Shutter2U

Thesis

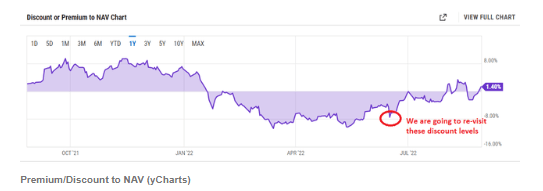

The Allspring Multi-Sector Income Fund (NYSE:ERC) is a multi-asset fixed income closed end fund. The CEF has current income as its main objective and has a global investment mandate. When we first reviewed this name in August, we identified an abnormality in the premium to NAV exhibited by the CEF. The fund was riding the bear market rally wave at the time, and outside of a positive NAV performance driven by spread tightening, the vehicle also displayed a very high premium to NAV. At the time we stated:

An interesting development occurred after the violent market sell-off in June – the fund for some reason moved from a roughly -8% discount to NAV to a premium to NAV of around 1.4% now. We expect this to reverse. We also expect another leg of the current bear market to develop which is going to result in wider credit spreads and thus lower NAV for ERC. New money entering the space would do well to avoid ERC since its analytics are not compelling. Individuals already in the fund should think about trimming some exposure.

Furthermore we identified our target for the move in the premium to NAV:

Target Move for Premium (Author)

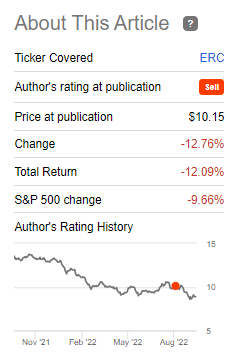

Let us have a look at what the fund did since our article:

Performance (Seeking Alpha)

The vehicle is down more than -12% on a total return basis since we penned our research. That is worth more than a year of fund dividends. The drivers for the move, as we identified in our original piece, have been the premium to NAV and wider credit spreads:

Our main vector accounted for most of the move, with the premium to NAV now reverting to a discount and composing -8% of that total return. A retail investor needs to differentiate between two types of fixed income CEFs (broadly speaking) in today’s environment:

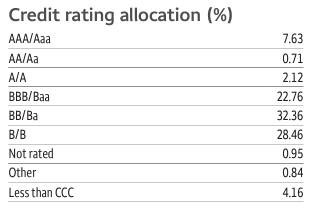

(A) Funds which contain collateral at the bottom of the credit spectrum (“B” or “CCC” holdings)

(B) Funds which have a blend of assets and contain holdings across the credit spectrum

We have seen the CEFs which fall in category A) above expose a move to a discount to NAV at the beginning of the year and propensity for that discount to stay there. Why? Because the market is concerned about a long recession and actual impairments in the credit portfolios. Therefore in taking advantage of the CEF structure investors express uneasiness regarding the propensity for the collateral to “gap-down”.

Conversely fixed income CEFs which fall in category B) above have seen their moves closely correlated with the markets, with a beta factor. That means that as the risk-on rally took hold in July/August, those CEFs saw not only a move up in the NAV value, but also an increase in the premiums to NAV. We call that a beta factor to the wider market. ERC falls in this category and as the market rallied the CEF saw its discount move to a premium to NAV that was not justified.

CEFs with beta factors like ERC can be actively traded when such discrepancies and abnormalities are identified. If credit spreads on U.S. high yield move much wider we expect ERC to exhibit the same beta factor on the downside -i.e. the discount to NAV will become larger than usual. Will it be warranted? We think not. Having met our target we are moving to neutral (‘Hold’) on ERC and closely watching its collateral and market developments.

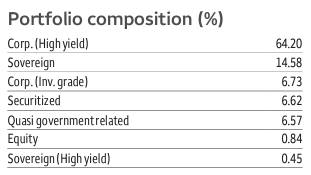

Holdings

The fund is overweight U.S. high yield names which account for over 60% of the portfolio:

Holdings (Fund Website)

In terms of credit quality the fund is overweight below investment grade names, both via its High Yield and Sovereign sleeves:

Ratings (Fund Website)

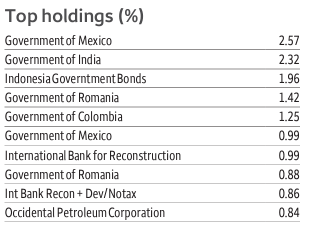

We can see that ERC has a bucket for AAA bonds, which are mostly rates driven rather than by credit spreads. Outside of the Sovereign portfolio the fund is very granular:

Top Holdings (Fund Website)

We can see that the top holdings are mostly the international sovereign bonds, which have been bought with fund weightings above 1%.

Performance

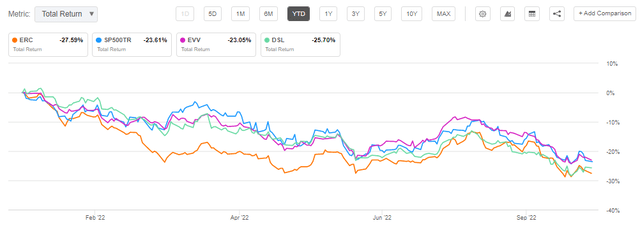

The fund is down over -27% year to date after rallying in the summer:

YTD Total Return (Seeking Alpha)

It has been a tough year for fixed income, with higher leveraged funds driving the move down. Well-balanced vehicles have also exposed a beta to the market moves driven by investor forward sentiment.

Conclusion

ERC is a global fixed income CEF. The vehicle is currently overweight U.S. high yield and has current income as its main objective. When we first reviewed the fund in August we assigned it a Sell rating driven by its abnormally high premium to NAV and what we were considering to be a bear market rally at the time. Both of our theses proved correct with the fund reverting to a discount to NAV and the broader market selling-off. The fund’s discount to NAV is now at our targeted level, giving up all of its summer gains. We see ERC as a balanced fixed income CEF that has a beta factor to the wider market, and tends to move in tandem with wider risk-on / risk-off moves. Our target having been met we are now on Hold (neutral) on the name.

Be the first to comment