pixelfit

“With results in from 97% of companies in the S&P 500, index constituents are on track to post roughly 2% year-over-year profit growth for the third quarter, according to FactSet.”

This is from The Wall Street Journal.

The expectation for the fourth quarter: a 2.1 percent decline!

And, for 2023?

Although expectations right now are for small positive numbers for 2021,

“estimates are too high going into the new year.”

Estimates for the new year…will be coming down.

You have the Federal Reserve shrinking its securities portfolio.

You have liquidity in the banking system going down.

You have the year-over-year rate of growth of the M2 money stock, “going negative.”

You have all the right variables going in the wrong direction.

Corporate earnings have to fall in 2023.

Looking For A Pivot

Investors last week, however, were still looking for a pivot in the Federal Reserve’s position.

At this stage of the effort to slow down inflation, a “pivot” may not provide a sharp enough turn for these figures to be reversed.

The “lag-in-effect” has taken over as the movement of policy tools takes time to fully impact markets.

Much of the movement described above is already built into the books.

But, investors still are looking for the Federal Reserve to pull them out of the downward-trending stock market.

But, this is the scenario that the Federal Reserve created.

During the last period of economic expansion, the one that followed the Great Recession, investors got used to the Federal Reserve always stepping in after a period where it looked as if the Fed was letting the market tighten.

Some downward market movement occurred, the stock market dropped modestly, and then the Fed came right back into the market with further quantitative easing, or, something, that got the stock market rising again.

As it turned out, it was always safe for investors to “buy the dip” because the Federal Reserve always came in to drive the stock market higher.

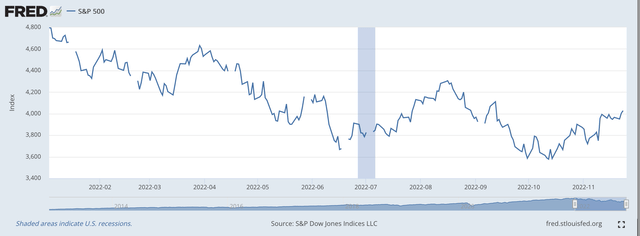

S&P 500 Stock Index (Federal Reserve)

Even during the stock drop that took place because of the Covid-19 pandemic, the Fed always came back into the market to keep stock prices on an upward pace.

Investors learned.

It was OK to “buy the dip.”

And, that is what investors are having trouble with right now.

Hence, the volatility in the marketplace. Investors are constantly “buying the dip” and causing rebounds in stock prices.

Here is the picture since the beginning of 2022.

S&P 500 Stock Index (Federal Reserve)

The volatility seems more severe in this picture than the one shown earlier because the chart covers a much shorter period of time.

The 2023 Market

So, what if my forecasts are right?

The Fed continues to shrink its securities portfolio into the first half of 2023.

The liquidity in the banking system continues to decline.

The growth in the M2 money stock turns negative and stays there for six months or so.

And corporate earnings decline, year-over-year.

What will investors be doing if all this happens?

Further drops in stock market prices?

Not a real pretty picture.

Be the first to comment