MikeMareen

The Investment Plan

Camber Energy (NYSE:CEI) is a company focused on acquiring, developing, and then selling both natural gas and crude oil in the United States. With most of their operations taking place in Kansas, Missouri, Louisiana, and Texas. As they are acquiring these products they are then storing them in their own facilities where they also refine in order to mark up the price and make a profit.

Oil, and especially American oil, has been a hot topic in 2022, but this has meant that shareholders of Camber Energy have been rewarded. Instead the share price has plummeted 95% because of fears that rapid share dilution will continue. Right now the situation seems unclear about the possibility of a turnaround for the company, so investors should consider pulling out and selling before more inevitable pain.

Latest Earnings Report Highlights

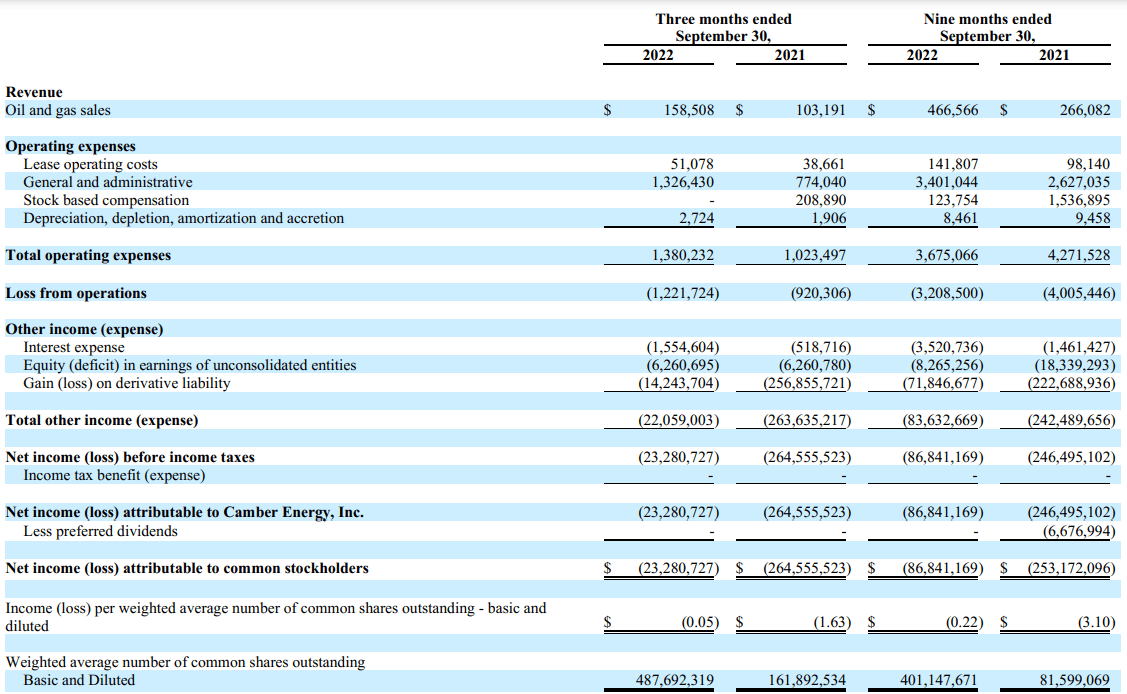

In the latest earnings report, Camber Energy generated $158 million in revenues from their oil and gas sales. This was an increase of 53% compared to last year. I think this is impressive given that there has been a lot of pressure on companies to find more renewable energy sources. But despite this, Camber Energy managed to have another quarter of revenue growth. The bottom line, however, did not see the same love in my opinion. As the company had a loss of $22 million, this has shareholders worried about the future of the company.

Income Statement (Camber Energy Q3 Report)

The net income has managed to increase as Camber Energy placed its focus on margin expansion. I think this marks that they are on their way perhaps to better profitability. But it’s overshadowed by the aggressive share dilution that has been happening.

The outlook and comments by the management of the company are split. On one side they are confident in their ability to further leverage the expertise of their teams and improve their financial performance. But they are also blaming the volatile prices of gas and oil for having issues and causes for their continued non profitability. But I found it worrying that the management noted “These conditions raise substantial doubt regarding the Company’s ability to continue as a going concern”. The road ahead seems very tough.

Sector Outlook

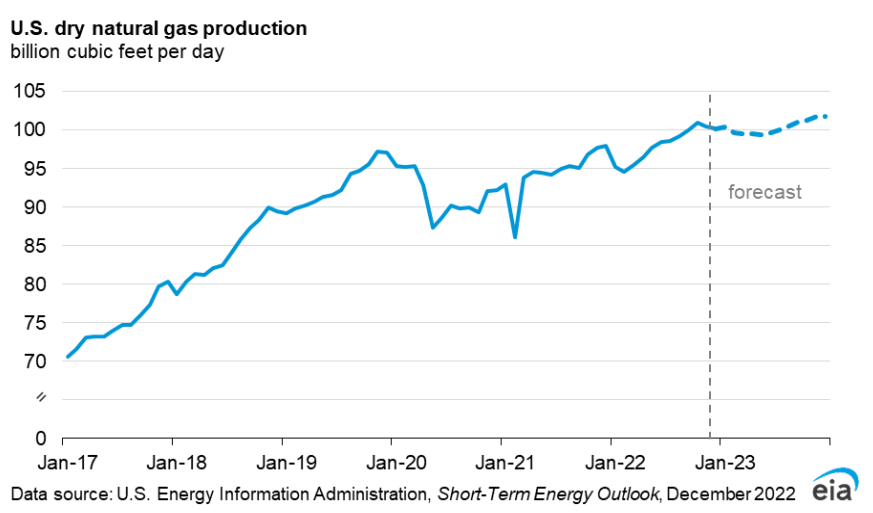

Camber Energy is a part of the energy sector but of course focuses more on the natural gas and oil part of it. Knowing how a sector or small part of a sector might develop in the coming years is vital for any investor.

Looking at the short-term, I think that a lot of companies will see fluctuating revenues as commodity prices continue to be volatile. But in the long-term, it might start to ease and stabilize a bit more.

Natural Gas Outlook (Energy Information Administration)

It’s no secret that governments and companies are eager to push for cleaner energy. With the USA devoting the IRA to further help with companies choosing and developing renewable energy sources. In the long-term I think most people understand that natural gas and oil will see much less use. But I think people are misinterpreting how far away that is. It will still be with us for the next several decades. That still makes investments into the sector viable. As these large companies place a large focus on giving back value to the shareholders, I will rest assured I am prioritized by them. So looking for companies with strong cash flows even through tough times and with a healthy and growing dividend will be very beneficial.

Competition

The natural gas and oil industry is full of companies all competing for their share of the pie. With Camber Energy I think that some of its closer competitors are Petrolympic (OTCPK:PCQRF), Canada Energy Partners (OTC:CNDPF) and U.S. Energy Corp (USEG). As Camber is seeing decreases in revenues compared to several years ago, it seems they are losing market share to some of the companies I just mentioned.

In terms of growth here, USEG seems to be the winner, seeing some YoY growth. But what you need to know about Camber is that share dilution is still happening. They are doing it faster than the other mentioned companies which makes it riskier for investors. Looking at the TAM there is still growth possible for each of these companies, but investors need to be aware of risks like share dilution or volatile commodity prices.

The Balance Sheet

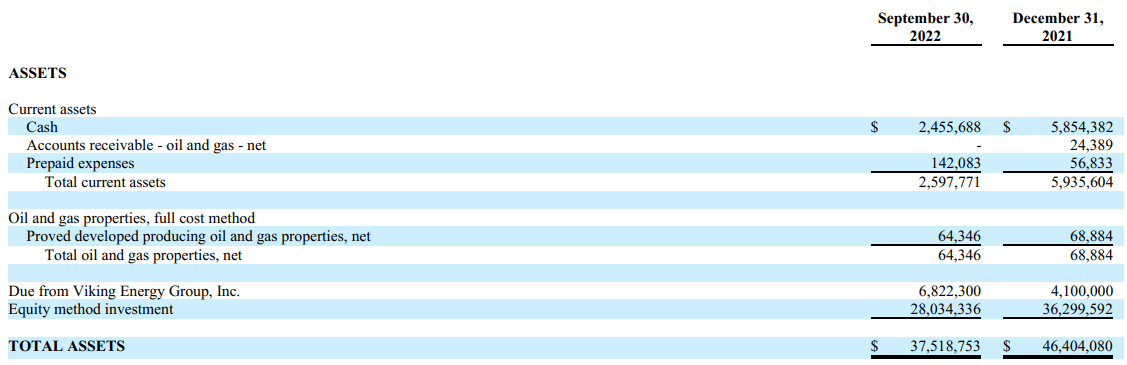

Looking at the balance sheet is crucial to do before making an investment case for any company. With Camber Energy I want to look at the cash/debt that they hold, the ratio between the assets and the liabilities. But I will also take a peek at the share dilution and the current cash flow for them.

Cash wise I see a large decrease YoY, cut more than 50%. They have $2.4 million in cash right now, down from $5.8 million in 2021. The worrying part here for me is that this current amount of cash is not sufficient to cover the current liabilities of $3.2 million. This should be a warning to investors that share dilution will continue at a rapid pace.

Camber Energy Assets (Camber Energy Q3 Report)

The assets have been decreasing 24% YoY, largely due to the largest assets the company holds has seen its value reduced. Camber Energy holds $28 million in equity method investments. Essentially, the investments they made into other companies have now seen a reduction in value. This is worrying as the management has not been able to make successful acquisitions in a time where natural gas and oil companies saw drastic improvements in revenues.

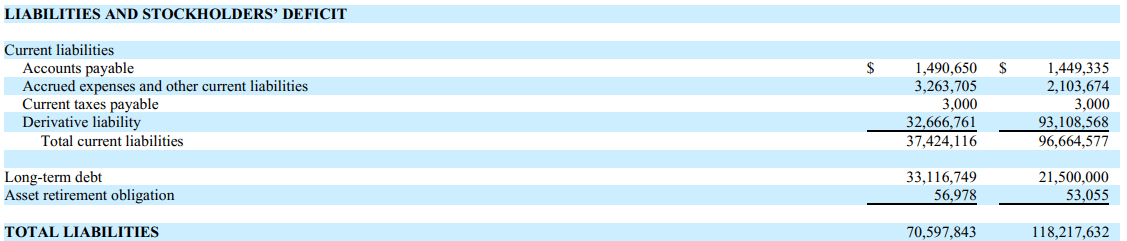

Camber Energy Liabilities (Camber Energy Q3 Report)

Right now Camber Energy has an asset/liabilities ratio of 0.53. Not a very good position to be in as they have a large amount of debt to take care of. Amounting to a staggering $33 million in the latest report. With a small cash position and no positive free cash flow, paying back this debt without diluting shares will be very difficult in my opinion.

Outstanding Shares (Seeking Alpha)

Share dilution has been common practice in the last years, as the management tries to raise capital to keep the company going. With a negative bottom line I think it’s very likely this share dilution will continue and hurt any investor with money in the company.

Cash Flow (Seeking Alpha)

Cash flow continues to be negative for Camber Energy as they struggle to raise the bottom line. I think it will take several years of progress and growth until any meaningful cash flow will be visible. Until then I expect the cash position to take a hit and shares will continue being diluted.

Valuing The Company

Right now Camber Energy is not seeing increased revenues despite an industry where growth is happening at a wide scale. I think that putting any price target on the company right now is irresponsible. Instead I think there are some issues that need to be addressed before any thoughts about investing should be had.

Price Chart (Seeking Alpha)

Firstly, the revenues need to once again start increasing. Otherwise you would simply invest into a dying company and waste your money.

Secondly, the bottom line also needs to see improvement. Revenue growth is great, but profitability is just as important.

Thirdly, share dilution needs to drastically slow down. Investors are getting none of the value if this continues. If these first three things can be achieved then perhaps the company is worth a second look. Until then, selling any shares in the company is recommended. I fear that we will continue seeing lower share prices in the short-term at least.

Conclusion

Camber Energy operates in an industry that has been under a lot of pressure as demand for oil and natural gas has increased whilst the prices have been nothing but stable the last few years. This comes as an increased demand for renewable energy sources has left many oil companies struggling.

With revenues still increasing, the bottom line hasn’t seen the same line. With large net losses and profitability seeming far away the management has a lot of work to do. Share dilution has been an ongoing issue for investors, which has caused the share price to drop more than 90% in the last 12 months.

Before I finish off this article, I want to mention some things that could help potentially make for an investment. If I can see the company able to leverage their abilities and increase the bottom line and achieve positive cash flow then that would be a great first step. If both natural gas and oil prices remain elevated for the next several years I could see the management capitalizing on this and get the business back on track.

Investing into Camber Energy right now seems way too risky and investors are much better off selling their shares and moving on to better opportunities.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment