SeventyFour/iStock via Getty Images

Introduction

While real estate investment trusts (REITs) often offer safety as a result of their conservative business models, most are having a really hard time this year. The Federal Reserve is aggressively hiking rates as inflation continues to be persistently high. Meanwhile, economic growth is slowing, causing investors to feel extremely uncomfortable.

One of the companies I have liked for years is Sun Communities (NYSE:SUI). This company is focused on manufactured housing, RV communities, and marinas. This REIT truly has it all, as it has a solid business model allowing for strong growth. It has a healthy balance sheet, protecting investors against mayhem and rapidly growing dividends. That dividend is now close to 3%, which is a multi-year high.

In this article, I make the case for investments in SUI, which I believe is a must-own company for both growth and income-oriented real estate investors.

So, let’s look at the details!

A Tricky Environment

I am not a typical REIT investor as I prefer “growth” over a high yield. Don’t get me wrong, I almost exclusively buy dividend stocks. However, I often avoid slow growth and very high yields.

The best thing about sell-offs like the current one is that we now get more opportunities that offer a decent yield and high dividend growth.

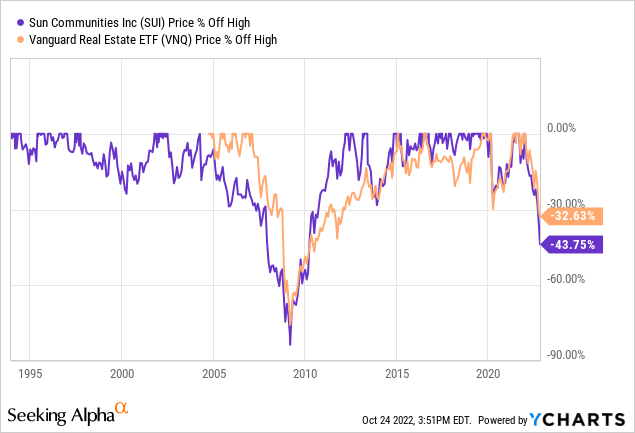

Sun Communities is currently in the worst drawdown since the Great Financial Crisis, falling 44% from its all-time high reached in the last week of December.

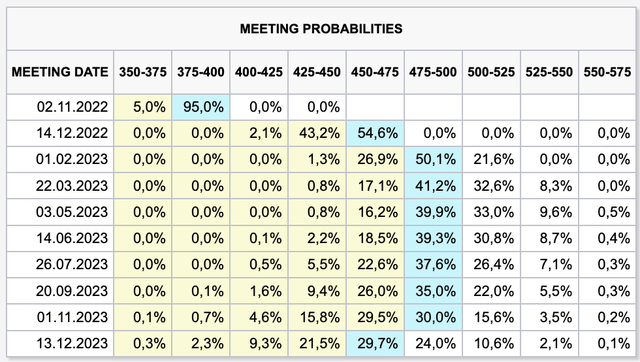

It’s a tricky market, to put it mildly, as an aggressive Fed is causing rates to spike in a time of weakening economic growth. The terminal rate is now expected to be 4.75% to 5.00%, which is up from the current rate range of 3.00%-3.25%. A rate cut is now expected to occur in December 2023.

This not only means that the pressure on home and asset prices, in general, is rising, but also that financing (expanding) becomes more expensive. These two issues are obviously related.

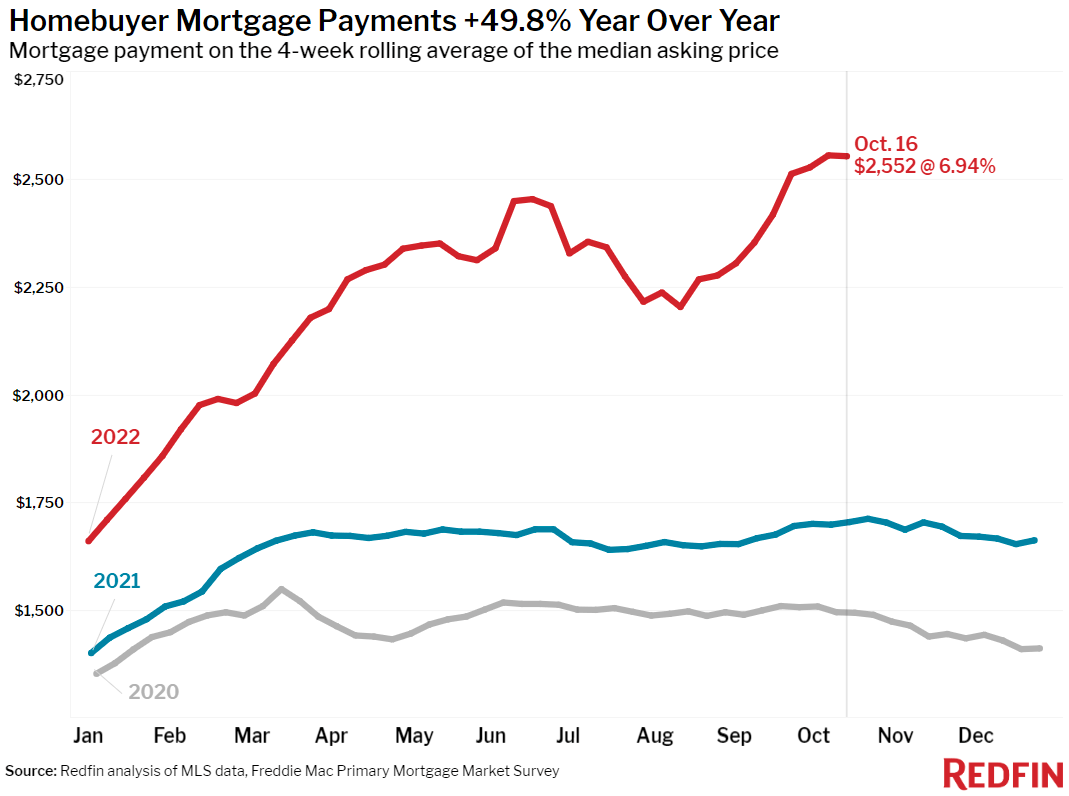

The average mortgage payment is now $2,552 per month (6.9%). That’s up from less than $1,750 in 2021.

Redfin

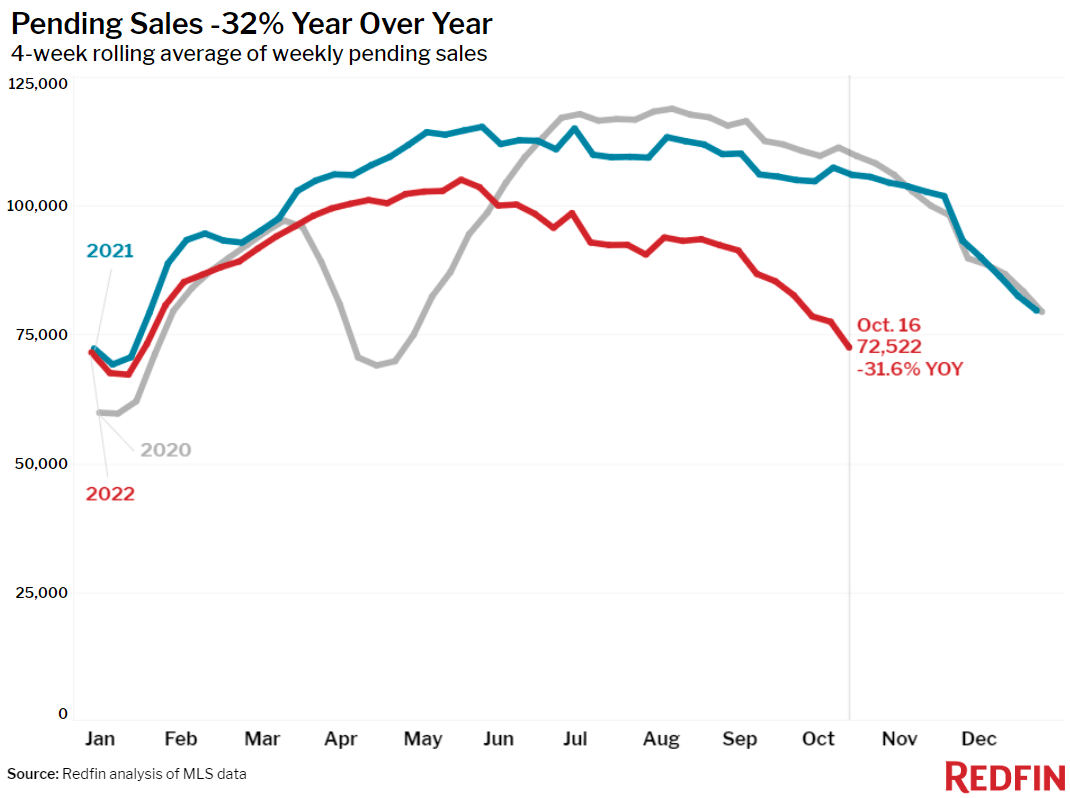

As a result, the housing market is weakening as people aren’t selling their homes anymore. Why sell a house if financing is expensive and prices are falling?

Redfin

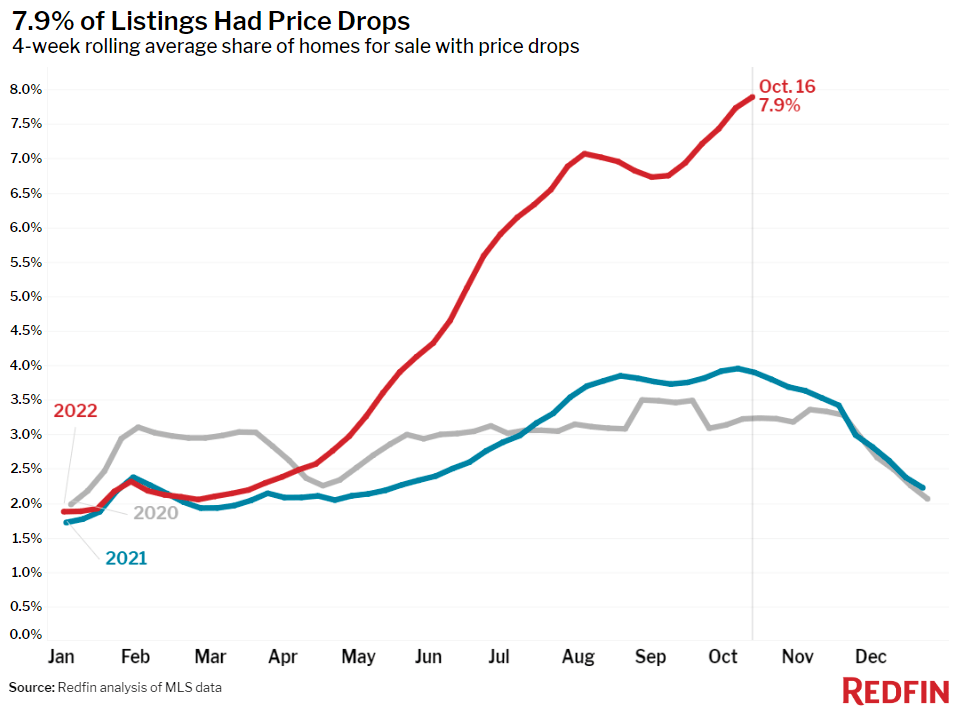

This is leading to weakening prices. On October 16, 7.9% of home listings experienced price drops.

Redfin

Moreover, there is now an alternative to stocks.

Higher rates mean that investors do not have to buy stocks to get a decent yield.

Or as Jonathan Levin put it:

Would you rather buy a risk-free long-term Treasury bond yielding more than 3.5% or take your chances in the stock market? The jury is apparently still out among investors, but at least they’re debating the matter – as has rarely been the case in the post-financial crisis era.

In other words, I’m looking for a company that offers a great valuation because of the sell-off, a great balance sheet to withstand the Fed’s hiking cycle and potential economic weakness, and a company that actually benefits from the current housing market.

That’s where Sun Communities comes in.

SUI Offers Growth & Value

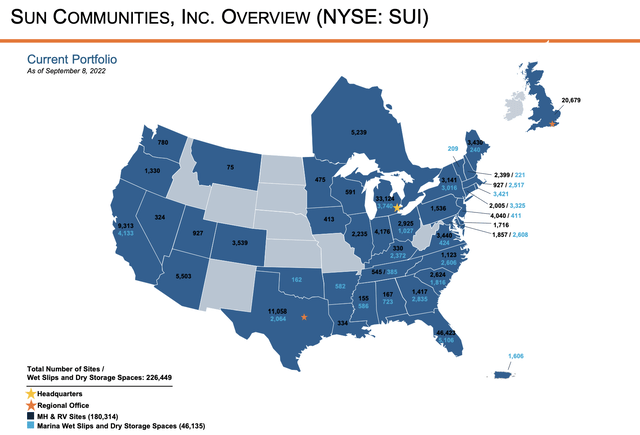

With a market cap of $14.9 billion, Sun Communities is one of the nation’s largest residential REITs. However, it’s not a very common residential REIT as it owns manufactured housing (“MH”) and recreational vehicle (“RV”) communities, as well as marinas.

According to the company:

Typical tenant leases for MH sites are year-to-year or month-to-month, renewable upon the consent of both parties, or, in some instances, as provided by statute. Certain of our leases, mainly at our Florida and California properties, are tied to the consumer price index or other indices as they relate to rent increases. Generally, market rate adjustments are made on an annual basis. These leases are cancellable for non-payment of rent, violation of community rules and regulations, or other specified defaults.

Founded in 1975, Sun Communities has grown into a REIT giant owning 662 properties, covering more than 200,000 developed sites in 39 states in the US, parts of Canada, and the United Kingdom, where the company bought Park Holidays, including 12,300 owner-occupied sites.

49% of the company’s revenues come from MH assets, followed by RV (32%), and Marinas (19%).

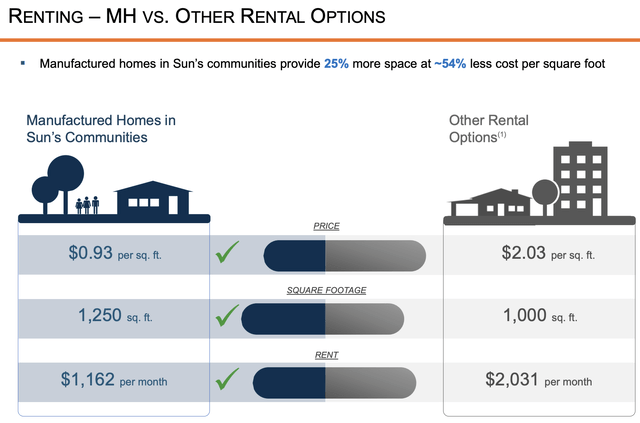

One of the biggest benefits the company brings to the table is exposure to affordable housing. Essentially, MH alternatives in SUI communities provide 25% more space at 54% less cost per square foot, according to the company.

Compared to other rental options, MH alternatives are roughly 43% cheaper. There are, of course, some drawdowns as MH communities are often (somewhat) remote, and while the quality has improved significantly, it is not always comparable to “traditional” alternatives.

Nonetheless, the advantages of MH communities have grown significantly over the past 10 years.

This explains why the company enjoys high occupancy rates. As of September 30, total MH and RV occupancy (excluding the UK) was 97.1%. It was 97.4% in the prior-year quarter, when COVID benefited RV communities a bit more than it does now.

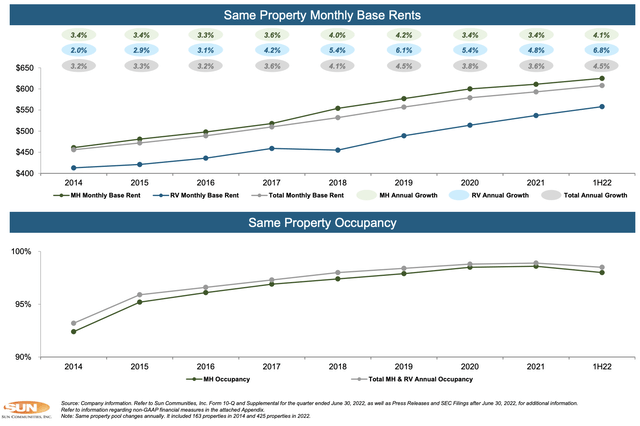

These assets allow the company to gradually hike rents. Over the past 8 years, total monthly rent increases were between 3.2% and 4.5%, with occupancy rates in the high 90% range (with an increasing trend). 70% of MH communities are 98%+ occupied.

It also helps that the company’s assets allow for strong internal growth. On top of the 4.5% average rent increase as of June 2022, rents are tied to CPI – “market rent”, which protects the company and its investors against inflation.

That said, internal growth is also provided by available sites on existing properties. Since 2020, SUI has invested roughly $200 million in its own properties, targeting a 10-14% internal rate of return. In 2020 and beyond, more than 10,800 sites are available for expansion.

External growth is based on acquisitions. Since 2010, SUI has invested $11.6 billion in new properties. Year-to-date, SUI has added another 63 properties, covering roughly 22,000 sites.

These operations have provided the company with outperformance. Since the year 2000, the company has grown its net operating income by 5.1% per year, beating multifamily REITs by 240 basis points. Over the past 20 years, the company did not have a single period of a rolling 4-quarter period with negative NOI growth.

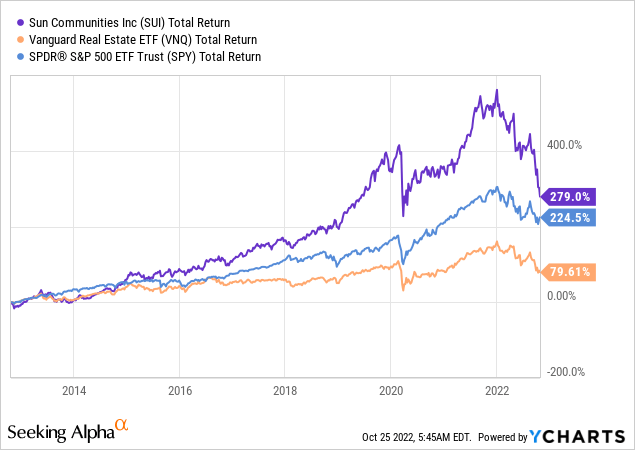

As a result, SUI shares have outperformed both the S&P 500 and the Vanguard Real Estate ETF (VNQ) on a total return basis. Going back to 2012, SUI shares have returned 279%, beating the S&P 500 by a considerable margin, even after dropping more than 40%. VNQ has returned just 80%, which is why I’m very picky when looking for real estate investments.

Speaking of dropping more than 40%, the valuation has become quite attractive.

The SUI Dividend & Valuation

One of the reasons why investors avoided SUI is because of its subdued yield.

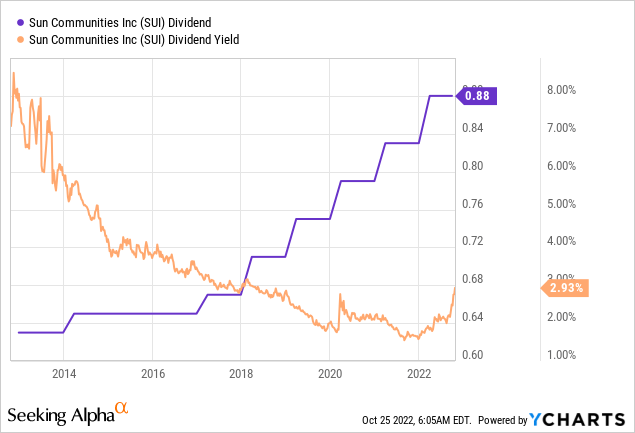

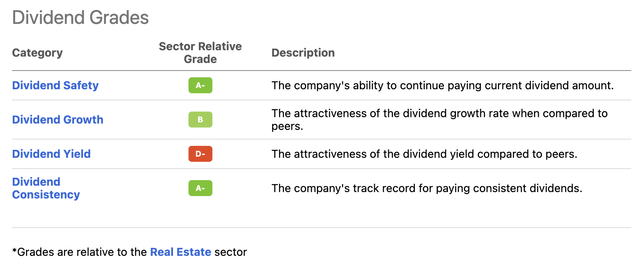

However, thanks to the sell-off this year, that has changed. SUI distributes a $0.88 per share per quarter dividend. This implies a 3.0% yield, making it the highest yield since early 2018.

The payout ratio is 57% of adjusted funds from operations. The sector median is 74%. The 10-year average dividend growth rate is 3.3%.

These are the most “recent” hikes:

- March 2022: 6.0%

- March 2021: 5.1%

- March 2020: 5.3%

- March 2019: 5.6%

In other words, the longer-term average is a bit skewed as dividend growth has picked up after 2018.

With regard to the valuation, it helps that the yield has come up to a 4-year high.

Moreover, the company trades at 16x its own 2022 core FFO guidance this year. This is at the lower bound of its long-term valuation range, caused by strong fundamentals but a deteriorating share price.

Moreover, as Weighing Machine noted in a recent article:

Interestingly after this year’s decline SUI trades in-line with large cap multifamily REITs whereas historically it has traded at a 10-15% premium (and as I’ve written recently, I find the multifamily REITs to be attractive at today’s prices). I believe that today’s share price represents a compelling entry point for long-term, risk-averse investors. I expect the stock could re-rate to 20-22x FFO (middle of historical range) which would represent 30-40% upside.

The Balance Sheet

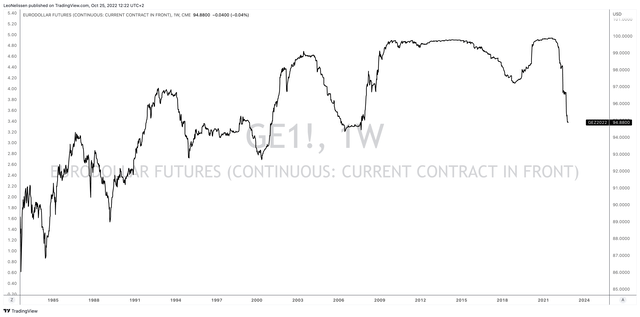

Eurodollar futures are trading at $94.88, indicating a 3-month LIBOR rate of more than 5.0%. That’s the highest interbank rate since the Great Financial Crisis, putting tremendous pressure on companies depending on financing.

TradingView (Eurodollar Futures)

The good news is that SUI has an investment grade balance sheet, with a Baa3 and BBB rating from Moody’s and S&P Global, respectively.

Roughly 84% of the company’s debt has a fixed rate with an average weighted maturity of 7.9 years. Moreover, just $906 million worth of mortgage debt matures before 2026, buying the company time at a time of sky-high rates.

The average weighted interest rate is 3.4%, which is attractive.

Net debt remains close to 6x EBITDA, which is the median of the 5-year range.

Takeaway

Bear markets aren’t a lot of fun. However, they come with new investment opportunities. One of these opportunities is buying Sun Communities at a discount. The MH/RV REIT operator offers a 3% yield, a low valuation, and the opportunity to benefit from outperforming total returns on a long-term basis.

Moreover, unlike some of its REIT peers, the company has a healthy balance sheet, mainly fixed-rate debt, no major maturities in the 3 years ahead, and the opportunity to grow internally.

While it’s hard to make the case that the market cannot fall any lower, I believe we’re at a point where it makes sense to buy SUI shares a bit more aggressively.

(Dis)agree? Let me know in the comments!

Be the first to comment