courtneyk

The iShares U.S. Real Estate ETF (NYSEARCA:IYR) contains a lot of specialised REIT exposures that actually have a purpose in the current environment. However, we argue that IYR’s exposure to the real estate bucket on markets is going to be a problem for it if likely factors cause the market to revise expectations around the rate cycle. Inflation continues, and comments today from some of the boys at the FOMC could cement market concerns about MoM inflation. Moreover, we see spectres on the horizon with Russia and China and their impact on the commodity markets. Overall, real estate is too levered to the rate environment to be a safe bet right now.

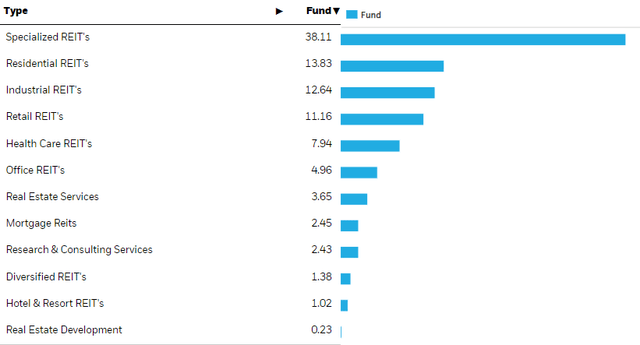

Quick IYR Breakdown

Let’s just discuss the sectoral exposures, as we’ve talked about some of the IYR exposures specifically in the past.

The specialised REIT exposures are nice. Most of them have rent hiking clauses that keep their effective durations low and competitive with both rate hikes and inflation. Moreover, they often have value propositions, such as Telco infrastructure or Internet Exchanges, that keep them highly relevant in the market with pricing power.

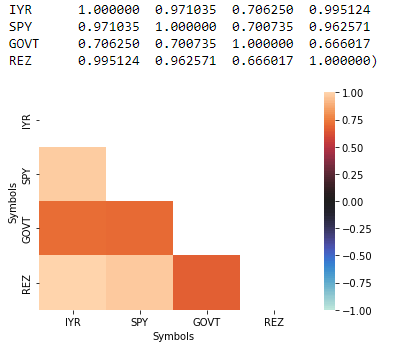

However, the IYR trades together with the general market, especially the buckets associated with general (where we mean residential) real estate – where development economics inextricably linked to interest rates are most relevant.

Instrument Correlations (VTS)

Bottom Line

If IYR is going to trade with the general market and residential real estate values, we need to be worrying a lot about the rate cycle. Markets are being pretty lax about it lately, and we worry that a couple of factors aren’t being priced in.

- The end of COVID-zero means China will be revenge traveling. This will put upward pressure on oil. Moreover, industry will resume, and this will put upward pressure on a host of global commodities which rely on the China demand sink such as iron ore and steel/steel products.

- Russia is retaliating to European price caps and sanctions with production cuts, putting upward pressure on oil. Finally, their permafrost-based wells could freeze up if production levels get too low, and with sanctions they will be less equipped to service such issues.

We are seeing some continued inflation, with figures up less than a percent MoM meaning sequential inflation. While this is quite benign, the problem is that global commodity reflation could grow it further. Moreover, things like food and shelter continue to cost more and this could give credence to concerns around inflation perpetuation as this affects households the most harshly.

Today, we get more members of the FOMC speaking on the inflation figures. They could raise some flags and markets could get hit. Moreover, with structural issues likely to rebound commodity prices globally, figures could continue to worsen and realise the downside of a longer rate cycle than equity markets anticipate. This will take IYR down a peg together with residential real estate and the rest of the US market.

Best to avoid it, despite the benefits of specialty REIT exposures.

Thanks to our global coverage we’ve ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment