ugurhan

Earnings of 1st Source Corporation (NASDAQ:SRCE) will likely be flattish this year and the next. The growth of specialty finance loans will likely be a key driver of earnings growth next year. Further, earnings will benefit from the lagged repricing of fixed-rate loans. Overall, I’m expecting 1st Source Corporation to report earnings of $4.82 per share for 2022 and $4.87 per share for 2023. Compared to my last report on the company, I’ve raised my earnings estimates for both years as I’ve revised my margin and loan estimates. Next year’s target price is quite close to the current market price. Therefore, I’m downgrading 1st Source Corporation to a hold rating.

Loan Growth To Slow Down To The Historic Rate

1st Source Corporation’s loan growth continued to gather pace in the third quarter, which positively surprised me. The portfolio grew by 3.8% in the third quarter, leading to 9-month growth of 7.8% or 10% annualized.

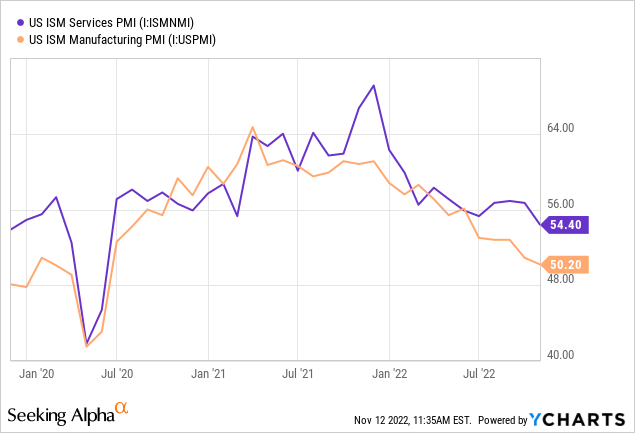

Around half of 1st Source Corporation’s loans are in the community banking segment while half are in specialty finance. The outlook for community banking loans isn’t too bright because of the high-interest rates. Residential mortgages are especially vulnerable to borrowing costs as home buyers can delay purchases. On the other hand, the outlook for specialty finance is better. This segment includes loans for aircraft, trucks, etc.; therefore, their demand depends more on economic activity than on costs that can be passed on. For specialty finance loans, the Purchasing Managers Index (“PMI”) is a good gauge of demand. The manufacturing PMI index is still in the expansionary territory (above 50), though it’s barely hanging on. Services PMI is in better shape, as shown below.

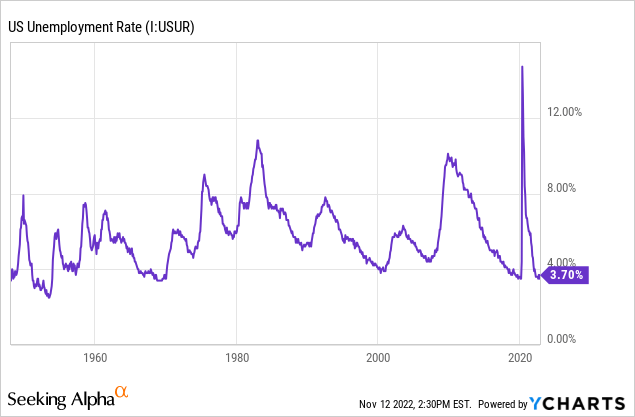

Another reason why I’m hopeful about the specialty finance segment is the extraordinary labor market. As shown below, the unemployment rate hasn’t been this low in decades.

Within the specialty finance segment, I’m particularly positive about solar loans, which made up about 6% of total loans at the end of September 2022, according to details given in the 10-Q filing. I’m expecting these loans to continue to surge in the coming quarters as the economy continues to shift towards sustainable and renewable energy.

Considering these factors, I’m expecting loan growth to decline to the lower end of the historical range over the next few quarters. I’m expecting the loan portfolio to grow by 2% in the last quarter of 2022, leading to full-year loan growth of 10%. For 2023, I’m expecting the loan portfolio to grow by 5%. In my last report on 1st Source Corporation, I estimated loan growth of 5.9% for 2022 and 4.1% for 2023. I’ve raised my loan growth estimates because of the performance in the third quarter which beat my expectations. The performance has made it evident that I underestimated the management’s capabilities before.

Meanwhile, I’m expecting deposits to grow in line with loans. Other balance sheet items will likely trail loan growth. The following table shows my balance sheet estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |

| Financial Position | ||||||

| Net Loans | 4,735 | 4,974 | 5,349 | 5,219 | 5,739 | 6,031 |

| Growth of Net Loans | 6.8% | 5.1% | 7.5% | (2.4)% | 10.0% | 5.1% |

| Other Earning Assets | 1,034 | 1,105 | 1,394 | 2,374 | 1,879 | 1,955 |

| Deposits | 5,122 | 5,357 | 5,946 | 6,679 | 6,754 | 7,098 |

| Borrowings and Sub-Debt | 329 | 276 | 291 | 330 | 451 | 470 |

| Common equity | 762 | 828 | 887 | 916 | 798 | 856 |

| Book Value Per Share ($) | 29.4 | 32.4 | 34.7 | 37.0 | 32.4 | 34.7 |

| Tangible BVPS ($) | 26.1 | 29.1 | 31.5 | 33.6 | 29.0 | 31.3 |

| Source: SEC Filings, Author’s Estimates(In USD million unless otherwise specified) | ||||||

Further Margin Expansion Ahead Due To Slow Repricing Of Loans

1st Source Corporation’s net interest margin expanded by a remarkable 28 basis points in the third quarter, up from the 15-basis points expansion in the second quarter of the year. This is quite an achievement given the characteristics of the loan book. 1st Source Corporation’s loan portfolio is slow to reprice, as fixed-rate loans make up 63% of total loans and variable-rate loans make up 37% of total loans, as mentioned in the second quarter’s presentation (the third quarter’s presentation hasn’t been released yet). On the other hand, deposits are quicker to reprice as interest-bearing demand and savings accounts make up around 57% of total deposits.

On the plus side, fixed-rate loans had an average life of only 2.6 years remaining at the end of June; therefore, a large part of the portfolio can be expected to reprice in 2023. Due to these repricing characteristics, I believe the margin expansion will continue throughout 2023 even though the up-rate cycle will most probably end by the mid of next year.

Considering these factors, I’m expecting the margin to grow by 5 basis points in the last quarter of 2022 and 16 basis points in 2023. Compared to my last report on the company, I’ve raised my margin estimates for all quarters till the end of 2023 because my outlook on interest rates is more hawkish than before.

Expecting Earnings To Be Flattish

The anticipated loan growth and margin expansion discussed above will act as the key catalysts for earnings through the end of 2023. On the other hand, a commensurate increase in operating expenses will restrict earnings growth. Meanwhile, the provisioning for expected loan losses will likely remain at a normal level. I’m expecting the net provision expense to make up 0.30% of total loans in 2023, which is the same as the average for the last five years.

Overall, I’m expecting 1st Source Corporation to report earnings of $4.82 per share for 2022, up by just 3% year-over-year. For 2023, I’m expecting earnings to grow by just 1% to $4.87 per share. The following table shows my income statement estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |

| Income Statement | ||||||

| Net interest income | 214 | 224 | 226 | 237 | 263 | 298 |

| Provision for loan losses | 19 | 16 | 36 | (4) | 12 | 18 |

| Non-interest income | 97 | 101 | 104 | 100 | 90 | 87 |

| Non-interest expense | 186 | 189 | 187 | 186 | 185 | 209 |

| Net income – Common Sh. | 82 | 92 | 81 | 118 | 119 | 120 |

| EPS – Diluted ($) | 3.16 | 3.57 | 3.17 | 4.70 | 4.82 | 4.87 |

| Source: SEC Filings, Author’s Estimates(In USD million unless otherwise specified) | ||||||

In my last report on 1st Source Corporation, I estimated earnings of $4.58 per share for 2022 and $4.68 per share for 2023. I’ve raised my earnings estimate as I’ve revised upwards both my loan and margin estimates.

My estimates are based on certain macroeconomic assumptions that may not come to pass. Therefore, actual earnings can differ materially from my estimates.

Downgrading To A Hold Rating

1st Source has been increasing its dividend every year since 2017. Given the earnings outlook, I’m expecting the company to increase its dividend by $0.02 per share to $0.34 per share in the third quarter of 2023. The earnings and dividend estimates suggest a payout ratio of 27% for 2023, which is close to the five-year average of 30%. Based on my dividend estimate, 1st Source is offering a forward dividend yield of 2.3%.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value 1st Source. The stock has traded at an average P/TB ratio of 1.54 in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| T. Book Value per Share ($) | 26.1 | 29.1 | 31.5 | 33.6 | ||

| Average Market Price ($) | 51.8 | 46.7 | 36.6 | 46.7 | ||

| Historical P/TB | 1.98x | 1.61x | 1.16x | 1.39x | 1.54x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $31.3 gives a target price of $48.1 for the end of 2023. This price target implies a 15.7% downside from the November 11 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.34x | 1.44x | 1.54x | 1.64x | 1.74x |

| TBVPS – Dec 2023 ($) | 31.3 | 31.3 | 31.3 | 31.3 | 31.3 |

| Target Price ($) | 41.8 | 44.9 | 48.1 | 51.2 | 54.3 |

| Market Price ($) | 57.0 | 57.0 | 57.0 | 57.0 | 57.0 |

| Upside/(Downside) | (26.7)% | (21.2)% | (15.7)% | (10.2)% | (4.7)% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 12.7x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| Earnings per Share ($) | 3.2 | 3.6 | 3.2 | 4.7 | ||

| Average Market Price ($) | 51.8 | 46.7 | 36.6 | 46.7 | ||

| Historical P/E | 16.4x | 13.1x | 11.5x | 9.9x | 12.7x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $4.87 gives a target price of $62.1 for the end of 2023. This price target implies a 9.0% upside from the November 11 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 10.7x | 11.7x | 12.7x | 13.7x | 14.7x |

| EPS 2023 ($) | 4.87 | 4.87 | 4.87 | 4.87 | 4.87 |

| Target Price ($) | 52.4 | 57.2 | 62.1 | 67.0 | 71.9 |

| Market Price ($) | 57.0 | 57.0 | 57.0 | 57.0 | 57.0 |

| Upside/(Downside) | (8.1)% | 0.4% | 9.0% | 17.5% | 26.1% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $55.1, which implies a 3.3% downside from the current market price. Adding the forward dividend yield gives a total expected return of negative 1.0%.

In my last report, I determined a target price of $54.4 for December 2022 and adopted a buy rating. Since then, the stock price has rallied, leaving a small downside to next year’s target price. Therefore, I’m now downgrading 1st Source Corporation to a hold rating.

Be the first to comment