KanawatTH

Introduction

In August 2022, I wrote an article on SA about high-performance automotive parts supplier Holley (NYSE:HLLY) in which I said that the second half of 2022 won’t be much better in spite of a significant amount of demand being pushed into Q3.

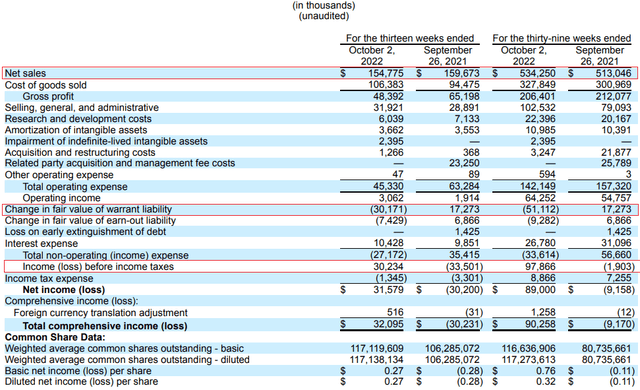

Well, net sales went down by 12.7% quarter on quarter in Q3 2022 and the guidance for the full year was reduced once again. As a result, I no longer think that demand for the company’s products is sticky. Let’s review.

Overview of the Q3 2022 results

In case you haven’t read any of my previous articles about Holley, here’s a quick description of the business. The company designs, manufactures and distributes high-performance products for car and truck enthusiasts such as carburetors, fuel pumps, superchargers, and engine tuners. Some of its brands include Accel, Flowmaster, and MSD and the USA accounts for over 97% of net sales. Holley listed on the NYSE in March 2021 through a merger with a special-purpose acquisition company (SPAC) and one of its main selling points was how demand was sticky as 82% of all car and truck enthusiasts consider budgets on parts recurring expenses while 54% of the company’s consumers earn more than $75,000 per year (see slide 13 here).

However, Holley went bankrupt during the Great Recession and in 2010 the company emerged from Chapter 11 bankruptcy for the second time over a period of just 3 years as sales declined by 19.5% in 2009 to just $90.2 million. With high inflation rates in the US hitting demand for discretionary goods, it seems that this time won’t be much different. You see, net sales declined by 7.1% year on year to $179.4 million in Q2 2022, but the company said that some were pushed into Q3 due to supply chain disruptions, and chip shortages. However, Q3 net sales decreased by 12.7% quarter on quarter to just $154.8 million despite supply chain pressures easing in August and September. Net sales were lower than Q3 2021 despite not comparing apples to apples here as non-comparable sales associated with acquisitions contributed $7.7 million in Q3 2022. You see, Holley bought three small companies for $13.8 million since the start of 2022, namely John’s, Southern Kentucky Classics, and RaceQuip. In addition, Baer, and Brothers Trucks were acquired in December 2021 for $48.3 million. And with revenues declining, the margins are shrinking significantly. In Q3 2022, the main reason Holley was still profitable was the lower share price as this resulted in significant changes in the fair value of the warrant liability.

Holley

The decline in sales can be traced to the electronic systems category, where there was a 15.7% year on year decrease to $62.2 million. I find this surprising considering Holley mentioned in its Q3 2022 earnings call that receipts of microchips have improved:

And when we talk about the fact that our receipts of microchips have improved, those — the specific microchip we’re talking about there is one that is used in our largest electronic product line that uses those types of chips – source here

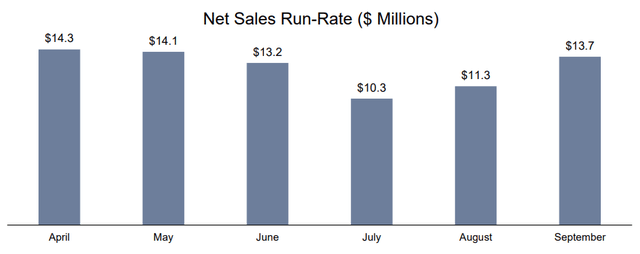

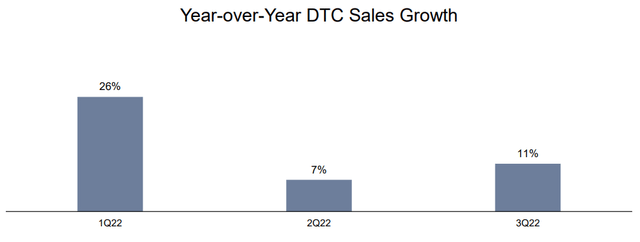

On a positive note, September 2022 net sales rose by 31% year on year and the run-rate was close to the level from May 2022. In addition, direct-to-consumer (DTC) revenues are still holding up well.

Holley

Holley

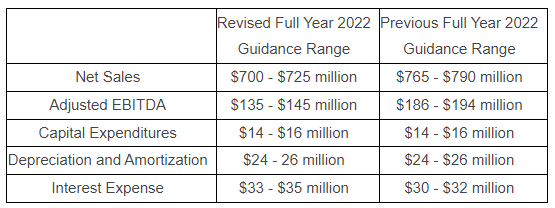

However, the full year guidance has been revised downwards once again and now Holley expects to book net sales of between $695 million and $710 million and adjusted EBITDA of between $118 million and $124 million. For comparison, this is how the guidance looked at the end of Q2.

Holley

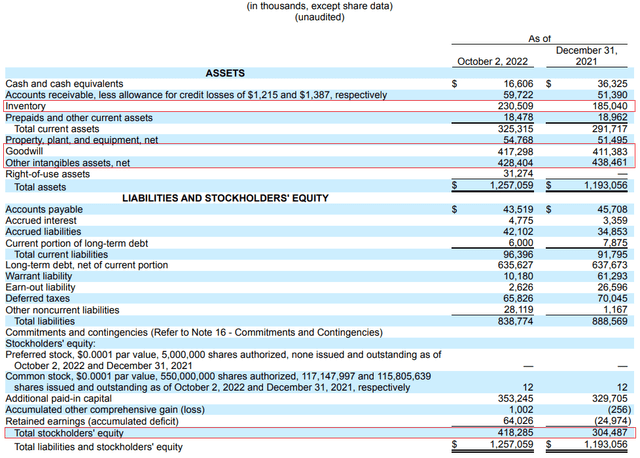

Turning our attention to the balance sheet, I think the situation doesn’t look good as the weighted average interest rate on Holley’s borrowings under its credit facility rose to 6.8% on October 2 compared to 5.2% a quarter earlier. The company had $650.9 outstanding under this credit facility and the interest rate is based on LIBOR. In addition, the tangible book value (TBV) is still deep in the red and I find it concerning that inventories have grown beyond $230 million despite excess past due orders shrinking by $11.1 million quarter on quarter to $30.6 million.

Holley

Don’t get me wrong, Holley is not in danger of insolvency at the moment. The company has more than $140 million in available liquidity and the vast majority of its debt is due in November 2028. However, we should keep an eye on the situation as the credit facility has a 5x net leverage covenant and the net leverage ratio was up to 4.3x as of October 2.

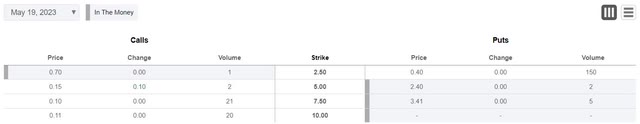

Overall, I think that Q3 2022 was another poor quarter for Holley from a financial point of view and that net sales and adjusted EBITDA for the full year could be slightly lower than the new guidance considering the company hasn’t been conservative in its estimates over the past few quarters. So, how do you play this? Well, short selling seems like a viable idea as data from Fintel shows that the short borrow fee rate stands at just 1.29% as of the time of writing. In addition, call options are somewhat cheap at the moment.

Seeking Alpha

Looking at the risks for the bear case, I think that the main one is that the net sales run-rate from September could be sustained through Q4 which would allow Holley to beat its guidance for the full year. This is likely to provide a boost for the share price.

Investor takeaway

The new Holley was supposed to be resilient to macroeconomic pressures, but I think that its financial results this year are proof that little has changed compared to the Great Recession. The financial performance is still highly sensitive to recessions and Holley could be in trouble once again if it doesn’t find a way to improve its profitability as the net leverage ratio is approaching 5x. In my view, opening a small short position seems viable but risk-averse investors should avoid this stock.

Be the first to comment