akinbostanci

Financials have lost some luster recently. A drop in intermediate-term interest rates while the short-end of the Treasury curve remains high is not a great recipe for firms that borrow short and lend long. Still, being able to pay out low rates to depositors and invest in paper earning north of 4% is still a winning asset-liability strategy for financial institutions.

One niche of the sector that is generally insulated from those yield curve changes is insurance equities. This group benefits from higher interest rates with less emphasis on the shape of the yield curve. It’s also a somewhat defensive spot that is insulated from big negative swings in the macroeconomy.

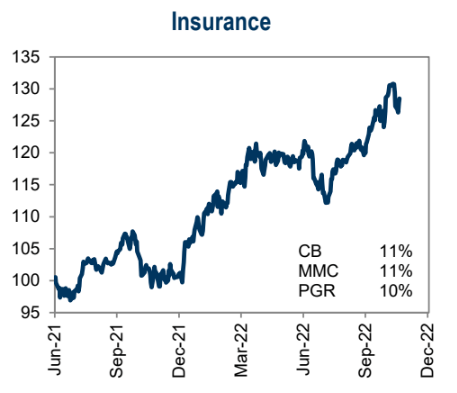

Not surprisingly, the insurance industry has greatly outperformed the broad market in the last 18 months as evidenced in the chart below from Goldman Sachs. But is there still protection and alpha in this group? Let’s dig in.

Insurance Industry’s Relative Strength Keeps Up

Goldman Sacks Investment Research

The iShares U.S. Insurance ETF (NYSEARCA:IAK) offers investors exposure to U.S. companies that provide life, property and casualty, and full line insurance, according to iShares. It is a market-cap weighted fund that features a reasonable expense ratio of just 0.39% annually while paying out a 1.7% trailing 12-month dividend yield. While not a giant ETF with under $600 million in assets under management, but the 30-day median bid/ask spread is not too high at 10 basis points. I advise using limit orders with IAK trades as its average daily volume, as of December 2, is less than 100,000 shares, per the fund provider.

There are 56 total positions in the ETF, and it can be volatile at times with a historical standard deviation above 23% despite its strong outperformance against the broad market in the last two years. Overall, though, the equity beta is less than one.

On valuation, the forward price-to-earnings ratio is very low at just 10.3, per iShares. Morningstar marks the fund with a strong five stars and a bronze rating.

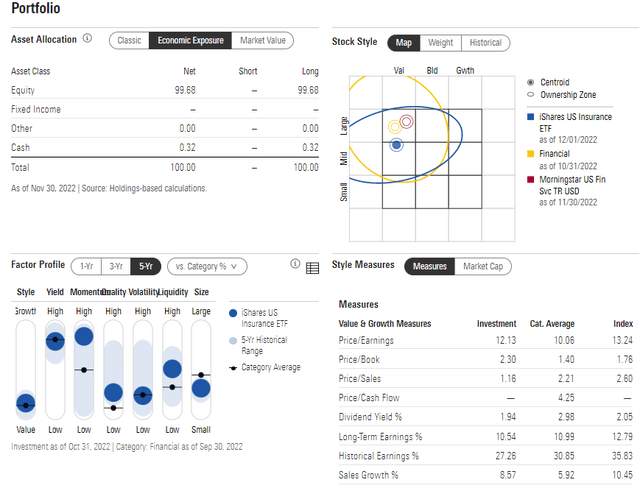

IAK: Factor Analysis & Key Portfolio Statistics

In terms of the portfolio, I do see concentration risk with IAK. The largest two stocks make up more than 22% of the portfolio. The top 10 holdings represent a high 63% of the fund. IAK is plotted on the Morningstar style box as a mid-cap value ETF, but it is close to being considered a large-cap play.

In terms of historical price action using factor analysis, IAK is very much value-oriented while offering a high yield compared to the market. What’s interesting is that this defensive Financials sector area is now high in momentum, according to Morningstar.

Take caution, though, as the portfolio is considered low quality, but I suspect that is due to the unique asset/liability structure of insurance companies. As such, volatility compared to the market is low.

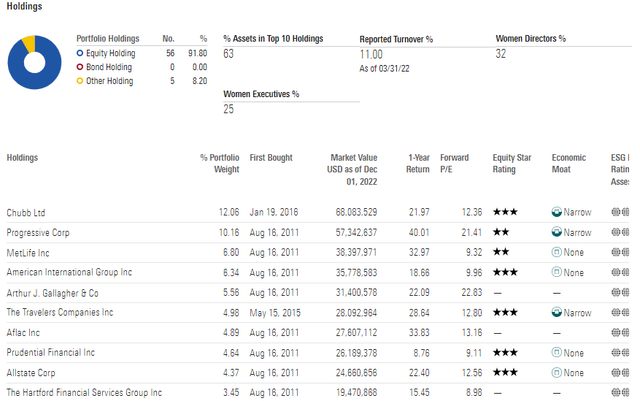

IAK: Portfolio Holdings & Concentration

Overall, I like the valuation at about 12 times earnings, using Morningstar’s calculation, as long-term earnings growth is robust. The resulting PEG ratio is barely above one using its long-term earnings growth rate.

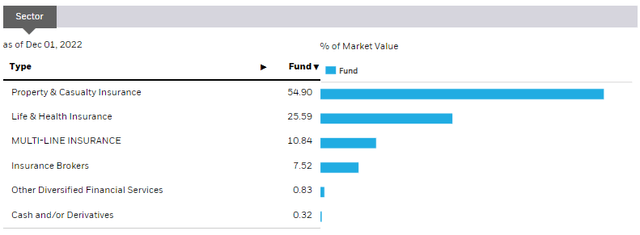

At a higher level, IAK is most positioned in the property & casualty insurance space with lighter exposure to life & health.

IAK: Industry Breakdown

The Technical Take

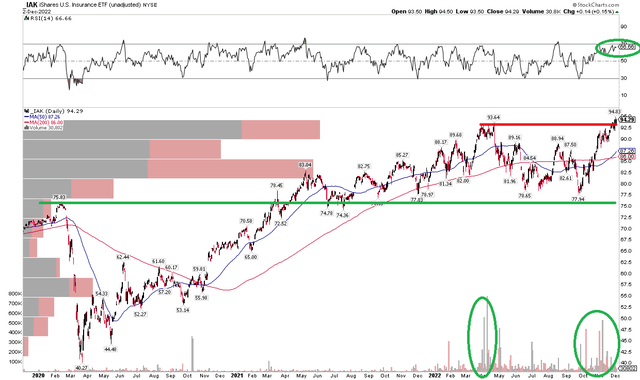

With a decent valuation and a low beta, how does the chart look? I see bullish features on the chart of IAK. Notice below that shares closed last week at fresh all-time highs on the weekly view (Wednesday’s daily close was marginally above Friday’s).

The fund is higher in eight of the last nine weeks, and is just now breaking above the high from the second quarter. Based on the all-time weekly high, I see a bullish price objective of about $110 based on the previous $78 to $94 range. That $16 difference is then added on top of $94 to arrive at $110.

Helping to confirm that bullish take are impressive volume trends and a strong RSI. Be on guard for a bearish false breakout if the stock moves back below, say, $92.

IAK: Fresh Weekly High Close With Strong RSI

The Bottom Line

I like the valuation and technical price action in IAK. Insurance companies continue to be resilient with relative strength versus the broad market.

Be the first to comment