FotografiaBasica/iStock Unreleased via Getty Images

Altria Group, Inc. (NYSE:MO) is a very popular stock on Seeking Alpha with more than 200,000 followers. Over the last 4 decades (yes decades) starting with the Cipollone v. Liggett Group in 1983, tobacco has been vilified by various government agencies and legislative bodies in an attempt to decrease smoking and the diseases associated with smoking.

But here we are in 2022 and once again MO is under attack with the FDA (Food and Drug Administration) about to eliminate MO’s reduced-risk cigarette alternative JUUL. And on the horizon is the US government’s attempt to eliminate nicotine in cigarettes.

Over the years, many attempts have been made to restrict, ban or eliminate cigarettes and over that time period MO has thrived.

MO’s Total Return value, which includes dividends and capital gains, has increased by 3,000% since 1992 in spite of all the attempts to terminate and/or restrict its products and profits.

This time is no different.

MO Stock Key Metrics

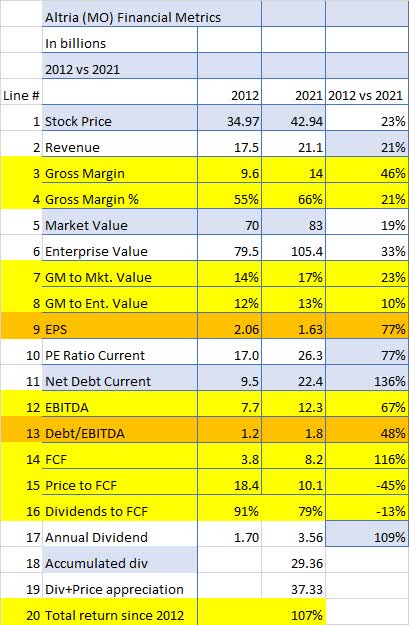

If we take a look at MO over the last 10 years, we can see that results are definitely improving. In fact, some of the numbers, like FCF (Free Cash Flow), border on the astounding.

Seeking Alpha and author

Let’s look at one of my favorite financial metrics, Gross Margin (GM).

Why do I like GM so much? Well, without a robust GM it is very difficult for any management team to generate big FCF and earnings numbers.

Note that in spite of unending tax increases, political vilification, and decreasing user numbers, MO has increased its GM (Line 3) by more than twice the increase in revenue (Line 2), 46% to 21%. Another big increase is in EBITDA (Line 12) which rose by 67% over the last 10 years.

But arguably the most important number is FCF (line 14) which more than doubled over the last 10 years causing the Price/FCF (line 15) to drop by 45%, meaning that MO is likely undervalued compared to 2012 in spite of giving long-term investors a 107% return (Line 20).

Also note if you are concerned about the dividend, that MO is actually paying out 13% less in dividends as a percentage of FCF (line 16) now than they were 10 years ago. That is indeed impressive.

All is not sunshine and lollipops though as the ghost of the JUUL acquisition for $12.8 billion in 2018 continues to haunt MO and its shareholders. So far the writeoffs have been $11.1 billion, and it certainly looks like the last $1.7 billion will be written off soon. Good riddance, I say.

But in the meantime, the unending write-offs have affected both reported (GAAP) earnings (Line 9) and of course the debt (Line 11). If there is any good news in this ongoing disaster, it is that write-offs at this point are non-cash although the debt used to buy JUUL has yet to be completely paid down.

But I would say overall that MO has done much better financially than I would have thought over the last 10 years.

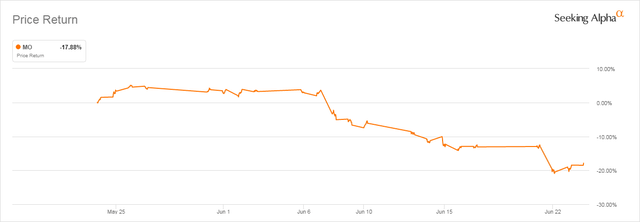

Why Has Altria Stock Dipped?

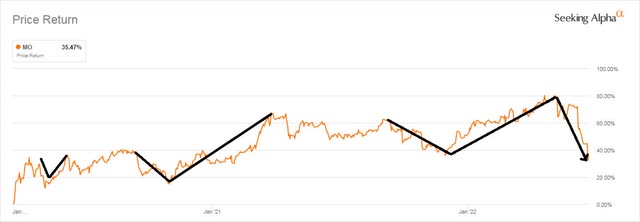

Altria’s stock price has dropped about 18% in the last month.

The main reasons are the JUUL ruling (see above) and the Biden administration’s vow to cut nicotine in all cigarettes by administrative fiat beginning with a new ruling in 2023. Then there is a comment period then, of course, the usual lawsuits by MO and other cigarette companies. The whole process will take years to settle, so I don’t see any effect on MO’s business for years, if ever.

My guess would be after years and years of litigation some settlements will be reached allowing different degrees of nicotine to be allowed with lower ones taxed less and higher ones taxed more.

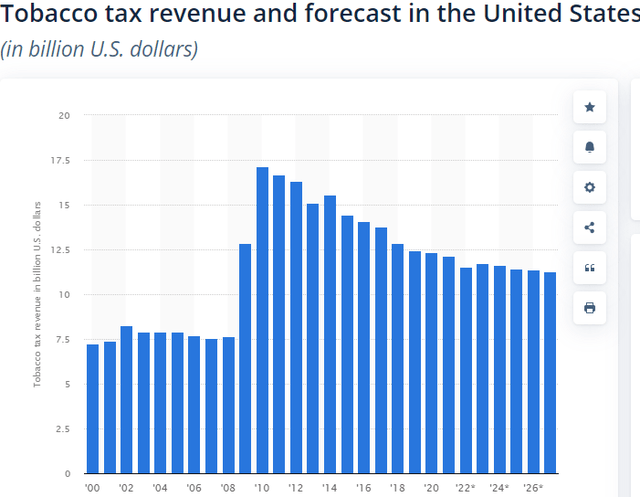

States have collected over $150 billion in taxes via cigarettes, and I don’t see a lot of support for the complete revocation of cigarette sales because of that.

Therefore, I see little or no harm to MO’s business prospects over the next 10 years at least.

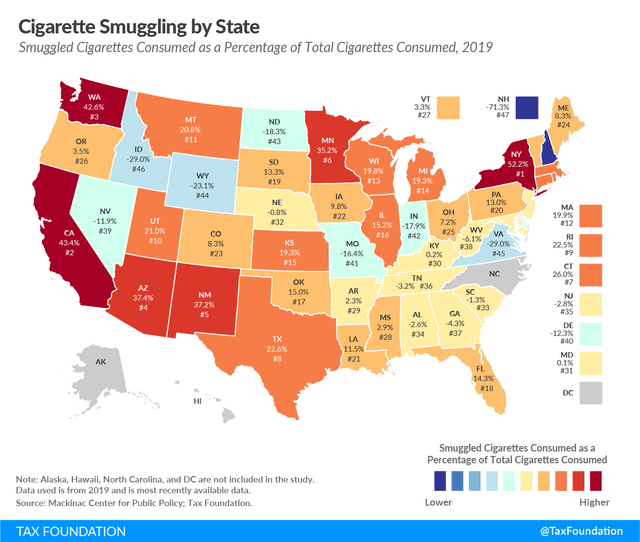

Another interesting chart showing the percentage of smuggled cigarettes by state comes from the Tax Foundation:

My thesis on the red states is higher taxes result in more smuggled cigarettes, although I have no hard data to support that argument.

As for JUUL, getting rid of a money-losing albatross can only be good for MO’s long-term price appreciation. The Wall Street Journal reported JUUL lost $259 million last year alone.

Is MO Stock A Good Long-Term Investment?

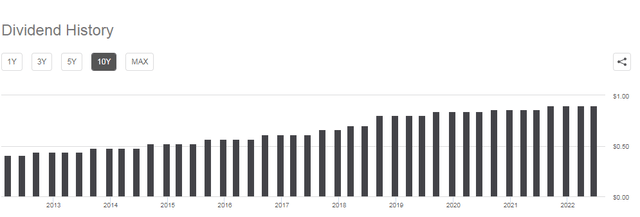

As I have shown above, MO’s long-term investment metrics have been excellent for the last 10 years. I fully expect them to continue over the next 10 years and with price appreciation plus the annually-increased dividends, long-term gains will be safe and abundant.

Look for another dividend increase next quarter with the announcement made sometime in September.

Is MO Stock A Buy, Sell, Or Hold?

Since the COVID-19 market crash in March of 2020, MO has been shown to be an excellent buy when purchased during big dips in price. Looking at the following chart, we can see that in every case over the last 2 plus years when MO had a big dip, the price shows a recovery within a few months.

This dip is no different because MO will continue to exceed expectations over the foreseeable future. I expect to see MO at $50 or higher by the end of 2022.

Altria is a strong buy for those looking for high dividends and moderate capital gains.

Be the first to comment