Marko Geber/DigitalVision via Getty Images

Takeda Pharmaceutical (NYSE:TAK) is a Japanese pharmaceutical company and one of the largest in the world, which is a leader in the treatment of rare diseases. While Gilead Sciences (NASDAQ:GILD) is a leader in the treatment of HIV and viral hepatitis and, amid the COVID-19 pandemic, was the key pharmaceutical company that supplied Veklury (remdesivir), which has saved the lives of thousands of hospitalized patients. Both companies have some of the highest dividend yields in the pharmaceutical industry, at around 5%, an extensive portfolio of approved medicines and product candidates, and high business margins, making Takeda Pharmaceutical and Gilead Sciences worth considering as long-term assets. However, despite this, one of these companies is more promising in the long run and is more likely to double the capitalization relative to the second.

Financial position of Gilead Sciences vs. Takeda Pharmaceutical

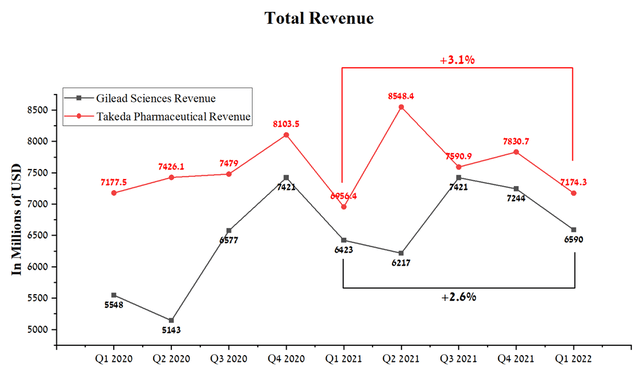

Takeda Pharmaceutical’s revenue was $7,174.3 million in Q1 2022, up 3.1% year-on-year. At the same time, Gilead Sciences showed similar dynamics, which earned $6,590 million in Q1, showing an increase of 2.6% compared to Q1 2021.

Source: Author’s elaboration, based on Seeking Alpha

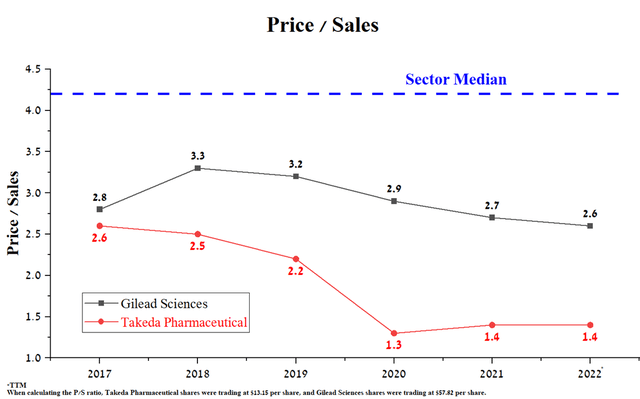

The price/sales ratio of both companies is lower than the average for the pharmaceutical industry, which indicates that they are undervalued by Wall Street. Currently, Takeda’s P/S ratio is 1.4, which is 46.2% lower than that of Gilead Sciences, showing that the Japanese company is an even more undervalued asset in the industry.

Source: Author’s elaboration, based on Seeking Alpha

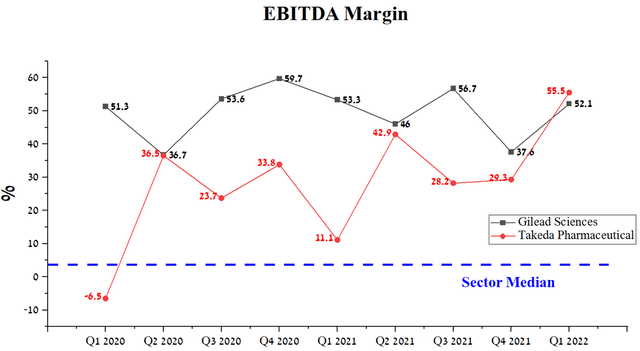

It should be noted that the EBITDA margin of both companies is at a high level, which favorably affects the maintenance of high dividend yields and R&D spending necessary to maintain a leading position in certain medical fields. However, Takeda’s EBITDA margin tend to improve quarter-on-quarter, while Gilead Sciences’ performance is smoother.

Source: Author’s elaboration, based on Seeking Alpha

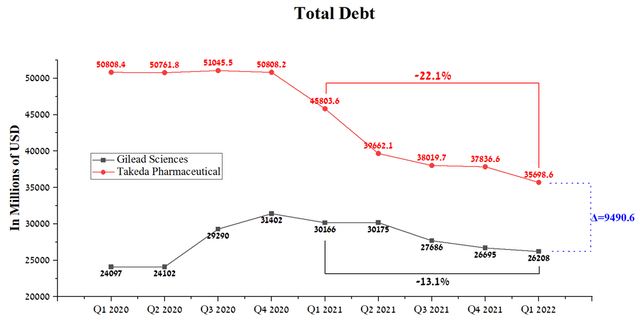

The improvement in margins is due to the fact that the Japanese pharmaceutical company successfully integrated the Shire business and, thanks to Takeda’s conservative management policy, significantly reduced its debt. While Gilead Sciences’ total debt rose slightly in 2020, and this was due to the $21 billion purchase of Immunomedics in 2020. The difference in total debt between the two companies is about $9.5 billion, which makes Gilead Sciences more attractive in terms of this indicator due to lower risks and debt servicing costs.

Source: Author’s elaboration, based on Seeking Alpha

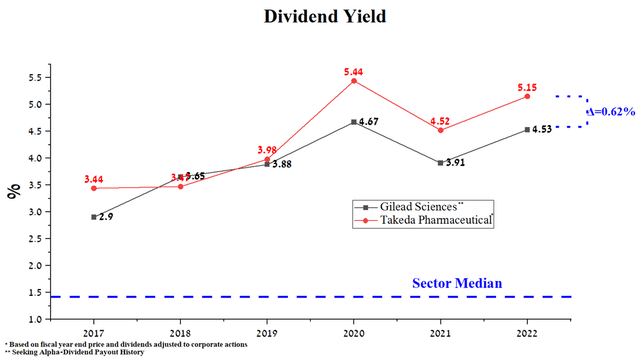

Takeda Pharmaceutical’s dividend yield of 5.15% is slightly higher than Gilead Sciences’ dividend yield of 4.53%. As can be seen, these yields are significantly higher for both companies than the average for the pharmaceutical industry, thus creating investment interest for people with a long-term investment strategy.

Source: Author’s elaboration, based on Seeking Alpha

Comparison of approved medicines

Both companies have dozens of approved drugs that bring in hundreds of millions of dollars a year. However, some of them have a critical role in generating cash flow, which is vital for business development. Thus, this part of the article will compare Takeda’s flagship with Gilead’s flagship, which have the largest share of sales in the portfolio of these companies.

Gilead Sciences’ top-selling drug

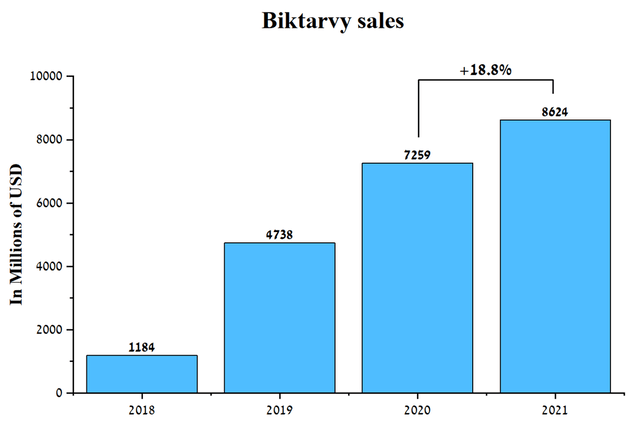

Biktarvy (bictegravir/emtricitabine/tenofovir alafenamide) is a drug used to fight HIV-1 infection by reducing the amount of virus in a person’s body, which reduces the chance of complications. According to HHS, about 37.7 million people worldwide had HIV in 2020, setting the stage for pharmaceutical companies to earn billions of dollars by saving the lives of people suffering from this disease. Biktarvy sales were $8624 million in 2021, up 18.8% from 2020.

Source: Author’s elaboration, based on quarterly securities reports

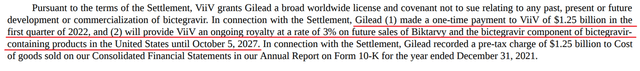

Despite a significant increase, sales of this drug accounted for 31.6% of Gilead’s revenue, which creates certain risks, since the company’s financial position is largely dependent on sales of one drug. In addition, the company has two key challenges that are highly likely to cause Biktarvy sales to stagnate. One such prerequisite is a settlement agreement with ViiV Healthcare, under which Gilead Sciences has paid $1.25 billion and will also pay a 3% royalty on all future sales of Biktarvy until October 5, 2027.

Source: Author’s elaboration, based on 10-K

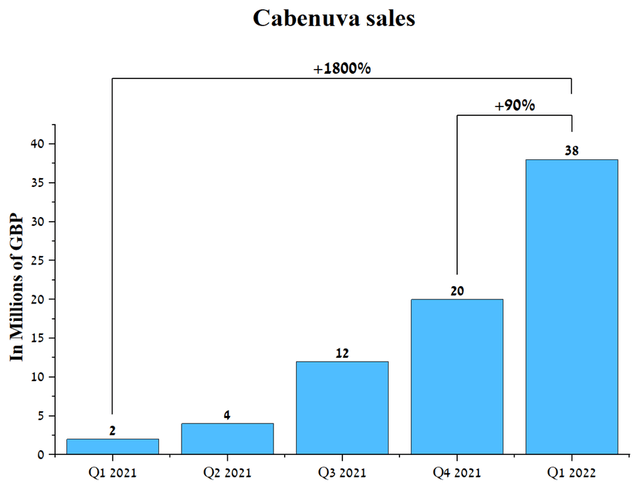

At first glance, 3% is an insignificant amount, but the company will not receive at least $250 million a year, which, in the face of increased competition in HIV treatment, will negatively affect Gilead Sciences’ revenue. The second factor driving down Gilead’s HIV revenue is the emergence of a more promising HIV medicine and the sale of generic versions of Truvada and Atripla. In my estimation, Biktarvy’s main competitor will be Cabenuva, which was developed by ViiV Healthcare. Cabenuva (cabotegravir + rilpivirine) is a long-acting drug given every two months and, like Biktarvy, keeps the virus levels extremely low. Based on the results of the clinical study, it was shown that about 88% of patients preferred Cabenuva while only 2% of patients preferred their previous antiretroviral treatment. In my estimation, patients preferred Cabenuva for several reasons, one of which is the significant reduction in the frequency of drug use. Patients using Biktarvy must take it every day, while ViiV Healthcare’s drug needs to be injected into the patient’s body only six times a year. Thus, it significantly improves the quality of life of an HIV patient. In addition, the safety profile of Cabenuva was slightly better than that of Biktarvy, which increases the likelihood of commercial success for ViiV Healthcare’s medicine. Since the beginning of the commercialization of Cabenuva, one can see a significant increase in sales of this drug from quarter to quarter. Cabenuva sales were around £38 million in Q1 2022, up 90% QoQ and 1800% YoY.

Source: Author’s elaboration, based on quarterly securities reports

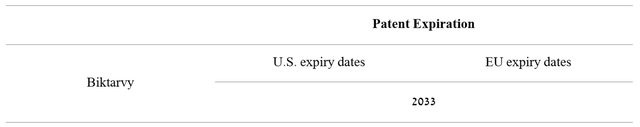

Thus, ViiV Healthcare’s drug is highly likely to become the gold standard in the fight against HIV, gradually taking market share from Gilead Sciences. The patents protect Biktarvy from commercializing a generic version of the drug until the end of 2033, which is a favorable factor that will allow Gilead to generate billions of dollars in net profit in the coming years.

Source: Author’s elaboration, based on 10-K

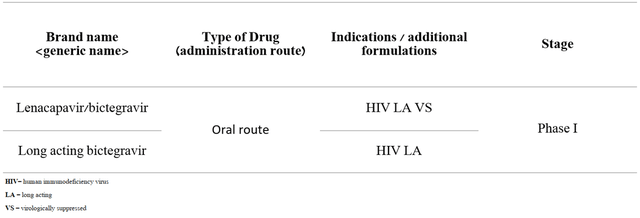

In conclusion, it should be noted that the company continues to conduct clinical studies that use one of the components of Biktarvy, namely bictegravir.

Source: Author’s elaboration, based on Earnings Call Presentation

As you can see, these clinical trials are in the initial stage, which does not create prerequisites for the growth of investment interest in these programs at the moment.

Takeda Pharmaceutical’ top-selling drug

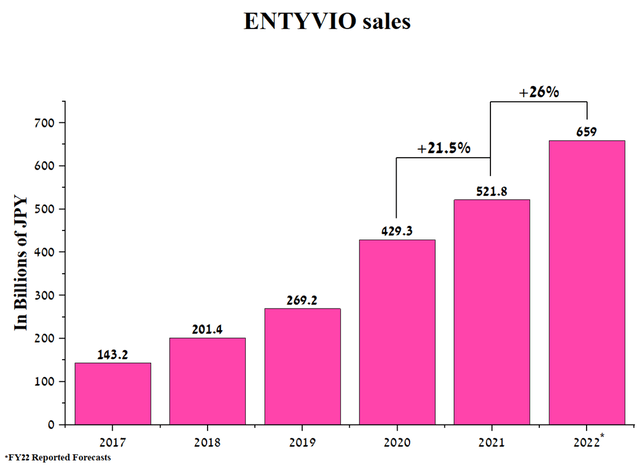

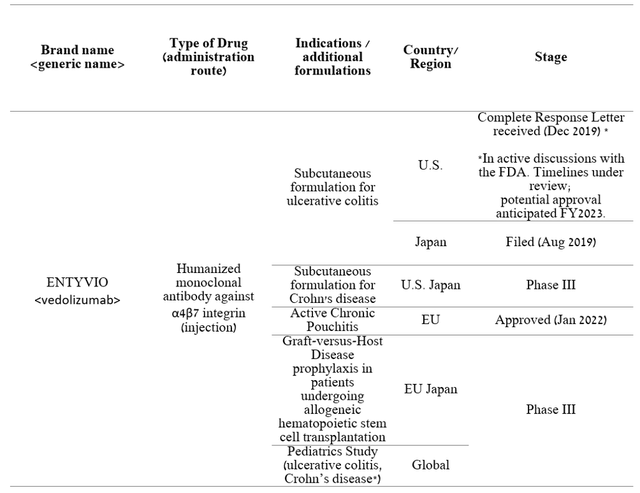

ENTYVIO (vedolizumab) is a drug used to treat moderate to severe ulcerative colitis and Crohn’s disease in 72 countries around the world. According to CDC, about 3 million Americans have reported that they have been diagnosed with one of these diseases. ENTYVIO’s sales were 521.8 billion yen in 2021, up 21.5% from 2020. In addition, the company expects sales to accelerate in 2022 when sales of the drug will be around 659 billion yen.

Source: Author’s elaboration, based on quarterly securities reports

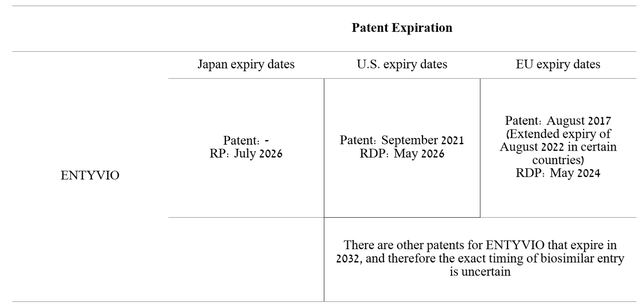

Sales of this drug amounted to 14.6% of Takeda’s revenue, which, unlike Gilead, is significantly lower, which indicates a stronger diversification of the Japanese company. It should be noted that even though Takeda’s revenue is growing, there are many competitors, some of which have strong efficacy and favorable safety profiles, which somewhat limit the more significant growth in ENTYVIO sales. Comparing the patent protection of Gilead and Takeda medicines, the patents for ENTYVIO expire a little earlier, which creates certain risks of reducing the company’s revenue in the future.

Source: Author’s elaboration, based on Form 20-F

In conclusion, Takeda is continuing its clinical trials with which the company intends to increase the number of potential patients for ENTYVIO. Compared to Biktarvy, you can see more extensive clinical programs using ENTYVIO, which in my opinion puts Takeda’s drug in a better position.

Source: Author’s elaboration, based on Form 20-F

So, comparing Takeda’s top-selling drug with Gilead’s top-selling drug, ENTYVIO wins by a slight margin in my estimation.

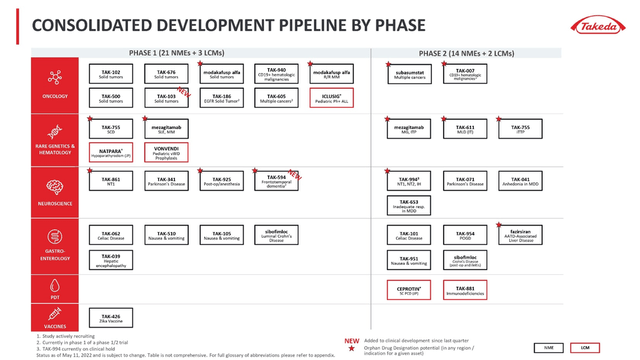

Comparison of medicines in development

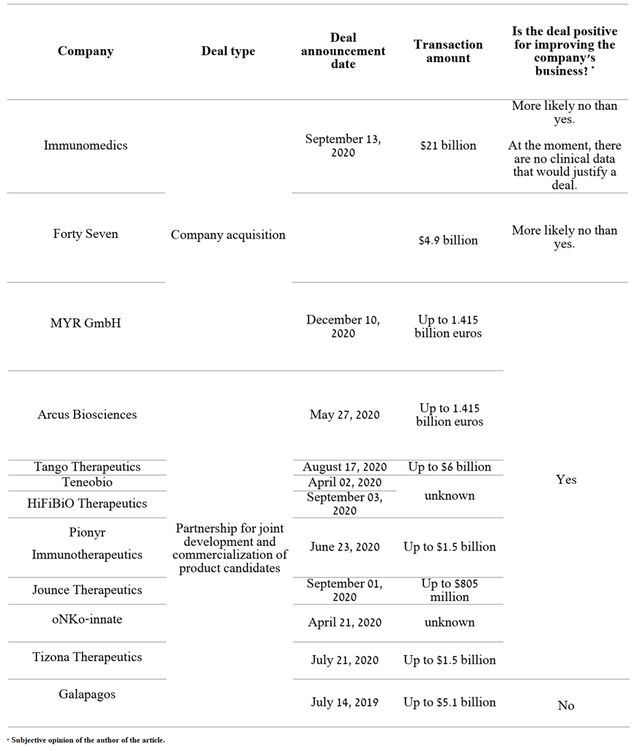

Both companies have a rich pipeline. Therefore, I want to focus on acquisition deals and/or co-development of product candidates with other pharmaceutical companies over the last two years. I believe that the concluded deals show investors how successful the company’s management is in finding undervalued assets and becoming a leader in the commercialization of drugs in various therapeutic areas.

Gilead Sciences

Over the past two years, the company has continued to conduct M&A transactions, buying pharmaceutical companies for billions of dollars and pursuing smaller agreements. The purpose of this policy is to diversify the company’s current portfolio of approved medicines, which is mainly focused on the treatment of HIV. As a result, Gilead management plans to become one of the leaders in the treatment of cancer.

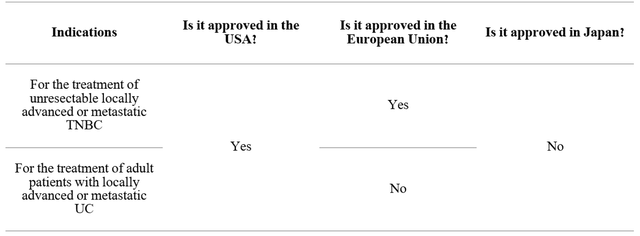

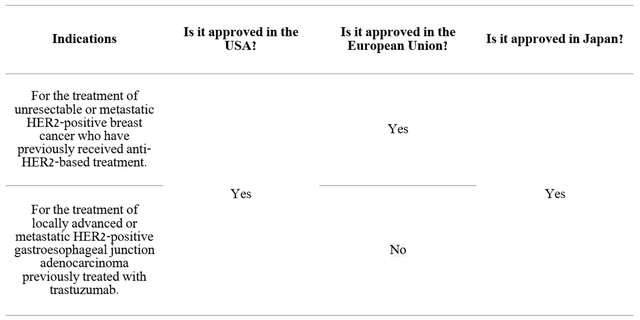

In this part of the article, I want to discuss the largest purchase of Gilead, namely Immunomedics, which took place on September 13, 2020 and cost the company 21 billion dollars and also led to an increase in debt by about 6 billion dollars. Under this agreement, the company acquired Trodelvy, which is approved by regulatory authorities for two indications.

Source: Author’s elaboration, based on quarterly securities reports

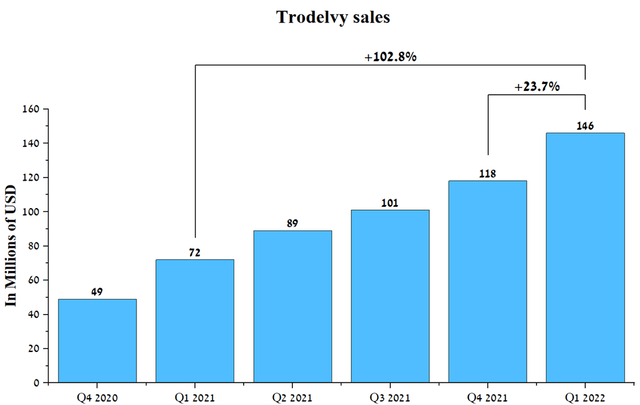

As can be seen, there is still scope for the company to expand its use of Trodelvy in countries outside of the US, which will help boost sales of the drug in the coming years. On the face of it, Gilead made the right decision to acquire a company that already had an approved product, thereby accelerating revenue growth for Gilead’s oncology division. Trodelvy’s sales were $146 million in Q1 2022, up 23.7% QoQ.

Source: Author’s elaboration, based on quarterly securities reports

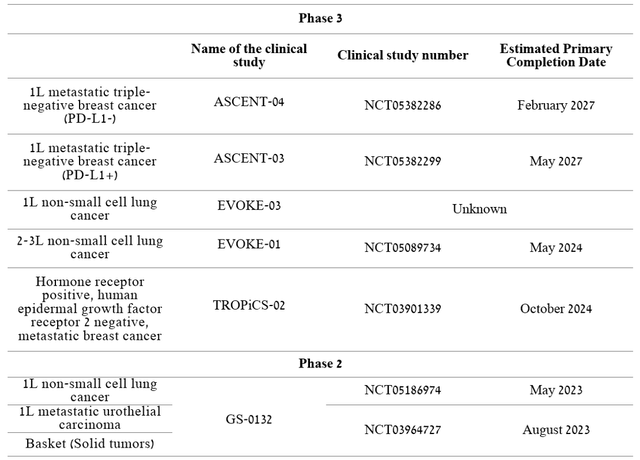

The company is running several Phase 2/3 clinical trials that, if the primary and secondary endpoints are met, would increase the total number of potential patients by hundreds of thousands.

Source: Author’s elaboration, based on Earnings Call Presentation

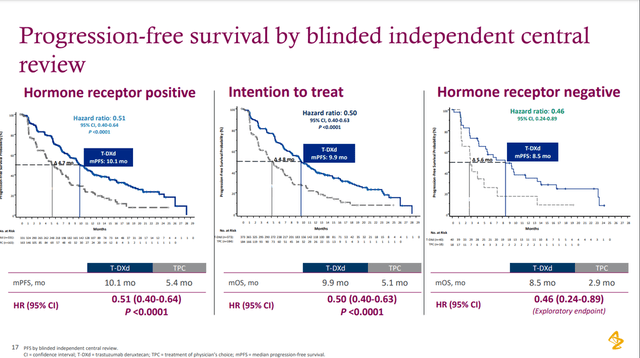

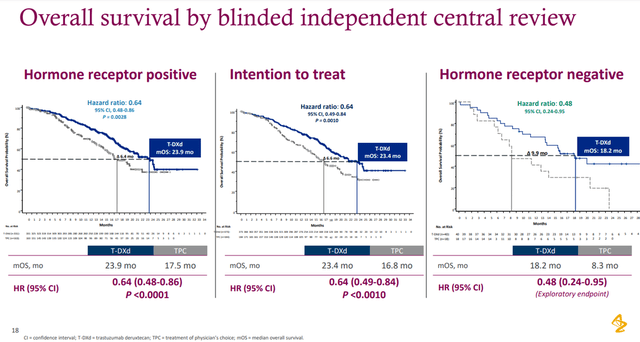

However, not everything is perfect with this deal as it may seem at first glance. On March 7, 2022, Gilead published preliminary results in Phase 3 TROPiCS-02 study evaluating the efficacy and safety of Trodelvy in the treatment of breast cancer, and Trodelvy outperformed chemotherapy in improving progression-free survival. Although a statistically significant result was shown, the improvement was only 1.5 months, which casts doubt on the high demand for this drug if it is approved by the regulatory authorities. Also, Gilead’s drug reduced the risk of death by 16% and extended the lives of patients by 1.6 months relative to those in the chemotherapy group. This value is not statistically significant, meaning there is currently no evidence that Trodelvy can prolong the lives of patients suffering from this disease. Although the study is ongoing, doubts are already emerging about how effective Gilead’s drug is for other indications. In addition, a competitor is using a similar mechanism of action to Trodelvy. This competitor is Enhertu, developed and commercialized by AstraZeneca/Daiichi Sankyo.

On June 5, 2022, AstraZeneca and Daiichi Sankyo presented positive data from a clinical trial evaluating Enhertu’s efficacy and safety in a population with low HER2 expression. The primary endpoint was reached, with AstraZeneca reducing the risk of disease progression or death by 49% compared to chemotherapy.

Source: Presentation ─ 2022 ASCO

In addition, a secondary endpoint was reached in which Enhertu reduced the risk of death by 36% compared with chemotherapy in patients with HR-positive disease.

Source: Presentation ─ 2022 ASCO

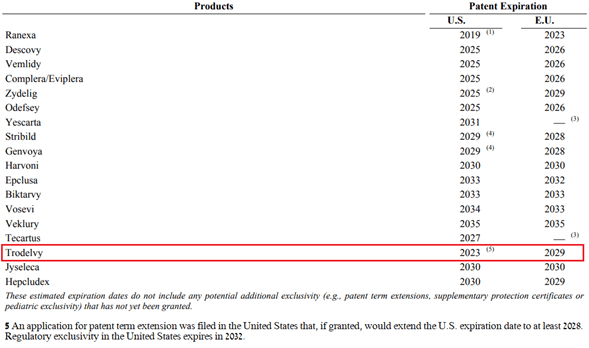

Let’s move on to the analysis of patents that protect Trodelvy from the commercialization of generic versions of this medicine.

Source: Author’s elaboration, based on quarterly securities report

European patents expire in 2029 and in the US in 2032, which, given the slow expansion of Trodelvy, calls into question the justification for spending $21 billion to buy this drug.

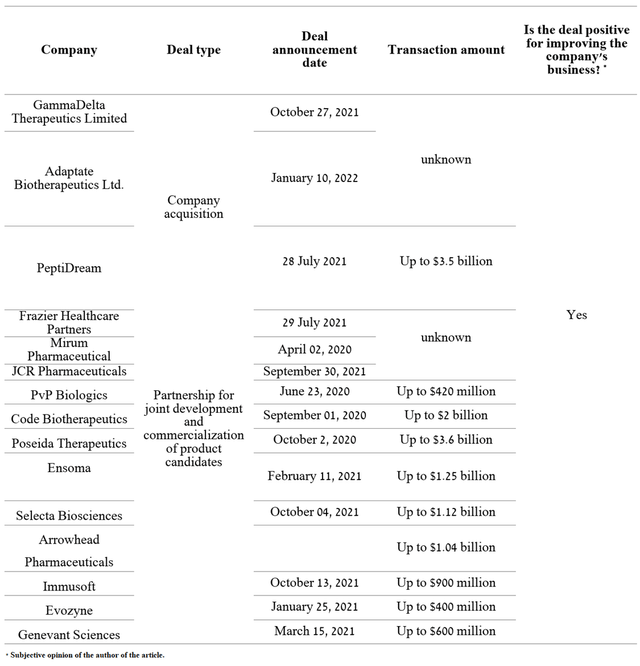

Takeda Pharmaceutical

Over the past two years, the Japanese company has had fewer major transactions than Gilead due to the need to repay the debt. However, as the Total Debt/EBITDA ratio decreased, the company’s management stepped up M&A deals aimed at finding product candidates for the treatment of orphan diseases, where there are many areas with high medical demand.

One of the shortcomings of the company’s strategy is that most of the product candidates are in pre-clinical or clinical phase 1/2 stages, as a result of which the deals will not have an impact on improving Takeda’s financial performance in the next 2-3 years.

The positive aspect of this strategy is the lower costs of R&D and the implementation of a more flexible policy for the selection of the most promising drugs. For example, in addition to Gilead’s failed acquisition of Immunomedics, there was also a $5.1 billion partnership with Galapagos (NASDAQ:GLPG) that saw many product candidates fail to reach primary endpoints, and filgotinib was rejected by the FDA.

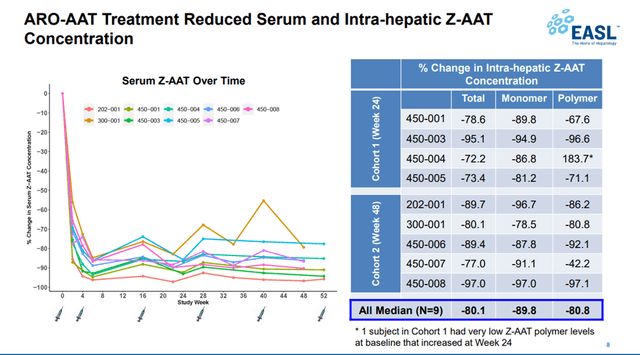

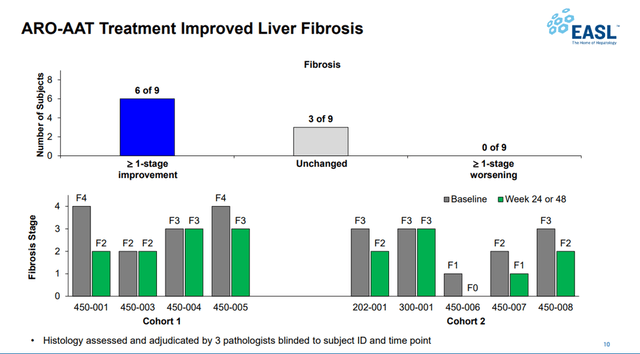

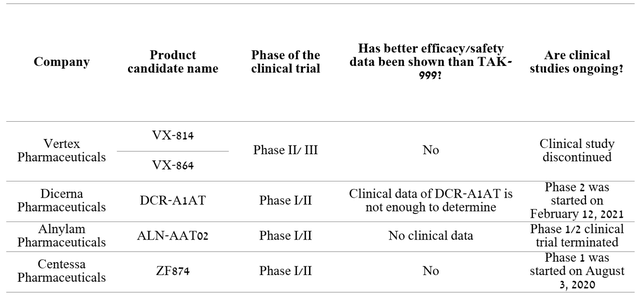

One of the most advanced programs among Takeda’s M&A deals is the acquisition of the right to commercialize TAK-999 from Arrowhead Pharmaceuticals (NASDAQ:ARWR). TAK-999 is a drug in phase 2 clinical trial being developed for the treatment of alpha-1 antitrypsin-associated liver disease. Currently, there are no approved drugs for this disease, which creates the prerequisites for rapid growth in sales if approved by regulatory authorities. At the end of June 2021, the company reported a significant reduction in serum Z-AAT, demonstrating the first clinical data showing preliminary efficacy of TAK-999.

Source: Arrowhead Pharmaceuticals Events & Presentations

In addition, 6 out of 9 patients experienced an improvement of 1 point or more in the METAVIR fibrosis stage from baseline.

Source: Arrowhead Pharmaceuticals Events & Presentations

Taken together, the published results suggest that TAK-999 has the potential to become the gold standard in the treatment of AATD. Currently, Takeda and Arrowhead are awaiting additional clinical data on circulating AAT levels and biopsy results in Q3 2022. Analyzing possible competitors, they are all at earlier stages and lag behind TAK-999 by at least 2-3 years.

Thus, comparing M&A transactions, I believe that in the short term, Gilead’s strategy looks better and will help maintain the growth of the company’s revenue. However, in the longer term, Takeda has more promising product candidates that will bring more value to long-term investors.

Technical Analysis

In terms of technical analysis, on the daily chart, you can see that the RSI has fallen below 30, which signals that Takeda and Gilead’s shares are oversold. At the same time, a bullish divergence began to form, which is one of the first signs of a possible reversal in the price of company shares. Despite the fact that both assets are below the 200 EMA, the shares of both companies have stabilized in the area of strong support zones, from which an uptrend began in the past.

However, there is a small difference between the two charts – this is the presence of unclosed gaps, which is a significant factor that will contribute to the desire of market participants to close them and, as a result, to increase the price of the company shares. One such gap on Takeda’s chart is in the $24-$25 per share area, which is 92% higher than the current price. In the case of Gilead, there is an unclosed gap in the region of $66-67 per share, which is 17% higher than the current price.

So both companies have very similar charts, but in my estimation, Takeda looks a bit more attractive in terms of technical analysis.

Conclusion

Takeda Pharmaceutical is a Japanese pharmaceutical company and one of the largest in the world, which is a leader in the treatment of rare diseases. While Gilead Sciences is a leader in the treatment of HIV and viral hepatitis and, amid the COVID-19 pandemic, was the key pharmaceutical company that supplied Veklury (remdesivir), which has saved the lives of thousands of hospitalized patients. Both companies have some of the largest dividend yields in the pharmaceutical industry and high margins and revenue, which, against the backdrop of current market weakness, creates the conditions for Takeda Pharmaceutical and Gilead Sciences to be considered long-term assets. However, thanks to a more diversified pipeline, a faster rate of improvement in financials, and significantly lower multiples, I believe that Takeda is more promising in the long term and more likely to double the capitalization relative to Gilead Sciences.

Be the first to comment