Carsten Koall

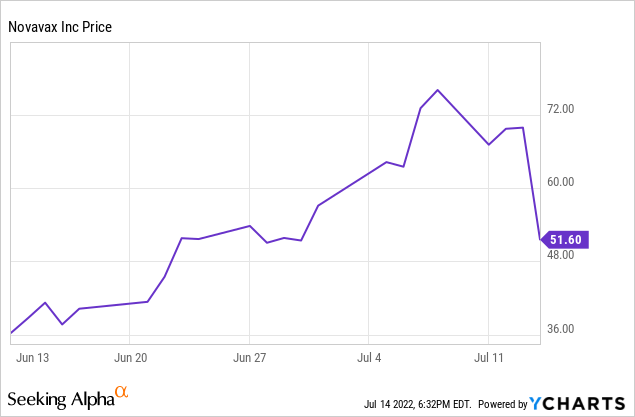

Novavax, Inc. (NASDAQ:NVAX) has waited years for FDA Emergency Use Authorization of its Covid-19 vaccine (recombinant, adjuvanted) for use in adults 18 and over in the United States. This news paired with a revised label in Europe resulted in a massive sell-off in the stock after Novavax had pretty much doubled off of recent lows the last month. As short-term traders flee the stock with impressive volume, opportunity potentially awaits those who can take a long-term view of the stock and its upside.

1. Impressive Volatility In The Stock

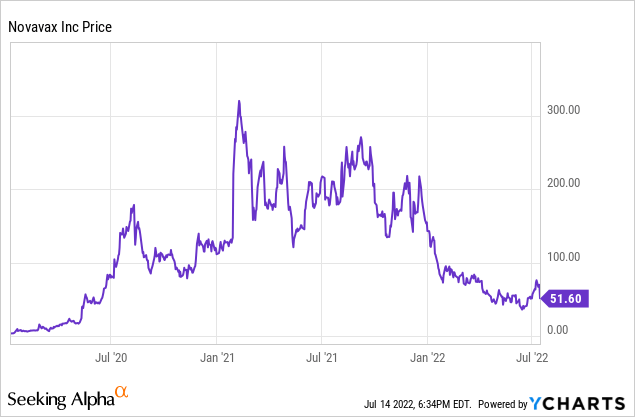

Novavax’s stock continues to trade in large swings as this ~$4B market cap small company can make major daily moves relatively easily as its float consists of only ~77.9 million shares. Here is a look at what the stock has looked like over the past couple of years as it vied with the other major vaccine producers to be the first to market a Covid-19 vaccine.

Novavax’s stock has traded from mere single digits to over $300 a share over the last couple of years as the company’s prospects rapidly changed over time. Novavax’s FDA conditional approval markedly closes the gap between itself and the first three companies to the U.S. Covid-19 vaccine market in Pfizer (PFE), Moderna (MRNA), and Johnson & Johnson (JNJ). Still, with this accomplishment, it remains only a fraction of the others market caps.

This gives Novavax huge potential, in my opinion, to grow its market cap in the coming years if it can rise from the bottom of the heap to the middle of the pack in growing its global and U.S. sales.

2. Novavax Is Already Cash Flow Positive

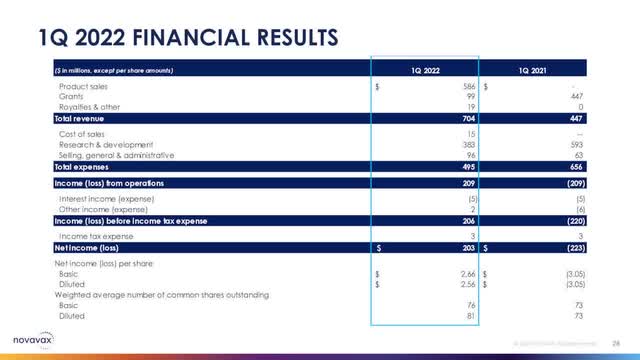

According to Novavax’s latest earnings report, it became cash flow positive for the first time last quarter. It recorded ~$203M in net income based on total revenue of ~$704M. Novavax accomplished this milestone without any U.S. vaccine sales. Any U.S. sales, even very conservative ones, should only help to move the revenue needle up.

Novavax Financial Slide (Novavax Q1, 2022 Earnings Presentation Slide)

3. Novavax’s Vaccine Is Protein Based

Pfizer, Moderna, and Johnson & Johnson all rely on mRNA technology to fuel their vaccines, creating strengths and weaknesses to that mode of treatment. Novavax’s Covid-19 vaccine though contains the SARS-CoV-2 spike protein and Matrix-M adjuvant. This more traditional vaccine treatment should appeal to unique segments of the population unable to tolerate mRNA-based treatments or those skeptical of them. According to the CDC’s webpage, only ~78.4% of the total U.S. population has been vaccinated with at least one dose. With ~10% of the population 18 and over still unvaccinated, there is still potential demand out there for a primary first course of vaccines for those hesitant to take anything so far.

4. Side Effects

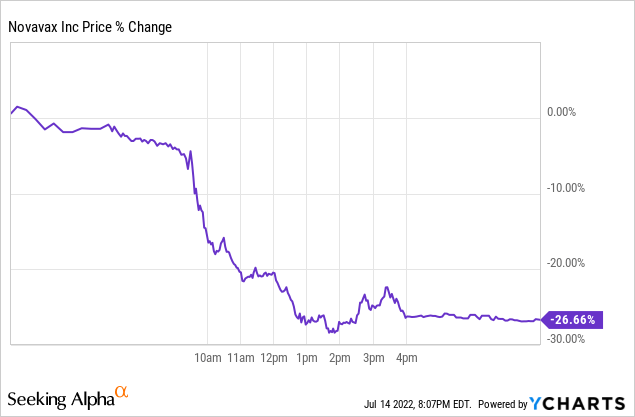

Novavax’s FDA approval was a traditional sell-the-news event that also happened to coincide with some bad news for the company from the European Medicines Agency. The EMA will be changing Novavax’s vaccine label to include the possibility of severe allergic reactions as a potential side effect, effectively raining on Novavax’s FDA approval day parade. The EMA said that “a few cases have been reported spontaneously” following administration of the shot. Doesn’t sound like the world is ending for Novavax’s Nuvaxovid, but it was easily enough to help send the stock plummeting the day after U.S. FDA approval.

The EMA continues to assess the risk of myocarditis and pericarditis with Nuvaxovid, but as of yet, there is no concern with it as there is with all the aforementioned mRNA vaccines. This could be a key point of differentiation for vaccine boosters in future years that could result in a reshuffling of vaccine preferences. Small chances of paraesthesia (unusual feeling in the skin, such as tingling or a crawling sensation) and hypoaesthesia (decreased feeling or sensitivity, especially in the skin) for Novavax compared to rare types of heart inflammation in mRNA vaccines could be a differentiator for many people going forward.

5. FDA Advise For October Vaccinations

In June of 2022, the FDA’s Vaccines and Related Biologics Advisory Committee led a meeting on updated vaccine shots for October, most notably to address mutations in the Omicron variant. This meeting included presentations from Pfizer, Moderna, and Novavax, even though Novavax had not yet received official FDA approval. The meeting noticeably lacked a presentation from Johnson & Johnson. The end result was an FDA recommendation for vaccine producers to produce a specific Omicron containing Covid-19 vaccine (BA.4 and BA.5 targeted in particular) for the fall. Novavax already has stated that it plans to have an Omicron specific vaccine ready to go for fall, potentially putting it on equal footing as the other vaccine producers when October rolls around instead of years behind.

6. Novavax’s Upcoming Fall Omicron Vaccine Might Be Superior

Novavax’s presentation on June 28, 2022 was an eye-opener for many experts in the field unfamiliar with Novavax. Novavax’s vaccine showed a broad immune response not only to Omicron, but to all currently circulating variants, including most likely BA.4 and BA.5. mRNA vaccines tend to decline significantly in effectiveness with subsequent variants, making it a more targeted technology, whereas Novavax’s vaccine seems to have remarkable performance against current and newer variations without the need for continuous updates. I would expect all vaccine producers to be able to come up with very good boosters for the fall at this point, but, October is still a ways away, meaning that potentially another variant or two might arise in that time. Novavax’s broad range of performance across all current variants might set it apart from the competition if new variants arise when fall rolls around.

7. Storage Conditions

Moderna’s mRNA vaccine currently must be shipped frozen at -20 degrees Celsius and can be stored that way for up to six months. Other mRNA vaccines have similar frozen storage issues which, however, are not nearly as big of a concern for Novavax and its vaccine. Novavax’s Nuvaxoid can be shipped and stored under cold chain conditions from +2 degrees to +8 degrees Celsius, instead of under frozen conditions. This could give Novavax advantages as the world shifts its focus more towards Third World countries, where cold storage can be more of an issue in harder to reach places of the globe.

8. Upcoming Catalyst

Novavax now has FDA approval, but can’t start selling its vaccine in the U.S. until the CDC signs off on it as well. Fortunately for Novavax, the CDC is having an Advisory Committee on Immunization Practices (ACIP) meeting coming up on July 19th. Novavax’s vaccine should be able to get the nod there for U.S. consumption, providing the company with at least one good headline coming up in the very near future.

9. Upcoming Earnings

Novavax has not announced yet when its Q2 earnings report will come out, but it will most likely be scheduled around the first or second week of August. This gives the company plenty of time to figure out its next steps now that it finally has gotten official FDA Emergency Use Authorization. This means updated guidance for the year which, in Q1, didn’t include sales from the U.S. and other authorizations it has achieved in the past quarter around the globe. As a newly profitable ~$4B company, even small gains in sales forecasts can make meaningful impacts on metrics such as the company’s Price/Sales at 3.32 or its Forward P/E which sits now at a paltry 2.94. The company also ended Q1 sitting comfortably on ~$1.6B in cash with ~$400M in receivables, which should help it expand global sales. Q1 also had the company voicing 2022 total revenue guidance for between $4B-$5B. When a stock is down big, nothing better to lift it up than an improved earnings period with updated guidance and numbers institutions can model around.

10. Recent Selloff In The Stock Is Overdone

When dealing with a massively volatile stock, buying extreme dips and selling extreme pops is never a bad idea if you want to keep an eye on profits. Novavax’s ~26% drop the day after FDA Emergency Use Authorization seems a bit excessive, even with the label change for possible severe allergic reactions from the European Medicines Agency.

Novavax has worked hard for the past two years to get its Covid-19 vaccine approved in the U.S. by the FDA. It was rewarded for this accomplishment by the stock selling off over 25% of its value based on a sell-the-news narrative coupled with a label change from the European Medicines Agency. However, many reasons exist for stockholders to jump into the stock at this time or to hold on to their shares for rapidly upcoming potential positive catalysts.

I was lucky in purchasing my first Novavax shares about a month ago for $36.45 a share, so had no problem holding through today’s carnage, as I believe in the potential long-term upside in the company. If you are an investor with a strong stomach, and the desire for large potential rewards, I fully recommend a look at Novavax. Best of luck to all.

Be the first to comment