AerialPerspective Works

Investment thesis

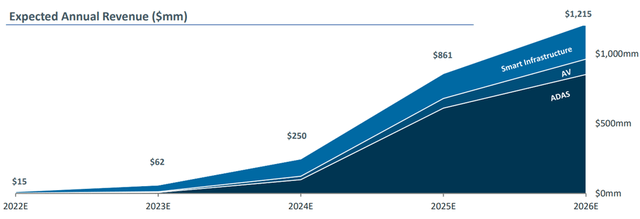

Cepton, Inc.’s (NASDAQ:CPTN) guidance for 2025 revenues of $861 million and 2026 revenues of $1.1 billion puts the company on the path to being one of the, if not the, fastest companies to ramp revenues amongst its peers. That said, only about $340 million of 2026 revenues are from wins already recorded by Cepton, with the large majority of those revenues coming from General Motors Company (GM) and the remainder yet to be booked, which is why I remain conservative relative to its aggressive targets. I believe Cepton is favorably positioned given its cost-efficient technology approach, but the combination of the wins and the advanced engagements to date largely all relate to Advanced driver-assistance system (ADAS) functionalities rather than L3+ systems, and Cepton will likely need more progress on the technology as well as validation of the technology before investors are further convinced of long-term upside for the shares.

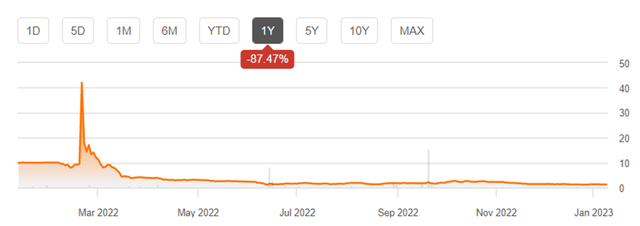

CPTN’s stock price movement (Seeking Alpha)

Company description

Cepton, Inc. provides LiDAR sensors, built using their patented Micro Motion Technology, for automotive applications around ADAS and Smart Infrastructure. Cepton’s products include Vista-X, Vista-P, Sora-P, Nova, and a smart LiDAR system bringing edge computing and perception – Helius.

Founders have strong track record in optical industry

The top leadership of the company has a very deep background in technology, with CEO Jun Pei and CTO Mark McCord receiving PhDs in electrical engineering from Stanford. Dr. Jun Pei has past experience in developing advanced 3D optical instruments, while Dr. Mark McCord has worked as an associate professor at Stanford. Dr. Liqun Han, with experience at KLA-Tencor and various roles related to operations, was recently appointed as the COO of the company. Mr. Hull Xu, previously the Director and Head of Electronics and Automotive Technology Coverage at RBC Capital Markets, serves as CFO of the company.

Founder led team of lidar industry pioneers (Company Presentation)

Cepton operates as a Tier 2 supplier as opposed to Tier 1 peers

The technology approach set forward by the team of founders and management and the focus on the most lucrative end-market in relation to automotive ADAS sets up Cepton for a strong revenue ramp. That said, in a key difference to LiDAR peers, Cepton is a Tier 2 supplier instead of a Tier 1. Cepton is looking to partner with Tier 1 suppliers, including traditional automotive Tier 1s, and the first key Tier 1 partner for Cepton is Koito at this time. Cepton’s position as a Tier 2 limits fixed-cost absorption headwinds for the company as Cepton waits to ramp revenue, but at the same time, the Tier 1 component supplier position limits the revenue opportunities for the company relative to certain LiDAR peers.

Active engagements with all of the top 10 OEMs, with General Motors its key current partner

Since its inception, Cepton has focused on bringing its Lidar technology to the mass market and has stressed the General Motors commercial win as a key validation of the technology. Inarguably, in relation to volume implications, the General Motors win is large and positions Cepton as one of the companies with a robust revenue ramp ahead of it in the medium term.

General Motors is pursuing Ultra Cruise as the Level 2 ADAS equipped platform for consumer vehicles with a full sensor suite comprising cameras, radars, and LiDAR. The win is in partnership with Koito as a Tier 1 partner. Signed in 2019, it is expected to run from 2023 to 2027 and cover 3 different GM platforms, including 8 models, which Cepton expects to reach 14 models over time. The estimated size of the General Motors award win is currently about $2 billion, making it one of the largest award wins from a single OEM to date, on account of the volume implications in terms of the number of vehicles.

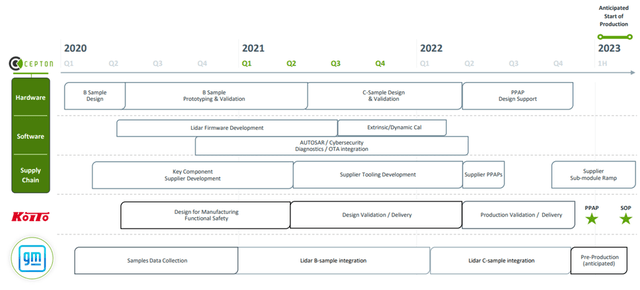

Anticipated series production target timeline at GM (Company Presentation)

Financial Outlook

Strong revenue CAGR driving ~$1.3 billion of revenues by 2030

Led by the GM award win, which I expect to start to hit the run-rate of normalized revenue by 2026/2027 and account for about $300 million on an annual run-rate basis, I expect Cepton to be positioned to ramp revenues strongly, to about $1.3 billion by the end of the decade. This pace of revenue growth would be marking about 73% CAGR through to the end of the decade.

Revenue ramp driven by production awards and strong pipeline (Company Presentation)

Margins should stabilize relatively early in the decade

Cepton relies on Tier 1 suppliers for the manufacturing of the fully assembled product as well as on contract manufacturers like Fabrinet for sub-module manufacturing, which largely implies a highly variable cost structure. The variable cost structure, in combination with the relatively lower bill-of-materials for Cepton leveraging simple design, should enable Cepton to achieve mid-40% gross margin in FY24, but I expect a stabilization following that on account of greater pricing pressures on ADAS systems relative to L3+ Autonomous systems.

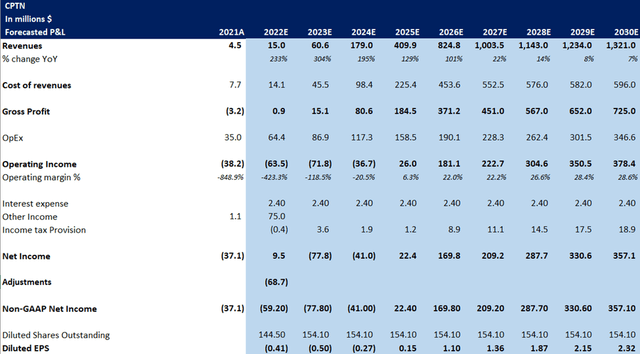

Achieves EPS profitability in 2025, ramping to earnings power of $2.32 by 2030

Cepton will achieve EPS profitability in 2025 on only about $410 million of revenues, with robust gross margins of ~45% and OPEX expense discipline allowing for a quick ramp on profitability. However, despite a very attractive path to EPS profitability, the revenue and earnings ramp in the second half of the decade should be slower and only lead to earning power at around $2.32 in 2030.

CPTN forecasted P&L (My estimates)

Financing needed and further dilution of existing shareholders likely

Cepton ended the last quarter with about $22 million of cash and cash equivalents and with total liquidity greater than $40 million, which implies a few more quarters of liquidity cushion with a cash burn of about $15-$20 million per quarter. However, unsurprisingly, the company would be better placed to strengthen its balance sheet beyond relying on liquidity instruments to navigate the macro while ramping on the GM win. On that front, Koito has already committed to invest $100 million, and in my view is likely to invest more to maintain its favorable Tier relationship with Cepton.

Final Thoughts

I keep a Hold rating on Cepton, Inc. based on the balance of a strong order book following the win with General Motors to support L2 ADAS functionalities with a cost-efficient LiDAR product. The absence of wins following it offers limited validation of both the opportunity for LiDAR in L2 ADAS applications as well as validation of Cepton’s technology. I believe Cepton’s technology approach positions it well for a cost-efficient product for OEMs targeting mass-market adoption of ADAS functionalities with high performance enabled by LiDARs. Early wins like the one Cepton has with General Motors provide the company an early mover advantage and an opportunity to iterate with OEM to develop a L3+ product.

Be the first to comment