The company is America’s second-largest intermodal railroad behind Buffett-owned BNSF.

Essentially, Norfolk Southern is a company that does well when the economy is strong. In times of economic weakness, the stock struggles as it is impossible to avoid lower sales when companies reduce output.

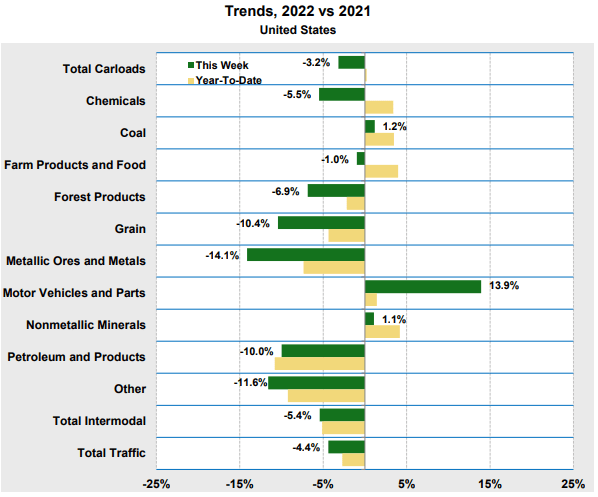

Right now, total traffic is down roughly 4.4% as only automotive shipments are rising due to slowly easing supply chain problems, allowing producers to turn backlog into finished vehicles.

Seeking Alpha

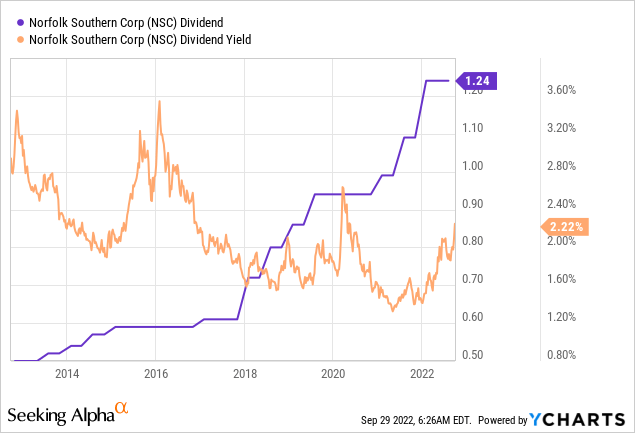

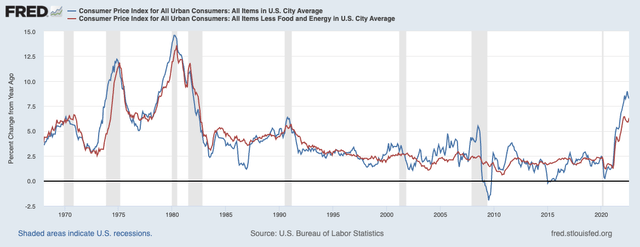

However, Norfolk Southern has strong pricing power and consistently rising operating efficiency, which is boosting free cash flow used to buy back stock and aggressively hike its dividend.

Norfolk Southern currently pays a $1.24 per quarter dividend. That’s $4.96 per share per year. This puts the yield at 2.3% yield, which is now slightly above the four-year average.

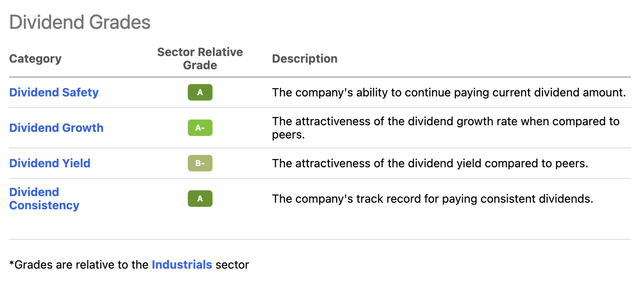

Just like Home Depot, Norfolk Southern has a very attractive dividend scorecard. In this case, relative to the industrial sector.

Over the past 10 years, the average annual dividend growth has been 9.9%.

The most “recent” hikes are:

- January 2022: 13.8%

- July 2021: 10.1%

- January 2021: 5.3%

- July 2019: 9.0%

The payout ratio is 40% using earnings of the past 12 months.

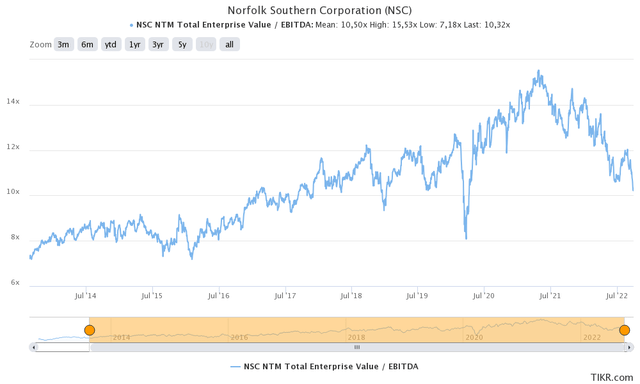

Moreover, the valuation has come down a lot as it erases the entire valuation increase since early 2018.

The company is now trading at 10.4x 2023E EBITDA of $6.3 billion using the implied enterprise value of $66.0 billion. This consists of a market cap close to $51 billion, $14.5 billion in expected 2023 net debt, and pension liabilities close to $600 million.

Moreover, both NSC and HD have healthy balance sheets with net leverage ratios of 2.3x EBITDA, and 1.5x EBITDA, respectively. So, even if economic growth continues to plummet, neither of these companies will likely run into financial trouble.

It also helps that both companies are consistently repurchasing shares, which is further fueling long-term outperformance.

Takeaway

The market is in turmoil. Economic growth is slowing and the Fed is making things worse as it needs to fight stubborn inflation at levels not seen since the 1980s. As a result, we’re now in a bear market with volatility in every major asset class.

Yet, as I’m a long-term investor, I do like that the market presents us with opportunities we wouldn’t get in a bull market.

In this article, I focused on two stocks that I added to quite aggressively this week. Consumer-focused Home Depot and railroad giant Norfolk Southern.

Both stocks offer satisfying dividend yields with high (expected) long-term dividend growth. Dividend growth is supported by solid business models that generate enough cash in recessions to support moderate growth and enough cash in strong economic markets to fuel double-digit dividend growth.

It also helps that both stocks engage in buybacks, which is paving the road for long-term outperformance.

While I am not sure if the market has bottomed, I do like the valuation of both and believe that NSC and HD are great tools to generate a lot of long-term wealth.

If the market keeps dipping, I will continue to buy to average down.

**On a side note, please let me know in the comment section if you like articles that cover more than 1 dividend stock. If there’s enough demand, we can build on this and add the top investments in each industry and work on different strategies.**

(Dis)agree? Let me know in the comments!

Be the first to comment