William_Potter

A Top Down Macro Analysis Method

Over the past two years, I have been actively covering Chinese e-commerce stocks, notably Alibaba (BABA) and JD.com (JD). Followers of my articles would know that I have been and still am long Alibaba despite the numerous macro and regulatory issues surrounding the company, due to the fact that Alibaba is fundamentally the strongest with viable growth avenues.

However as history has shown (and reinforced by the last two years), strong fundamentals alone are not enough for companies that operate in less capitalistic economies like China. Beyond strong business fundamentals and stable financials, it is equally or arguably more paramount that the business is aligned with the country’s growth strategy and values in the long term. Therefore in this article, I would be elaborating on why Pinduoduo (NASDAQ:PDD) would be my top e-commerce pick to capitalise on China’s reopening and economic recovery.

Key China Themes

To begin, I have identified the key themes that would affect and shape Chinese companies in the medium to long term, as well as some of the focus areas of the Chinese government:

1. Importance of Competition within Industries

Over the past few years, China has clamped down hard on monopolistic practices of its companies like Alibaba and DiDi Global (OTCPK:DIDIY). More recently, China has enacted antitrust laws in late 2022, and included phrases such as “encouraging innovation” and rules that businesses should not “exclude or limit competition by abusing data, algorithms, technology, capital advantages as well as platform rules.” Therefore, it would be important that a company is not at huge risk of breaching this rule, or even better, benefit from such a law.

2. Common Prosperity

Common prosperity is arguably one of the most popular phrases thrown around when discussing about China now. Essentially, common prosperity aims to reduce wealth inequality in China by supporting the development the of lower-income demographic and improving income distribution. Common prosperity is a long term goal in Xi’s plans as reinforced in his 2022 party congress speech, where “common prosperity” was among the top three keywords and emphasis, along with “security” and “high quality development”.

3. National Security

As mentioned, national security was a key topic in Xi’s party congress speech and its importance had been further shown through the delisting of DiDi Global this year.

4. High Quality Growth Consumption Driven Economy

“High quality development” signals a new direction for China’s growth story. This means that the country is no longer seeking growth at all costs, but moving forward will now look for sustainable growth. See it as a pivot from quantitative to qualitative growth. Some areas of development that were mentioned include science and technology, modernisation of the workforce, improving manufacturing quality & digital development.

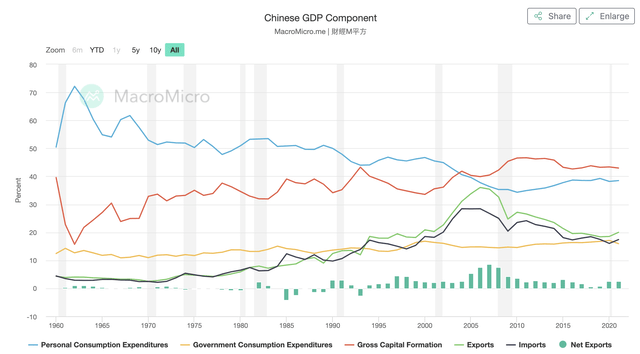

Consequently, some of China’s legacy GDP drivers have been hit hard as a result. For example, real estate which contributes around 7% of GDP was adversely affected in 2021 and 2022 by the government’s “three red lines“. This effectively halted reckless growth in the real estate sector but putting strict leverage restrictions, resulting in a sharp pullback in the real estate sector. Another avenue of growth that China is pushing to plug in this hole would be through increasing consumption spending. Currently, consumer consumption sits at around 40% of the GDP, vs ~60% for most developed countries.

China GDP Breakdown Across Time (MacroMicro)

Consumption is a key focus for the Chinese government as it is part of both the 5 year plan for 2025, as well as the long term 2035 vision. With high quality growth resulting in the decline of legacy sectors and an ever intensifying trade war with the US, consumption will only become increasingly important driver of growth in the long term hence such consumption related industries will likely see favourable governmental policies moving forward.

Pinduoduo Is A Small E-Commerce Player That Can Benefit From Healthy And Fair Competition

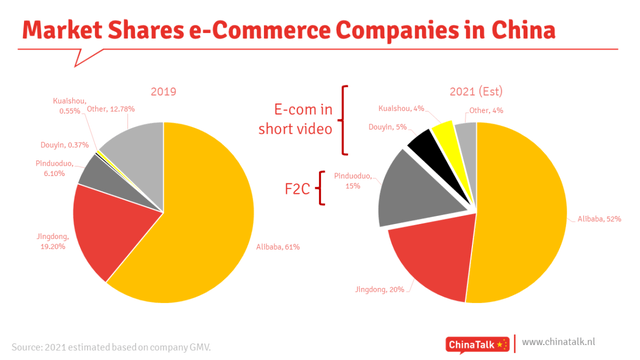

With regards to the first theme on “importance of competition”, Pinduoduo is well positioned within the Chinese e-commerce industry to ride this trend as it is currently only the third largest player with a 15% market share as of 2021. JD.com and Alibaba are the two largest with 20% and 52% of the market respectively. Being a relatively small e-commerce player, this shields Pinduoduo from anti-monopolistic investigations and troubles that have bugged larger players in the past two years.

China E-Commerce Market Share (China Talk)

With new antitrust laws in place, this will also prevent larger players like JD and Alibaba to block the rise of Pinduoduo through predatory methods such as exclusive merchants contracts or excessive promotions.

Additionally unlike its rivals, Pinduoduo only operates in one business vertical which is e-commerce and does not have a huge portfolio of other businesses under their umbrella. While horizontal integration is beneficial and value accretive in most cases, that might not be too desirable for investors of Chinese companies as such companies would be at a higher risk of being deemed as a “monopoly”. Pinduoduo is unlikely to have such a problem in the near future given their size and breadth of their operations.

Third, Pinduoduo also has the lowest commission rates compared to Alibaba and JD. Pinduoduo’s transaction service fee is reported to be 0.6%, compared to 2-8% for JD and 2-5% for Tmall. Beyond commissions and transactions, Pinduoduo also requires the lowest deposit for setting up a store.

| Pinduoduo | Alibaba | JD | |

| GMV (RMB bn) | 2441 | 7494 (China Retail Only) | 2145 (Estimated) |

| Commission Revenue (RMB bn)* | 14.14 | 306 | 72.118 |

| Take Rate % | 0.57% | 4.08% | 3.36% |

To cross check this assertion, a comparison of commission revenue and GMV was taken for these three companies. Note that commission revenue of Alibaba & JD are not directly reported and bundled with other revenue sources like marketing hence they are likely lower in reality. However, these take rates seem to fall within the reported ranges hence it is likely that Pinduoduo indeed has the best commission structure for sellers.

While this may seem trivial, I personally think that it could be a potential area of scrutiny in the future regarding anti monopolistic regulations as it affects the profitability and number of sellers. Since Pinduoduo seems to be on the lower range here, they would also be more protected should such an issue arise. Additionally, having a much lower rate also gives Pinduoduo another avenue of growth through raising rates. They would have a good runway to increase and still be the lowest.

Pinduoduo’s Sellers & Buyers Benefit From Common Prosperity

Pinduoduo essentially started to provide a platform for farmers in poverty stricken areas to sell their produce to buyers in the cities. While their offerings have grown more diversified, agriculture still remains at the heart of their business. In early 2022, Pinduoduo announced that it would continue investments into smart agriculture and host agriculture related festivals to support and bring more farmers on board their platform. Clearly, Pinduoduo’s value proposition aligns with that of China’s common prosperity, and management is doubling down on this aspect to drive growth.

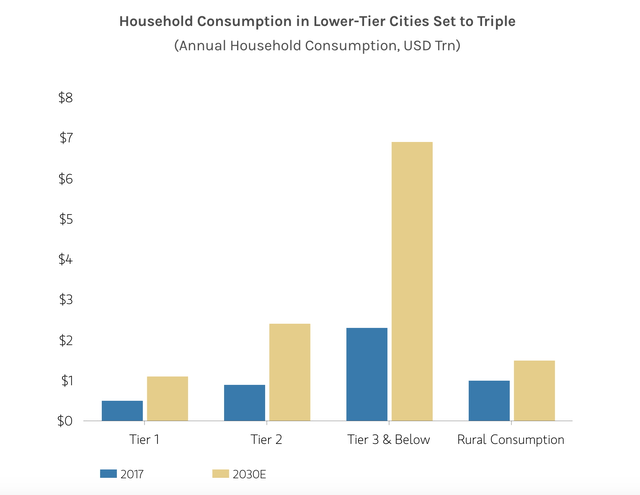

Turning to consumers, Pinduoduo also mainly targets lower tier consumers, with 58% of users living in Tier 3 and below cities. This was where Pinduoduo’s model was able to thrive as the lower tier consumers were largely ignored, yet they were more inclined to group purchases and spent more time on mobile chatting to friends and family than their higher tier counterparts. Hence, Pinduoduo was able to penetrate with low cost, group buying products that required consumers to on board friends and families.

Low tier cities have always been a key engine of growth for China, with Morgan Stanley forecasting consumption to “surge from U.S.$2.3 trillion in 2017 to U.S.$6.9 trillion in 2030”, in an old report. With common prosperity measures, I would expect this growth to be even greater, benefitting Pinduoduo.

China Household Consumption Growth By City Type (Morgan Stanley)

Therefore, Pinduoduo would be a strong beneficiary of common prosperity as their business model and strategy are well aligned with the goals of the country, allowing them to reap the rewards along the way.

Consumption Driven Companies Like Pinduoduo Will Be Vital To China’s Growth

So why have I focused on e-commerce for this article? As discussed under my final key theme, China’s focus for the medium to long term would be on high quality growth industries and consumption. While e-commerce sales growth is expected to taper down to high single digits by 2025, it is already the largest contributor of retail sales in China. Over 840 million Chinese consumers are on e-commerce (~75% of adult population), hence favourable consumption policies will likely have a strong impact on e-commerce spending.

Pinduoduo, JD.com & Alibaba Can All Thrive

Therefore, Pinduoduo along with JD and Alibaba will likely be benefactors of China’s changing economy dynamics. Whilst greater focus remains on Pinduoduo for this article, I remain bullish on Chinese e-commerce in general. When analysing the three major players, it can be seen that each company has their own niche in this industry and all three have a huge possibility of thriving together.

Pinduoduo remains focused on agriculture and group buying for lower tier consumers, JD is a go to for consumer electronics while Alibaba’s Tmall is known for brands and higher quality products. In recent years, JD and Pinduoduo have both turned a profit, reflecting favourable economics of the industry.

How Do They Rank?

Given that I have covered all three companies before, you might ask how do I rank them in order of how investable they are? While different investors would have different believes and analysis, I would go in this order: Pinduoduo being the most attractive, followed by Alibaba than JD.

Pinduoduo being the first is self explanatory through this article. Considering a macro view is extremely important when investing in China and Pinduoduo is very much aligned with the country’s goals and beliefs. Second would be Alibaba. Although Alibaba is one of the hardest hit over the past two years, the company’s fundamentals remain very strong. While they are slowly losing market share in China e-commerce, they are making use of this strong cash generative business to expand into cloud computing and new retail which is an often overlooked part of the business. Cloud is also turning profitable and would aid in margin expansion in the long run.

JD would come last as while they are expanding into many verticals, I believe that JD’s high growth is coming to an end as Alibaba has already expanded into areas where JD used to have a lead such as controlling the whole e-commerce supply chain. JD’s other ventures like cloud and transport also do not make up a significant portion of their revenue and are unprofitable and have low margins respectively. For deeper analysis, you may view my most recent articles on Alibaba and JD too:

- JD.com: Undervalued But Not Worth A Buy

- Alibaba: New Retail Is An Under-Appreciated Long Term Growth Driver

Long Term Outlook For Pinduoduo

I will now quickly elaborate on Pinduoduo’s valuation & where I see them moving forward. Do note that this is by no means a full valuation model, but I am taking a relative valuation standpoint since I am approaching this analysis from a more macro standpoint. I would conduct a detailed model should I deep dive Pinduoduo’s business fundamentals in future.

While e-commerce growth is slated to slow in China, I expect Pinduoduo to maintain growth rates around 20% in the near to medium term as they continue to gain market share.

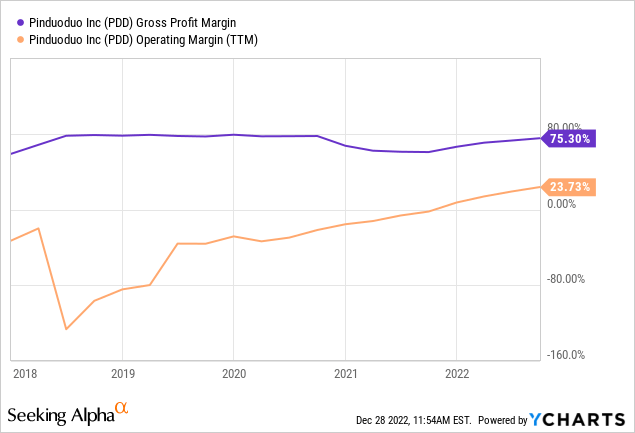

Bottom line should outpace top line growth too with Pinduoduo continuing to reap economies of scale and gross margin returning to the stable 80% level as inflationary pressure eases. Consequently, earnings and free cash flow growth should be comfortably within the 20-30% range.

At a forward PE of ~20 today, Pinduoduo no longer seems as cheap as it was a few months ago. In hindsight, it would have been great to purchase during the dip two months ago, but hindsight is always 20/20. However, I believe that Pinduoduo is still trading at a fair price today, with a PEG <1 and still room for slight multiple expansion. There are two reasons for this.

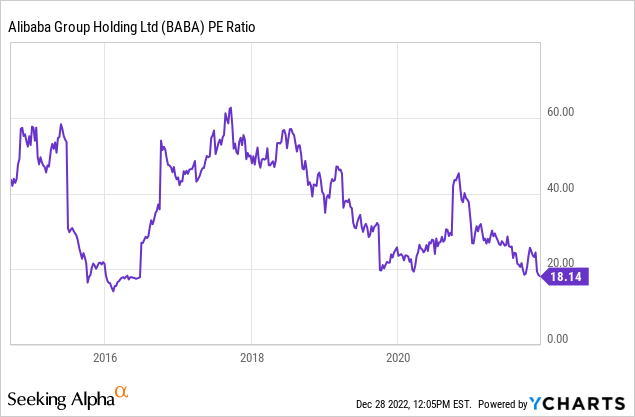

1. In my earlier article on Alibaba, I have analysed that mature retailers with low growth tend to trade at an average PE of 20-25. Hence, with higher margins and faster growth, Pinduoduo definitely deserves a PE above 20, even when discounting out the China risk.

2. When we look at Alibaba’s PE in its high growth phase, it often exceeds 40x. Therefore even if we take a discount for the added China risk today and a more saturated e-commerce industry, a PE ~30 is not unreasonable.

Additionally, while it is good to have a Chinese stock discount given sentiment around Chinese stocks now, my article had essentially addressed why I believe that Pinduoduo would be a company that thrives along with China’s long term vision moving forward. Therefore, in a best case, Pinduoduo could actually realise its full valuation potential when concerns eventually subside or Pinduoduo continues to outperform with each year.

Risks Still Involved

Ultimately, there will still be significant risks involved in an investment of Pinduoduo.

First, Pinduoduo is listed in the US and there is still the delisting risk. While Chinese authorities are already working with the SEC for a resolution, this might not come to fruition. Fortunately, as seen in DiDi Global’s case, Pinduoduo could still trade OTC should delisting occur.

Second, the Chinese economy is still on a cusp of a slowdown and an impending recession would also affect China and Pinduoduo. However, given that Pinduoduo is a low cost e-commerce solution that sells necessities like agriculture produce, they could actually benefit from a trade down effect.

Finally, the poor sentiment around Chinese investments could remain for a prolonged period of time or additional regulations could shock investors. However, with China’s recent activities of re-opening and the reduced scrutiny around its companies, I believe that economic recovery and growth is now the country’s priority and fund inflows into China would gradually resume over time.

Conclusion

In conclusion, after analysing China’s regulatory and economic actions over the past two years (and losing money in the process too), I have identified key themes that a company should fulfil in order to benefit from China’s recovery moving forward. Pinduoduo fits the bill perfectly for the two main issues: common prosperity and anti-monopoly. Hence, I believe that they are the best positioned e-commerce company to invest in as China’s economy and stock market recovers.

Today, Pinduoduo is trading at a fair value, but given the volatile nature of Chinese companies and how news can easily swing stock prices, I believe that investors could also wait for a slight pullback to start a position in Pinduoduo.

Be the first to comment