Rich Fury

8/24/23 was the day many SoFi Technologies (NASDAQ:SOFI) investors were waiting for as President Biden announced the administration’s student loan forgiveness plan. A moratorium was placed on federal student loans, pausing payments since the beginning of the pandemic, and more than 2 years later, a decision has finally been made. SoFi has adapted and grown through adversity, diversifying its revenue away from refinancing federal student loans as its other business lines have only gotten stronger. SoFi started as a student loan refinancing company, and until the pandemic, refinancing student loans was their largest driver of revenue. This segment has been operating at less than 50% capacity since Q2 2020, and in 4 months, the floodgates will open as federal student loan payments will restart once again. Looking back at what Anthony Noto and the SoFi management team have accomplished is remarkable, and the moratorium may be the single best event that occurred for SoFi’s long-term operations.

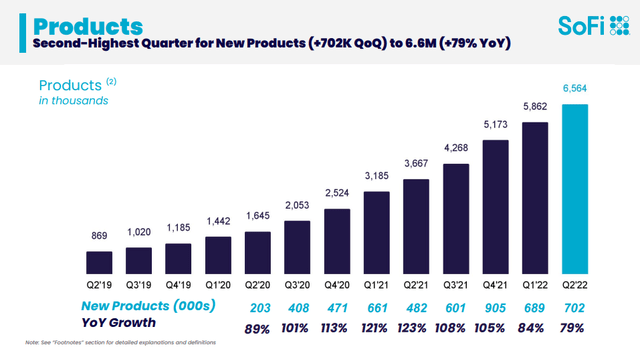

Since Q2 of 2022, SoFi has added 4.99 million (315.71%) new products with a total of 1.2 million lending products and 5.36 million financial products. SoFi’s revenue has grown from $136.25 million in Q2 2020 to $356 million in Q2 2022, and this was done while its student loan business was operating at less than 50%. The continuous extensions of the moratorium significantly impacted SoFi from a revenue standpoint, but it also made the company stronger, and shareholders were able to see how well management could execute and pivot when unexpected obstacles impeded their projected path. As repayments will begin on 1/1/23, millions of borrowers will look to refinance their student loans, and this should be a large catalyst for SoFi in 2023.

SoFi‘s segment financials and how an ending moratorium will impact them in 2023

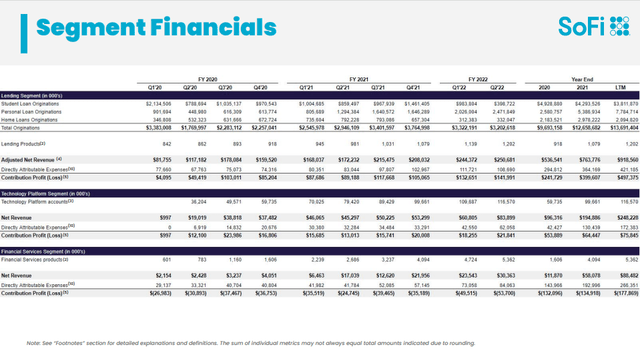

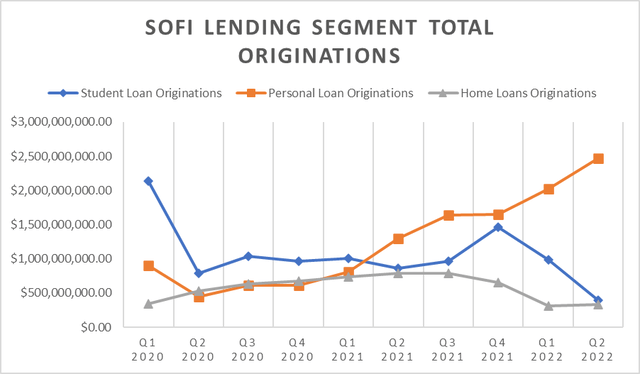

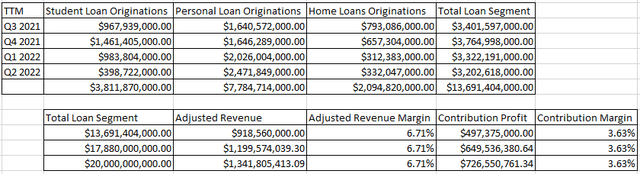

Over the previous 2 years, SOFI has increased its adjusted net revenue from the lending segment by 206.62% ($168.93 million) to $250.68 million, while its contribution profit increased by 3,367.42% ($137.9 million) to $141.99 million. Student loan originations are accounted for by the blue line in the chart below, which represents the lending segment financials from the SoFi slide below.

In Q1 2020, student loan originations accounted for 63.09% of the lending segments business. Over the next 2 years, student loan originations declined from 63.09% of the lending segment revenue mix to just 12.45% in Q2 2022. There hasn’t been a single quarter since Q1 2020 where student loans accounted for more than 50% of SoFi’s lending segment revenue, and in 4 of the last 10 quarters, student loans accounted for less than 30% of the lending segment revenue mix. If I was to use the $2.13 billion in student loan originations from Q1 2020 as SoFi’s baseline for the next 2 years, the student loan segment only operated past 50% capacity in Q4 of 2021 due to uncertainty around the end of the moratorium. Over the past 9 quarters, including Q4 2021, student loans have operated at an average of 44.09% based on Q1 2020’s levels, and if I stripped away Q4 2021 as a fluke, student loans would have operated at an average of 41.05% over the past 8 quarters.

Without the need to refinance due to uncertainty around when the moratorium would end, SoFi’s student loan originations have declined to under $400 million in the recent quarter. In the TTM, total loan originations across student, personal, and homes amounted to $13.69 billion. This has amounted to $918.56 million of adjusted revenue and $497.38 million of contribution profit. This means that SoFi’s revenue margin has been 6.71%, and its contribution profit margin has been 3.63% from their total loan originations over the past 12 months. Hypothetically, if SoFi was able to average $2 billion per quarter in student loan originations in 2023, which is lower than Q1 of 2020, and there was no growth in personal or home loans, their total loan originations would amount to $17.88 billion in 2023. If SoFi’s margins stayed the same, they would generate $1.2 billion in adjusted revenue and $649.52 million in contribution profit, which place them both at a YoY growth rate of 30.59%. At the rate personal loan originations have grown, there is certainly a chance SoFi could generate $20 billion in loan originations in 2023 if student loans get back to where they were in Q1 of 2020. If SoFi was to generate $20 billion in loan originations, their adjusted revenue at a 6.71% margin would be $1.34 billion, and their contribution profit would be $726.55 million at a 3.63% margin. The margins also have the potential to increase as we have only seen 4 months of the banking charter reflected in the TTM earnings.

President Biden’s Student Loan Forgiveness Plan

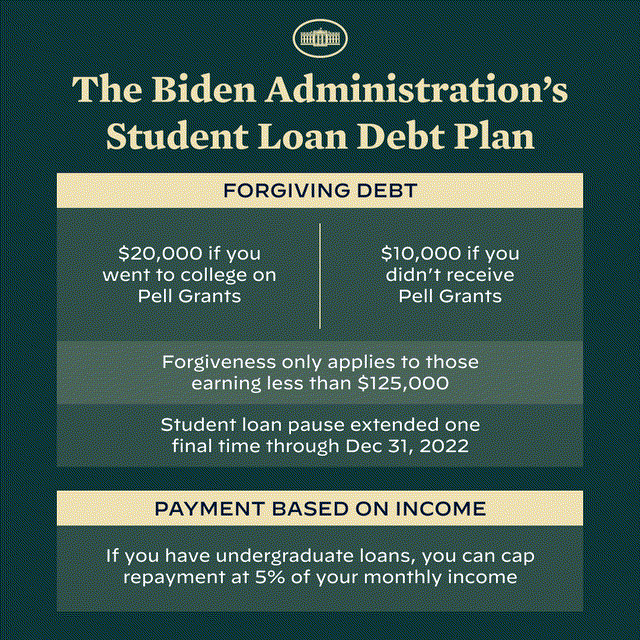

These are the details that were released from the White House and how it impacts SoFi.

President Biden released an outline of The Biden Administrations Student Loan Forgiveness Plan on 8/24. Here are the broad strokes of the plan:

- The freeze on federal student loan payments has been extended for the final time and will end on 12/31/22

- U.S. Department of Education will provide up to $20,000 in debt cancellation to Pell Grant recipients with loans held by the Department of Education

- U.S. Department of Education will provide up to $10,000 in debt cancellation to non-Pell Grant recipients.

- $10,000 in debt cancellation to non-Pell Grant recipients.

- The Biden-Harris Administration is proposing a rule to create a new income-driven repayment plan that will substantially reduce future monthly payments for lower- and middle-income borrowers.

- Require borrowers to pay no more than 5% of their discretionary income monthly on undergraduate loans. This is down from the 10% available under the most recent income-driven repayment plan.

There has been a misconception that student loan forgiveness would negatively impact SoFi. Anthony Noto has done an excellent job explaining the implications on how student loan forgiveness would impact SoFi. Prior to the pandemic, SoFi’s student loan refinancing business had an average student loan that was $70,000. SoFi was doing over $2 billion of quarterly refinancing. Since the moratorium, this segment has operated at 50% or below except in Q4 2021 as there was an increase to refinance as people thought the moratorium was going to end. Any loans that were refinanced in with SoFi throughout the moratorium will not be canceled as these are now private loans.

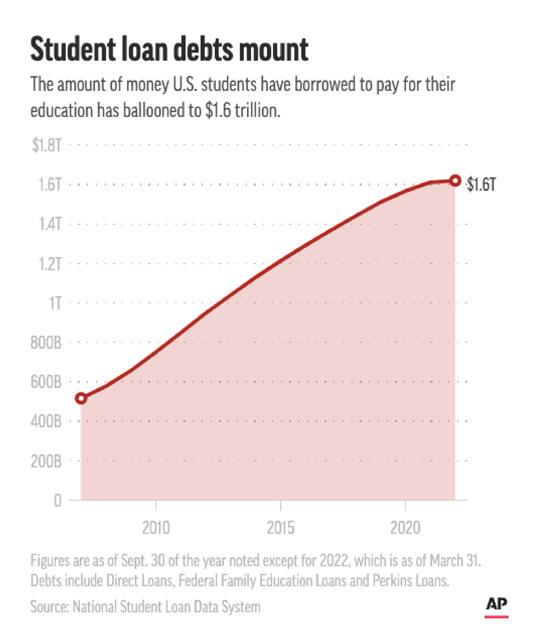

There is currently $1.6 trillion of federal student loan debt, and there are reports surfacing, such as the one from CBNC, that President Bidens Student Loan Forgiveness plan could amount to $329.1 billion. If this number is accurate, there would still be $1.27 trillion in federal student loans, which need to be repaid. Previously, the average amount of federal student loan debt that was refinanced through SoFi was $70,000. Once President Biden’s plan takes effect, the average $70,000 in debt to be refinanced would drop to $60,000. There will be an influx of individuals scrambling to look at their previous federal student loan interest rates, then what the rates on refinancing those loans are, and make adequate adjustments. Currently, SoFi hasn’t originated new loans from federal student debt, but that will all come to an end quickly. In SoFi’s case, this is great news because their largest business segment, which was stopped dead in its tracks, will be a thriving business once again as a revolving door of federal student loans will be privatized through SoFi. This couldn’t have occurred at a better time as SoFi has a national bank charter. SoFi’s bank charter allows them to utilize customer deposits instead of borrowing money from traditional banks at around 2.25%. This creates a larger spread as privatized loans will be funded from SoFi’s balance sheet, creating larger amounts of profits for SoFi.

Associated Press

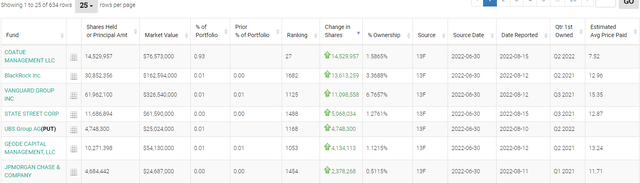

The latest 13F Filings look interesting as several companies have increased their position in SoFi while Softbank unloaded a portion of their shares

Some of the largest financial institutions in the world continue to add to their position in SoFi. BlackRock (BLK) added 13.61 million shares last quarter, while Vanguard added 11.1 million shares, and State Street (STT) added 5.07 million shares. JPMorgan Chase (JPM), which is SoFi’s competition, added 2.38 million shares of SoFi last quarter. Looking through the rest of the top 25 institutions that added to their positions in SoFi, names such as Nuveen Asset Management, Credit Suisse, Citadel Advisors, and Bank of New York Mellon can be found.

Recently headlines circled about SoftBank Group (OTCPK:SFTBY), which held more than 83 million shares of SoFi, planned to sell a portion of its shares. It looks like SFTBY sold 18.23 million shares last quarter due to the 13D filings. While a large seller of shares is never a great headline, I am more focused on which institutions are adding to their positions. SoFi is positioning itself to become a top financial institution, and regardless of if people want to believe this or not, progress is being made.

Steven Fiorillo, Seeking Alpha

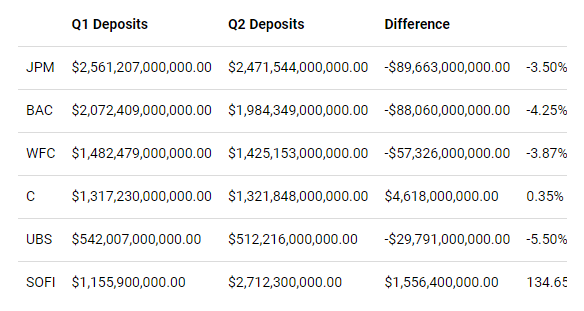

SoFi’s deposits grew by $1.556 billion in Q2, up 134.65% QoQ. When I look at the big banks, only Citigroup (C) saw their deposits increase as JPMorgan Chase had a -$89.66 billion (-3.5%) decline in deposits. SoFi added $17.1 million in daily deposits across Q2, and this was only their 1st full quarter with a bank charter. SoFi is offering 2% APY on checking accounts with no account fees as long as you enroll in direct deposit with them. I don’t believe we will see any of the large banks come close to matching SoFi, and more of the younger generation will gravitate toward SoFi. As a true cloud-based financial institution, SoFi is developing products and services geared toward the pace of life for a generation that is accustomed to instant gratification.

Conclusion

I believe SoFi has several catalysts going into 2023, and we will see a significant increase in 2023’s guidance when its released compared to 2022’s final numbers. The clarification on student debt is what SoFi needed, and it couldn’t have come at a better time as SoFi has a national banking charter that will lower its cost of capital to fund private loans. I believe we will see deposits increase significantly throughout 2022, and into 2023, SoFi’s student loan business will get back to where it was, and its other business lines, including the technology segment with Galileo, will continue to grow. In 2023, SoFi is moving their checking, savings, and credit card to the Technisys technology stack, creating $75 – $85 million in cumulative cost savings from 2023 to 2025, then an additional $60 – $70 million of cost savings on an annual basis. While these are large catalysts, the biggest one could be several years away when SoFi has built out its new platform. SoFi is incorporating the Technisys Cyber Bank platform and Galileo’s backend payment processing, which will be backed by SoFi’s bank charter to create the AWS of Fintech. I think SoFi will surprise many people in 2023 with their numbers, from KPIs in their business to their income statement.

Be the first to comment