Travel Faery/iStock Editorial via Getty Images

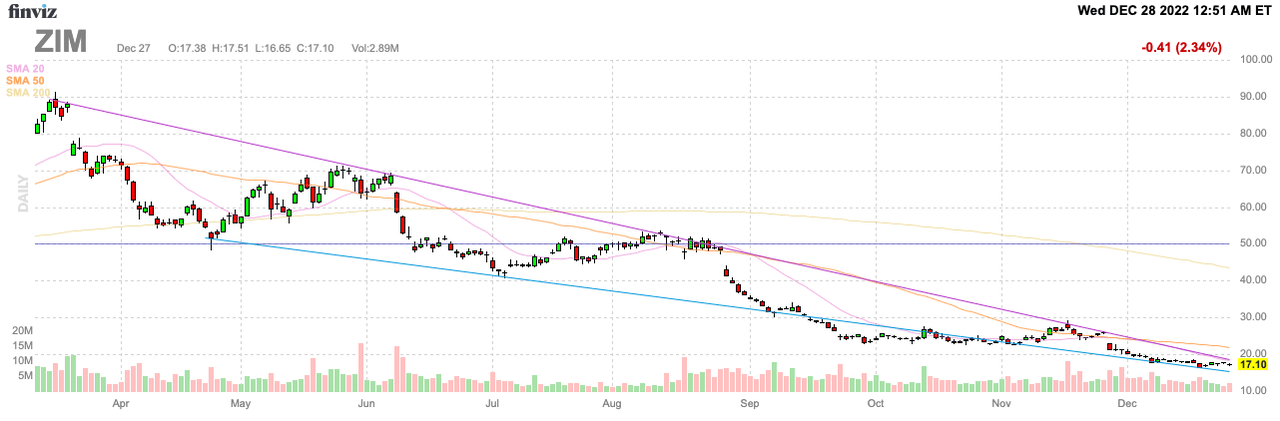

The recent weakness in ZIM Integrated Shipping Services Ltd. (NYSE:ZIM) probably limits the downside in 2023, but the stock isn’t likely to rally anytime soon. Global container shipping rates have crashed and are still leaking lower while the order book for new ships is higher. My investment thesis remains more Neutral on the stock due to excessive newbuilds in the sector, but ZIM isn’t likely to crash from these levels even without a dividend.

Source: FinViz

Shipping Prices Still Slipping

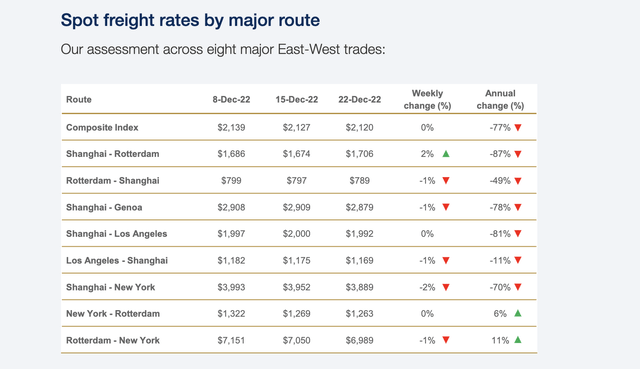

A lot of shipping indexes are starting to stabilize at prices down 80% from end of 2021 levels, but the indexes haven’t reached bottom yet. The Drewry World Container Index slipped 0.3% for the week of December 22. The index has now fallen for 43 consecutive weeks.

Investors looking at the major East-West routes will see only one that gained WoW. Note, a small WoW decline escalates into large losses over a long period. The Shanghai – New York route fell $63 in the last week and a combined $104 in just 2 weeks.

Even the routes listed with no change in the last week have fallen over the last couple of weeks. The Shanghai – Los Angeles route actually fell $8 WoW with the trend remaining highly negative after falling 81% over last year’s level.

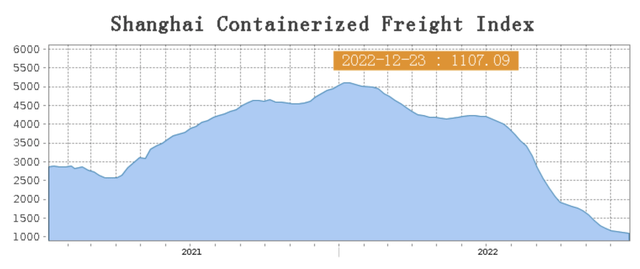

The SCFI index continues to plunge with the shipping index now down to 1,107. The index was still above 4,000 to start 2022 and ZIM reported a level of 1,579 when reporting Q3 earnings in a sign of the quick deterioration of shipping rates.

Source: Shanghai Shipping Exchange

Internal Problems

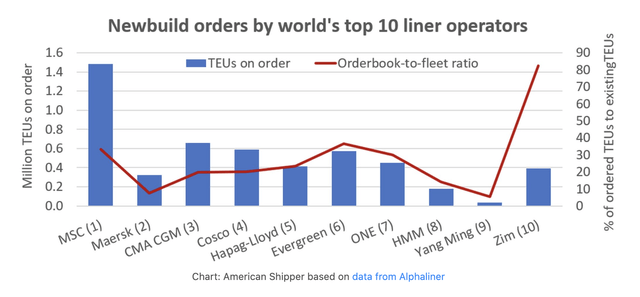

A lot of the problems with ZIM is the ship building spree for 2023 and 2024 where the company led the industry with an 82% order book to fleet ratio. Other shipping companies had larger order books, but ZIM was the only company above 30% on the fleet ratio.

While this newbuild data was from back at the end of June, market analyst Alphaliner suggests order books continue to grow. Back in June, the order book stood at a capacity of 7 million TEUs and the new estimate is for the latest orders to push the order book above 8 million TEUs.

The containership industry pricing isn’t going to improve with supply set to surge with no end in sight. ZIM won’t recover until the supply situation resolves itself to match the more normal demand levels going forward.

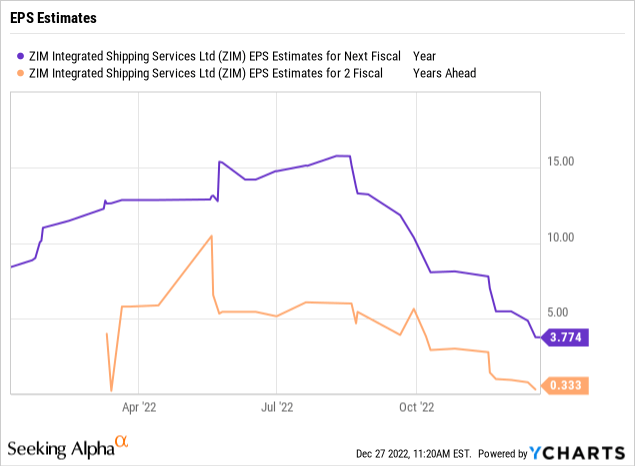

The stunning decline comes after analysts actually predicted ZIM would generate over $15 in 2023 EPS. The consensus EPS estimate has now slipped to below $4 with some analysts forecasting a loss for next year while 2024 will be dismal.

Investors need to remember the Q4 EBITDA target of $0.8 to $1.1 billion quickly disappears by year end. The company didn’t disagree with the assumption from analyst Alexia Dodani of Barclays from the Q3’22 earnings call that only one-third of the Q4 EBITDA target would be earned in the 2H of the quarter. In essence, ZIM will end the year with an exit rate at $533 to $733 million.

Once these numbers are hit with $380 million in quarterly depreciation charges, the profit picture quickly disappears. Remember, these numbers are from the end of Q4 when the main issue is demand. The container ship oversupply issue doesn’t really become a problem until 2023 and beyond.

ZIM has the balance sheet with $4.5 billion in cash and no debt outside of lease obligations to help survive a tough few years.

Takeaway

The key investor takeaway is that ZIM isn’t appealing with the container shipping market still under pressure before the flood of new supply hits the market. The company is likely to start losing money in 2023 and completely wipe out the dividend.

Due to the weakening market, ZIM seems unlikely to pay a large true-up dividend with Q4. Either way, the stock will struggle for a few years until the shipping market stabilizes.

Be the first to comment