Hulton Archive/Hulton Archive via Getty Images

Co-produced with Treading Softly

The world often fights against change. The more radical the shift, the more you see forces opposing it for a myriad of reasons. For some, it’s simply the sake of comfort, they hate to do something different. For others, it’s the risk that change brings to their power, control, or finances.

I am brought back in history to a discussion between Napoleon and Robert Fulton. Fulton, the inventor of steam-powered ships, was trying to sell the idea to the famed General. An excerpt from Weird History 101: Tales of Intrigue, Mayhem, and Outrageous Behavior by John Richard Stephens tells the story like this:

After Robert Fulton, the so-called inventor of the steam engine, mentioned his idea of a steamship to Napoleon, the French emperor exclaimed, “What, Sir? Would you make a ship sail against the wind and currents by lighting a bonfire under her deck? I pray you excuse me, I have no time to listen to such nonsense.”

Napoleon rejected the revolutionary idea out of hand. It seemed like a farce on its face. Eventually, steam-powered ships would revolutionize how humanity braved the seas. Yet, one of history’s greatest Generals could not imagine this working.

When it comes to our retirements, many great men have had great ideas. Whatever your investing style is, you can point to successful investors, past and present, who offer sage advice that supports your method. Often, the advice is conflicting.

Do you make the “trend your friend” and avoid stocks that have fallen or are you contrarian and “buy when there is blood in the streets”? Do you “buy low and sell high” or do you “buy and hold for the long-term”? Do you “cut your losses” or do you “average down”? Do you “take your profits” or do you “let your winners run”?

In the end, you need to figure out what will work best for you and your situation. For over 5300 members of High Dividend Opportunities, income investing via our Income Method has revolutionized their retirements and portfolios.

For decades, the common refrain from retirement advisors is that you need to build up $1 million, $2 million, $5 million in portfolio value and then fund your retirement by selling off shares. The Income Method takes a very different approach, one that many dismiss out of hand. Instead of focusing on the price of the market at any given moment, we focus on the income generation potential our portfolios have.

Today, we want to share two amazing dividends that can help make your portfolio income something new and powerful. Like adding steam power to a ship, these picks can add the ability to face strong winds and stormy seas head-on, without losing ground. The winds will blow the market up or down, we don’t care because our engine is pushing our incomes up!

Let’s dive in.

Pick #1: ATAX – Yield 7.4%

America First Multifamily Investors, L.P. (ATAX) is a unique partnership that invests in residential multi-family real estate through two segments:

- Buying “mortgage revenue bonds” or MRBs, which are first-lien mortgages secured by properties that have an affordable housing component. ATAX buys and holds to collect the interest.

- Investing in new construction with a developer partner through their “Vantage” joint venture. The venture builds the properties, leases them up, and then sells them to other investors as fully leased properties. Although there is some revenue from rent collections during the lease-up period, the bulk of ATAX’s gain comes from the sale of properties.

ATAX also directly owns two student housing properties, but they are a minor contributor to results. Let’s take a closer look at ATAX’s two main sources of gains.

Supplemental Financial Report for the Quarter Ended December 31, 2021

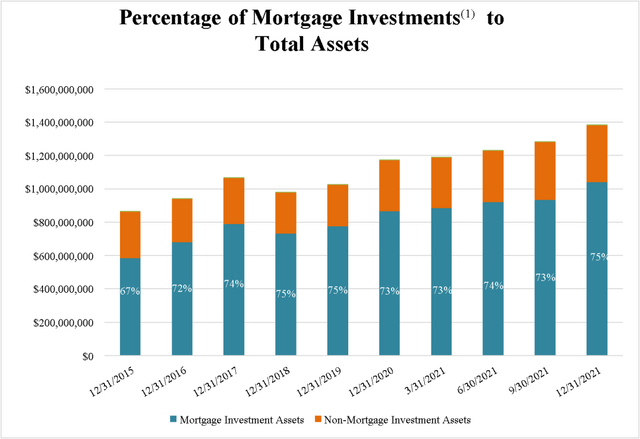

Three-quarters of ATAX’s assets are mortgage investments. Primarily “MRBs” with a few “government issuer loans” which have a different name for essentially the same thing. These are loans that are issued by state housing agencies in order to encourage the development of subsidized housing.

As an additional incentive for investors, the interest on these mortgages is tax-exempt at the Federal level and in most states. This is a benefit that ATAX passes along to investors through its partnership structure. In 2020, the result was that 100% of income was tax-exempt, though, in “normal” years, the tax-exempt portion of the distributions has run 30-40%.

Supplemental Financial Report for the Quarter Ended December 31, 2021

The taxable loss in 2020 is due primarily to net rental real estate losses that exceeded gains on sale for tax purposes during the year related to the Partnership’s investment in unconsolidated entities. – Supplemental Financial Report

MRBs have proven to be reliable investments over the years as defaults have been rare and cash flow has been consistent. Thanks to the significant strength in multi-family real estate, this niche will continue to be a source of steady and reliable profits for ATAX.

The Vantage properties that ATAX invests in have been very profitable, however since most of the gain is realized when the properties are sold it is very lumpy.

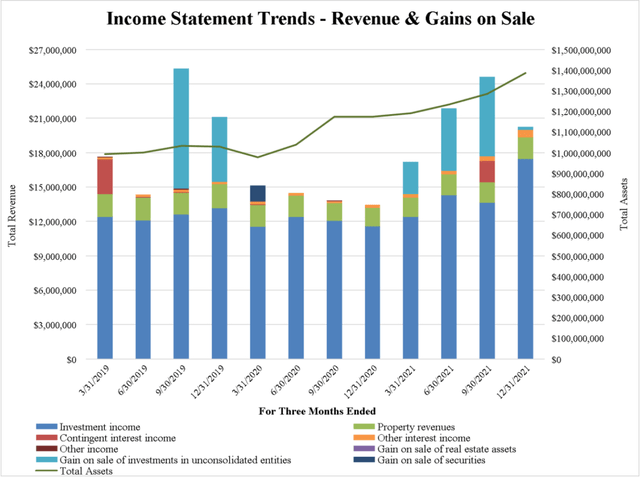

The following slide displays a lot of information, it shows ATAX’s income based on type each quarter. Focus on the lighter blue color that is at the top of some quarters like September 2019. These are the gains on sale for their Vantage properties.

Supplemental Financial Report for the Quarter Ended December 31, 2021

As you can see, in some quarters it is very high, other quarters there is none because ATAX didn’t sell a property. The distribution was cut in 2020 as ATAX decided not to sell any properties. The management made the decision that it was better to hold the properties and wait for the real estate market to recover than to try to sell the properties for smaller gains in a market impacted by COVID.

This was exactly the right decision, as the real estate market is very hot right now. ATAX recently announced a sale of their Vantage at Murfreesboro property which resulted in a $16.5 million gain on a $12.2 million investment in 2018, plus $658,000 investment income from collected rents. ATAX had approximately a 140% total return on investment in just 3.5 years! The tangible benefit for investors is $0.20/unit ($0.60 post-split) in CAD (Cash available for distribution), ATAX generally seeks to distribute 100% of CAD.

Last year, ATAX opted to pay out a special distribution at the end of the year to distribute proceeds from the Vantage sales in 2021. We expect them to follow a similar strategy in 2022. ATAX has another 5 properties that are already leased up, or will likely be leased up by year-end, meaning we could see several more property sales with large gains in 2022. This year is going to be huge for ATAX, primarily due to the large number of Vantage properties that are ready to be sold in a hot real estate market. They decided to hold through 2020, and now they have an above-average number of properties to sell when demand is high!

Pick #2: MPW – Yield 5.5%

For 2022, we expect Medical Properties Trust (MPW) to focus on its balance sheet. Moody’s has updated its outlook to “positive” in 2021 for a potential one to two-notch upgrade. This would make MPW an “investment grade” rated company, which would be very meaningful for MPW’s cost of debt.

The two largest negatives that Moody’s noted are tenant concentration and debt/EBITDA. Specifically, Moody’s wants to see Steward making up “closer to 20%” of MPW’s assets and debt/EBITDA under 6.0x. MPW has two large transactions that will cause MPW to get much closer to both of these targets.

The first is a portfolio sale to Macquarie, which recently closed, resulting in $1.3 billion in proceeds to MPW that it intends to use to deleverage. MPW will retain a 50% interest in the properties.

The second is a transaction where HCA Healthcare will acquire the operations at 5 hospitals currently run by Steward. HCA will sign a new lease with MPW at substantially similar terms as Steward has. This transaction is expected to close in Q2.

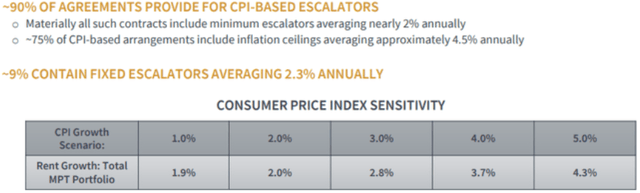

Additionally, MPW will benefit in the coming years from rising inflation as the majority of its leases have escalators tied to CPI.

June 2021 Investor Presentation

The bottom line is that we can expect MPW to pull its horns on growth for a bit as it focuses on digesting its current acquisitions, realizes some gains on older properties, and deleverages. If MPW acquires any new properties, we expect them to do so primarily with equity, either by reinvesting capital from realized gains or from issuing new shares. The priority right now should be trying to get an investment-grade rating by year-end, which in the long term will provide significant gains for the company and shareholders.

Fortunately, it is a great time to slow down because high inflation will drive organic internal growth. Rents will rise, expenses will stay down and AFFO will continue to rise even without new acquisitions. MPW is currently yielding 5.5%, with a dividend growth rate of about 4% over the past 5 years. With higher inflation, we expect that dividend growth will accelerate in the coming years, especially if MPW succeeds in getting an investment-grade credit rating.

Getty

Conclusion

When it comes to adding power to your portfolio, MPW and ATAX offer excellent means of doing so. They operate in sectors that generate income in good times and bad by being part of essential elements of our economy and the fabric of our society. We all need medical care, we all need a place to rest our heads.

When it comes to building an income portfolio or supercharging your portfolio’s income-generating ability, taking small steps to assemble the perfect, well-oiled income-generating machine is important. As you invest in companies that produce ample dividends, you’ll find that you have money flowing into your brokerage account constantly. That makes it easy to reinvest a portion of your dividends and keep your portfolio’s income growing every month.

Once you see your income growing rapidly, you will feel more confident, and ready to face the challenges of the market head-on. You don’t have to worry about whether the market is in a good mood or bad mood. You’ll know that your portfolio is producing the income you need.

You have the choice of deciding how you want your retirement to play out. That’s up to you! Which is exciting and terrifying all at once. You can pawn off the responsibility to another, but in the end, regardless of their management or mismanagement of your funds, you get the results – for better or worse! For this reason, I take ownership of my portfolio and aim it squarely at producing excellent income.

What will you do? Will you revolutionize your portfolio one excellent dividend-paying security at a time, or will you follow another path and hope for the best? Either way, I want you to see success. I can tell you that income investing is a surefire way to find the success that others and you are looking for.

Be the first to comment